Bitcoin

Bitcoin exchange deposits drop to 2016 lows – Here’s what it means

Credit : ambcrypto.com

- BTC trade deposits have shrunk to 2016 lows.

- CryptoQuant analysts view this as a sign of a significant rally for BTC in the long run.

Since December nineteenth Bitcoin [BTC] is struggling to remain under $100,000, however the long-term outlook for the cryptocurrency stays constructive.

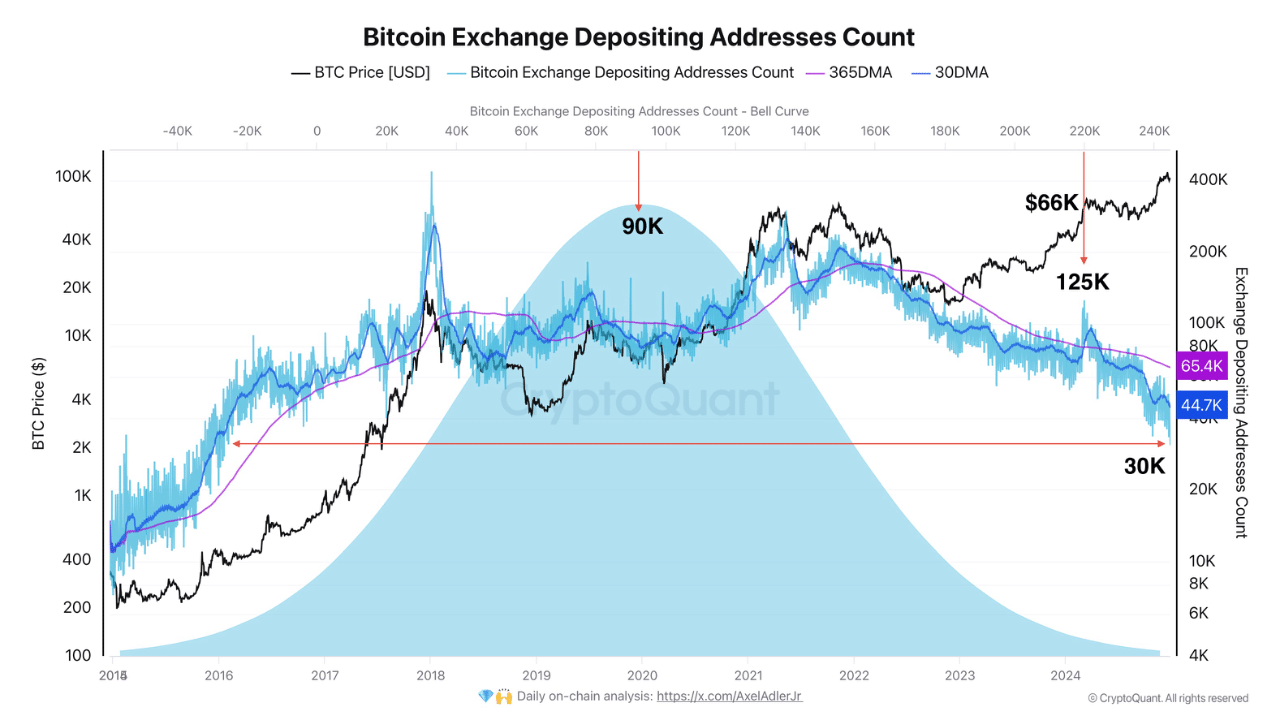

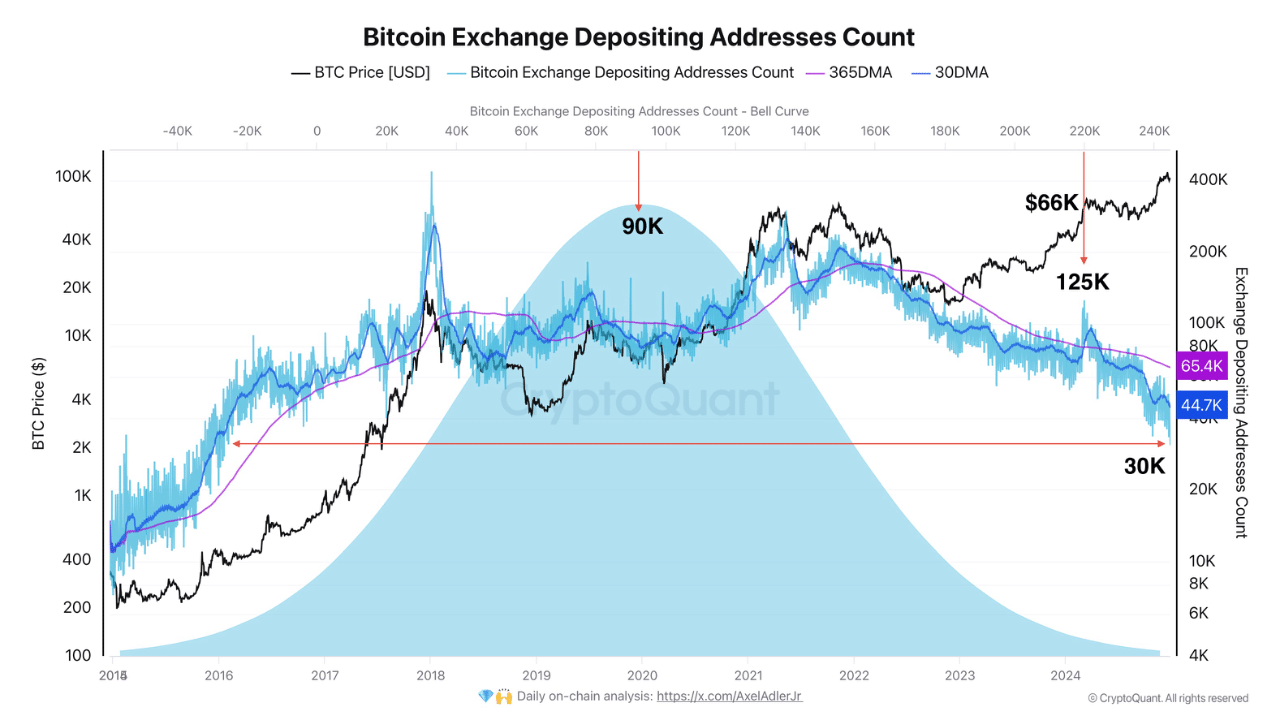

In line with CryptoQuant analyst Axel Adler, the quantity of BTC being moved to exchanges has fallen to 2016 ranges. Adler added that the final time BTC deposits on exchanges fell this low, a significant rally ensued.

“It usually means that they might quite hold their BTC in a private pockets than get able to promote.”

Supply: CryptoQuant

In comparison with early 2024, when day by day deposits of BTC peaked at over 125,000 cash, the present worth fell under 45,000 BTC, mirroring 2016 ranges.

Extra BTC leaves the exchanges

Curiously, the above-mentioned constructive outlook was additionally strengthened by extra BTC being faraway from exchanges.

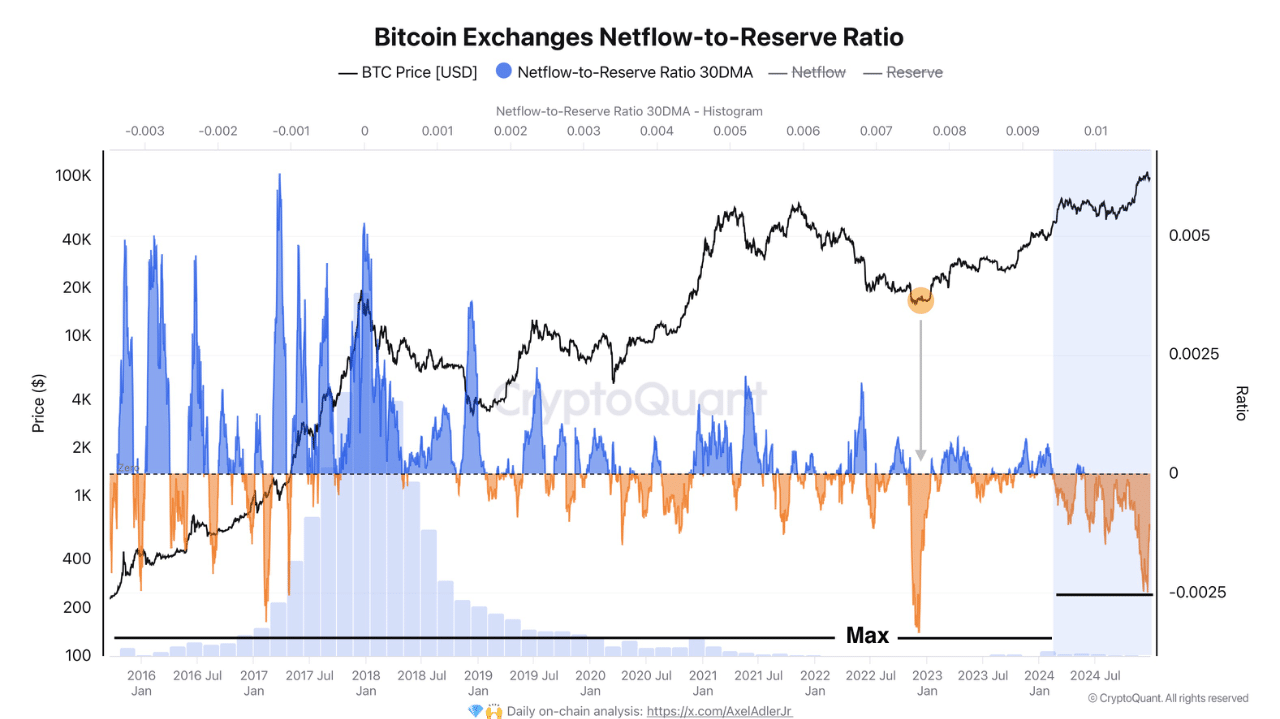

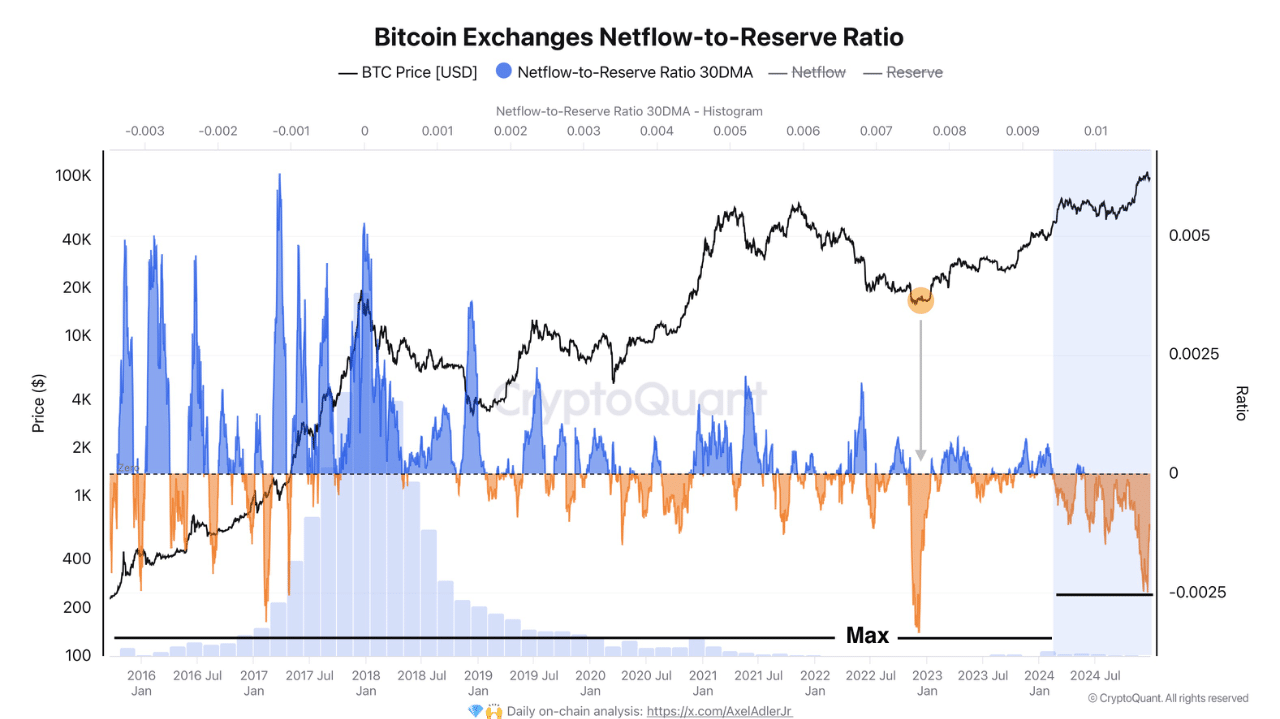

Utilizing the BTC internet flow-to-reserve ratio, Addler famous that the measure was unfavorable, underscoring its dominance in foreign money outflows.

The ratio measures the correlation between internet inflows/outflows relative to BTC reserves.

The unfavorable worth advised that, on common, extra BTC left the exchanges than registered deposits. It is a typical bullish sign.

Supply: CryptoQuant

In brief, BTC’s long-term prospects have been nonetheless constructive regardless of the current spike in development busy promoting holding the asset underneath $100,000.

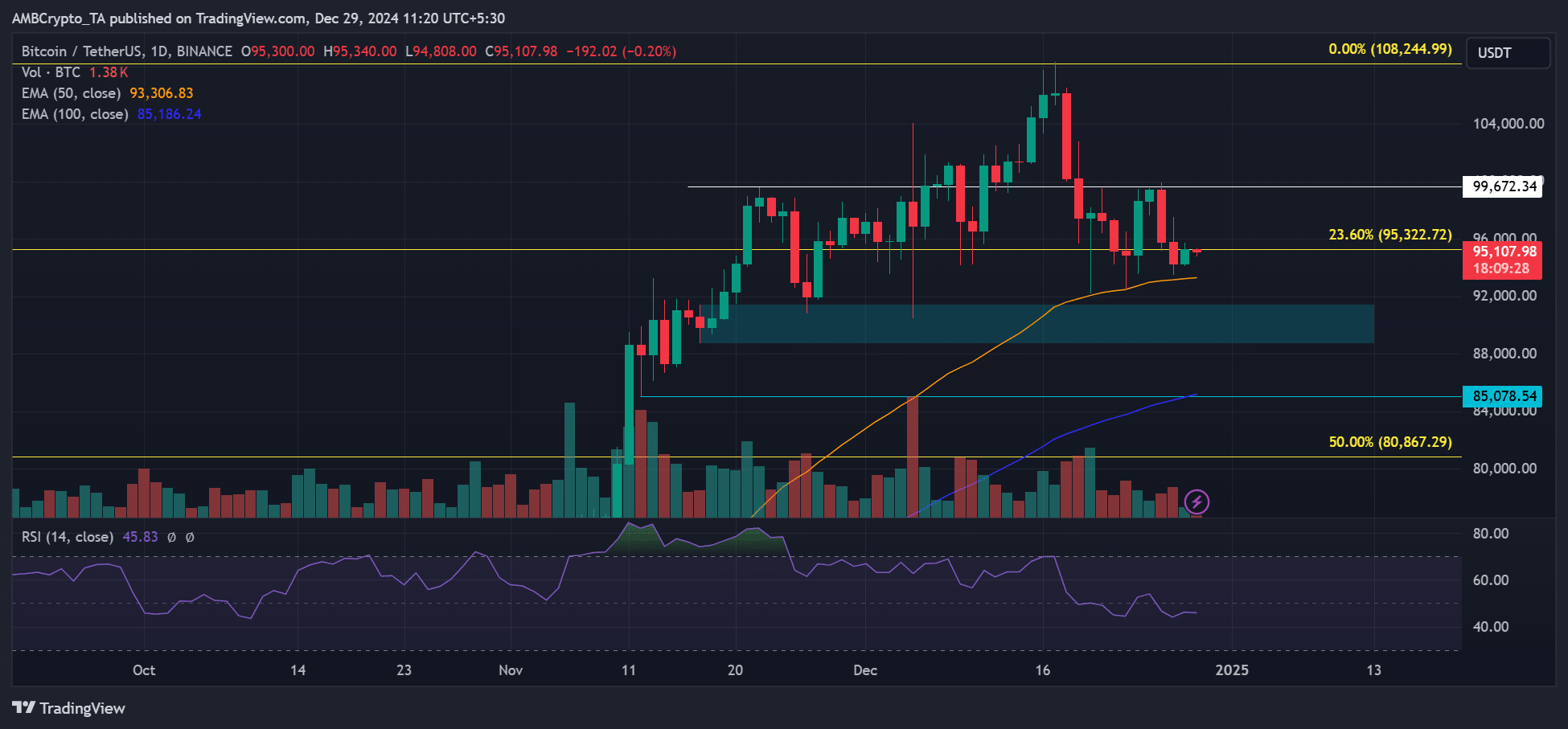

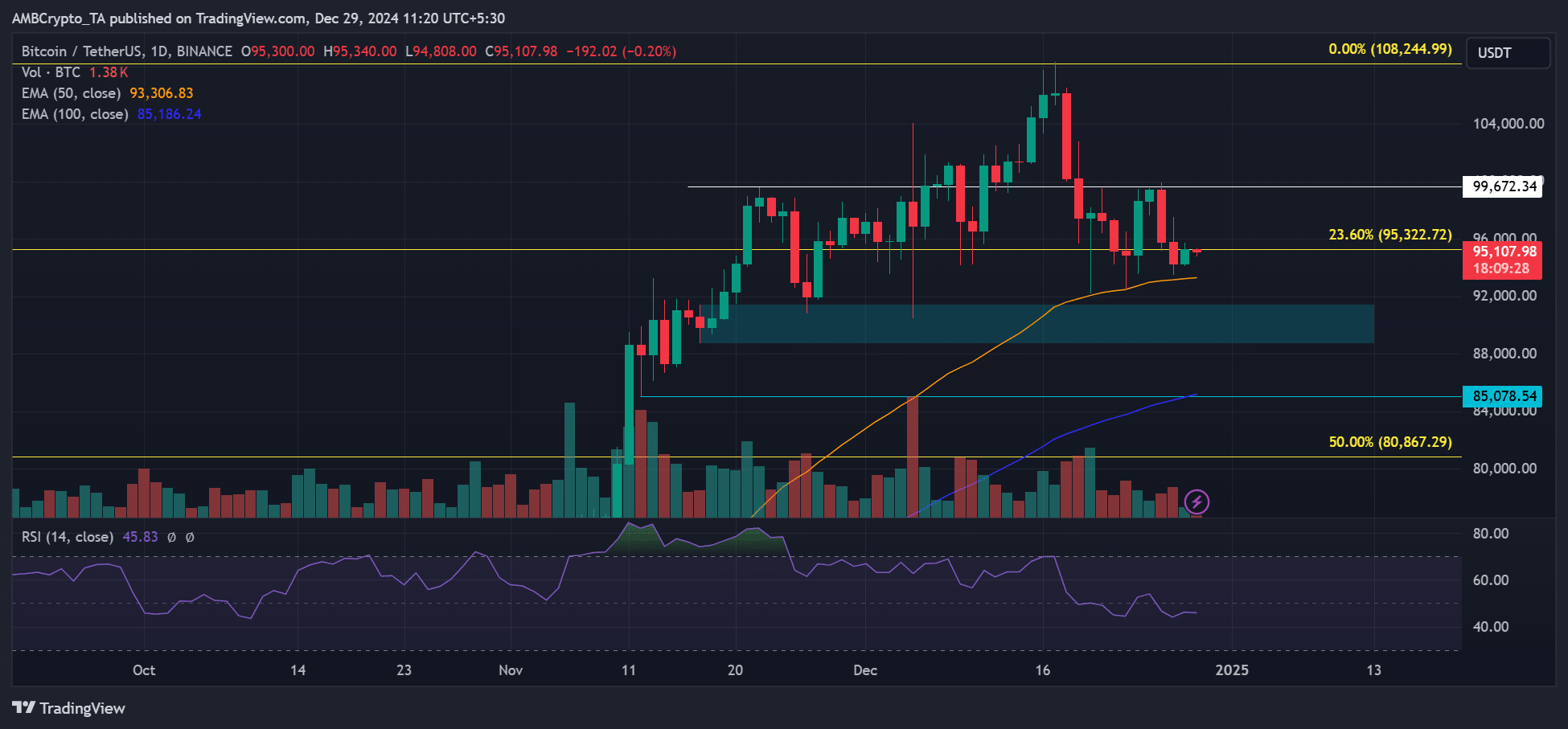

In the meantime, the BTC value remained range-bound in the course of the holidays, consolidating between $100,000 and the 50-day EMA (Exponential Shifting Common).

Furthermore, the day by day RSI dipped under 50, indicating a short-term weakening in demand.

Supply: BTC/USDT, TradingView

Learn Bitcoin [BTC] Worth forecast 2025-2026

Ought to bearish stress proceed within the close to time period, a drop to $90K or $85K could possibly be on the playing cards.

Nevertheless, staying above the dynamic assist of a 50-day EMA might improve the possibilities of a $100,000 retest or a bullish breakout.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now