Bitcoin

Bitcoin Eyes $130,000 If Fed Signals Dovish Policy

Credit : bitcoinmagazine.com

Bitcoin Value closed at $ 115,390 final week, which briefly briefly violated the resistance stage of $ 115,500 when it was pressed in the course of the weekend, solely to dive again and shut the week behind it. Final week, a robust inexperienced candle produced for the bulls and maintained Opwing Momentum this week. The American producer worth index got here far on expectations final week, giving Market Bulls hope on the approaching determination determination of the Federal Reserve. Nonetheless, American inflation information was lukewarm the following morning, as a result of it registered at 2.9%, as anticipated, however greater than the studying of the two.7percentlast month. The Federal Reserve could have its work reduce this week in the course of the FOMC assembly on Wednesday, the place it should weigh the advantages and downsides of chopping or not. The market expects utterly one 0.25% Interest reduction (as could be seen in polymarket), so each hesitation now by the FED will in all probability result in a market correction.

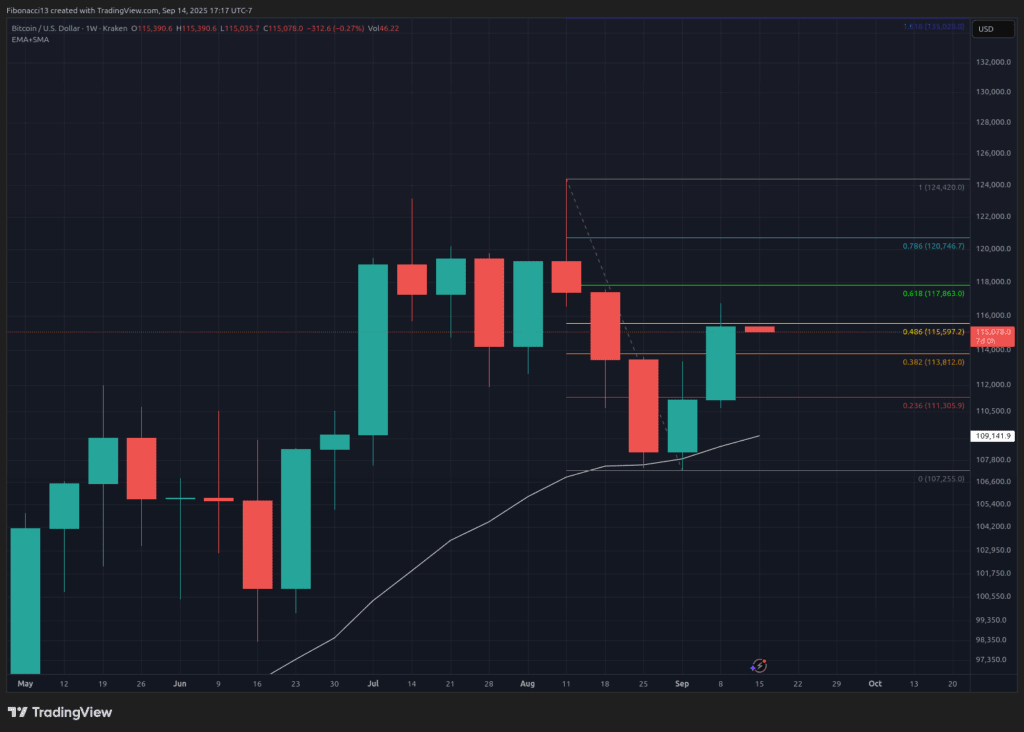

Most necessary help and resistance ranges now

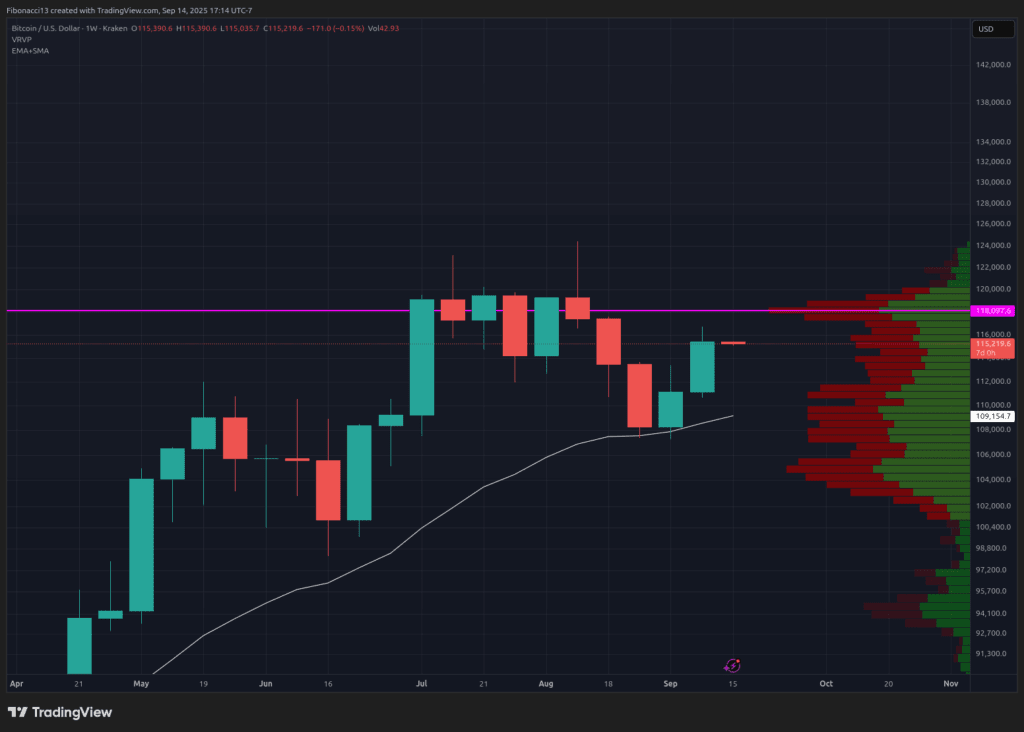

On this week the $ 115,500 stage is the following resistance stage that Bitcoin will need to shut. Nonetheless, $ 118,000 will stand in the way in which right here. If Bitcoin nonetheless allows a robust week, it’s potential that the value solely pushes in $ 118,000 Intreeek to shut it on Sunday. We’ve to anticipate that sellers are sturdy in stepping and bulls to provide again some soil.

If Bitcoin sees weak point this week, or a rejection of the extent of $ 118,000, we have now to look down on the $ 113,800 stage for short-term help. Beneath we have now weekly help at $ 111,000. Closing beneath would problem the $ 107,000 low.

Outlook for this week

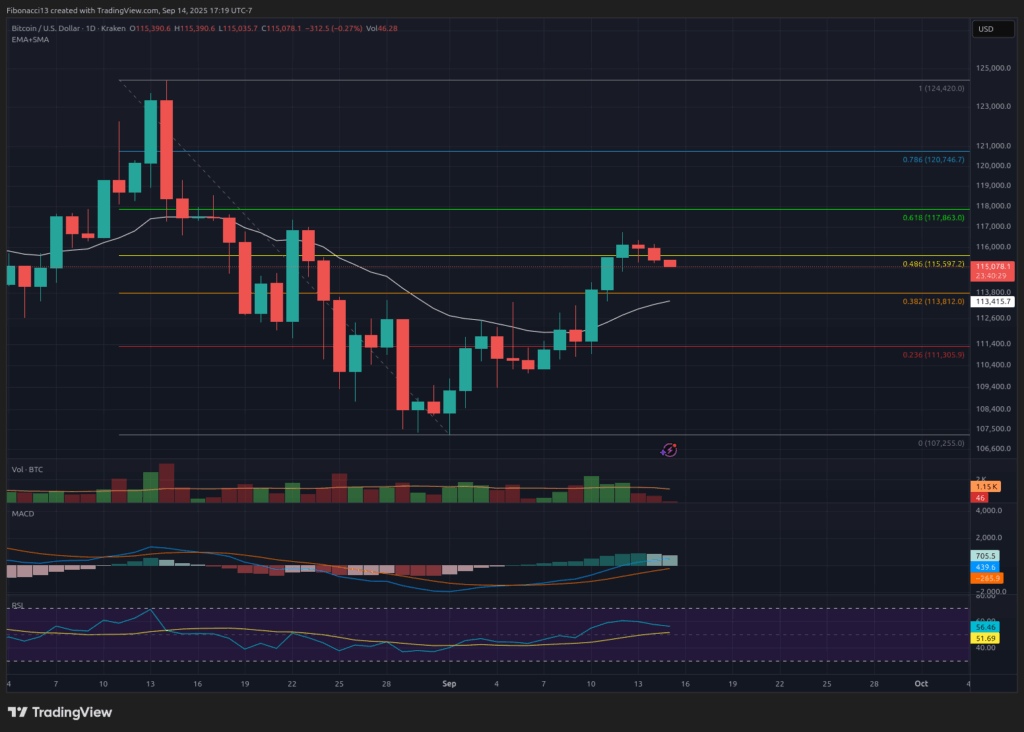

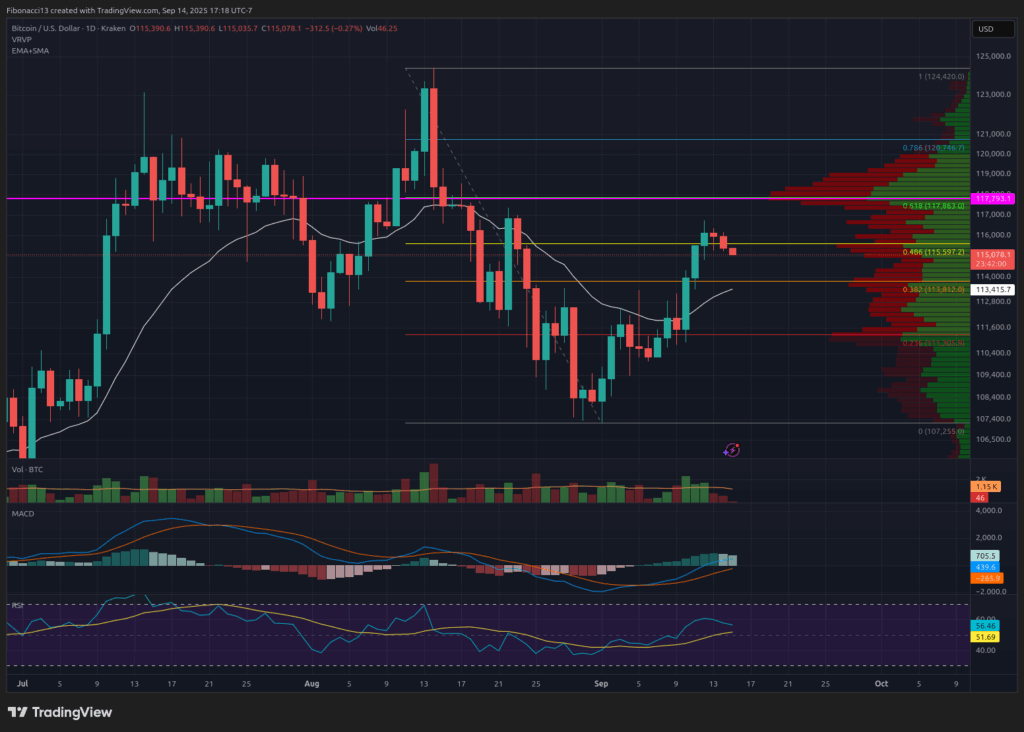

Zooming in on the every day graph, bias is simply considerably Bearish from the tip of Sunday, after rejection of $ 116,700 final Friday. Nonetheless, this might shortly return to a bullish prejudice, if Monday’s American inventory market prize additionally resumes his bullish pattern. The MACD is at present making an attempt to maintain it above the Zero line and restore it as help for Bullish Momentum to renew. Within the meantime, the RSI immerses however stays in a bullish place. It can have a look at the 13 SMA for help if the sale intensifies till Tuesday.

All eyes will likely be for chairman Powell and the Federal Reserve on Wednesday whereas he speaks at 2.30 pm Jap. With one thing apart from an announcement of 0.25% lowered announcement at 2:00 pm in all probability precipitated a substantial market volatility that would definitely go over in Bitcoin.

Market temper: Bullish, after two inexperienced weekly candles in a row – expects the extent of $ 118,000 to be examined this week.

Within the coming weeks

Shifting Momentum above $ 118,000 will likely be necessary within the coming weeks if Bitcoin can soar over this approaching impediment within the close to future. I might anticipate Bitcoin to happen within the $ 130,000s if it may well once more set up $ 118,000 as help.

Assuming that the FED will decrease the charges this week, the market will then look ahead to October for an additional rate of interest discount. That’s the reason supporting market information and steady cutbacks will likely be essential for the Bitcoin worth path sooner or later, which signifies that a bullish continuation of latest highlights is fueled.

Then again, necessary Bearish occasions, or the Fed that shock everybody with a choice to not reduce on Wednesday, will definitely ship the Bitcoin worth down once more to check help ranges.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipate the value to be greater.

Bears/Bearish: Sellers or buyers who anticipate the value will likely be decrease.

Assist or help stage: A stage at which the value for the energetic ought to apply, not less than within the first occasion. The extra touches of help, the weaker it turns into and the higher the possibility that it’s going to not maintain the prize.

Resistance or resistance stage: Reverse help. The extent that may in all probability reject the value, not less than within the first occasion. The extra touches in resistance, the weaker it turns into and the higher the possibility that it isn’t to cease the value.

SMA: Easy On common. Common worth based mostly on closing costs in the course of the specified interval. Within the case of RSI that is the common power index worth in the course of the specified interval.

Oscillators: Technical indicators that modify over time, however normally keep in a bond between set ranges. Thus, they oscillate between a low stage (usually that represents over -sold circumstances) and a excessive stage (normally signify overbough circumstances). E.g. Relative power index (RSI) and advancing common convergence-divigence (MACD).

MacD Oscillator: The advancing common convergence divergence is a momentum scillator that dedicates the distinction between 2 progressive averages to point each pattern and momentum.

RSI -userator: The Relative power index is a momentum scillator that strikes between 0 and 100. It measures the velocity of the value and adjustments to the velocity of the value actions. When RSI is older than 70, that is thought-about overbough. When RSI is beneath 30, that is thought-about to be bought over.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024