Bitcoin

Bitcoin Fear and Greed Index fuels fears of BTC’s price drop

Credit : ambcrypto.com

- Bitcoin Seizes on Average Worry; If this continues, short-term holders could promote to interrupt even.

- Their departure may imply a all-time low worth.

Bitcoin [BTC] Bulls have prevailed after what seems to be the longest consolidation in historical past, pushing BTC above $60,000. Nevertheless, the momentum was short-lived, with BTC falling under help and buying and selling at $59.8K on the time of writing.

In consequence, market sentiment has returned to worry as bulls and bears battle for management of key help ranges.

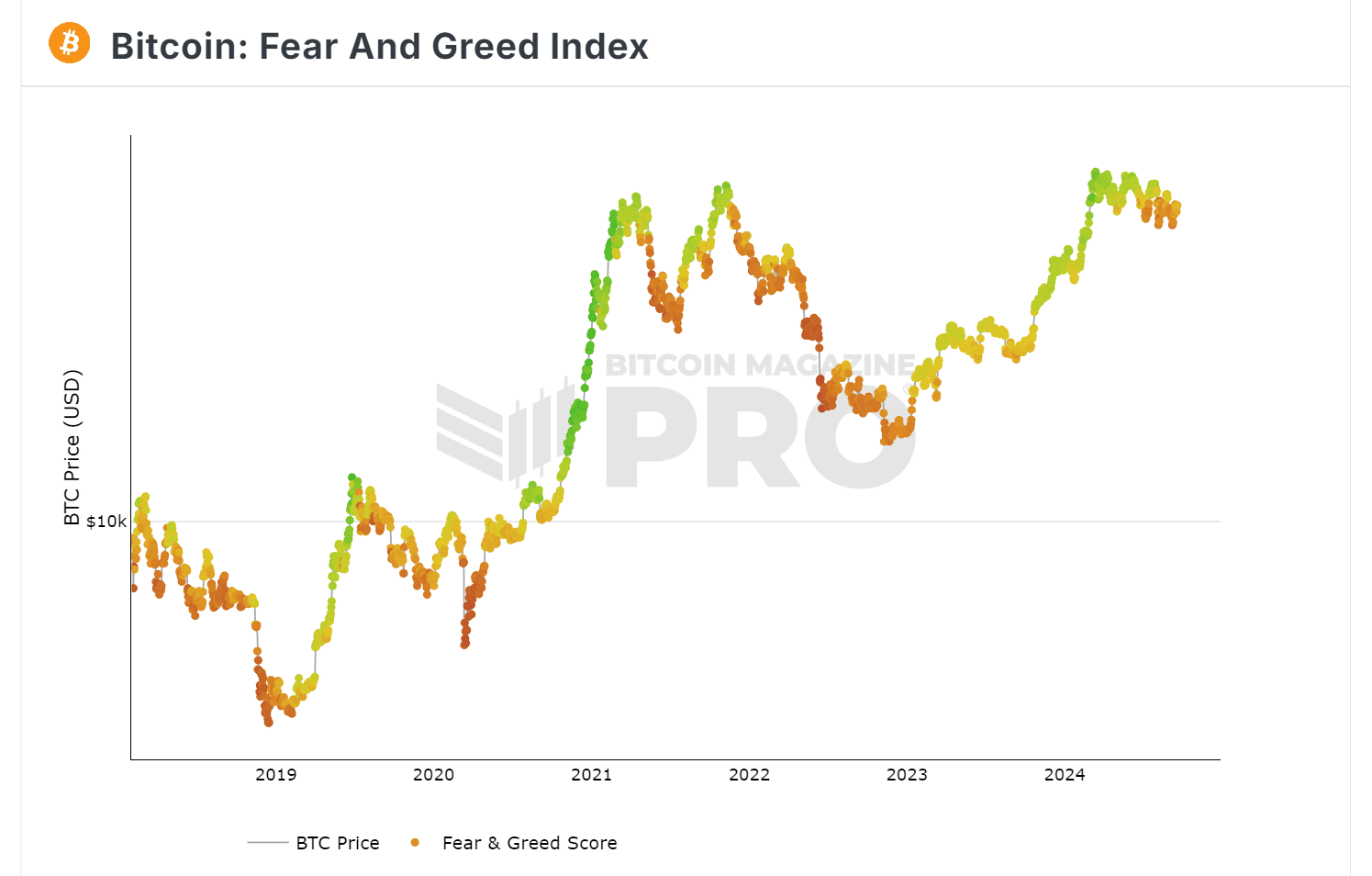

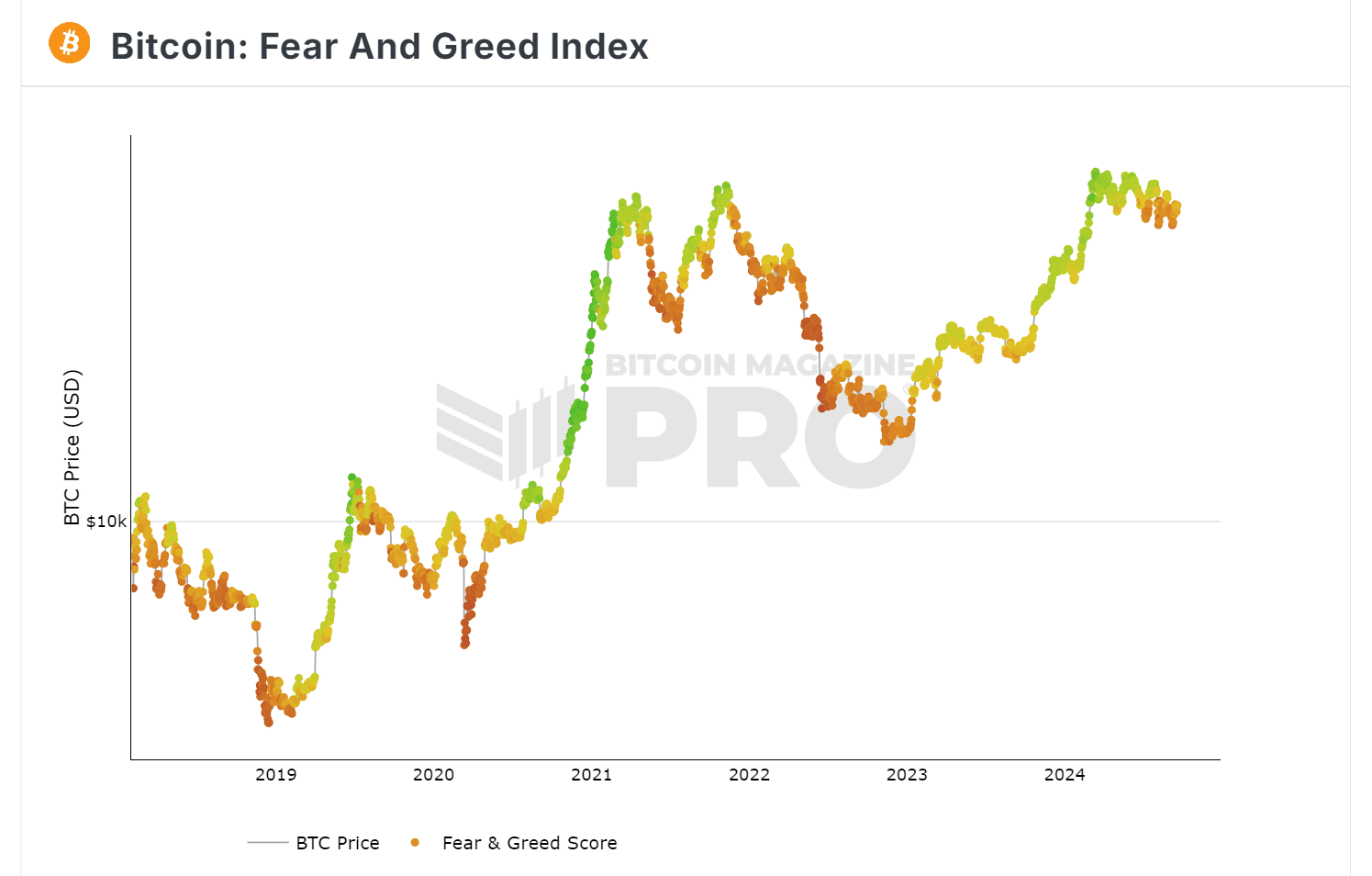

Bitcoin Worry and Greed exhibits nice worry

Traditionally, an index under 20 has meant excessive worry, usually in keeping with worth bottoms. Throughout these durations, new traders flood the market in the hunt for low cost BTC, whereas short-term holders exit to interrupt even.

At present, the Bitcoin market is experiencing average worry, making traders extra cautious. If this pattern continues, it may enhance the chance of a worth backside.

Supply: Bitcoin Journal Professional

Merely put, if worry persists, short-term holders could promote, driving costs down. Solely as soon as a worth backside is reached can a restoration immediate traders to purchase the dip.

Subsequently, monitoring STH exercise may present insights. If worry results in panic promoting, Bitcoin could possibly be headed for a worth backside.

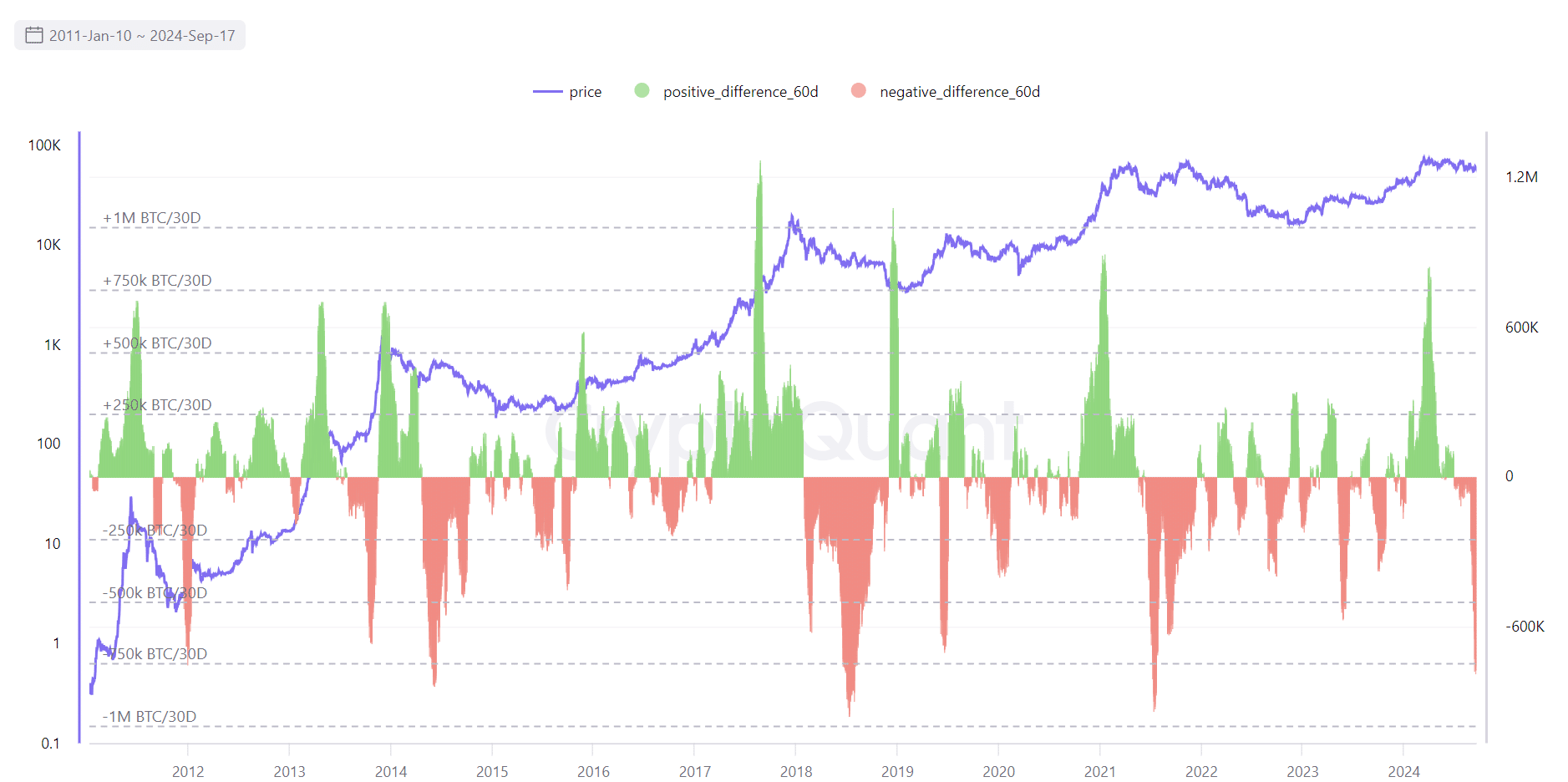

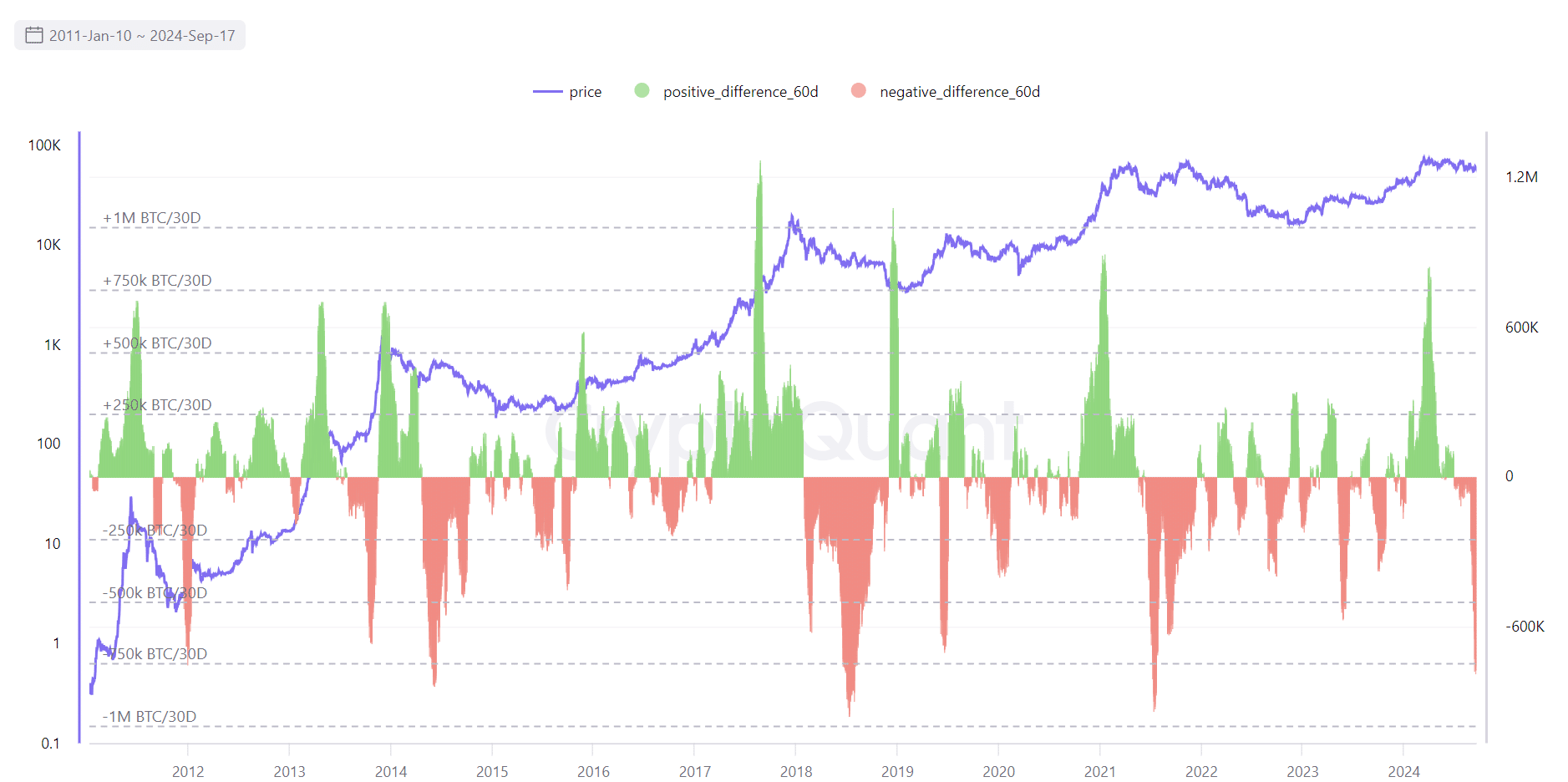

STH’s exit poses an actual risk

Based on AMBCrypto’s evaluation of the chart under, a spike in STH’s damaging web place usually signifies a market prime adopted by a bearish pullback.

Briefly, STH exits sometimes happen when BTC encounters vital resistance, with the next decline reflecting their technique to exit earlier than costs fall.

Supply: CryptoQuant

Opposite to common perception, if this pattern continues, the $60,000 – $61,000 vary may act as resistance somewhat than help.

Subsequently, if the bulls fail to take care of management, BTC may return to the $51,000 help earlier than a potential correction.

To substantiate this pattern, AMBCrypto examined long-term holders. If $60,000 turns into the subsequent backside, it may current a buy-the-dip alternative.

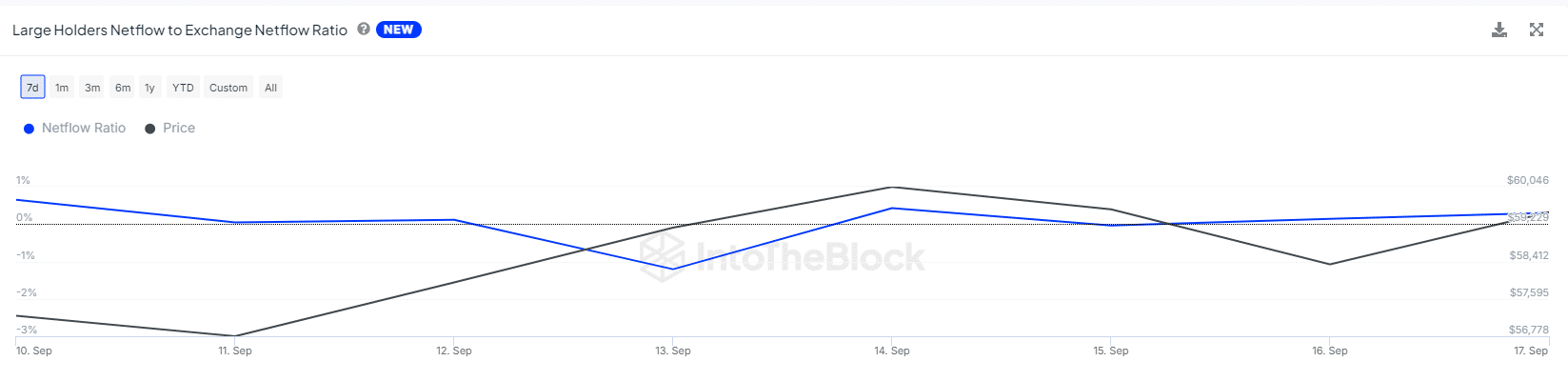

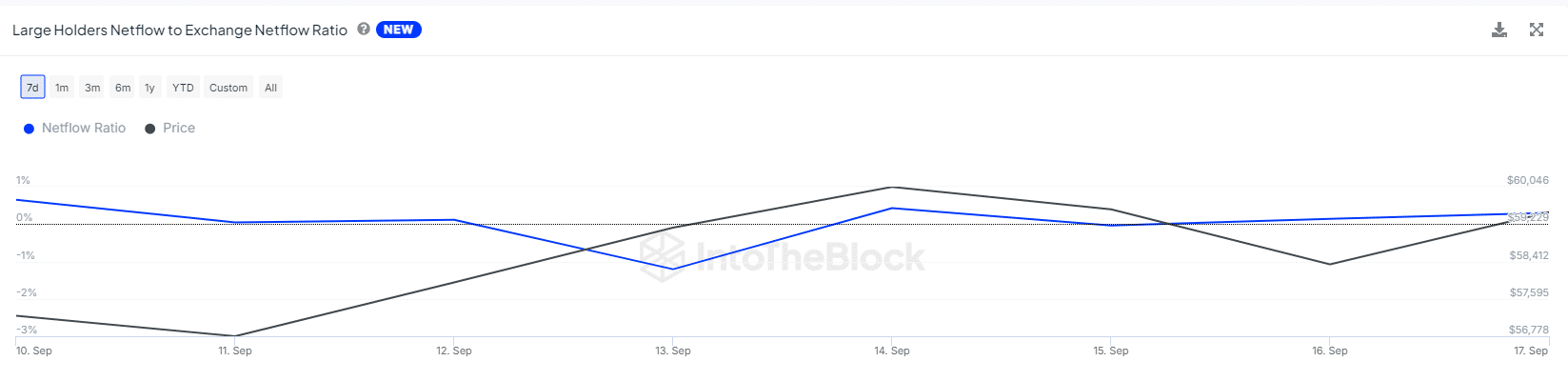

Massive cohorts maintain the important thing to the highest

Whereas short-term holders are adjusting their positions as BTC encounters essential resistance, long-term holders have been actively disinvesting to maintain the $60,000 degree as the subsequent help zone.

The web stream ratio, now at 0.30%, has doubled from the day before today, indicating rising help from giant hodlers, as proven on this after.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Worth forecast 2024-25

$60,000 represents a key battleground, with short-term holders viewing this as a possible market backside, bolstered by rising worry.

The reversal from $60,000 to strong help will depend on long-term holders, whose actions may name into query the value ground.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now