Bitcoin

Bitcoin gains as U.S. labor market weakens: BTC as a safe haven, confirmed?

Credit : ambcrypto.com

- Bitcoin received grip as a macroheg, supported by rising ETF influx within the midst of wider rotation of buyers.

- Kansas Metropolis Fed LMCI fell for a second month, which strengthens the rising recession dangers within the US financial system.

The American financial system can step in turbulent waters.

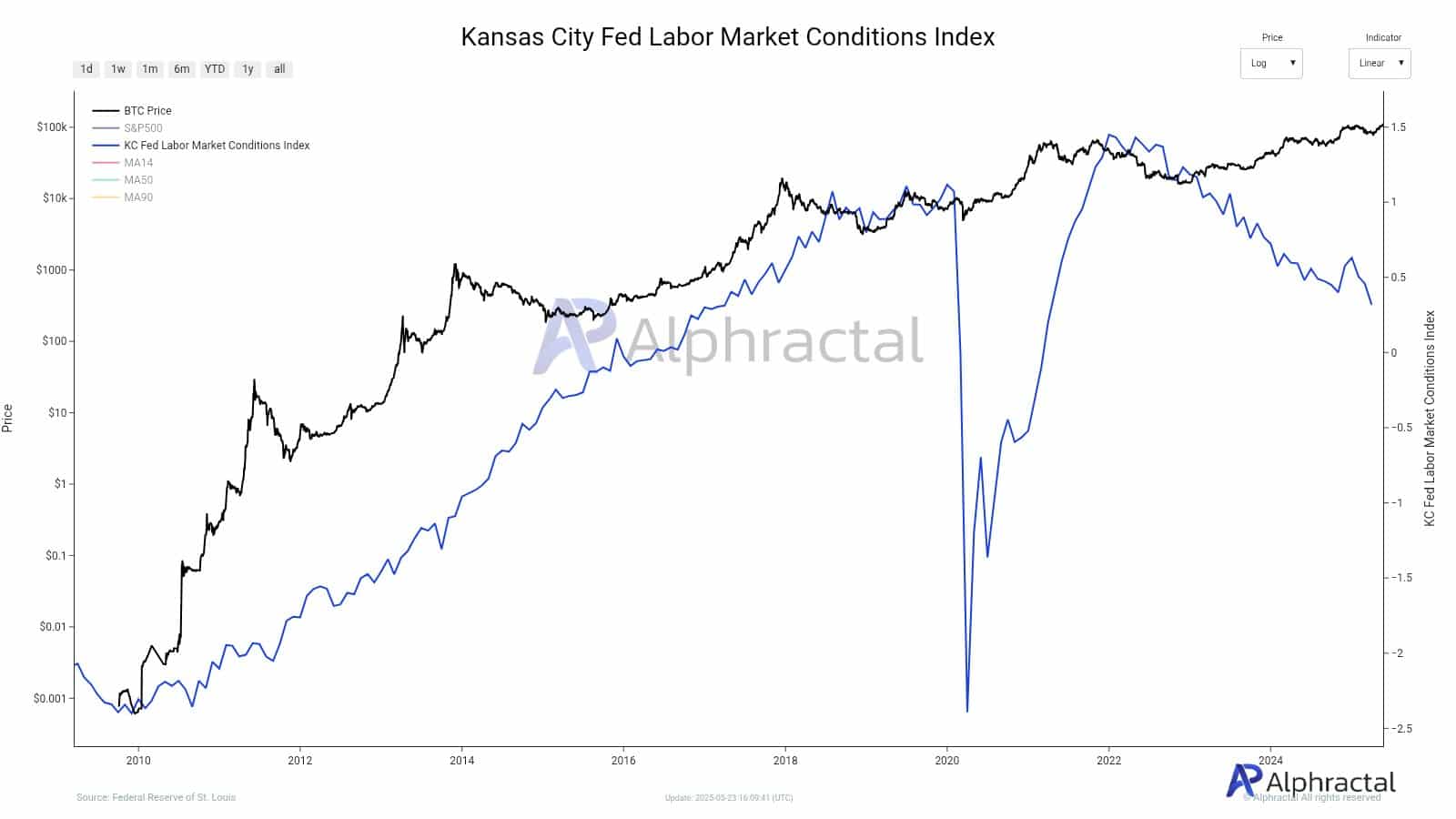

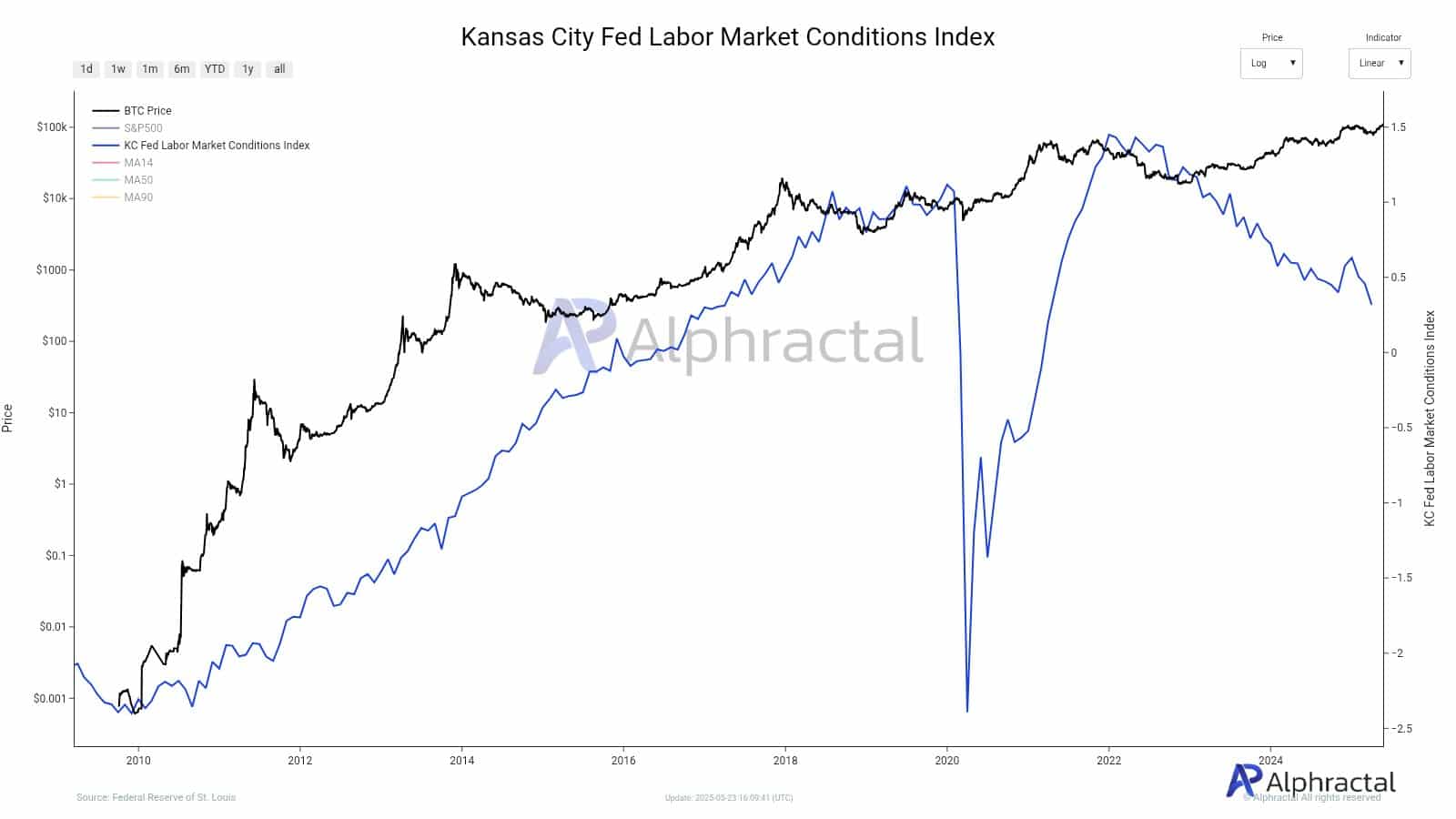

The Kansas Metropolis Federal Reserve’s Labor Market Circumstances Indicators (LMCI) fell for the second consecutive month, to show Much more weak spot on the labor market.

Autumn is the latest of a collection of warning indicators that predict the likelihood of an imminent recession.

Whereas the normal markets are beginning to nod underneath the burden, Bitcoin [BTC] Will be within the win. The latest figures present a tree in BTC ETF consumption, which signifies the rising demand of buyers.

Is the ‘Protected Haven’ standing of the digital cash then crucial driver behind the subsequent Bullrun? Let’s determine it out!

Labor market flashes purple once more

The LMCI is an in depth measure of the momentum and the exercise of the American labor market.

Falling LMCI often factors to falling job creation, delaying wages or much less aggressive recruitment practices. This additional decline helps the view that working circumstances are extra aggressive than anticipated.

Economists maintain a detailed eye on the LMCI, as a result of it typically strikes earlier than the final macro -economic indicators.

If the indicator goes down, this could be a signal that the tight rate of interest coverage of the Federal Reserve begins to chunk deeper into the true financial system.

Supply: Alfractaal

An indication of investor’s portfolio rotation

Within the meantime, Bitcoin appears to be gaining on this volatility.

Latest figures for BTC ETF confirmed a steep enhance within the consumption, with institutional cash more and more flowing.

This can be a signal of a noticeable change in investor sentiment, from conventional shares to digital property comparable to Bitcoin.

Greater than only a hedge within the brief time period, the positioning of Bitcoin as “digital gold” will get renewed validation.

In occasions of financial disaster, buyers search refuge in results which can be scarce in supply, liquid and decentralized.

BTC matches right here and has discovered increasingly use as a car for diversification in occasions of macro -economic stress.

Supply: Bitbo

Recess story feeds Bitcoin’s query story

After all, if work statistics are sinking and the macro threat grows, buyers can pace up the urge for food for Bitcoin.

We’ve seen this PlayBook earlier than – the discount of labor markets usually results in hypothesis about slicing the FED charge.

If that babbling turns into louder, threat property comparable to BTC can catch a brand new bid, particularly if capital runs from shares and non-correlated digital property.

With influx into BTC ETFs that tackling pace, the market can witness the preliminary part of a extra worldwide threat in stability.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now