Bitcoin

Bitcoin faces sell pressure: Will THESE demand levels prevent a freefall?

Credit : ambcrypto.com

- BTC’s rally comes as international alternate reserves proceed to say no.

- The sentiment means that BTC may fall additional till it finds a crucial level for a restoration.

Bitcoin [BTC] The market efficiency is just not what you’d anticipate after a big rebound final month, which took the market to a brand new all-time excessive with a rise of 33.14%.

At the moment the 24-hour revenue is minimal: 0.78%. Whereas this means extra shopping for exercise than promoting, the upward motion is way from assured, AMBCrypto studies.

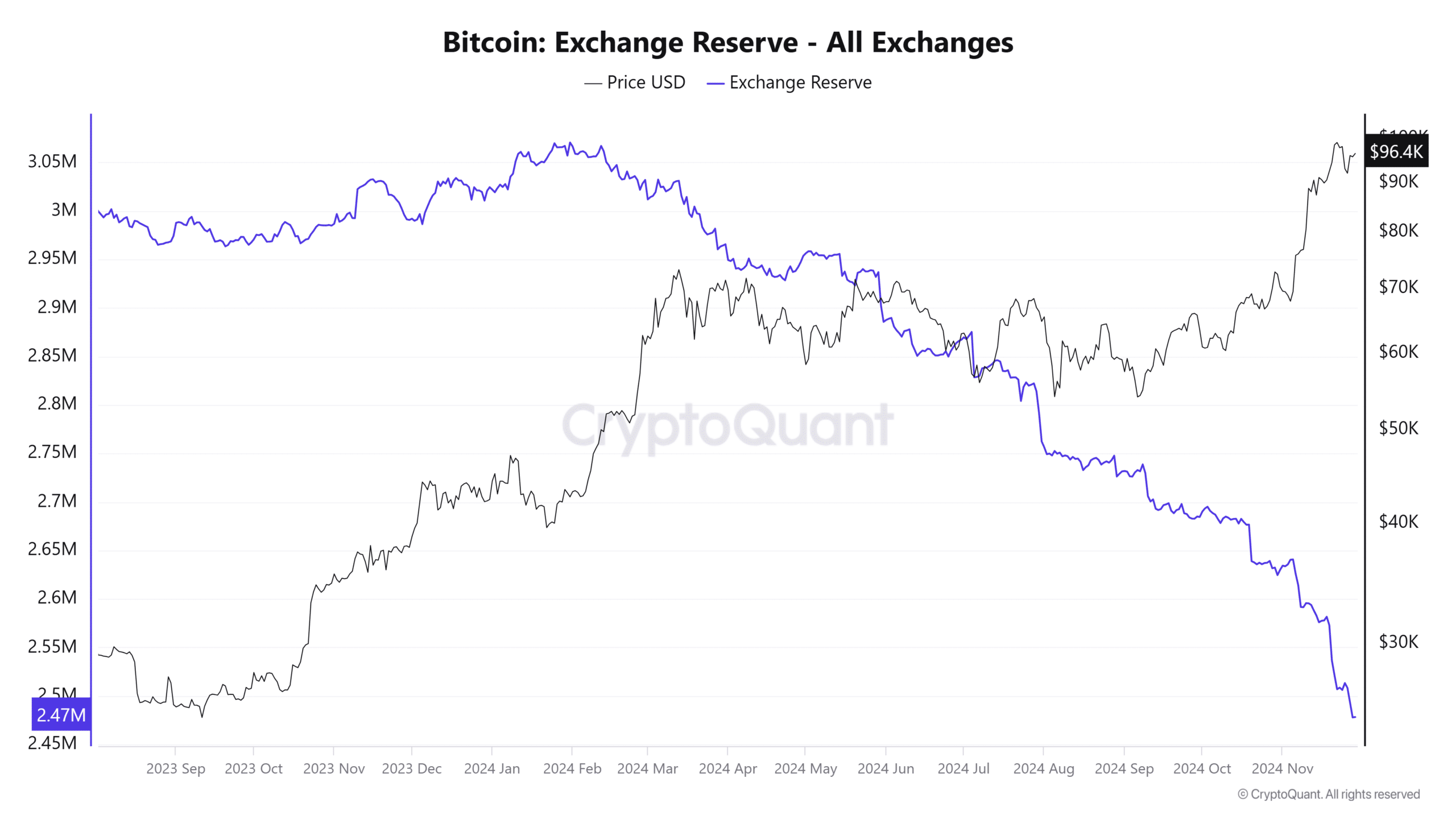

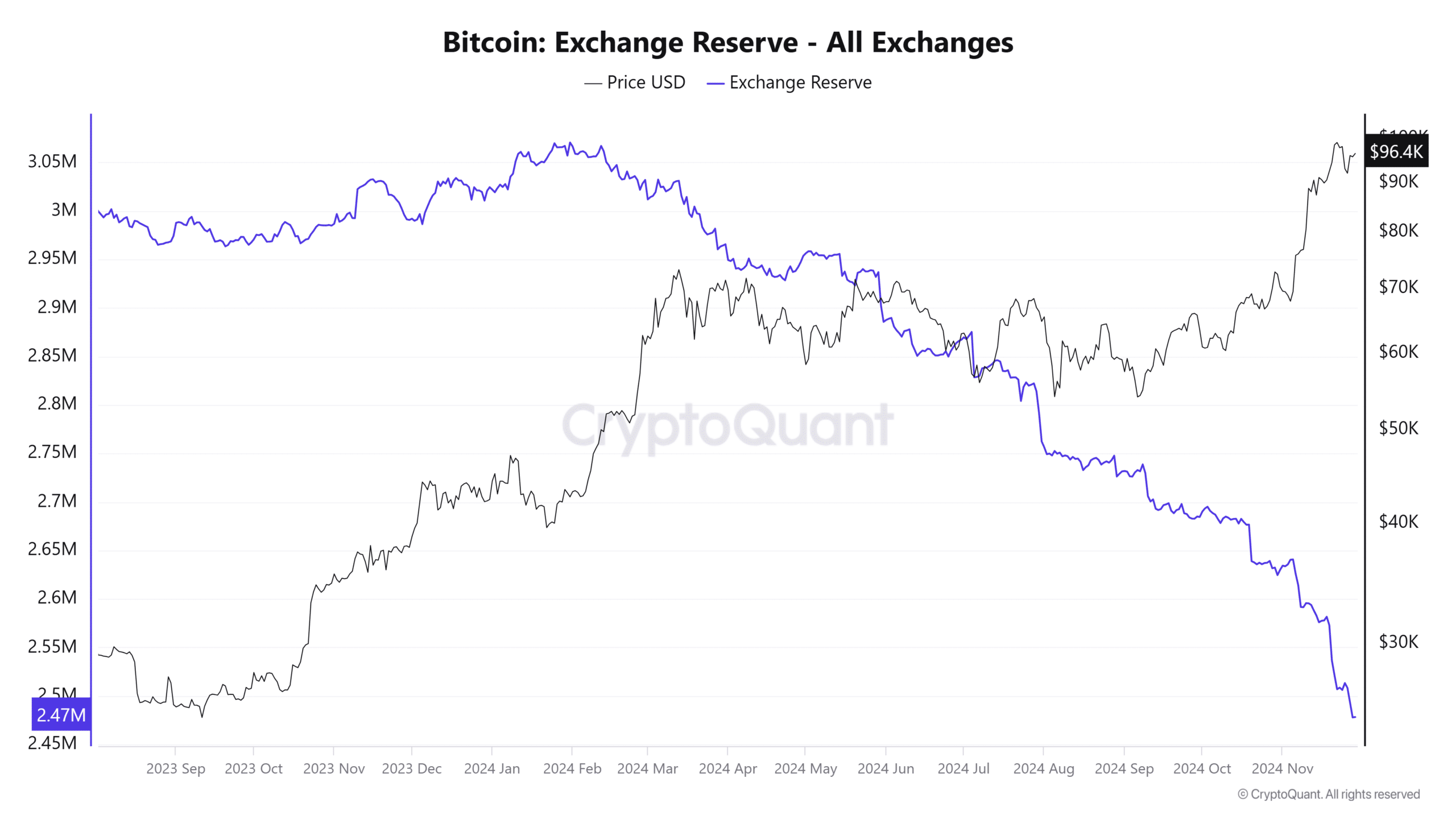

The BTC provide on exchanges continues to say no

Information from CryptoQuant studies a continued decline in Bitcoin availability on cryptocurrency exchanges. The Change Reserve is down 0.61% prior to now 24 hours and 1.53% prior to now week.

Supply: Cryptoquant

A drop in Change Reserve sometimes signifies a diminished circulating provide of BTC on exchanges, an element that usually helps value will increase resulting from shortage.

This decline has performed a task in BTC’s latest beneficial properties on the each day chart. Nevertheless, the sustainability of this rally stays unsure, with AMBCrypto outlining the important thing elements to observe.

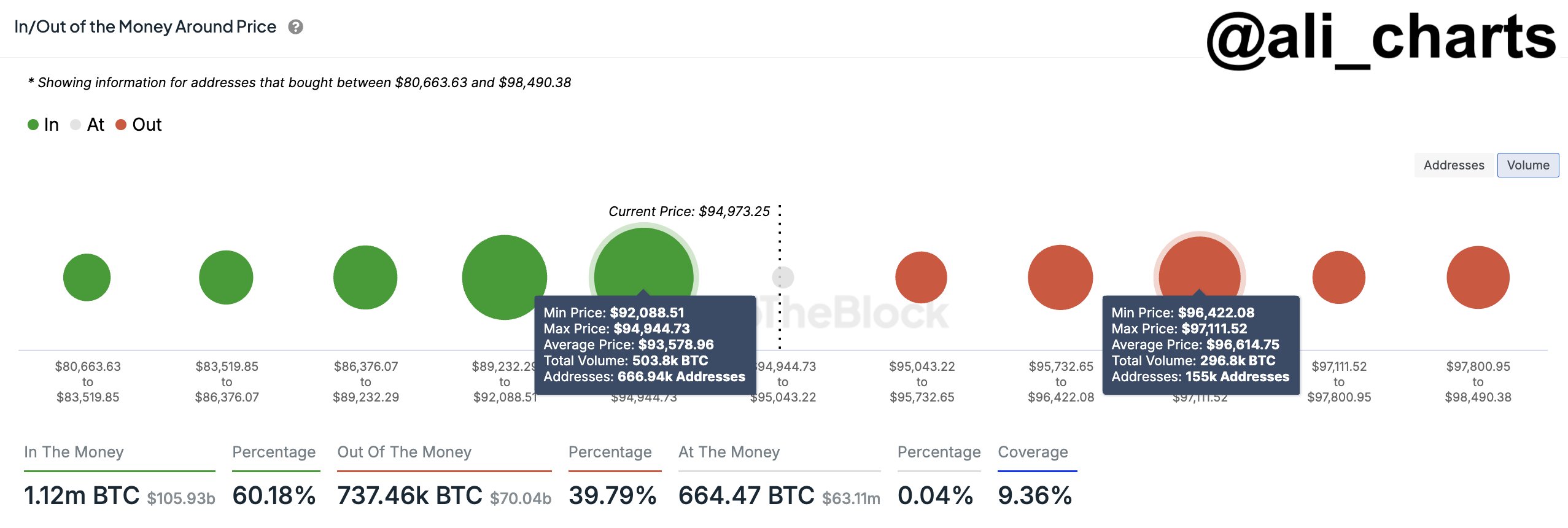

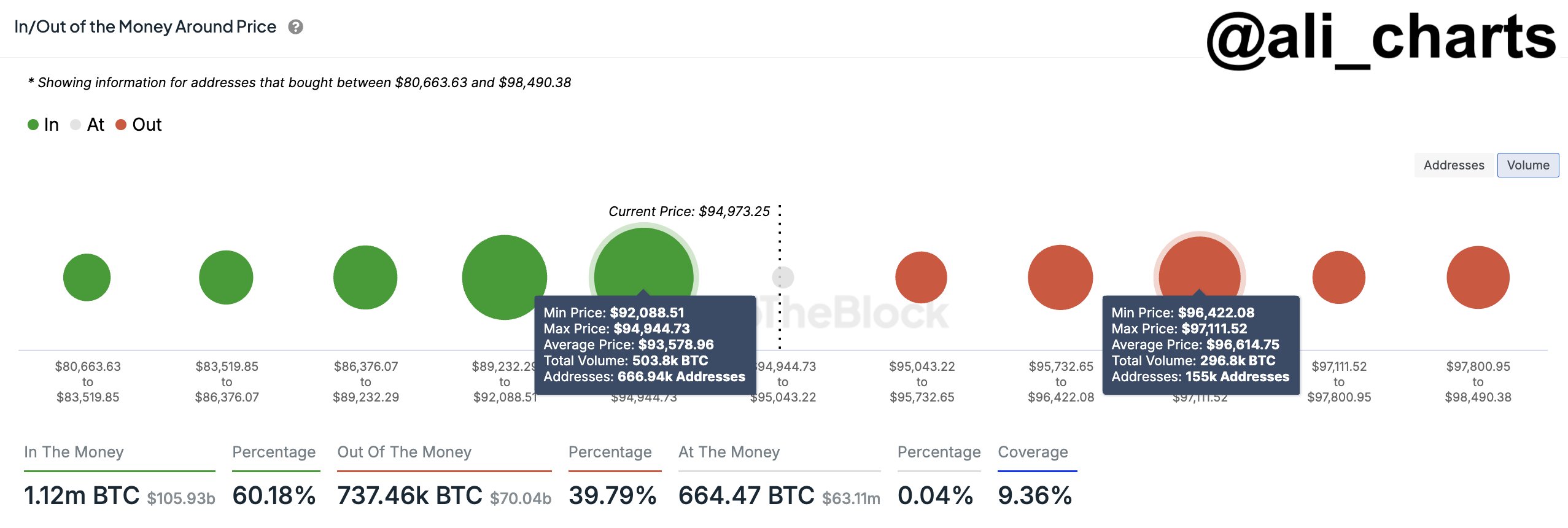

Promoting strain will increase as BTC reaches the provision space

According to Based on analyst Ali, BTC is at a crucial juncture because it has entered a provide zone at $96,614.75. There may be important promoting strain right here, with promote orders totaling 296.8K BTC.

If BTC faces a decline, Ali emphasised the significance of the following key demand zone at $93,578.96, the place purchase orders for 503.8K BTC from 666.94 addresses are concentrated.

He acknowledged:

“Remaining above this assist degree is a should to forestall these holders from promoting.”

Whereas the stronger shopping for orders at this degree recommend this might maintain, the result relies on the depth of promoting strain.

Supply:

AMBCrypto additionally observed a warning signal, with a pointy enhance in BTC inflows to exchanges – 2,678 BTC moved within the final 24 hours – additional elevating the potential of a value drop.

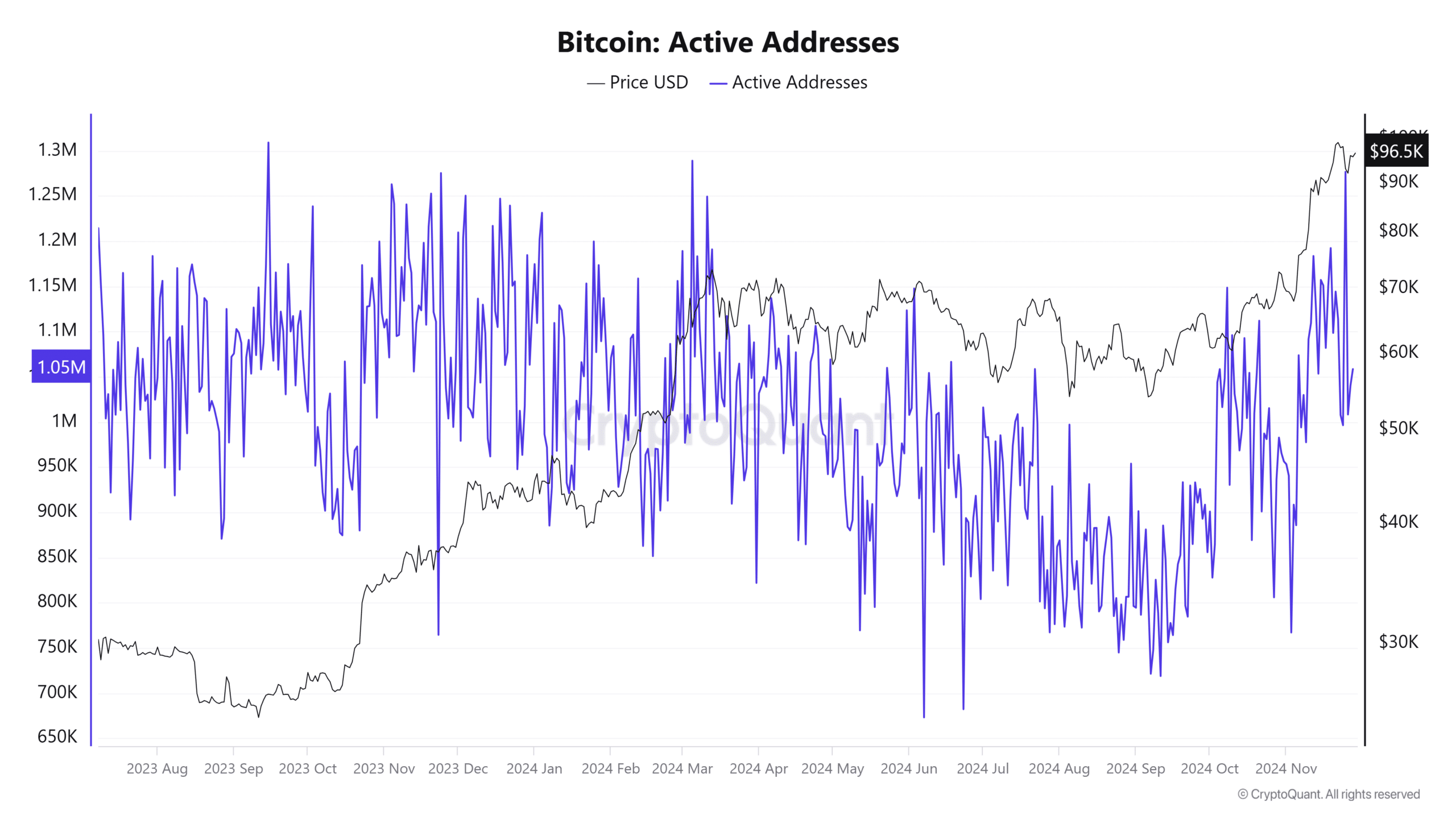

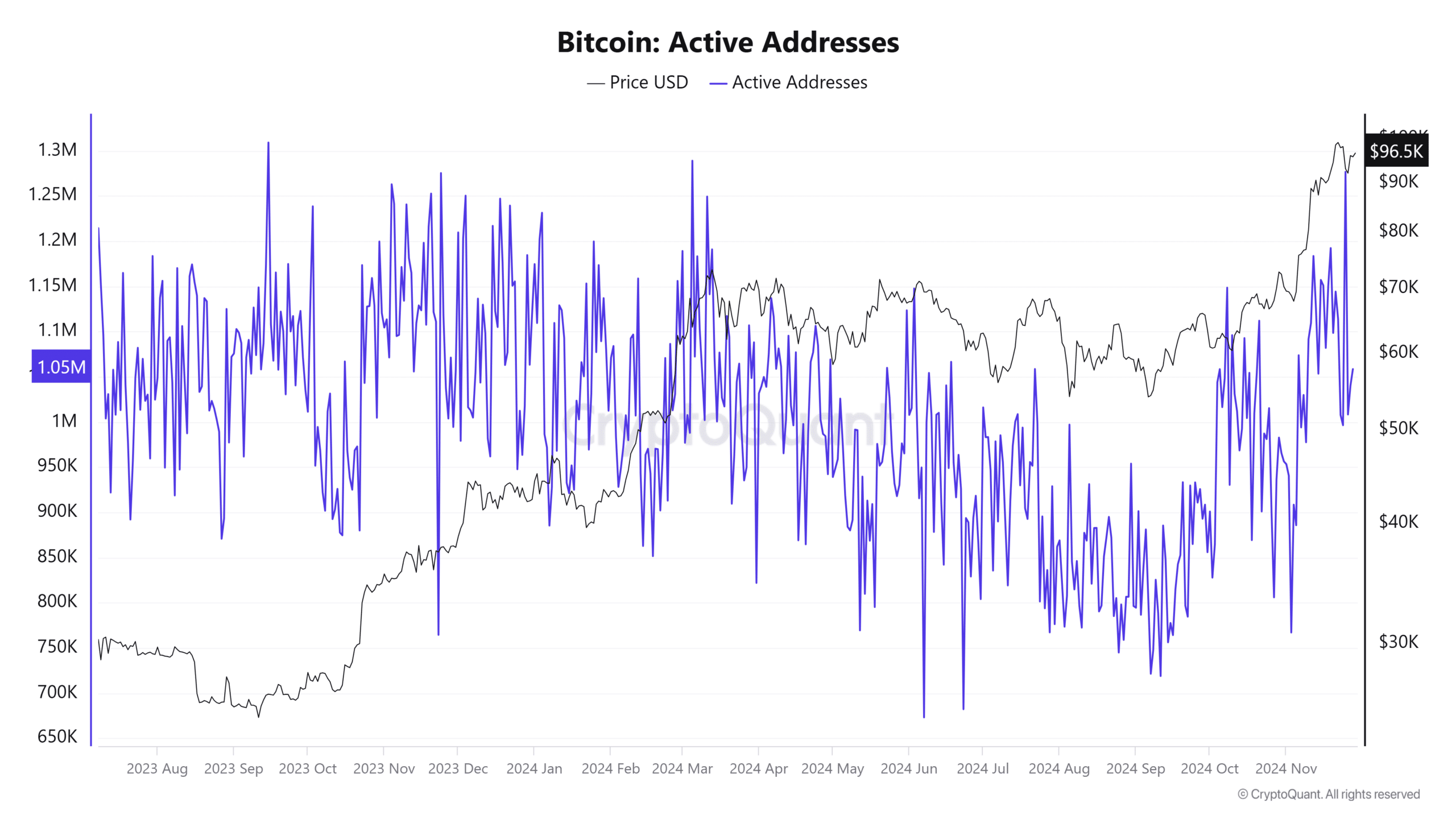

Retail participation is declining

Retail buyers, who play an necessary position in asset value actions, are displaying indicators of declining curiosity because the variety of lively addresses has dropped considerably by 35.03%.

Learn Bitcoin’s [BTC] Value forecast 2024–2025

A drop within the variety of lively addresses sometimes means diminished shopping for exercise, which may contribute to a possible value drop for BTC, presumably in the direction of the aforementioned demand zone.

Supply: Cryptoquant

If the demand zone maintains present purchase order quantity and handle exercise, a value reversal from that degree stays potential.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now