Ethereum

Bitcoin hits $106K ATH, but what’s stopping Ethereum from hitting $4K?

Credit : ambcrypto.com

- Ethereum intently mirrors Bitcoin’s actions, making it more and more delicate to a potential correction.

- As whales proceed to dominate, it is going to be essential to maintain an in depth eye on their every day actions.

Bitcoin [BTC] is up virtually 3% over the previous 24 hours, hitting a brand new all-time excessive of $106,488. As the brand new yr kicks off, momentum is clearly growing.

To not be outdone, Ethereum [ETH] is making its personal transfer, approaching its annual excessive of $4,000. Historically, ETH has mirrored the actions of BTC, however shaky fingers and over-positioning the market are some interrogate if Bitcoin’s newest surge indicators an impending high.

If that’s the case, might this be the second when ETH breaks free from BTC’s shadow? Because the market matures, is a distinction between the 2 now extra potential than ever?

Bitcoin nonetheless has the lead over Ethereum

2024 is coming to an finish and looking out again, it has been a yr of main milestones for Bitcoin. Within the first quarter alone, Bitcoin rose from $49,710 to an all-time excessive of $73,000 in simply 30 days.

Ethereum was not on the sidelines both. Throughout the identical interval, ETH additionally broke previous $4,000, reaching ranges not seen since 2021. However this is the catch: simply as Bitcoin reached its peak, ETH adopted swimsuit.

In only one week, ETH plummeted to round $3,100, with every day drops of as much as 10%.

Supply: TradingView

Quick ahead to now, and an fascinating growth has caught the eye of AMBCrypto. Whereas Ethereum’s worth motion on the every day chart continues to reflect Bitcoin’s actions, its worth swings – each ups and downs – have develop into more and more sharp and unstable.

Due to this fact, regaining $4K won’t be a straightforward activity for Ethereum. The preliminary pump will possible come from Bitcoin, however holding that worth and changing it into stable help is proving to be a difficult activity.

On this state of affairs, it appears possible {that a} ‘wholesome’ pullback will flush out weak fingers. Furthermore, the buying strain is on numerous ranges premiums hasn’t surged but, suggesting both capital is flowing into Bitcoin or FOMO hasn’t totally kicked in but.

Until this pattern reverses, Ethereum will possible proceed to expertise volatility on the every day chart, with sharp worth swings making it tough to foretell clear short-term course.

Whales are pulling the strings of ETH

AMBCrypto has uncovered a serious growth that might affect Ethereum, each within the brief and long run. The focus of Ethereum within the fingers of whales has reached 44%, placing it dangerously near the 47% held by retail buyers.

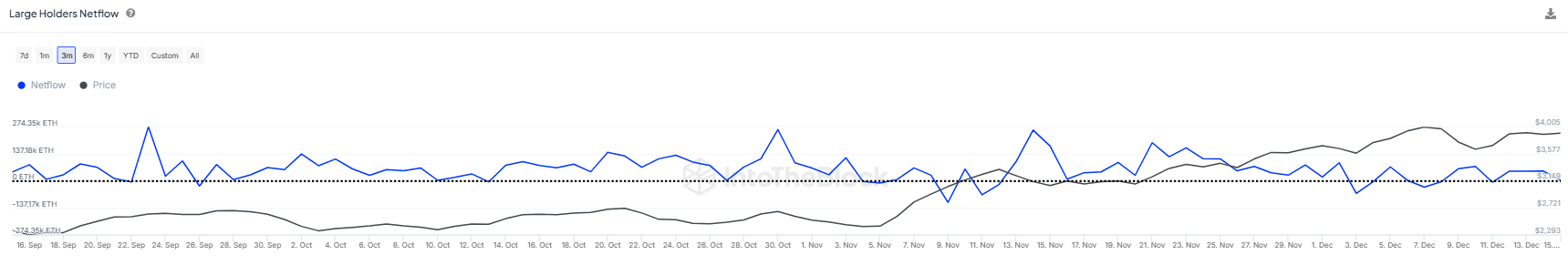

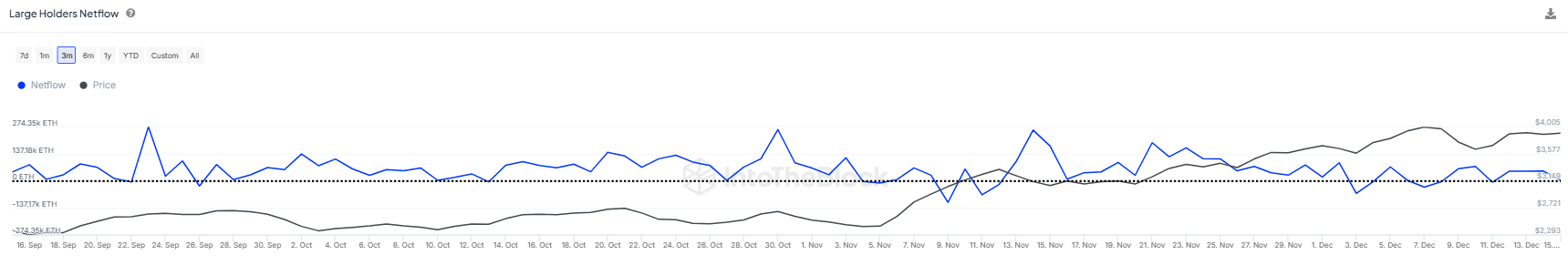

Whales sometimes manipulate the market by shopping for on the backside and promoting at the next worth, however over the previous ninety days their order ebook has develop into more and more inconsistent.

Supply: IntoTheBlock

The affect on Ethereum was clear: for 2 consecutive days, these whales deposited 40,000 ETH on exchanges as ETH reached $4,000 on December 6 – the identical day Bitcoin surpassed $100,000 for the primary time.

This led to a pointy 7% drop in ETH the subsequent day. Whereas these whales have been accumulate ETH, they skillfully timed the “dip,” solely to money out simply earlier than Ethereum might breach essential psychological targets and execute a textbook manipulation technique.

Learn Ethereum (ETH) Worth Prediction 2024-25

With all these elements enjoying a job, a relapse appears more and more possible. Analysts are predicting a Bitcoin correction, which might possible drag Ethereum down as effectively.

Nevertheless, if FOMO takes over once more, each retail and main gamers might seize the chance to purchase the dip at $3,700, the place there have been 4.6 million tokens earlier scooped up.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024