Bitcoin

Bitcoin: Exchanges see $40M daily USDT surge – Is BTC’s rally just starting?

Credit : ambcrypto.com

- USDT inflows point out robust demand for Bitcoin, inflicting its value to rise.

- Stablecoins are an integral a part of Bitcoin’s continued bullish momentum.

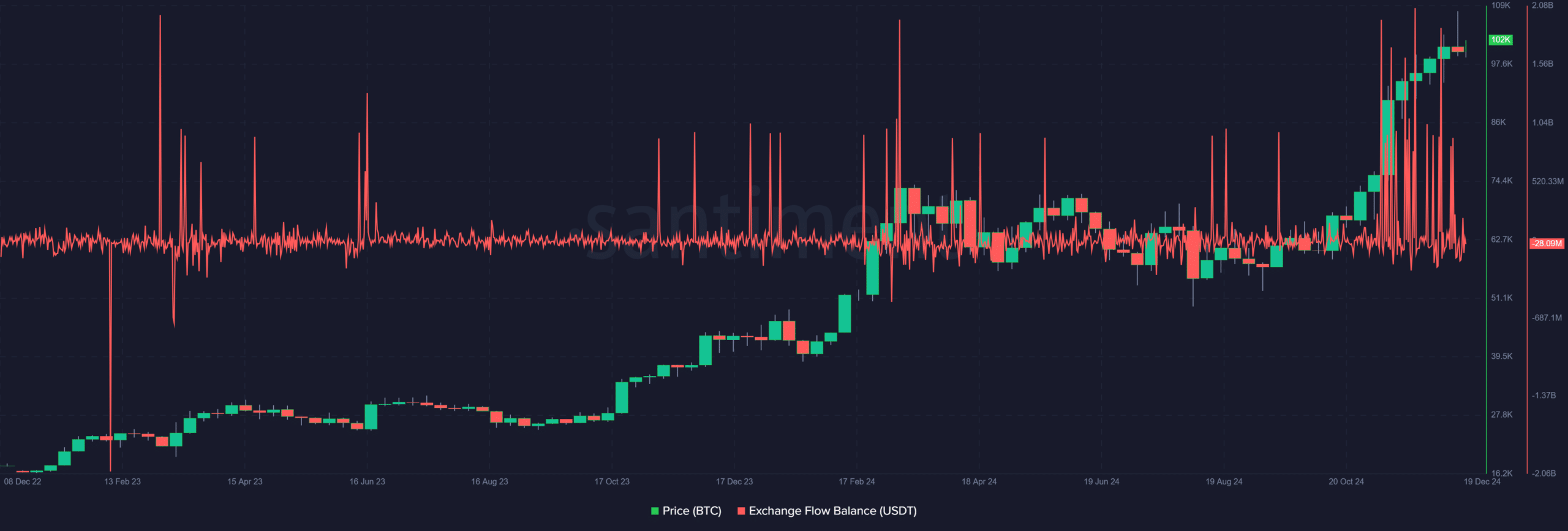

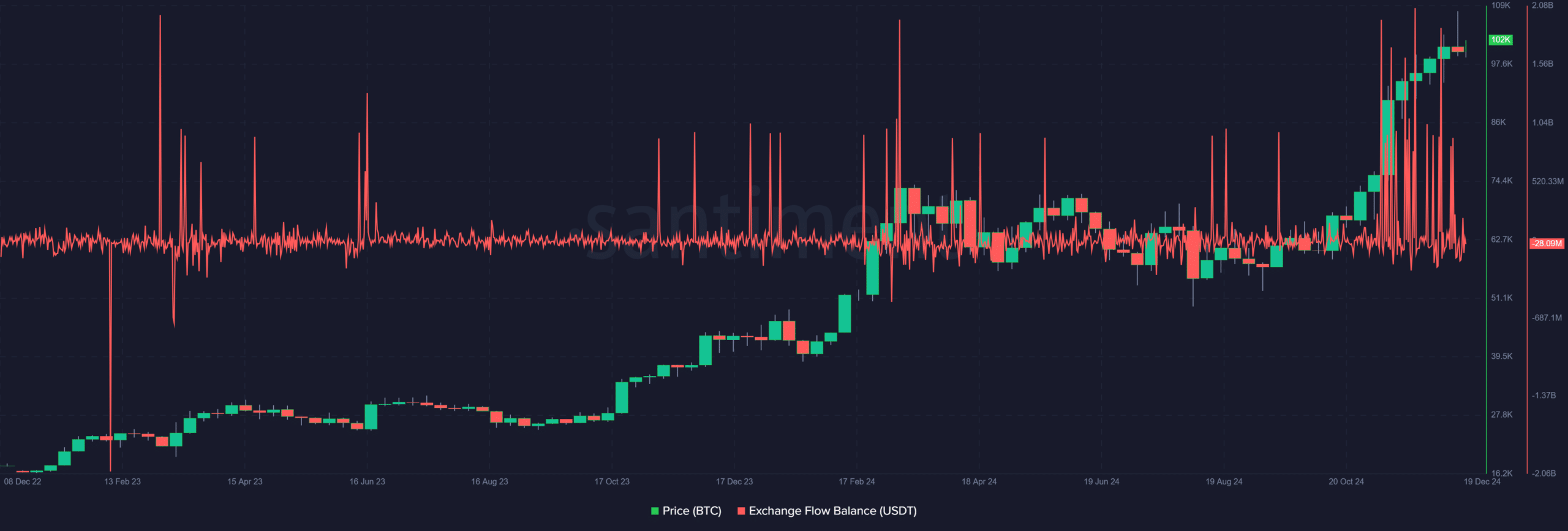

Latest information on the chain factors to an increase in Tether [USDT] inflows to centralized exchanges, averaging $40 million per day. This development means that stablecoins may very well be the driving pressure behind Bitcoin’s continued rally, with the cryptocurrency just lately reaching a report excessive of $108,000.

The numerous USDT deposits point out that giant traders are positioning themselves for additional positive aspects. Since stablecoins function a gateway to different belongings, these inflows may very well be an indication of confidence in Bitcoin’s potential for continued progress.

Significance of USDT inflows and their influence

The regular influx of USDT into centralized exchanges has change into a key indicator of investor sentiment.

Not like different belongings, stablecoin deposits usually point out preparation for buying and selling exercise, moderately than an impending sell-off. Traders use USDT as a liquidity bridge to purchase risky belongings like Bitcoin when market circumstances are favorable.

Supply: Santiment

With exchanges receiving a mean of $40 million USDT day by day, these inflows replicate the elevated demand for cryptocurrency publicity. This surge underlines institutional and retail investor curiosity in Bitcoin’s rally, indicating that stablecoins play a vital position in sustaining market momentum.

The development is particularly notable throughout occasions of heightened value exercise, because it underlines capital’s willingness to gas additional bullish runs.

Impact of stablecoin flows on the value of Bitcoin

Stablecoin flows, particularly these involving Tether, immediately affect Bitcoin’s value dynamics by rising shopping for stress. When massive quantities of USDT are deposited on exchanges, they typically precede elevated buying and selling exercise, pushing up the value of Bitcoin.

This sample is in keeping with Bitcoin’s latest surge to a brand new all-time excessive of $108,000, fueled by important USDT inflows.

Not like conventional belongings, stablecoins allow fast entry to the market, amplifying the influence of large-scale actions. The constant day by day deposits of $40 million point out a powerful demand pipeline for Bitcoin, preserving the bullish momentum going.

As stablecoin inflows proceed, analysts predict additional value will increase, reinforcing USDT’s essential position in shaping market developments.

Wanting forward

The stablecoin market will develop and mature considerably by 2025. Analysts predict that the mixed market capitalization of main stablecoins resembling USDT and USDC may double and even triple, reflecting their shift from area of interest monetary devices to mainstream belongings.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

This enlargement will possible come from clearer laws, higher adoption, and the rise of stablecoins pegged to native currencies, which may problem the dominance of dollar-backed choices.

Moreover, the mixing of stablecoins into conventional banking methods ought to enhance monetary providers and supply quicker and extra inclusive options worldwide.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now