Bitcoin

Bitcoin exchange deposits plummet to six-year low – What it means for BTC

Credit : ambcrypto.com

- Bitcoin change deposits have hit a six-year low and characterize the bottom stage of BTC deposits in that point.

- That stated, HODLERS are essential to keep away from a drop to the $55,000 assist.

Bitcoin [BTC] Bulls suffered one other setback after a short weekend spike that pushed BTC above $60,000. With three consecutive pink candles, BTC has retreated to $58K.

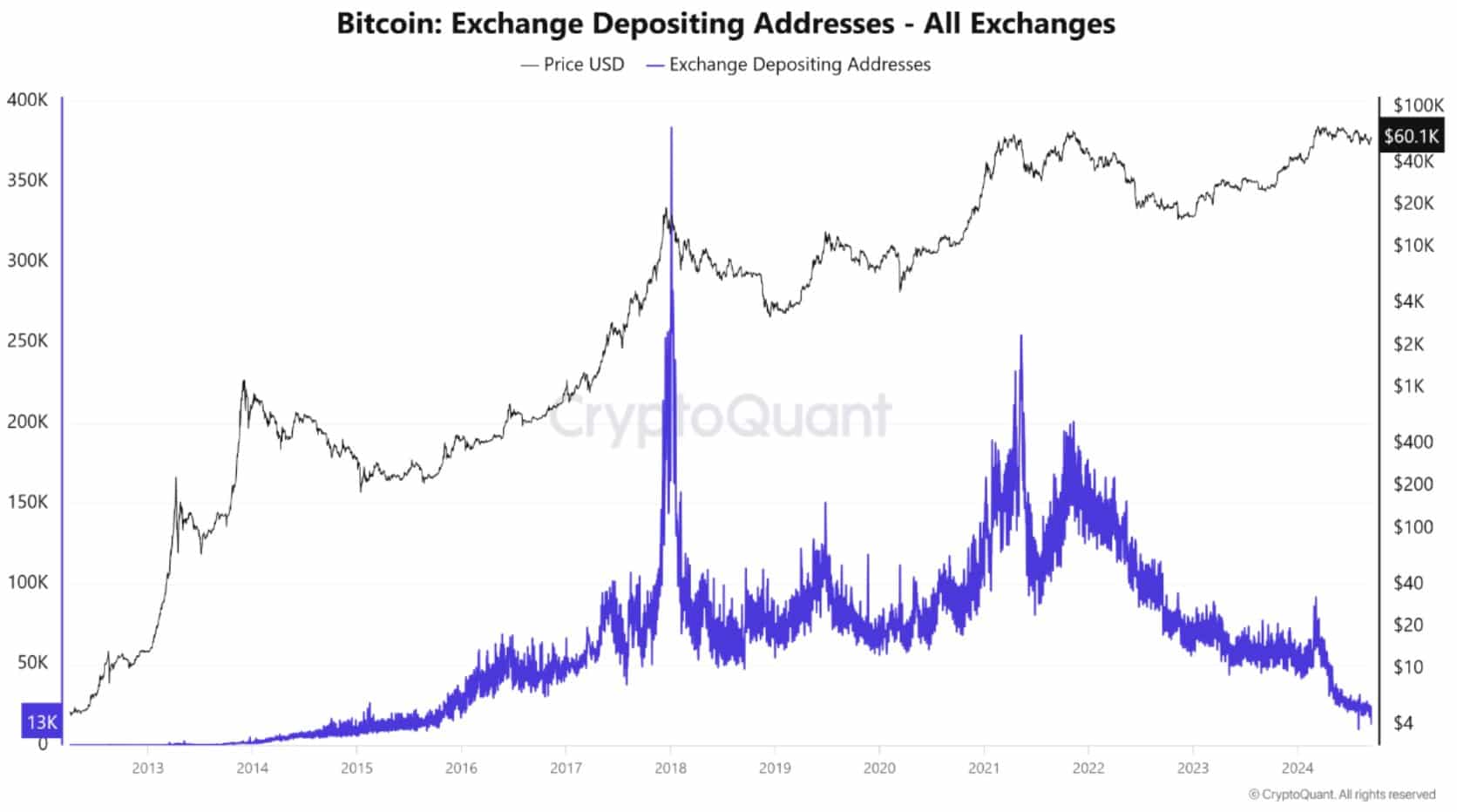

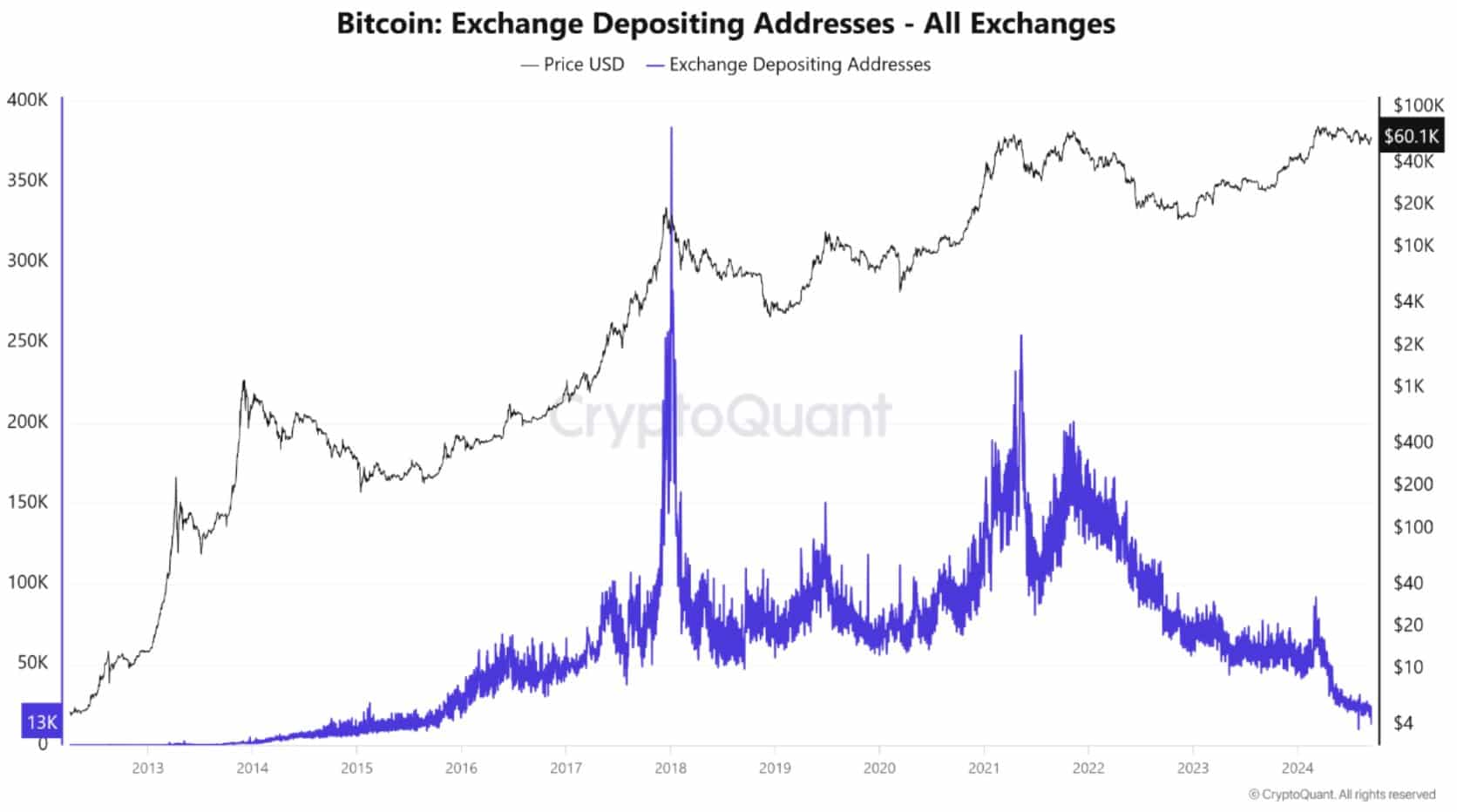

Whereas analysts are divided on whether or not $60,000 is assist or resistance, there’s a new CryptoQuant report reveals that Bitcoin change deposits have hit a six-year low of 132,100, indicating decreased promoting strain.

Might this milestone assist BTC keep away from a drop to $55,000?

Drop in BTC change signifies rising hodler dominance

The chart reveals fewer Bitcoin change deposits, which is normally a bullish sign. Economically, decreased provide can improve the worth of every BTC token.

Whereas for buyers, much less BTC on the exchanges signifies confidence in worth restoration.

Supply: CryptoQuant

Moreover, AMBCrypto’s evaluation reveals that spikes in BTC change deposits usually align with BTC testing excessive worth ranges, indicating profit-taking methods and infrequently resulting in steep declines, indicating potential accumulation.

Conversely, fewer deposits point out higher scrutiny by long-term hodlers, as noticed over the previous six years for the reason that final peak.

Merely put, the Bitcoin area is now dominated by hodlers who’re assured of a worth correction.

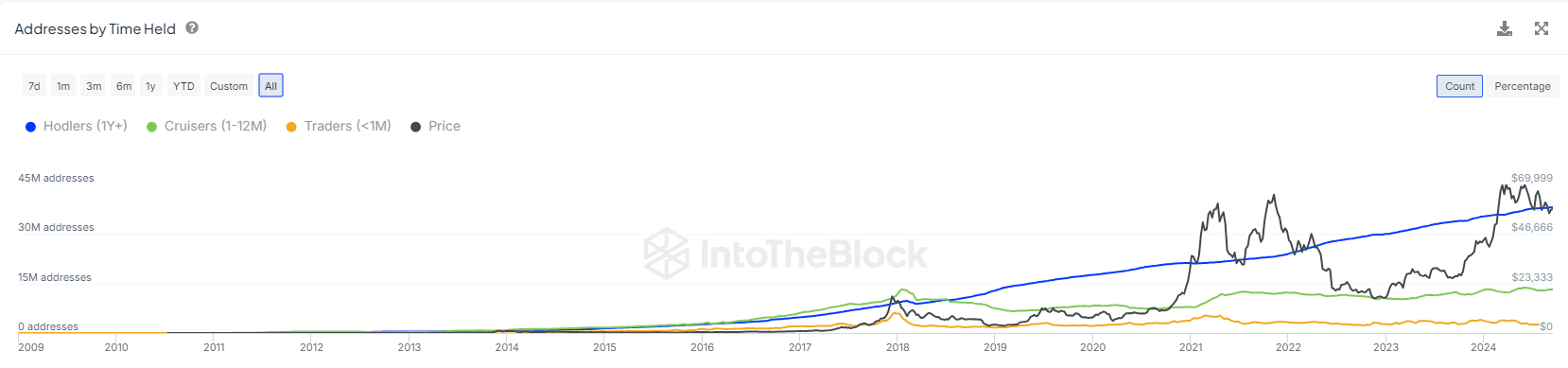

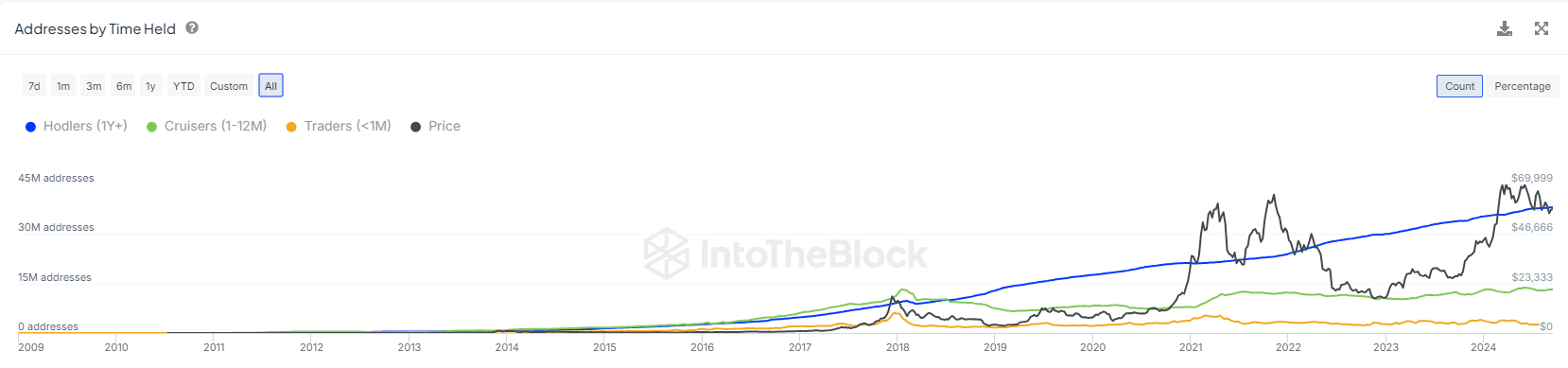

Supply: IntoTheBlock

As anticipated, the variety of hodlers has risen to 38 million, a staggering 375% improve from 8 million six years in the past. Notably, hodlers who’ve owned BTC for greater than a 12 months now characterize 70.77% of the entire variety of addresses.

Surprisingly, this share exceeds the quantity noticed throughout the mid-March rally when BTC reached its ATH.

Briefly, long-term holders are essential to keep away from a drop to $55,000 – however what are the possibilities?

The chances are intriguing

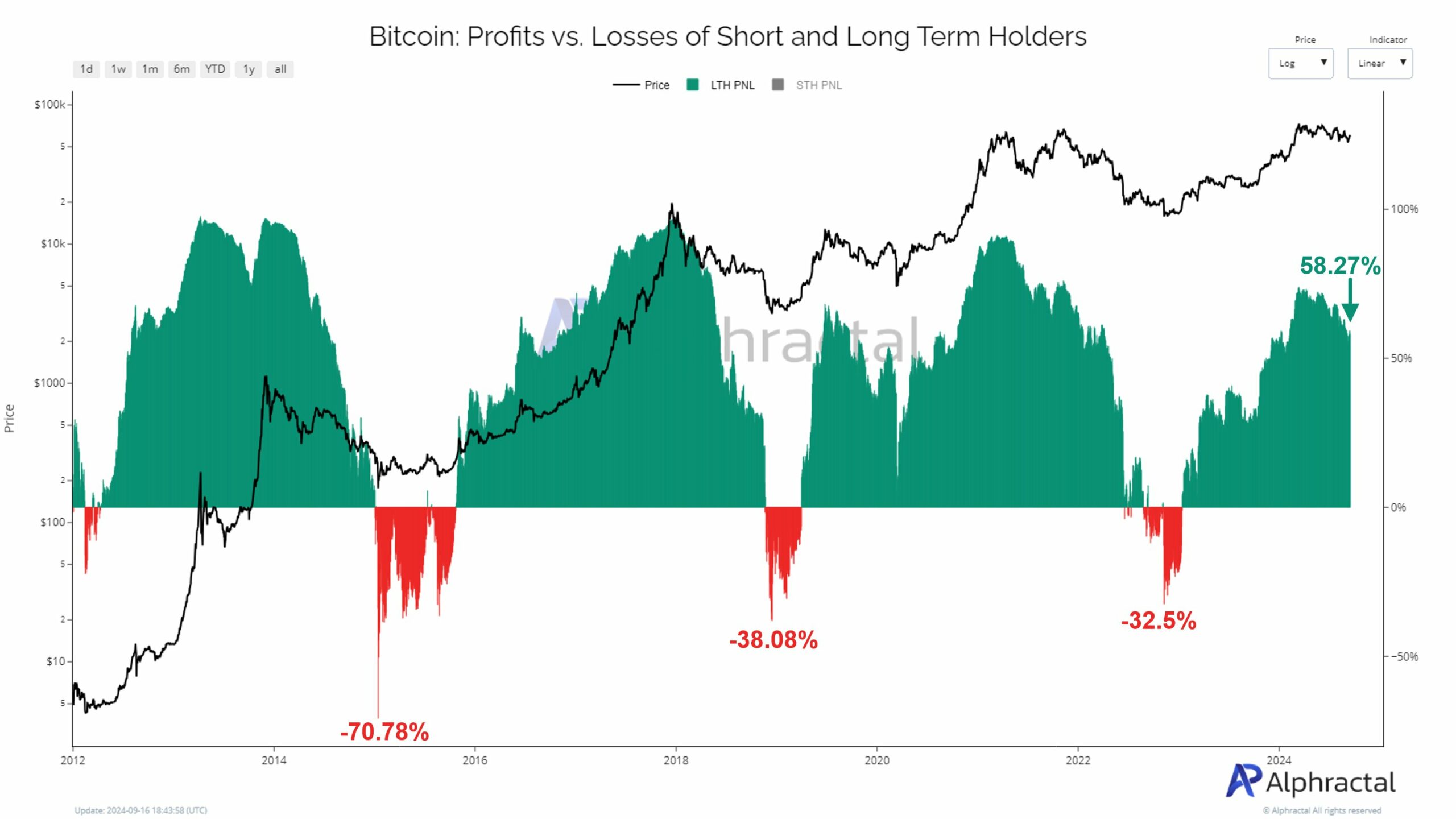

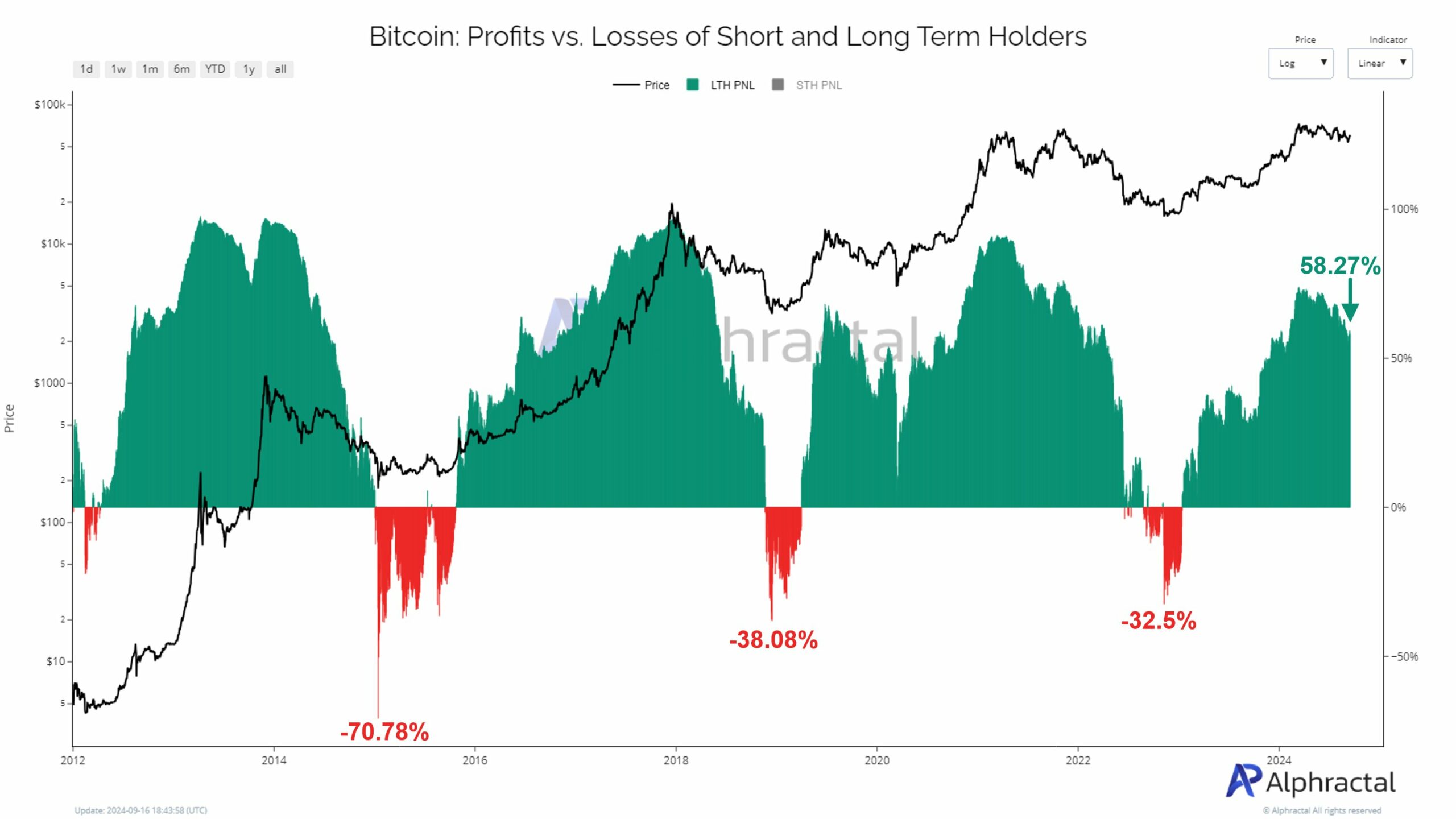

At the moment, 58.27% of LTH are making earnings, down from a peak of 74% on March 13 – a drop of 16%. Traditionally, a decline in revenue margin after reaching a excessive months later can sign a possible bear market.

Supply:

Briefly, whereas most LTH stays worthwhile, the weakening margin may point out a slowdown or bearish pattern forward.

Nevertheless, regardless of mounting losses for the reason that March peak when BTC examined $70,000, LTH’s continued assist alerts perception in a doable worth correction.

If this pattern continues, LTH may delay gross sales, as evidenced by decreased BTC change deposits.

Moreover, a doable Fed fee reduce may push BTC to a brand new ATH, assuming BTC deposits on exchanges proceed their downward pattern. Will they?

Time will inform

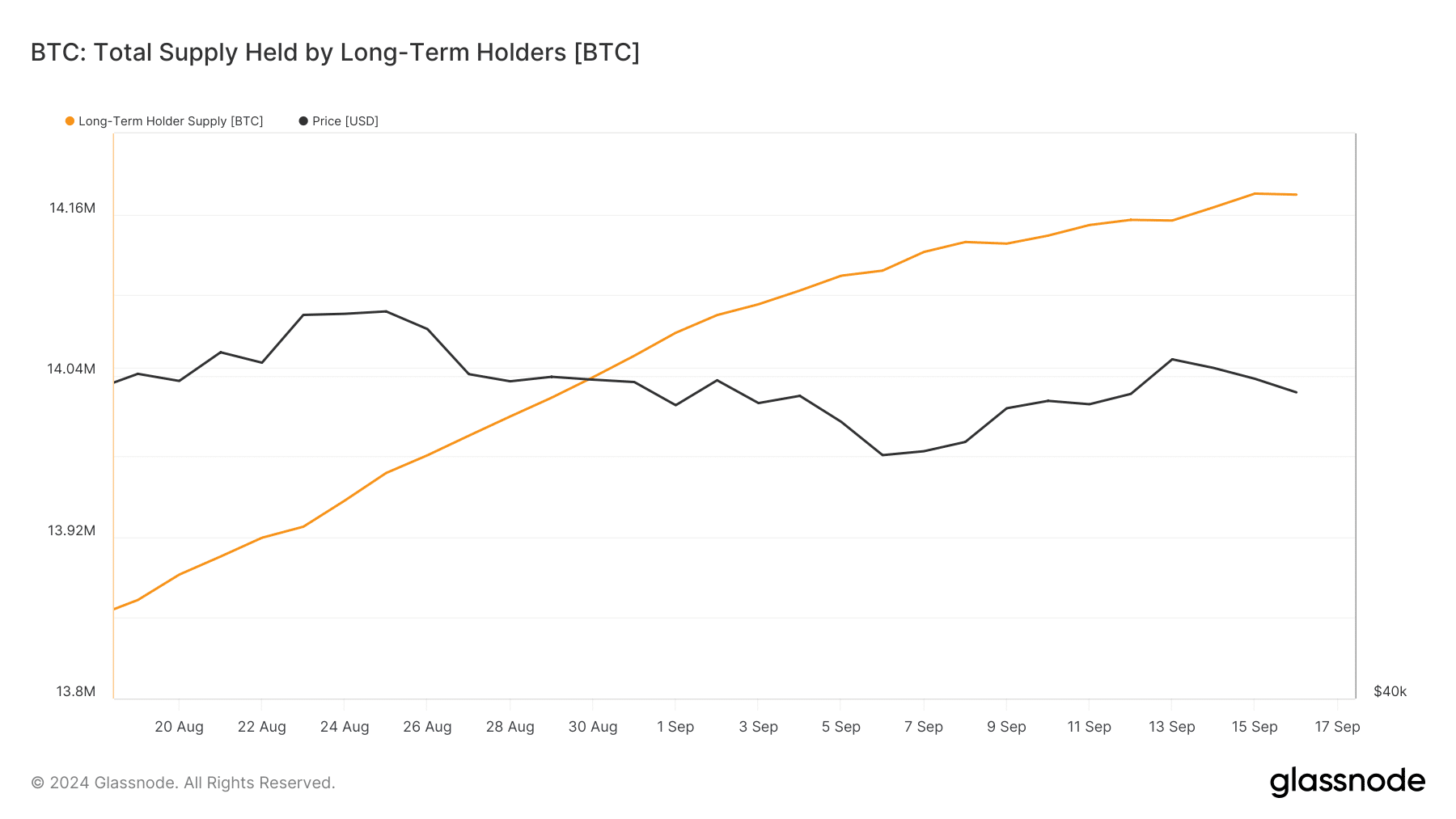

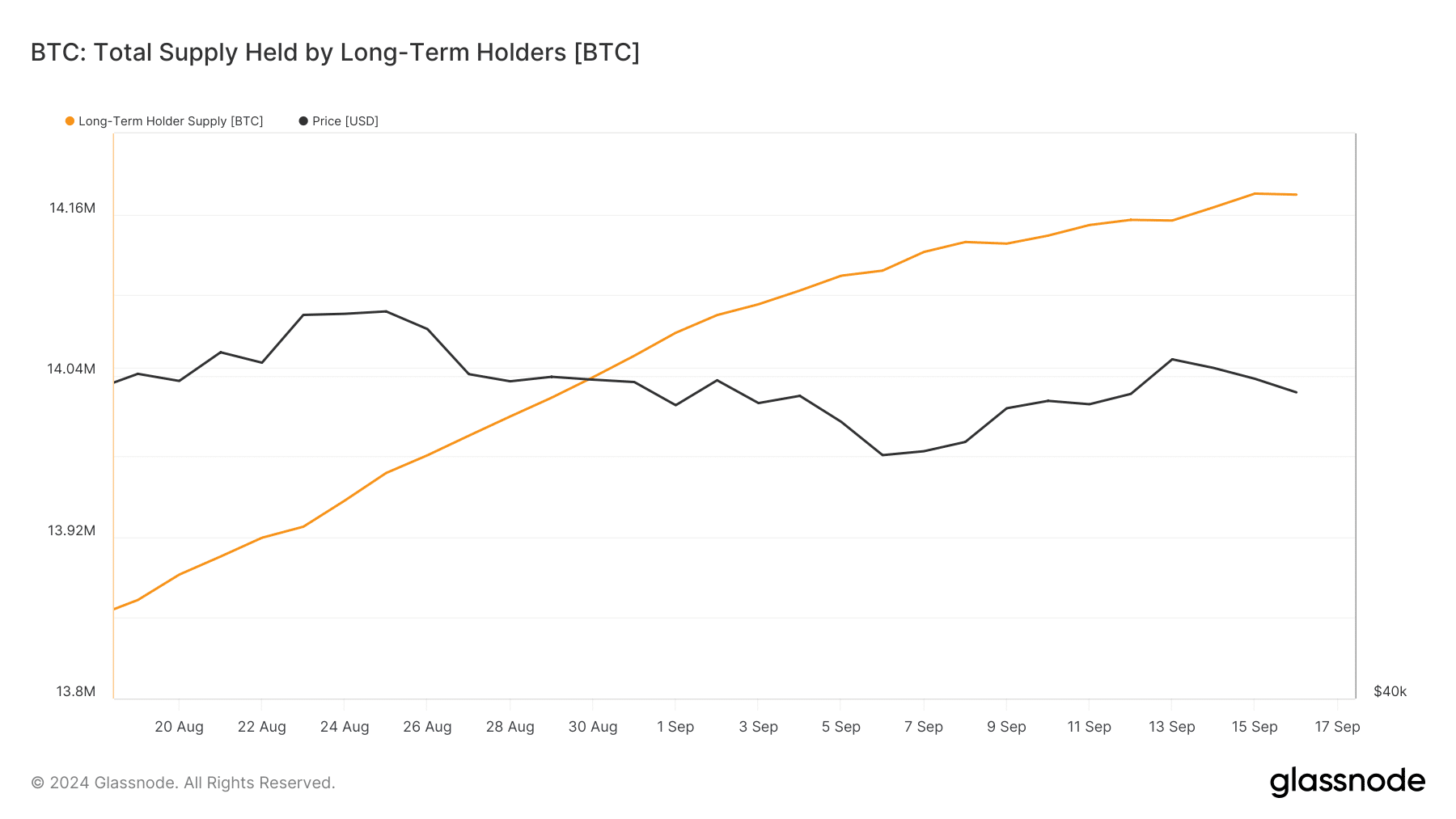

In the course of the 30-day lookback interval, LTHs offered a good portion of their holdings for the primary time on September 16, coinciding with BTC’s return to $58,000.

Supply: Glassnode

As talked about earlier, restoration requires LTHs to assist their positions by avoiding additional promoting. Nevertheless, this downturn was uncommon and nonetheless in line with AMBCrypto’s earlier projections.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

If LTHs can show this occasion is an anomaly, and Bitcoin change deposits stay low, the door to a brand new ATH may nonetheless be broad open.

Conversely, if LTHs proceed to promote, the $55,000 assist may very well be in danger and the trail ahead may turn into rather more unsure.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now