Bitcoin

Bitcoin holds on as Gold climbs – Is this the new safe haven duo?

Credit : ambcrypto.com

- Bitcoin nonetheless retains above $ 80k, as a result of buyers are searching for security in unsure markets

- Statistics indicated that 77% of holders had a revenue, with Netflows that help robust emotions

The worldwide economic system continues to step on shaky floor. Commerce relationships evolve, inflation shouldn’t be but absolutely eradicated and the inventory markets are simply beginning to present cracks. And but onerous property akin to gold and bitcoin steal the highlight in silence.

Gold even went a brand new highest level of $ 3,300 within the charts. Onerous on its heels BTC stays nicely above the worth stage of $ 80k. The 2 transfer synchronously and for a very good purpose are buyers searching for security.

As a result of conventional property are dropping their lead, Bitcoin appears to make his enterprise as a critical Protected-Haven contender.

Buyers have a look at BTC in unsure occasions

Buyers appear to reply to world uncertainty by transferring capital to property that retain worth. Gold has historically performed that function, however Bitcoin is shortly overtaking. The decentralization and world liquidity make it a sexy hedge.

With shares which are confronted with potential drawback and worldwide monetary coverage nonetheless stressed, BTC is now thought-about by some to be ‘digital gold’. The efficiency throughout current inventory gross sales have additional strengthened this sentiment.

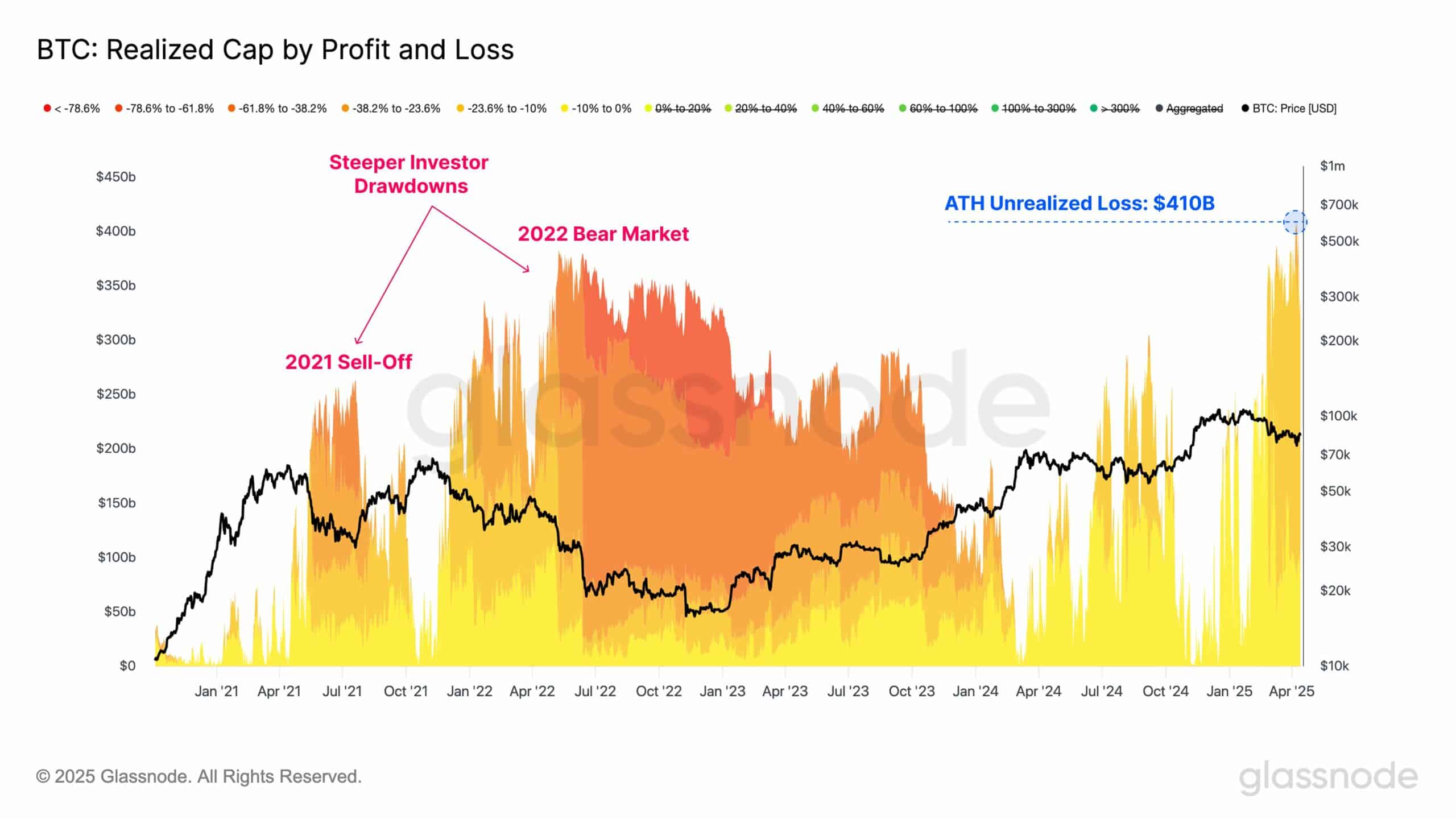

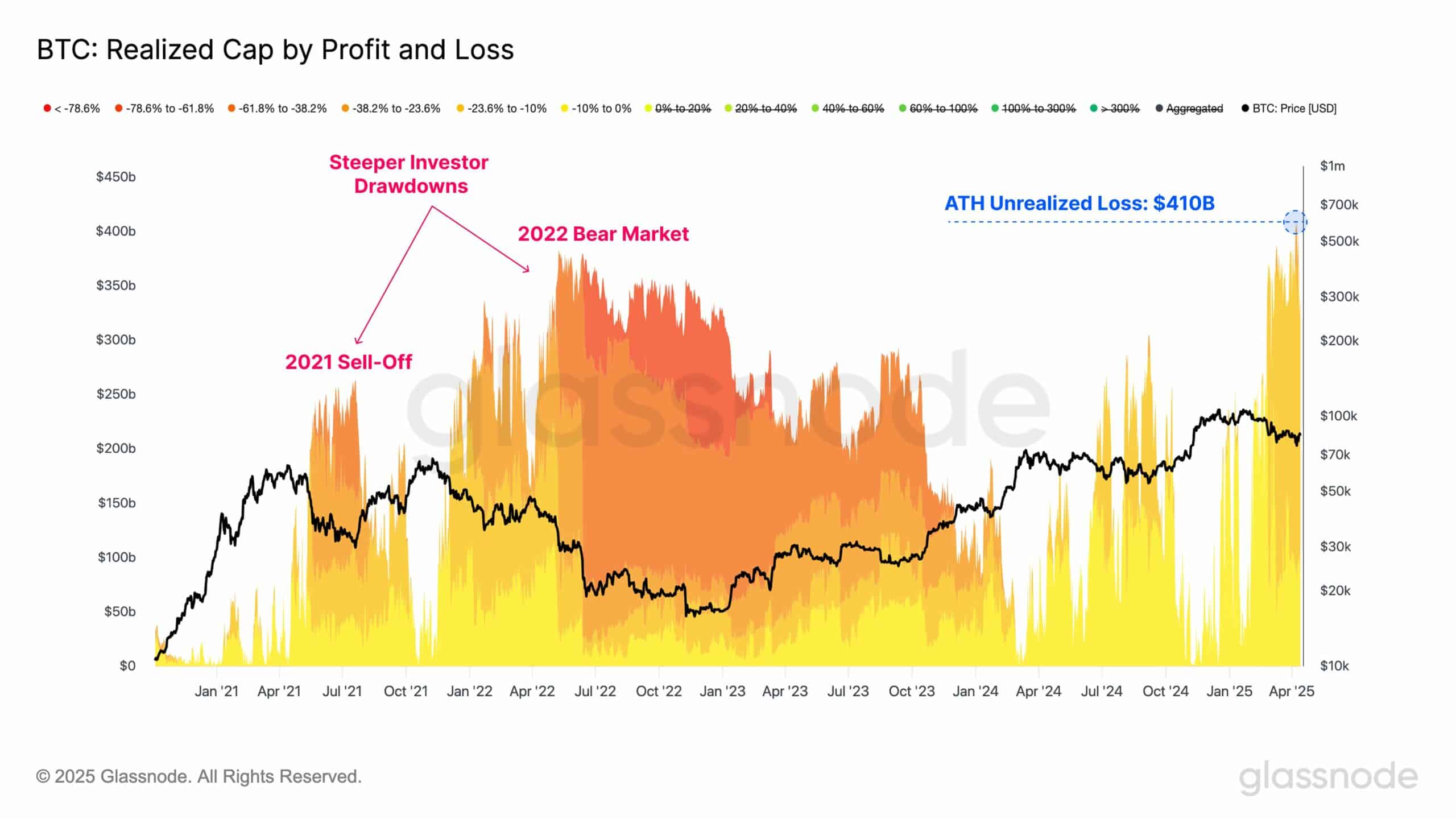

With the crypto that yields a excessive influx and diminished non-realized losses, the variety of massive investments on the present dip may push costs increased. The final time Bitcoin was included in such a excessive quantity on non-realized losses throughout the sale of 2021 and 2022 Bear markets.

Each occasions had been adopted by an vital bullish rally within the charts.

Supply: Glassnode

Statistics again the bullish case

Based on Intotheblock, chain statistics additionally indicated the rising belief. On the time of writing, Bitcoin’s Alternate Netflows was at 52%. That meant that extra BTC is withdrawn from inventory exchanges than deposited – a sign from buyers who’re the intention to maintain as a substitute of promoting.

The information has even proven that 77% of all Bitcoin addresses can have a revenue. This stage of profitability usually will increase the holder sentiment and helps worth stability, and even additional upwards.

Supply: Intotheblock

So long as there may be financial uncertainty and perception in conventional markets, Bitcoin will proceed to select nice. Staying above $ 80k isn’t just a matter of worth – it is sentiment. Patrons at the moment simply see worth in BTC.

With gold and bitcoin each red-hot, builds the secure haven story of power. If this continues, Bitcoin can’t keep in step alone, it could possibly contact new highlights.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024