Bitcoin

Bitcoin – Examining the true meaning of exchange reserves on Binance, Coinbase

Credit : ambcrypto.com

- Bitcoin’s foreign money move and reserves have fallen in latest months

- A transfer in the direction of $100,000 stays very probably for the world’s largest cryptocurrency

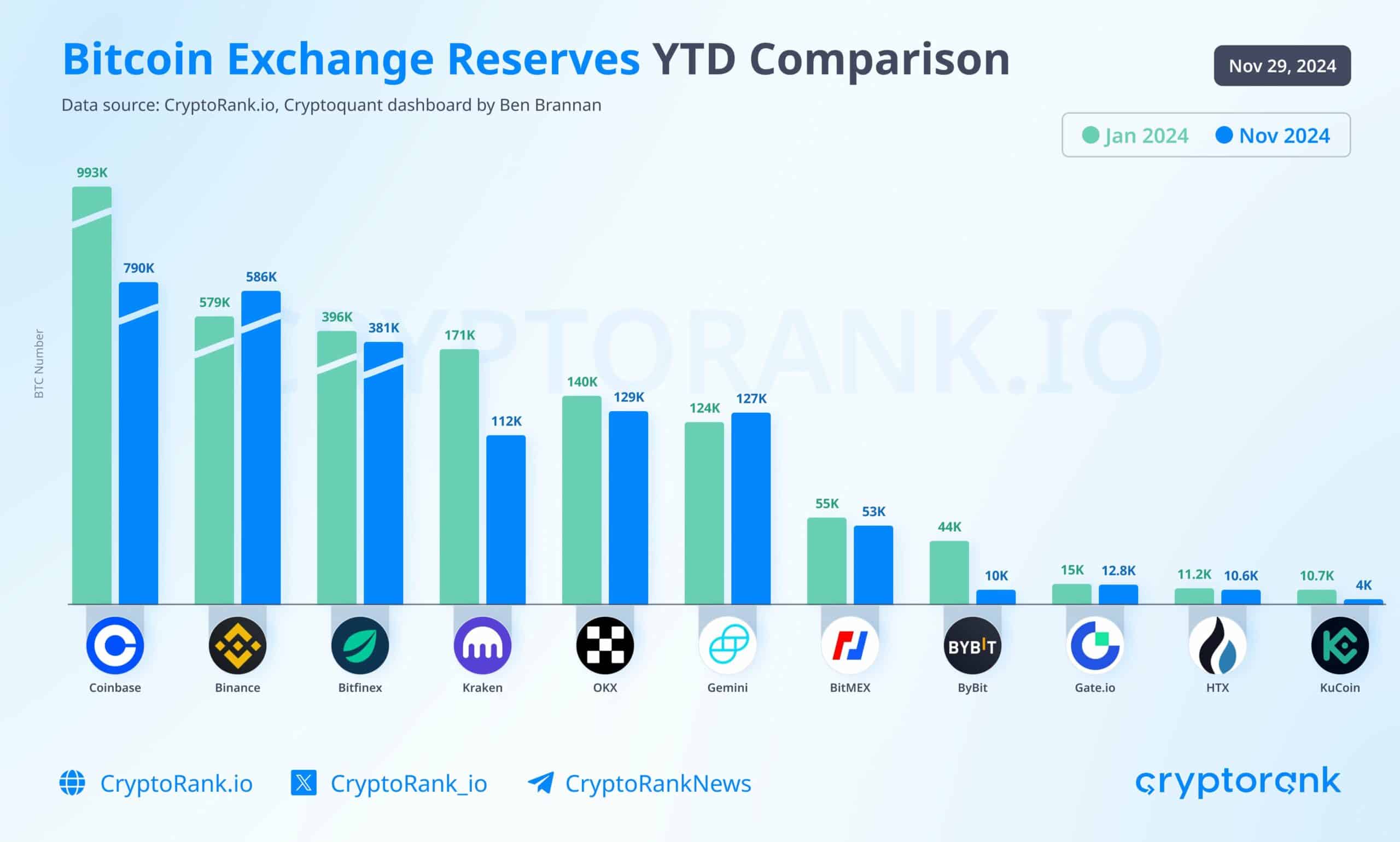

Bitcoin reserves on centralized exchanges (CEXs) have proven notable variations this yr. Whereas some exchanges, akin to Binance, have maintained comparatively secure reserves, others, akin to Coinbase, have seen massive declines.

These tendencies had been accompanied by a major decline in Bitcoin flows between exchanges. This may be interpreted as an indication of a maturing market and higher investor confidence.

Bitcoin change flows and market sentiment

The exchange-to-exchange move metric, which tracks Bitcoin transfers between exchanges, fell to an all-time low. CryptoQuant. Traditionally, spikes in these flows have coincided with intervals of market turmoil, as merchants moved BTC to Binance throughout main worth drops.

Nevertheless, diminished flows can even level to much less panic-driven habits – an indication of a extra secure and assured market setting.

Supply: CryptoQuant

On the similar time, Bitcoin’s international change reserves, particularly on all centralized exchanges, have fallen sharply over the previous two years.

From over 3.3 million BTC in early 2022 to only 2.5 million BTC on the finish of 2024, this decline underscored a broader development of self-adoption and diminished reliance on exchanges for storage. The accompanying chart illustrates this regular decline, which correlates with Bitcoin’s bullish trajectory in the direction of $100,000.

How inventory exchanges in any other case preserve reserves

A deeper dive into exchange-specific knowledge revealed main variations in how platforms handle Bitcoin reserves.

Coinbase, which caters largely to institutional traders, has seen vital outflows over the previous yr, with reserves falling from 993,000 BTC in January to 790,000 BTC in November. This development indicated the rising institutional choice for long-term self-management or chilly storage options.

Supply: CryptoRank

Quite the opposite, Binance’s reserves have remained comparatively secure, declining solely marginally from 579,000 BTC to 586,000 BTC.

The distinction between these two main exchanges reiterates the totally different methods of their consumer bases: Coinbase for institutional custody and Binance for retail.

Bitcoin worth developments assist market stability

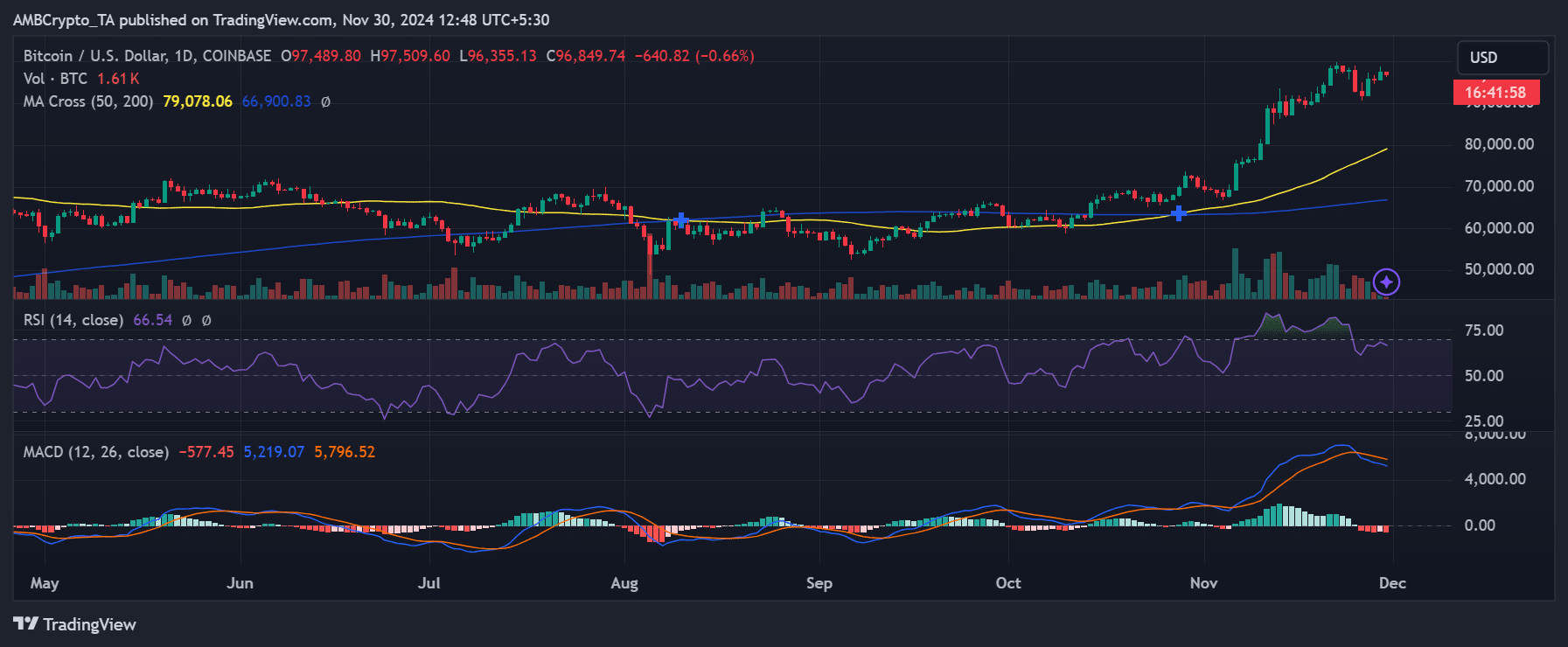

Bitcoin’s worth, valued at $96,849 on the time of writing, mirrored the energy of the broader market.

The RSI studying of 66.54 advised that the asset continues to be in overbought territory, however with out alarming divergence. The shifting common convergence divergence (MACD) additionally indicated continued bullish sentiment – an indication of investor confidence.

Supply: TradingView

Regardless of worth corrections, diminished Bitcoin motion between exchanges means a scarcity of panic-driven promoting. This stability is a departure from earlier cycles, during which bigger flows usually coincided with sharp worth declines.

The broader decline in international change reserves and diminished flows into Binance might level to evolving market dynamics. Decrease quantity of BTC on exchanges reduces fast promoting strain, doubtlessly paving the way in which for additional worth will increase.

Furthermore, the rise in self-custody is consistent with a maturing market, one during which traders are much less prone to succumb to panic promoting.

– Learn Bitcoin (BTC) worth prediction 2024-25

Nevertheless, the focus of liquidity on fewer exchanges like Binance comes with its personal challenges. Throughout instances of elevated buying and selling exercise, liquidity issues might come up. Particularly because the market strikes nearer to Bitcoin’s psychological $100,000 degree.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now