Bitcoin

Bitcoin hits $100K again after better than expected CPI data – More to come?

Credit : ambcrypto.com

- Bitcoin Reclaims $100,000, Albeit Briefly, With Each Inner and Exterior Elements Pointing to a Doable Breakout within the First Quarter

- Historical past exhibits us that the crypto market has a knack for defying mainstream predictions

The most recent financial information has put the Fed in a tough place. It is no shock that the crypto market wasted no time in responding. With a 4% improve in market cap, the highest cash are again within the inexperienced, and Bitcoin has shortly reclaimed $100,000, albeit briefly – a degree it hasn’t seen in additional than per week. Coincidence or technique? This improve gave the impression to be completely in keeping with Trump’s upcoming inauguration.

Clearly the stage has been set. With all these components at play, is it nonetheless too dangerous to foretell Bitcoin’s new all-time excessive by the top of this month?

When anticipation outweighs execution…

The crypto market’s response to the newest inflation facts was no fluke. December’s core CPI inflation fell to three.2%, beating the forecast of three.3%. This surprising dip has led to optimism concerning the rate of interest minimize, which is clearly mirrored within the 4% bounce.

This might be the turning level traders have been ready for. As inflation cools, the Fed may rethink decreasing borrowing prices. Decrease rates of interest may make leverage cheaper for merchants, probably flooding the crypto market with recent capital.

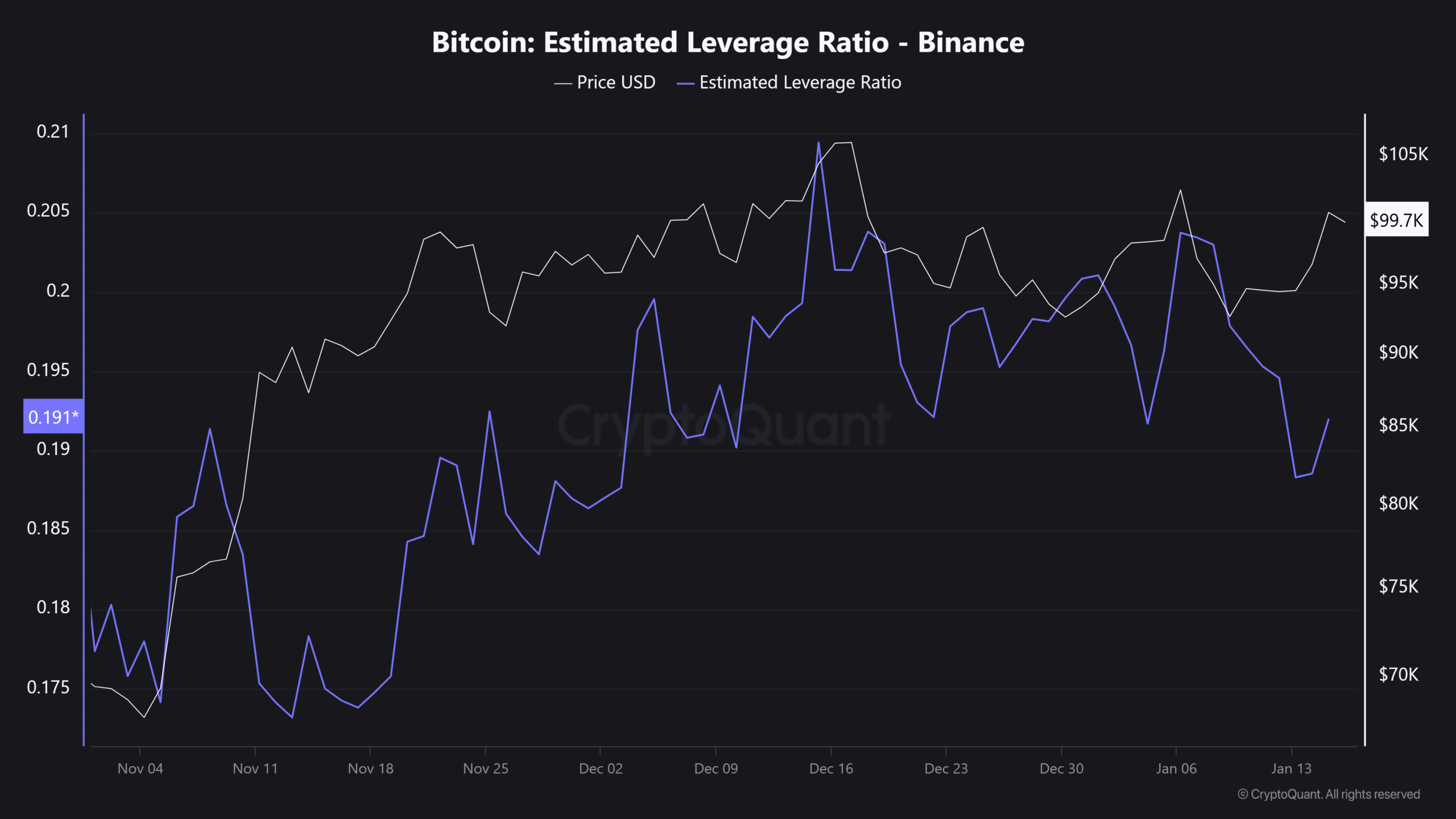

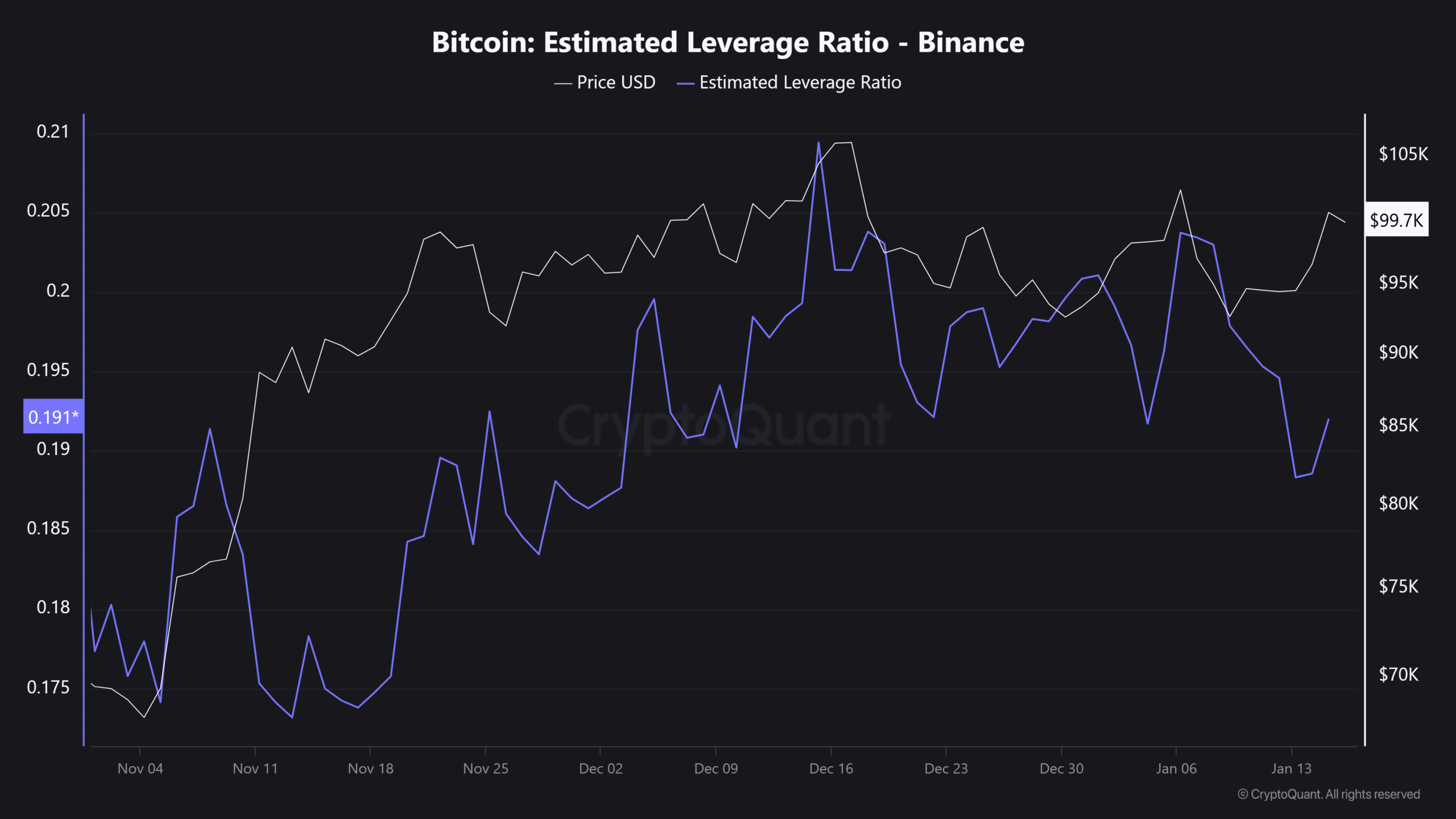

The Open Curiosity (OI) now exceeding $64 billion speaks volumes. With the leverage ratio on Binance rising, we may see much more motion if the Fed pulls the set off – one thing you may need to maintain an in depth eye on within the coming days.

Supply: CryptoQuant

However here is the catch: Bitcoin’s 3.61% bounce simply because the report fell wasn’t purely based mostly on the inflation information. It is a mixture of ‘anticipation’ round attainable price cuts, Trump’s crypto-friendly SEC overhaul proposal and his impending return to the White Home.

Collectively, these components set the stage for a possible $102,000 breakout for BTC. Nonetheless, reaching a brand new all-time excessive is not only about anticipation. Actual ‘execution’ is required. As we have seen time and time once more, the market likes to defy mainstream expectations. May this be one other a type of moments?

A take a look at the opposite facet of Bitcoin

To interrupt its all-time excessive, Bitcoin would wish a ten% improve from its press-time worth of $99.8k. Final 12 months, throughout the Trump pump, BTC rose as a lot as 9% in sooner or later. This time, nevertheless, the stakes are a lot greater.

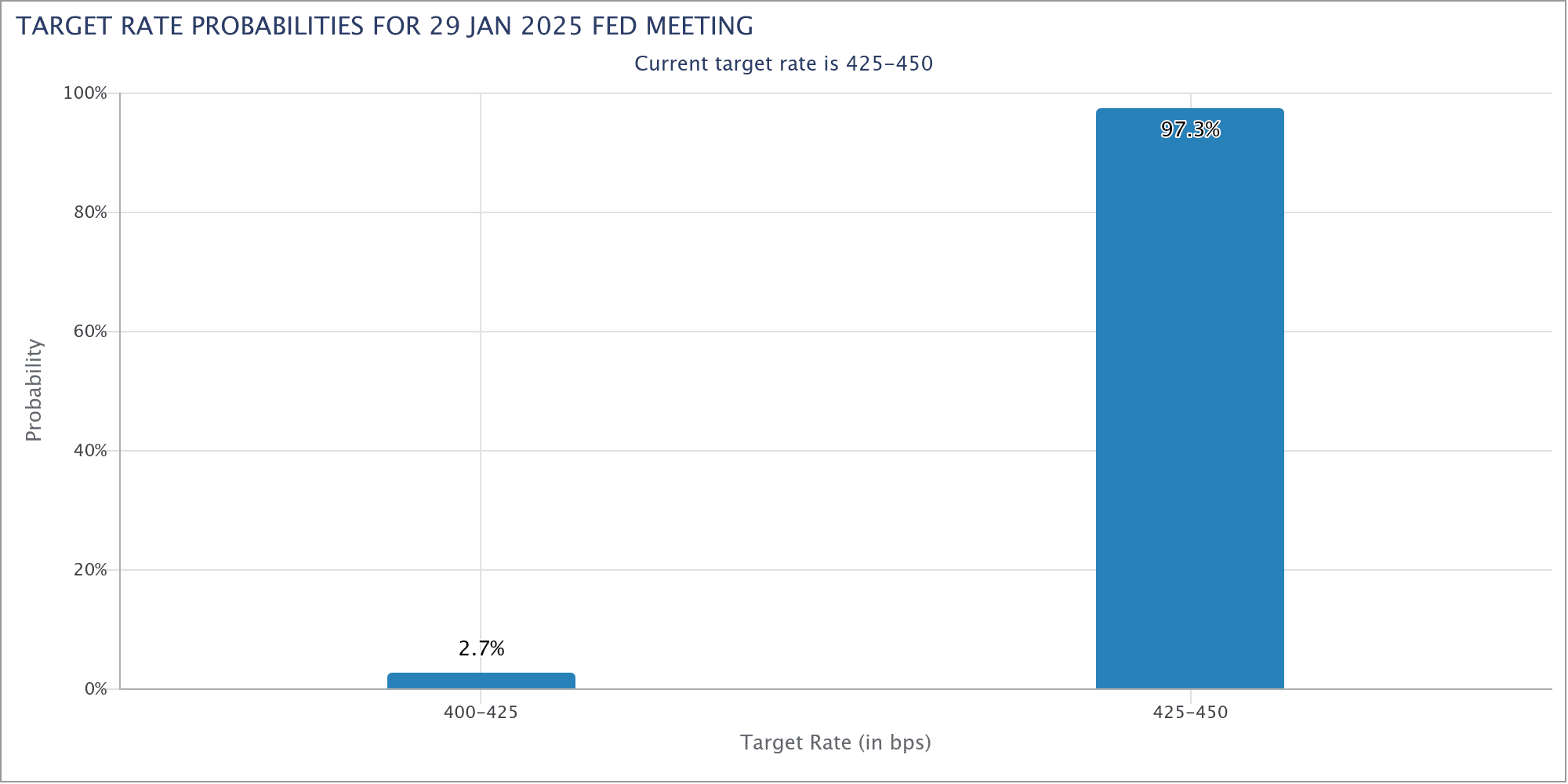

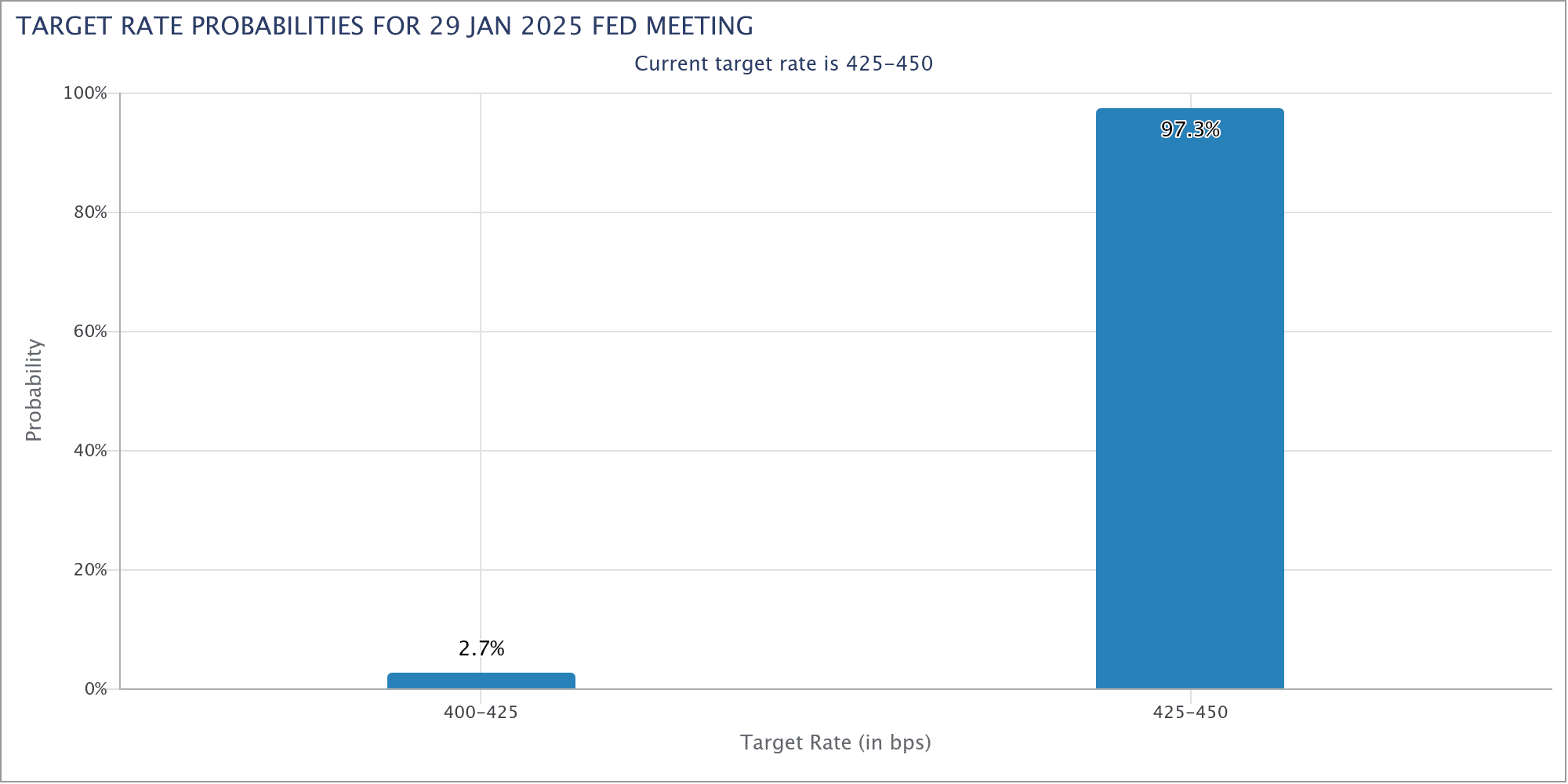

The following FOMC assembly is simply 13 days away and will form your complete panorama for 2025. The market is holding its breath, with a 97.3% probability of a price minimize hanging within the stability. Will the Fed ship, or will traders’ hopes be dashed once more?

Supply: FedWatch

Whereas a ten% improve appears inside attain, brace your self for top volatility within the coming days. Brief-term merchants are more likely to concentrate on fast earnings moderately than long-term investments. Add to that Trump’s renewed drive for rates on nations like Denmark and Canada, and it is simple to see why the Fed would possibly hesitate about chopping charges.

Learn Bitcoin’s [BTC] Worth forecast 2025-26

With so many unpredictable components at play, the street forward might be bumpy for Bitcoin, making it essential for traders to remain alert. The approaching days would decide whether or not the market’s optimism holds – or falters.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024