Bitcoin

Bitcoin eyes bullish breakout, but can BTC smash THIS major resistance?

Credit : ambcrypto.com

- Bitcoin struggled in opposition to resistance at $67,583; Breaking this degree may set off a transfer in the direction of $70,000.

- RSI and MACD present weakening momentum, whereas rising lively addresses point out potential bullish exercise.

Bitcoin [BTC] fell under $67,000 and hit an intraday low of $65,700 after shedding in a single day beneficial properties. Priced at $66,972.95 on the time of writing it reveals a decline of 1.22% within the final 24 hours and a couple of.01% within the final week.

Regardless of the short-term dip, Bitcoin’s market cap stays $1.32 trillion, with a circulating provide of 20 million BTC. Previously 24 hours, buying and selling quantity reached $46.32 billion, reflecting continued curiosity from merchants.

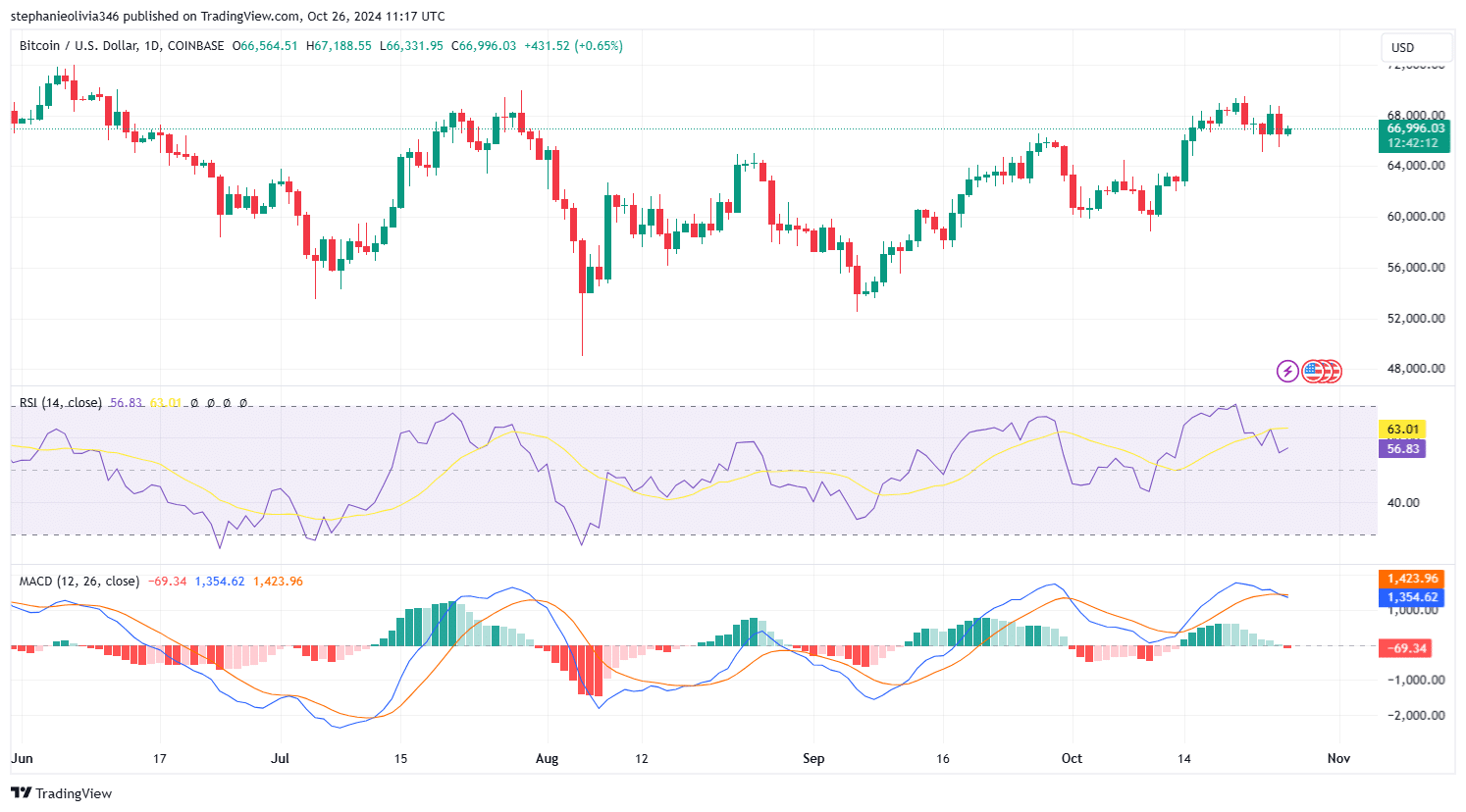

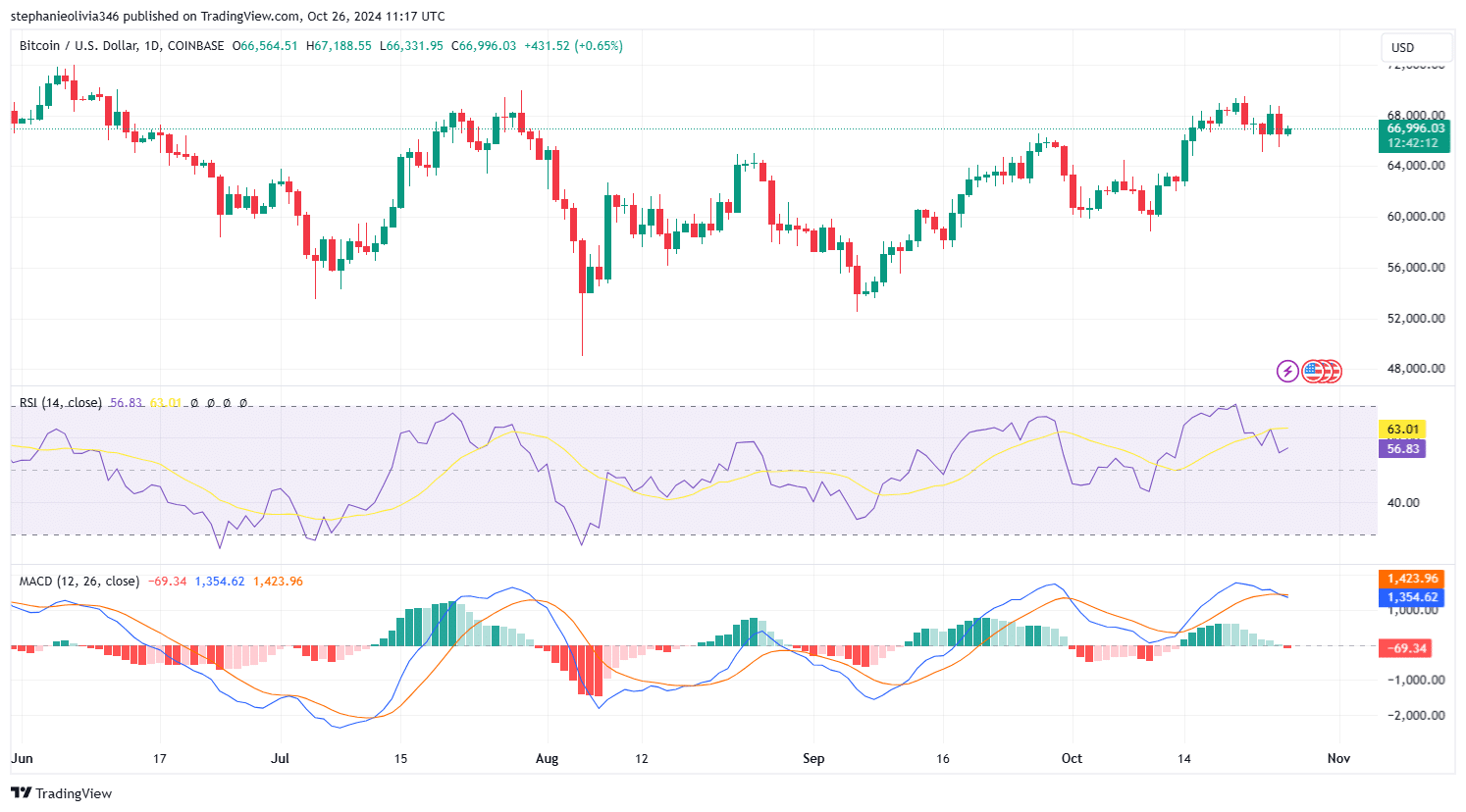

Bitcoin traded inside a transparent descending channel. This sample reveals a collection of decrease highs and decrease lows, indicating a bearish development.

The higher restrict of this channel, close to $69,000, has repeatedly acted as a powerful resistance degree, pushing costs decrease after each try to maneuver above it.

Because the chart reveals, current rejections have adopted comparable patterns, indicating that this resistance stays a key problem to additional beneficial properties.

Supply: TradingView

Help and resistance ranges

Bitcoin’s highest resistance zone was between $67,583.25 and $69,000, a spread that has constantly rejected bullish makes an attempt.

If Bitcoin manages to interrupt above this vary, it may pave the best way for an prolonged transfer in the direction of $70,000.

Nonetheless, if this degree will not be reached, Bitcoin may return decrease inside the descending channel.

Speedy help is recognized round $66,423.76, marked as a important degree on the chart. Ought to Bitcoin break this help, it may fall in the direction of the decrease restrict of the channel, projected between $60,000 and $62,000.

RSI and MACD evaluation

On the time of this publication, the Relative Energy Index (RSI) stood at 56.75, under the sign line of 63.00. This indicated that bullish momentum was weakening and approaching a extra impartial zone.

In the meantime, the RSI rose above 70 earlier in October, indicating overbought situations. The following decline indicated a correction, however the present RSI degree nonetheless leaves room for upward motion.

It is crucial that the bullish momentum stays above 50.

Supply: TradingView

The Transferring Common Convergence Divergence (MACD) line stays above the sign line, indicating a continued bullish development. Nonetheless, shrinking histogram bars point out declining momentum.

If the MACD line crosses under the sign line, it could point out a short-term downtrend or a interval of consolidation.

Exercise within the chain

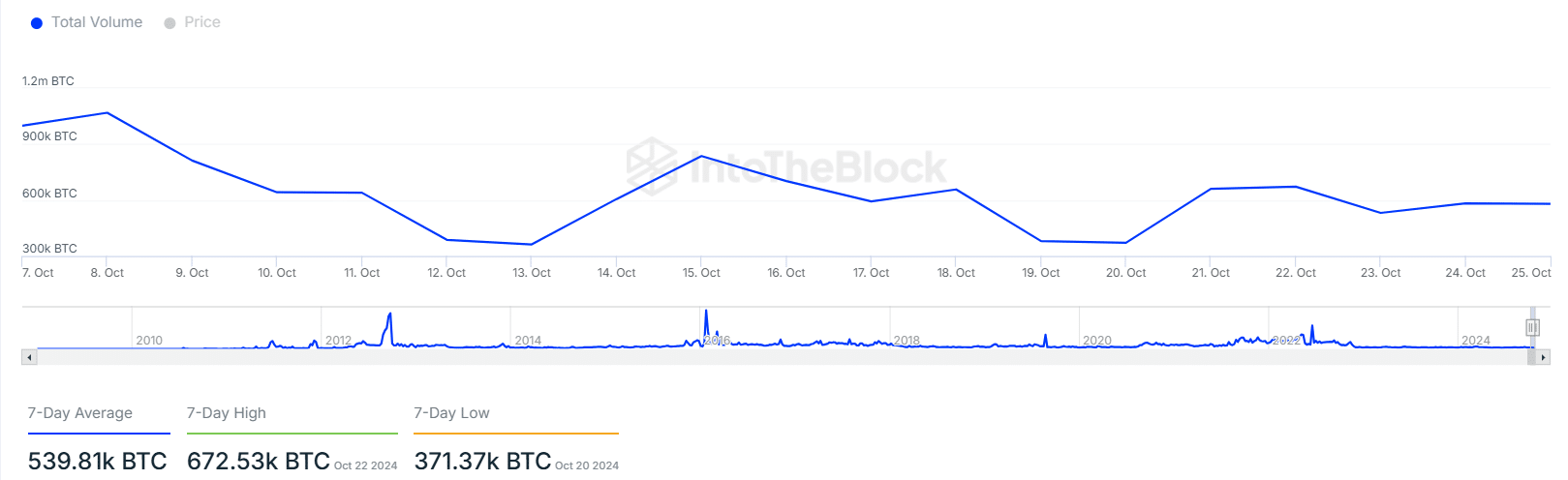

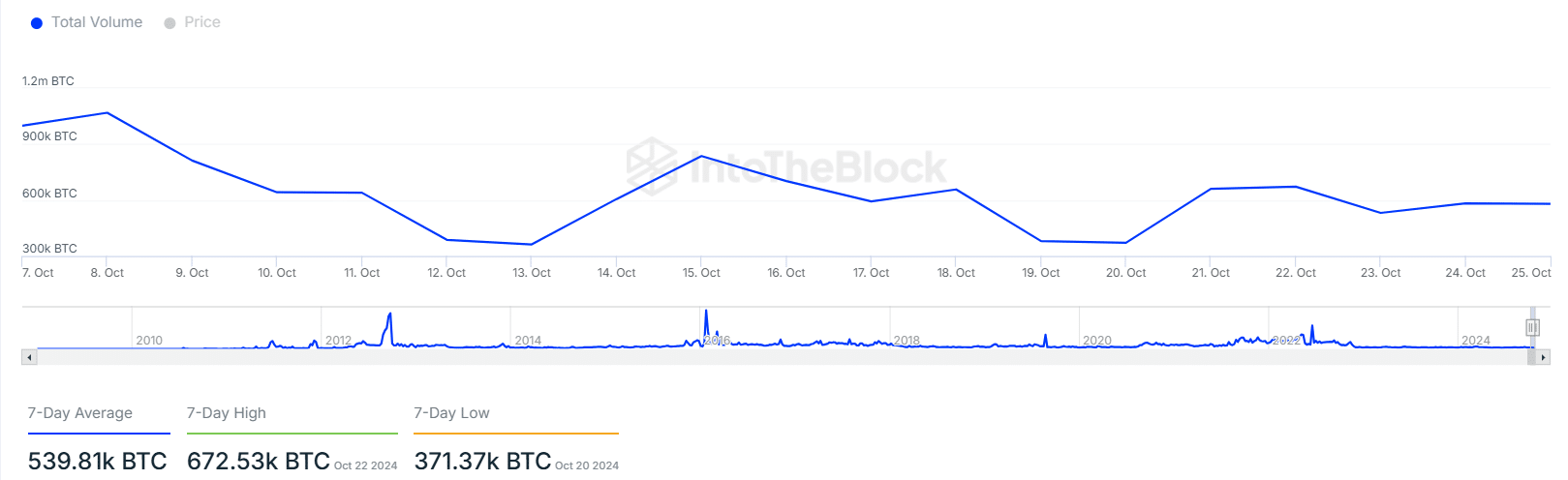

In response to InHetBlok Information reveals that lively Bitcoin addresses elevated by 5.20% over the previous week, indicating higher consumer engagement.

This contrasted with a 6.50% drop in new addresses, indicating present customers have been driving community exercise.

Bitcoin’s seven-day common transaction quantity was 539.81k BTC on the time of writing, with a current excessive of 672.53k BTC on October 22 and a low of 371.37k BTC on October 20.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Value forecast 2024–2025

The fluctuating quantity displays altering market exercise, with the current spike indicating growing engagement.

This variability in transaction quantity signifies ongoing modifications in buying and selling patterns, which may decide Bitcoin’s worth actions within the coming days.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September