Bitcoin

Bitcoin fear and greed index shows ‘extreme greed’: Will this drive a bull run?

Credit : ambcrypto.com

- Bitcoin confirmed sturdy bullish indicators, with excessive dominance and investor confidence at an excessive stage.

- The bullish traits confirmed indicators of constant, however volatility dangers endured as a consequence of change fee habits.

Bitcoin [BTC] continues to indicate sturdy bullish indicators, with the Worry and Greed Index reaching an excessive greed stage of 83. This means excessive investor confidence and rising optimism available in the market.

On the time of writing, Bitcoin was buying and selling at $98,503.78, down 0.85% prior to now 24 hours. Whereas this implies a powerful bullish development, it raises questions on Bitcoin’s potential to keep up this momentum or face a market correction.

Bitcoin Worry and Greed Present…

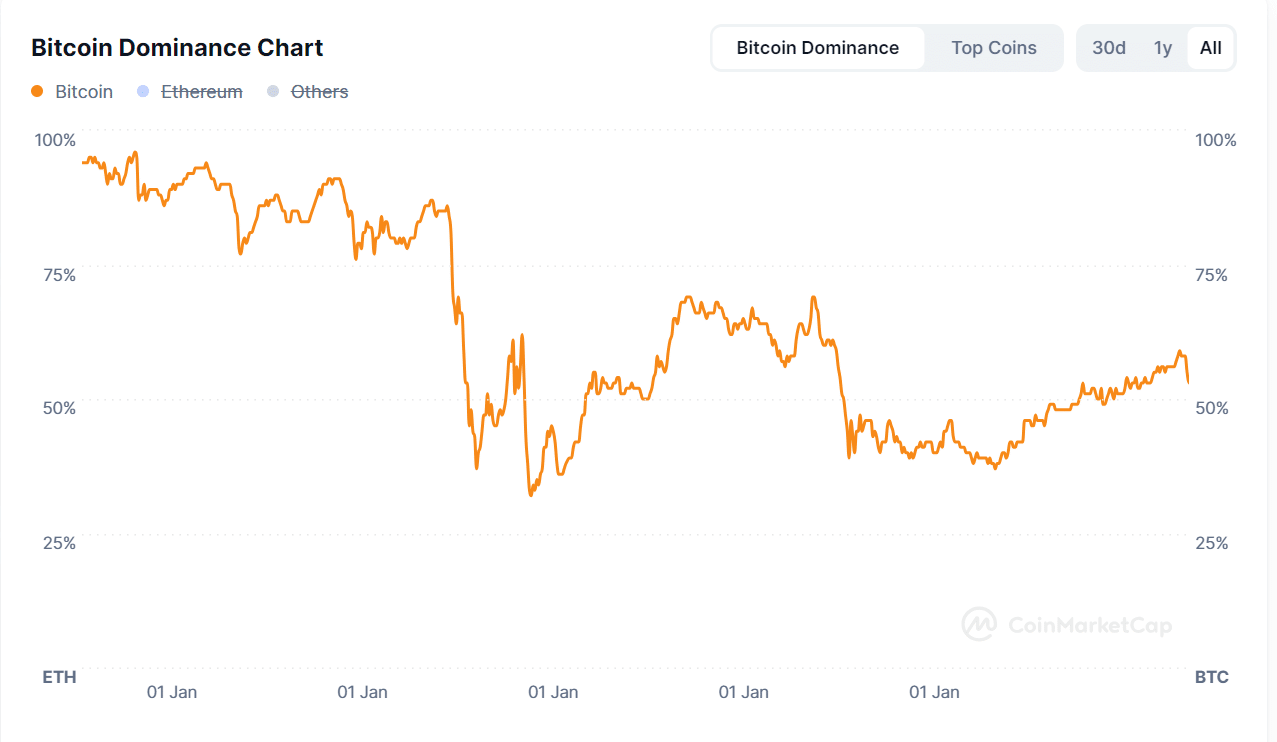

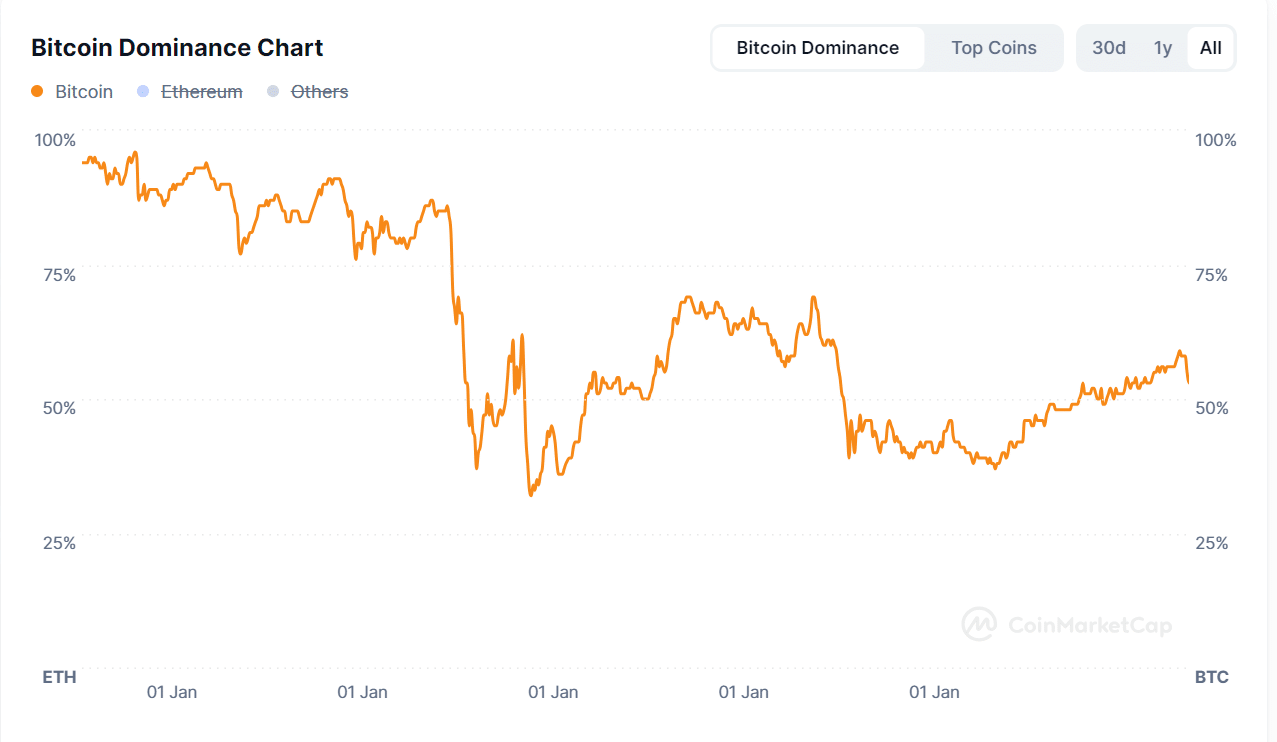

Bitcoin’s dominance stood at 54.5% on the time of writing, reflecting its vital affect on the general crypto market. Nevertheless, it noticed a each day drop of -3.5%, indicating a possible shift in curiosity in altcoins.

This implies that different cryptocurrencies might achieve power, which might influence Bitcoin’s dominance within the coming days.

Due to this fact, carefully monitoring Bitcoin dominance will present perception into market traits and any adjustments in dominance dynamics.

Supply: CoinMarketCap

A rise in optimism amongst traders

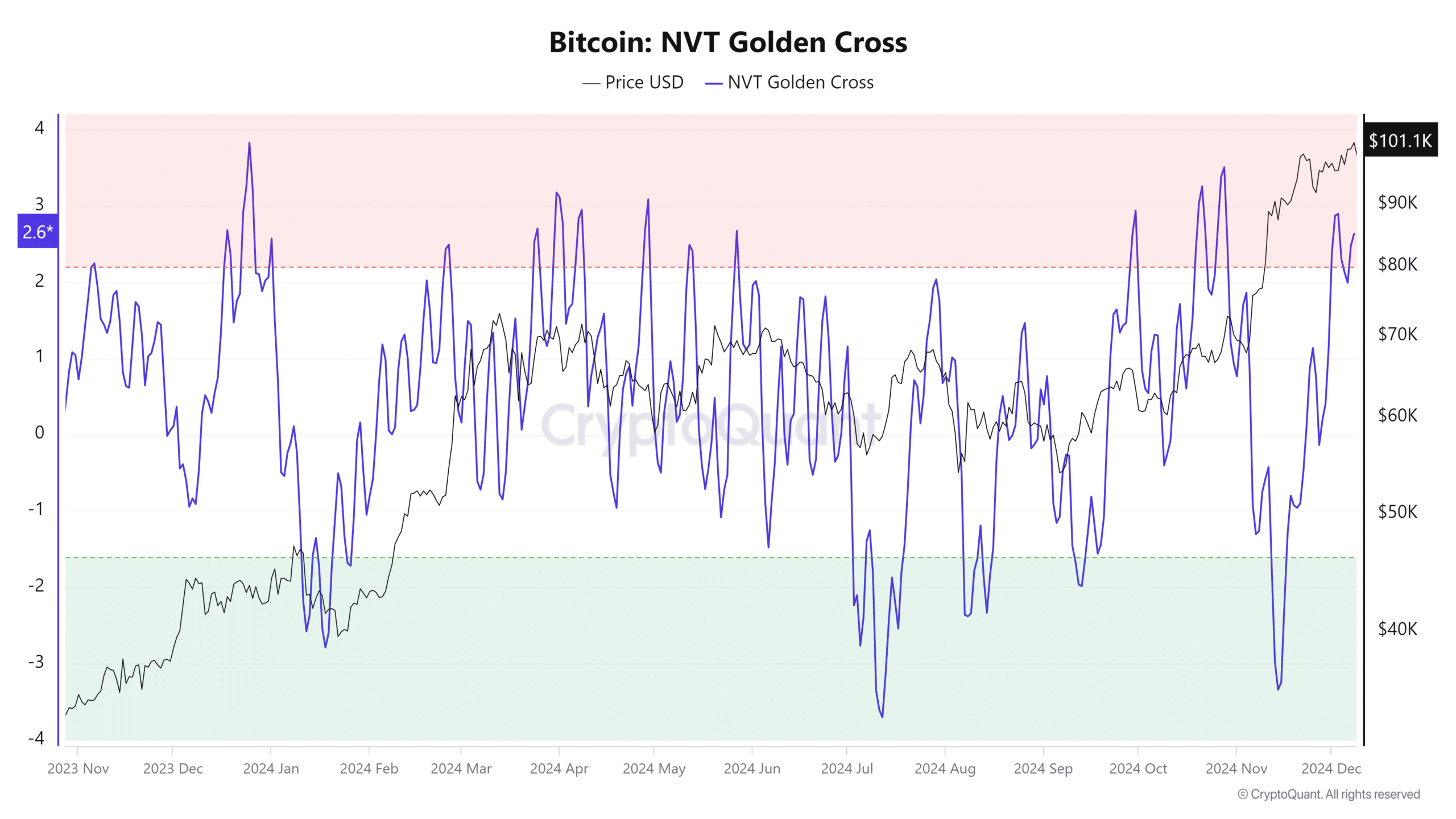

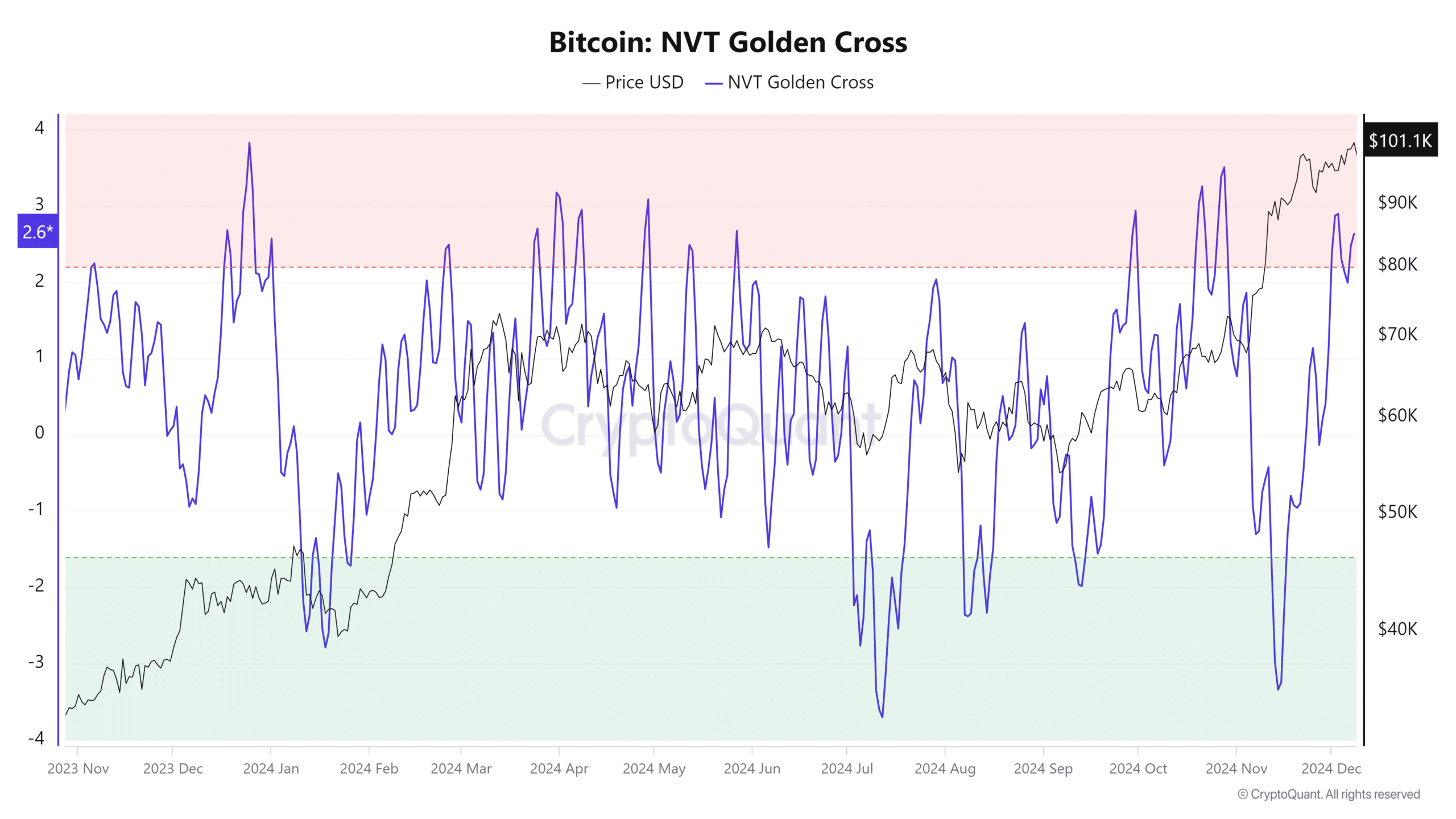

Bitcoin’s Community Worth to Transaction (NVT) gold cross noticed a exceptional improve of seven.84% in someday, reaching 2.6. This improve signifies rising investor curiosity in Bitcoin’s valuation in comparison with transaction quantity.

Such an increase normally signifies bullish sentiment and elevated confidence available in the market’s prospects. Moreover, it means that Bitcoin’s community metrics might appeal to extra traders, additional driving up costs.

Supply: CryptoQuant

THIS reinforces the bullish sentiment

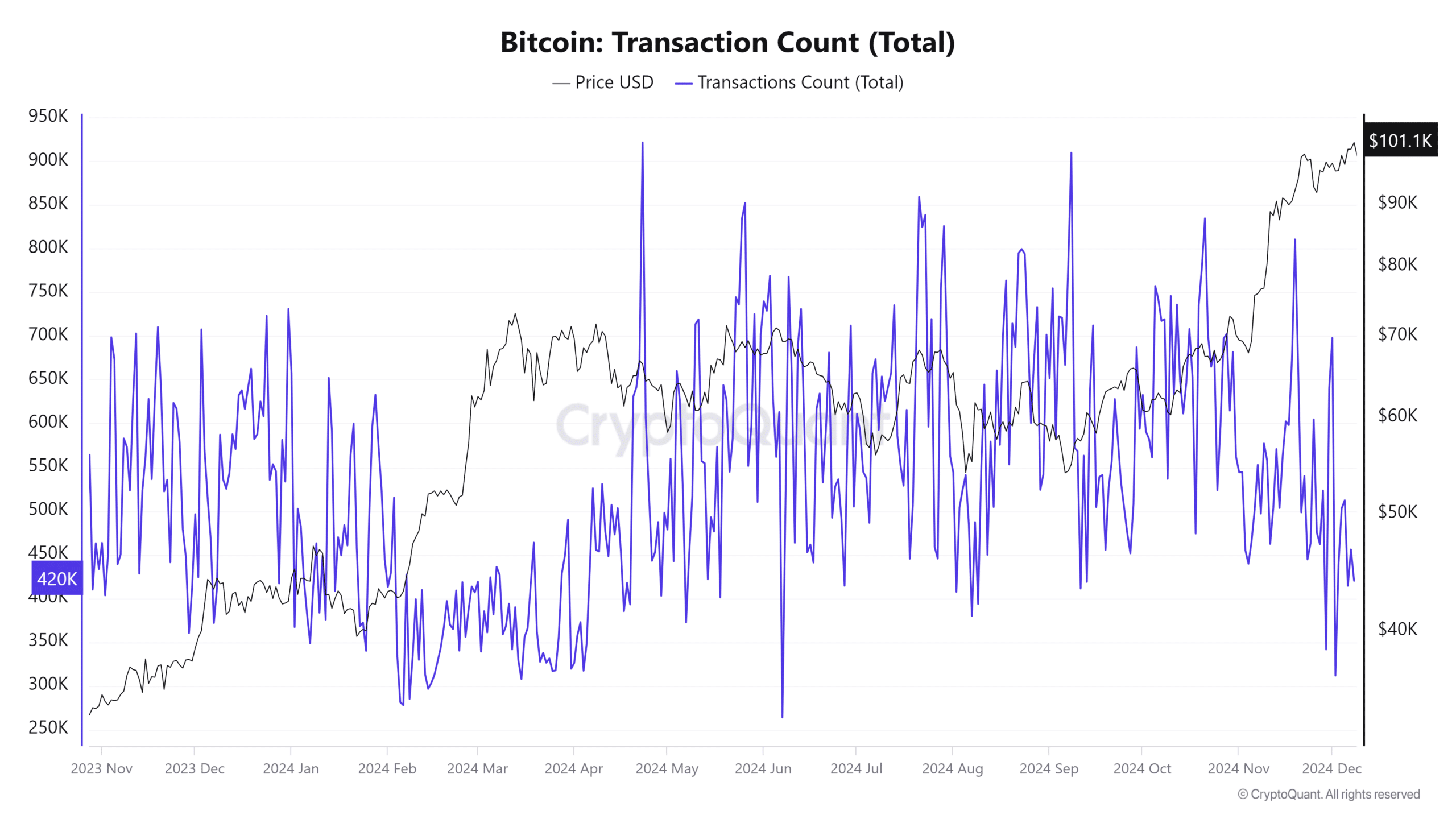

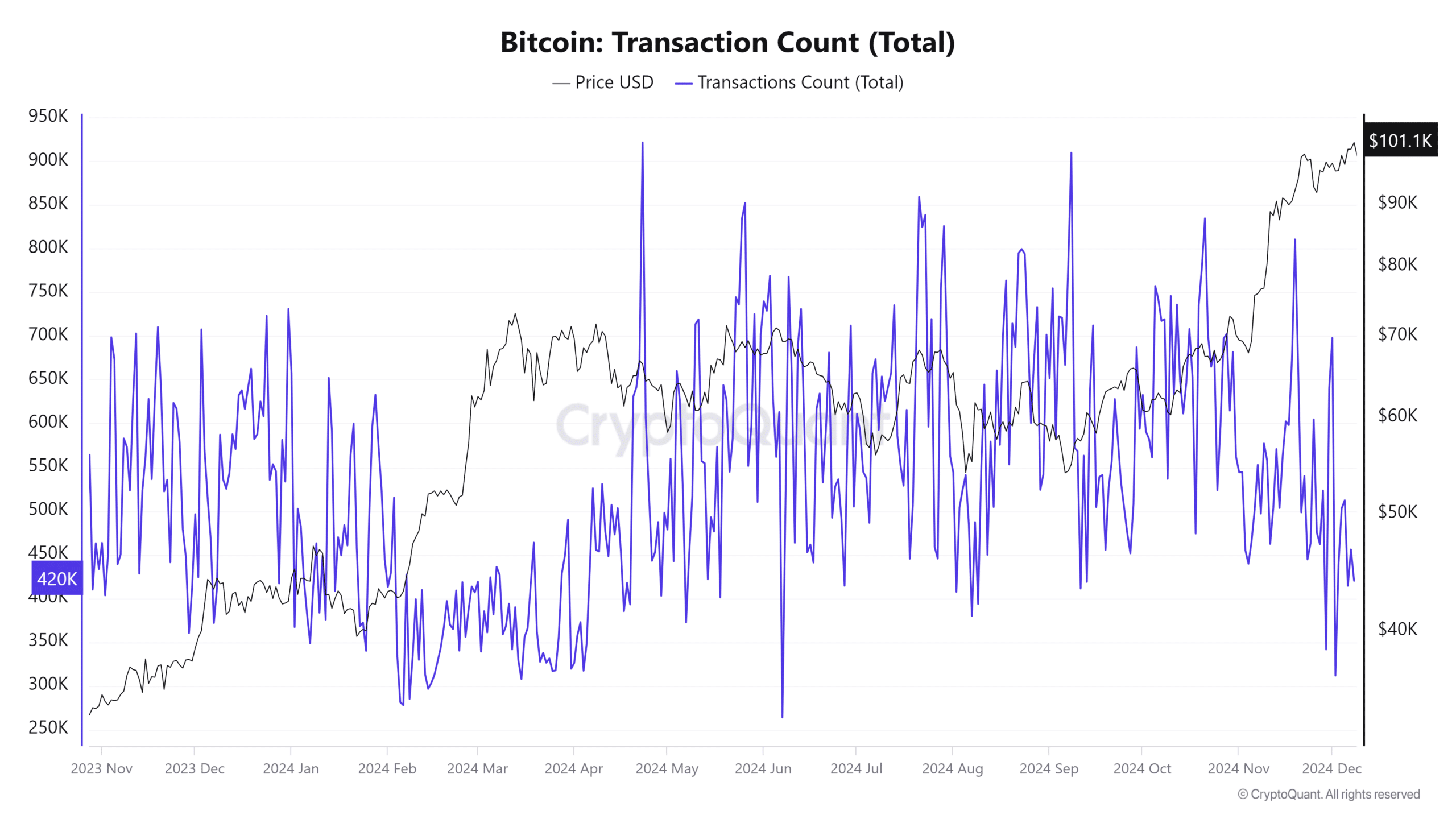

Bitcoin’s transaction rely noticed a each day improve of 0.94%, reaching 428,184,000 transactions. The rise in exercise highlighted a extra lively BTC community and better engagement amongst customers.

Such exercise indicated elevated investor curiosity and a better probability of continued bullish traits.

Due to this fact, the next variety of transactions strengthened Bitcoin’s place available in the market and supported the general bullish outlook.

Supply: CryptoQuant

Investor confidence is rising

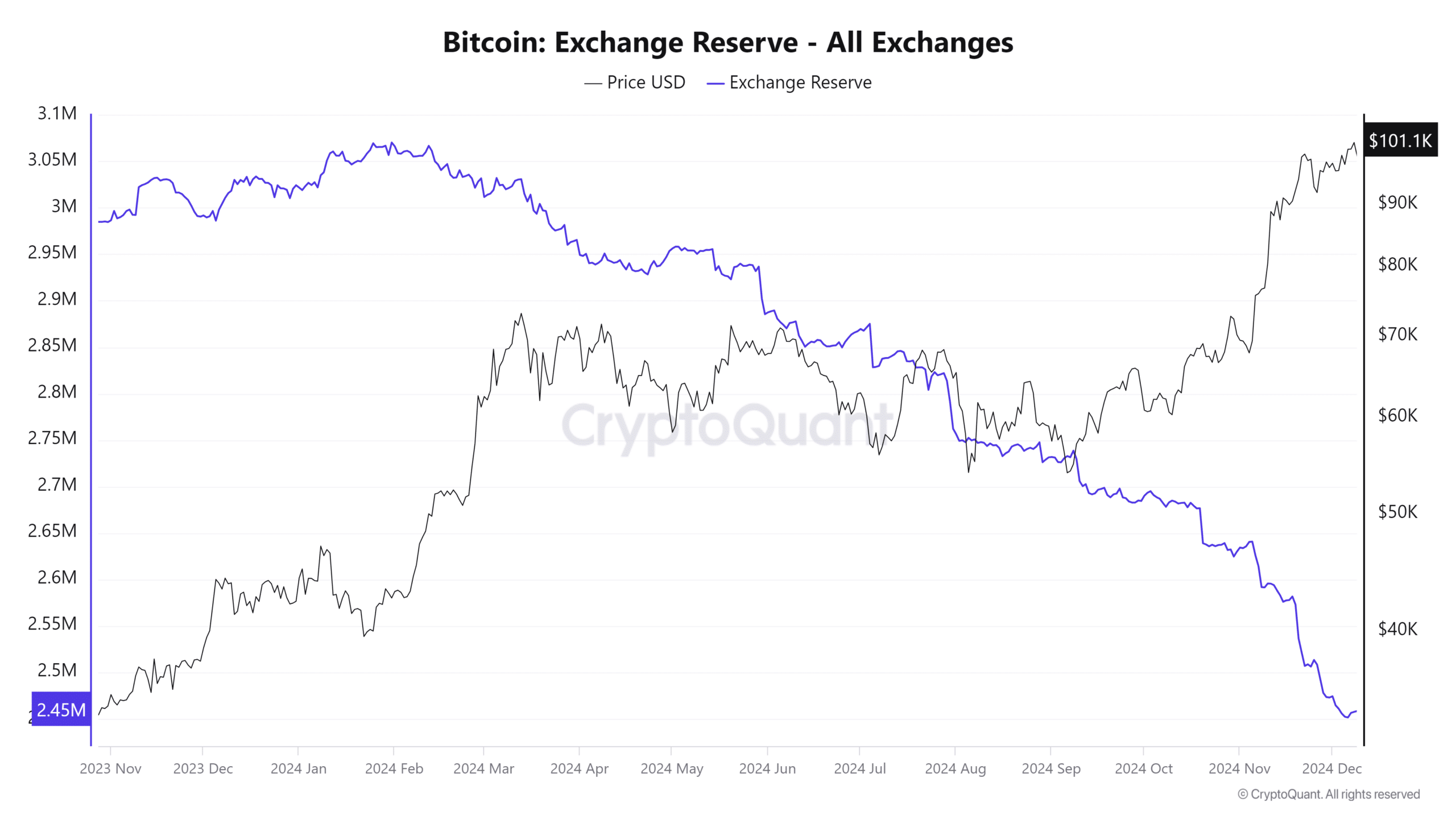

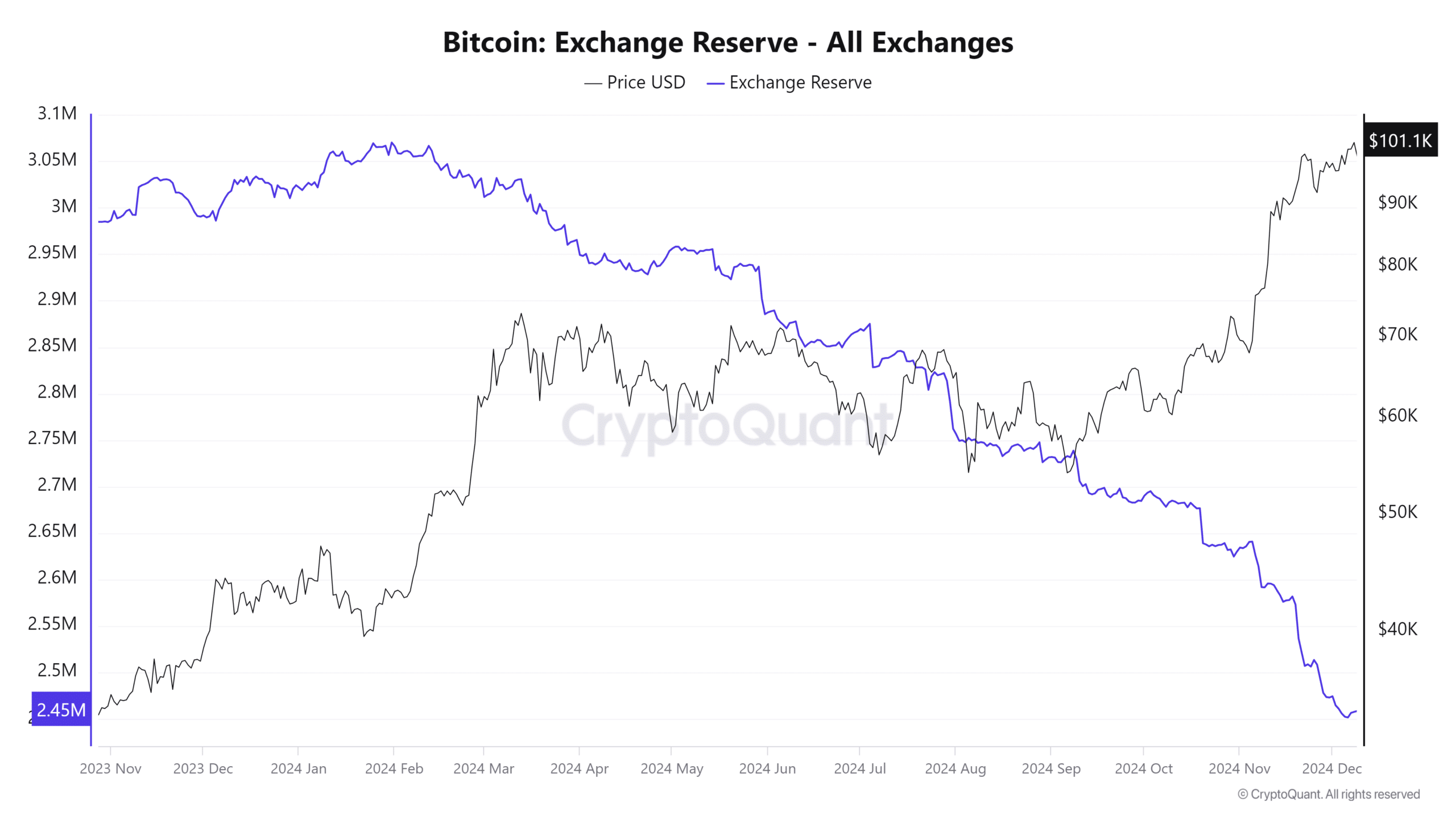

Bitcoin change reserves have fallen by 0.04% in 24 hours, now standing at 2.4573 million BTC on the time of writing.

This development exhibits that BTC holders are more and more transferring their property off exchanges, probably into wallets or long-term storage. Such a transfer reduces promoting stress available in the market and strengthens bullish sentiment.

Supply: CryptoQuant

Bullish traders maintain agency

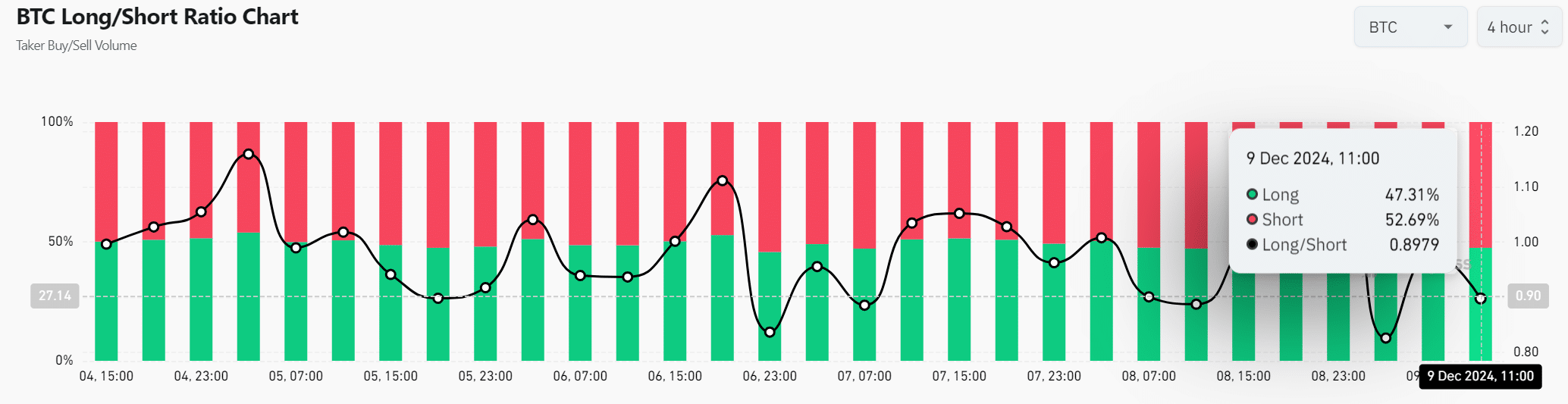

Bitcoin’s Lengthy/Brief ratio was 47.31% lengthy and 52.69% brief, leading to a ratio of 0.8979. These figures present that brief sellers nonetheless have a small benefit, however the excessive long-term rates of interest replicate sturdy bullish sentiment.

Due to this fact, BTC stays resilient, with a constructive outlook regardless of market fluctuations.

Supply: Coinglass

Bitcoin’s Worry and Greed Index at 83 signifies an especially bullish market outlook.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Nevertheless, as current figures present a mixture of good points and declines by way of dominance, variety of transactions and foreign money reserves, a correction stays attainable.

Due to this fact, Bitcoin might proceed its bullish run if present traits proceed, however merchants ought to stay vigilant in regards to the potential market volatility.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September