Analysis

Bitcoin & Ethereum Trigger Major Liquidity Sweep – What’s the Next Move for BTC and ETH?

Credit : coinpedia.org

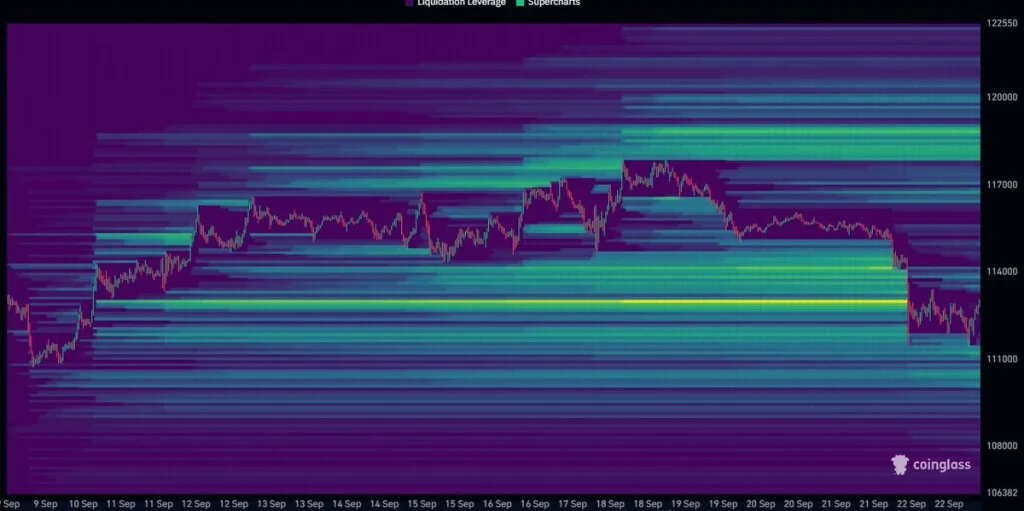

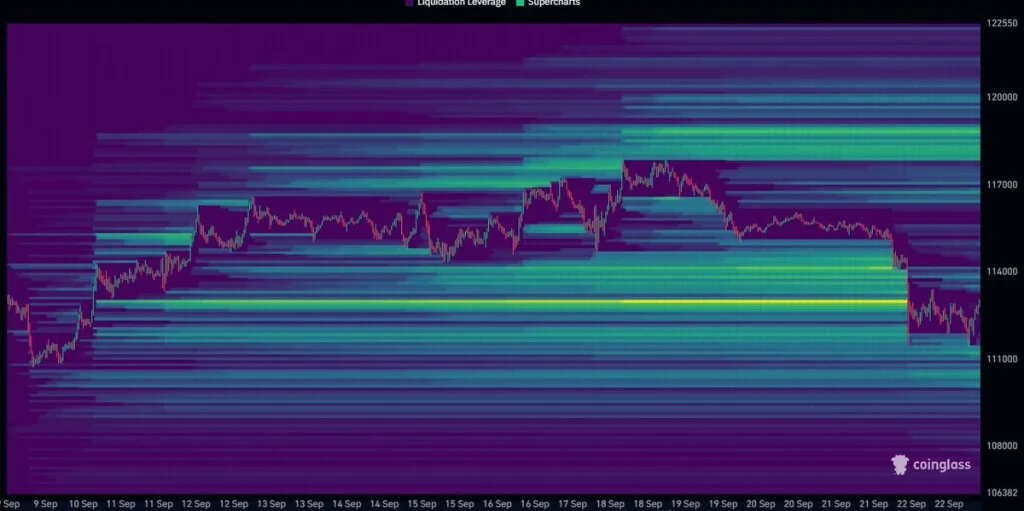

After an enormous sale, the costs of Bitcoin and Ethereum appear to stabalize with the bulls that get some energy. BTC Worth recovered after touching lows under $ 112,000, whereas ETH worth was firmly above $ 4000. The current knowledge reveals that the highest 2 tokens have shortened liquidity after reaching particular ranges, which has shaken the flattened volatility on the markets. The Coinglass knowledge shared by a well-liked analyst, Daan Crypto TradesHints to a bullish continuation.

This liquidity Hitte -Map emphasizes how Bitcoin worth marketing campaign just lately hunted closely clustered liquidation zones. The dense yellow-green areas across the vary of $ 111,000- $ 113,000 reveal the place Longs Livered have been pressured because the market dropped sharply. Such actions are frequent in crypto, as a result of the value typically goes to areas with excessive liquidity to reset market positioning. With this sweep full, BTC is now in a consolidation section, in order that merchants are stored to see if bulls can defend this zone or whether or not the market extends decrease to the following liquidity pocket close to $ 110,000.

Seen Ethereum, says the analyst,

“ETH additionally took out an enormous cluster.

At the moment, most liquidity within the neighborhood is increased because the native vary of lows are swept ”

With this, the analyst mentions necessary ranges to concentrate to Bitcoin and Ethereum, as $ 118,000 and $ 4700. Within the occasions that the BTC worth has issue rising above $ 113,000 and ETH is traded out and in of $ 4200, the query arises as as to whether the highest two tokens will obtain the aforementioned goal.

- Additionally learn:

- Avalanche (Avax) tries a bullish set – can it obtain $ 50 this month?

- “

What’s the subsequent step for BTC & ETH worth?

Bitcoin just lately wiped massive liquidity zones and activated a pointy lower to the vary of $ 111,000 – $ 113,000, the place dense liquidations have been erased. The value now consolidates simply above this zone, which signifies a possible exemption that patrons defend the present ranges. Quick resistance is close to $ 115,500, with an outbreak that opens the trail to $ 118,000. Alternatively, a failure to retain above $ 111,000 can expose BTC to deeper assessments to $ 108,000. Merchants rigorously take a look at whether or not this flush wraps restoration or continuation decrease.

Within the meantime, Ethereum adopted Bitcoin’s liquidity, sliding to the vary of $ 2,550 – $ 2,600 the place lungs have been cleaned up. The value is at the moment stabilizing after the flush, which means that the quick -term consolidation earlier than the following step. If patrons withdraw, ETH worth may return to $ 2,680 and probably $ 2,750 as rapid resistance ranges. Nevertheless, if the gross sales stress continues and $ 2,550 doesn’t maintain, the following liquidity pocket is sort of $ 2,480. Merchants now take a look at whether or not Ethereum can recuperate energy along with BTC or prolong its corrective decline.

Packing

Each Bitcoin and Ethereum have erased appreciable liquidity zones, the reset of market positioning and shaking lever merchants. With costs that stabilize virtually necessary assist, the rapid prospect is dependent upon whether or not bulls can defend these zones to activate a hereopy. BTC eyes $ 115,500 – $ 118,000 whereas ETH focuses on $ 2,680 – $ 2,750 because the momentum builds. Conversely, a breakdown beneath $ 111,000 for BTC or $ 2,550 can open the door for deeper liquidity baggage for ETH. The upcoming classes can be essential in shaping the pattern course within the quick time period.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, skilled evaluation and actual -time updates on the newest tendencies in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

A liquidity swing happens when the value rapidly goes to an space with many stop-loss orders, ‘sweeping’ from leverage merchants typically reversing the course.

The drop was in all probability a liquidity swing, with the market transferring to activate numerous livered lengthy positions earlier than it stabilized.

Stabilizing costs after sweeping, suggesting potential help. The subsequent step is dependent upon whether or not bulls can defend the present assist ranges.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now