Bitcoin

Bitcoin fear fades, but investors remain cautious – What’s holding BTC back?

Credit : ambcrypto.com

- Bitcoin holders take some revenue in the long run, which is an indication of ‘re-calibrated expectations’.

- BTC Open rates of interest and a rising stock-flow ratio trace to volatility and shortage.

Bitcoin [BTC] climbed by 1.33% in 24 hours to behave at $ 107,842 on 26 June, in order that panic was shaken off within the brief time period. Nevertheless, deeper statistics have painted a extra cautious image.

BTC Worry fades, however confidence doesn’t comply with

BTCs 25 Delta Skew-a benchmark For trader-staggered, greater than 10% to solely 2.96% are falling from greater than 10%. This Reflicted lowered panic amongst merchants. But not the whole lot is calm.

The three -months and 6 months ships remained unfavourable at -2.6% and -4.3% respectively. That signifies that the uncertainty has not disappeared within the medium time period.

It’s exceptional that possibility volumes nonetheless desire Putten, pointing to defensive positioning amongst bigger gamers.

Subsequently, though rapid subsequent to the concern has been withdrawn, it turned out that traders nonetheless haven’t recovered full bullish confidence.

Are merchants feeding the hearth with this?

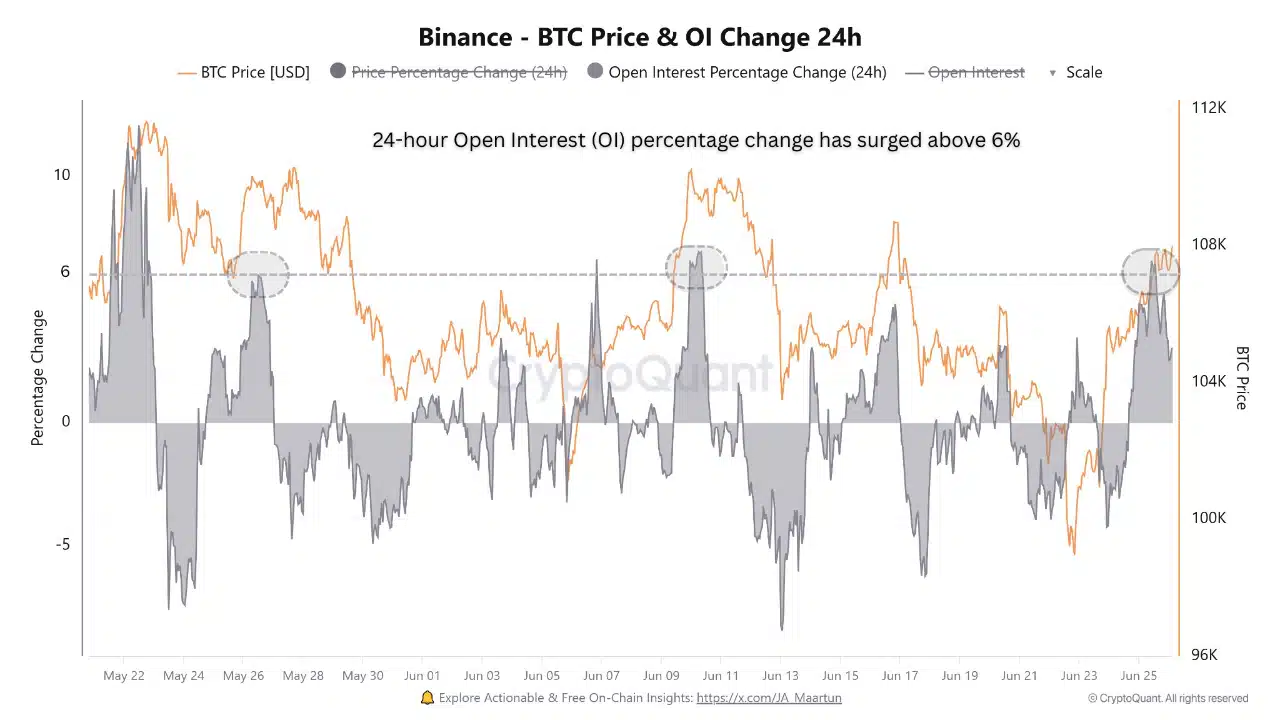

The open curiosity of Binance rose above 6% for the third time in two months and marked a exceptional improve in speculative positioning. Every of the final spikes in Could and June preceded sale and non permanent delays.

In fact this factors to a rise in speculative transactions and an overheated short-term setting, even when the value of BTC seems secure. In brief, leverage is again within the barrel.

Is belief in the long run slipping?

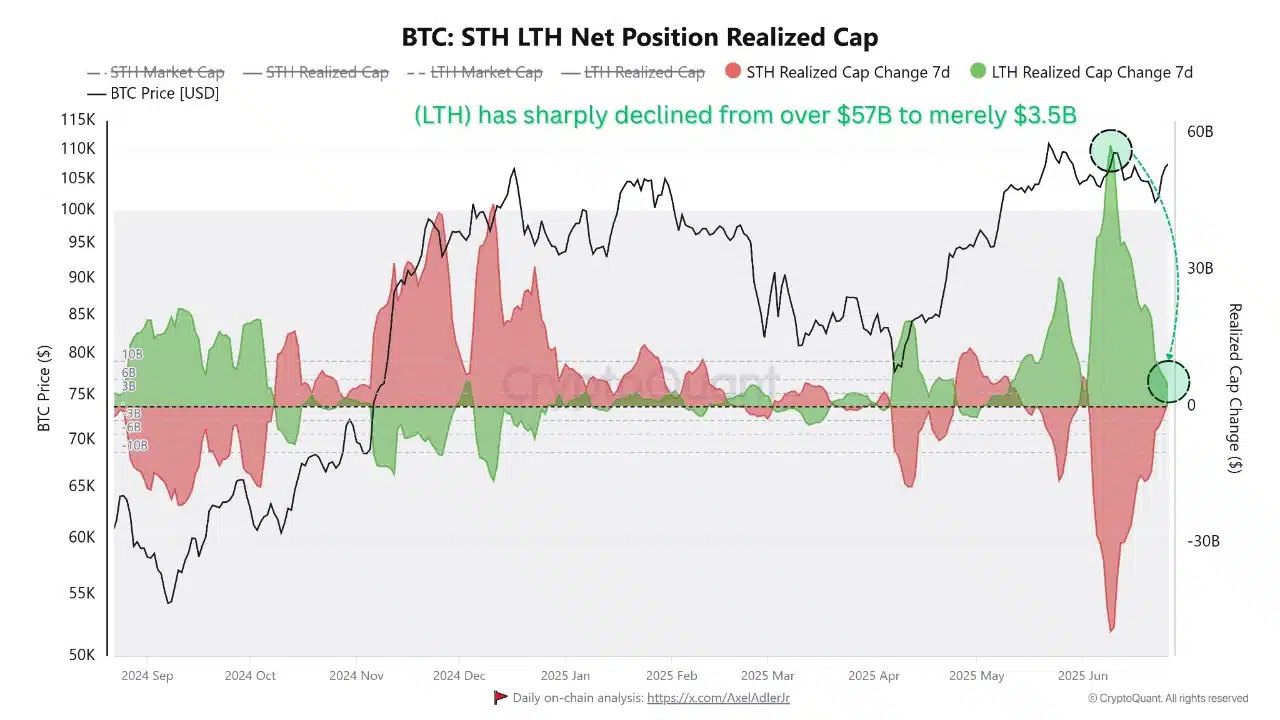

The web-term internet place achieved CAP from greater than $ 57 billion to only $ 3.5 billion, which revealed a giant worthwhile one.

This dive confirmed that LTHS, often probably the most affected person cohort of the market, began cropping publicity after appreciable revenue.

In fact this doesn’t shout a panic. It’s extra probably, with out massive Bearish catalysts in sight.

However such a steep drop nonetheless signifies expectations, presumably linked to macro uncertainty or halving fatigue.

Can BTC stay grounded with out touching overheating?

Alternate -wide commerce volumes have been phased out, in line with the bubble graph of cryptoquant. Although BTC floating close to Ath, there have been no indicators of frenzy.

Most quantity bubbles stay impartial to blue, which reinforces a wholesome setting the place worth actions aren’t powered by concern or greed.

Bitcoin Room offers that stability to consolidate, as an alternative of beating. As a substitute of touching overheating, the market can merely breathe deep earlier than the subsequent chunk is up.

Will this BTC lastly push in a brand new cycle?

Bitcoin’s stock-flow ratio rose to 387, to not point out the very best in latest months. This statistics comply with what number of years it might take to take advantage of BTC at present charges.

Though it isn’t all time, the sharp turnout displays the rising demand versus lowering provide, which can create upward strain.

Nevertheless, the timing of such results is commonly lagging behind. Though this peak strengthens the elemental worth story of BTC, it subsequently doesn’t but assure an upward upward upward low cost with no supporting worth promotion.

Though concern has decreased and the market avoids overheating, warning of LTHS and growing hypothesis complexity introduces.

BTC should rigorously navigate this wire – a wholesome consolidation for growing leverage – to put the muse for the subsequent main motion.

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024