Analysis

Bitcoin Holds Steady While Hash Rate Climbs to ATH; $125K Target Imminent After a Breakout

Credit : coinpedia.org

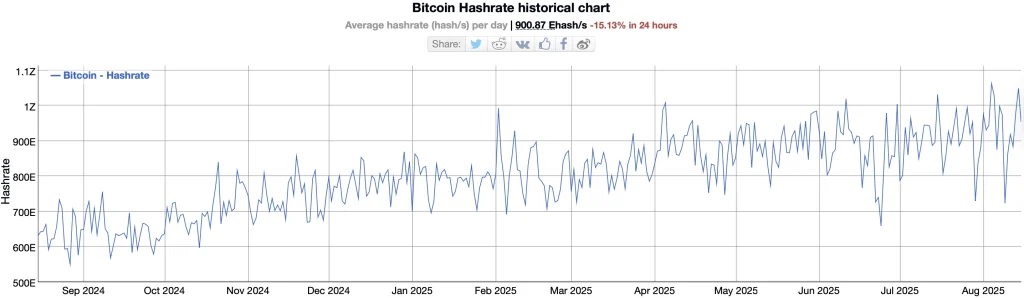

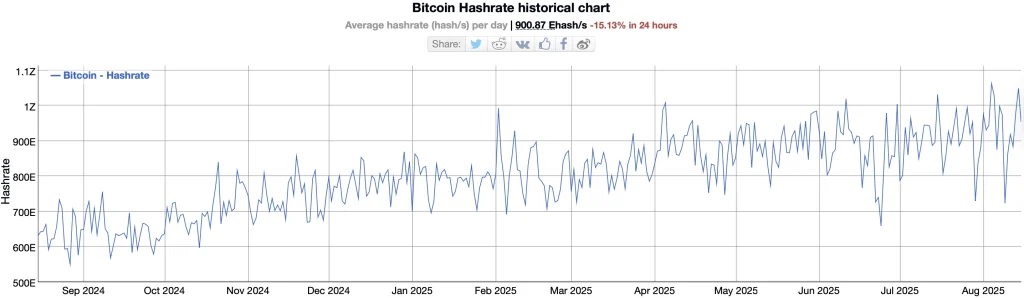

The worth of Bitcoin has entered right into a consolidation part, persistent after his sturdy assembly to new highlights earlier this 12 months. This “break” is typical after giant rallies, as a result of merchants take a revenue and new catalysts are anticipated. Consolidation phases usually precede giant pimples, making this an important interval for each brief -term merchants and lengthy -term holders. Whereas merchants debate or the subsequent step can be up or down, one other important measurement worth is rising calmly: the hash price of Bitcoin Community has set new highlights of all time. This divergence between worth and community power has attracted the eye of each analysts and lengthy -term traders.

Hash Price rises to registration ranges

In distinction to the lateral worth promotion, the Bitcoin hash price continues to rise and he reaches unprecedented ranges. The Hash Price measures the computing energy that the community protects – primarily the mixed power of all miners. An rising hash price signifies that extra miners dedicate assets, enhance safety and present belief in Bitcoin’s profitability in the long run.

Traditionally, the rising hash price has usually adopted interval development durations, as a result of larger BTC costs appeal to new mining investments. It is crucial that miners are likely to assume in the long run, so the continual development in hash price throughout worth consolidation indicators that underlie optimism sooner or later worth of Bitcoin.

Historic perspective: Worth traces, Hash Price follows

Trying again, the hash price and the value of Bitcoin present a powerful correlation, principally greater than 70% on multi-year scales. Nonetheless, the connection just isn’t completely aligned:

- Worth normally leads as a result of the next profitability encourages new miners to take part.

- Hash price delays due to the time it’s required to arrange tools and infrastructure.

- Variations occur, equivalent to in the course of the Chinese language mining ban in 2021, {that a} aggressive hash price decreased regardless of sturdy costs.

Nonetheless, when the hash price continued to climb throughout worth consolidation (eg 2019-2020), it was usually a precursor to giant bull runs.

What this implies for Bitcoin at this time

The present set-up worth with a record-high hash price could be interpreted as follows:

- Community fundamentals stronger than ever: Bitcoin is safer and extra resilient at each excessive hash pace.

- Miner Confidence Alerts Lengthy -term Bullishness: Miners wouldn’t pour a capital in {hardware} and electrical energy if they’d anticipated an extended -term worth weak point.

- Potential outbreak: Traditionally, comparable variations have preceded giant upward worth actions.

Bitcoin -Worth evaluation: Does the BTC worth rise again to $ 130k?

Though the value for a small correction is confronted and the native help breaks by way of, the token stays inside the sample. Bitcoin bulls don’t depart a stone untouched in defending essential help round $ 116,500. At the moment, the prize has recovered from the lows of lower than $ 117,000; Nonetheless, a rise above a sure vary can validate a rise above the bearish affect.

As could be seen within the graph above, the BTC worth continues to behave inside a rising wedge, and the latest correction has drawn the degrees underneath an vital resistance zone between $ 120,000 and $ 120,800. The worth finds its help on the BMSB (Bull Market Help Band), which is fashioned by the EMA of 20 weeks SMA and 21 weeks. Throughout a bull market, the value is predicted to stay above the extent of help; Nonetheless, if it falls underneath the vary, it’s seen as a shopping for choice.

Within the meantime, the MACD signifies a fall within the buying strain and the traces are trending to a bearish crossover. That’s the reason there’s a big risk that the value breaks the wedge and take a look at the help at $ 115,200. Nonetheless, this can lead to a rebound, as a result of the miners present monumental confidence within the Bitcoin (BTC) worth rally.

The present consolidation of Bitcoin could be irritating for brief -term merchants, however the rising hash price tells a unique story: the fundamental rules are stronger than ever. If historical past repeats itself, this miner-driven present of belief is usually a main indicator for the subsequent outbreak.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International