Bitcoin

Bitcoin: How retail participation is keeping BTC away from $100K

Credit : ambcrypto.com

- Bitcoin is down 5.6% from its document excessive of $99,645, with retail merchants but to affix the rally.

- Forex inflows and open curiosity revealed insights into market sentiment.

After a formidable rally that boosted Bitcoin [BTC] to an all-time excessive of $99,645 final week, the asset has now entered a correction part.

This marks a decline of 5.6% from its peak, with Bitcoin buying and selling at $93,602 on the time of writing, down 4.3% prior to now 24 hours.

The correction comes as Bitcoin inch nearer to the psychologically vital six-figure worth level of $100,000. Regardless of the decline, market analysts proceed to research key figures for indicators of what lies forward.

Retailer present development

A CryptoQuant analyst, Woominkyu, has carried out simply that marked An necessary statement: Retail merchants have but to play a major function in Bitcoin’s worth motion.

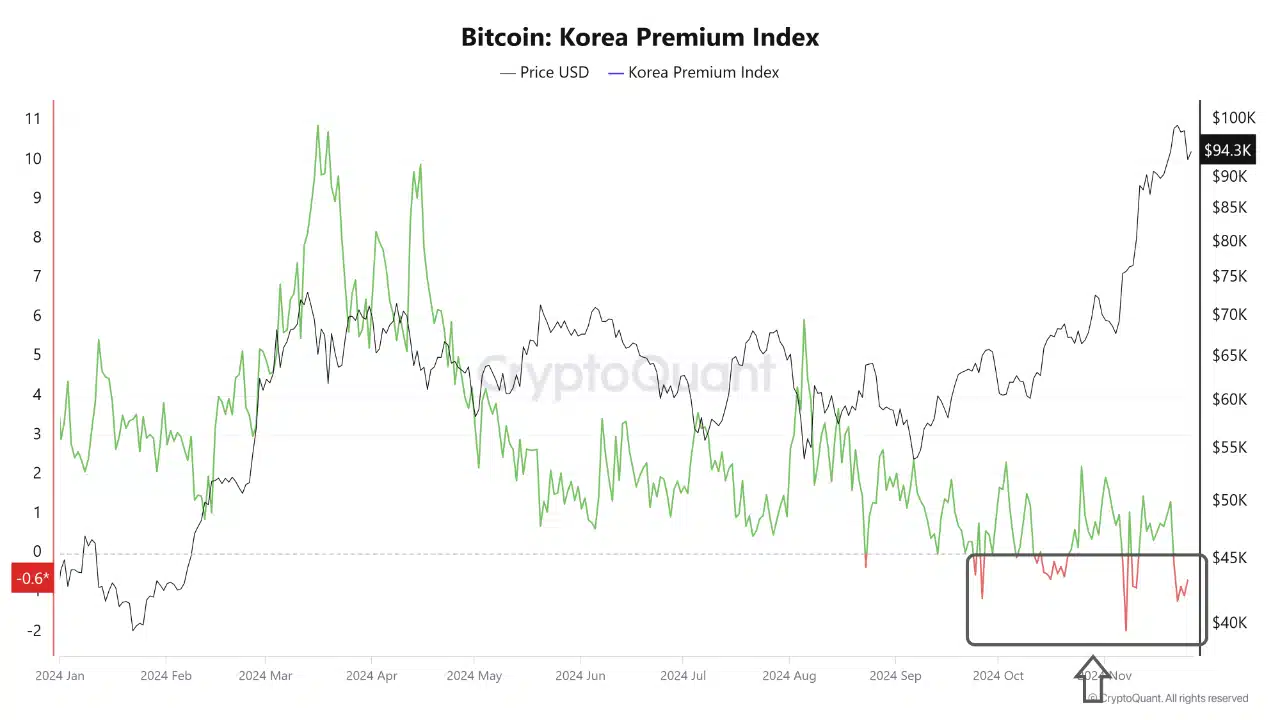

In accordance with the analyst, the Korea Premium Index, which displays retail participation, remained beneath -0.5 on the time of writing. Retail exercise has due to this fact not been a serious driver of the latest worth improve.

Supply: CryptoQuant

Traditionally, the Korea Premium Index has typically seen vital spikes earlier than Bitcoin reached a worth peak. Woominkyu emphasised the significance of intently monitoring this indicator to establish potential worth tops.

The muted retail involvement means that Bitcoin’s present rally is essentially pushed by institutional participation or different elements, leaving room for added momentum as soon as retail merchants reenter the market.

Change Outflows and Open Curiosity present insights

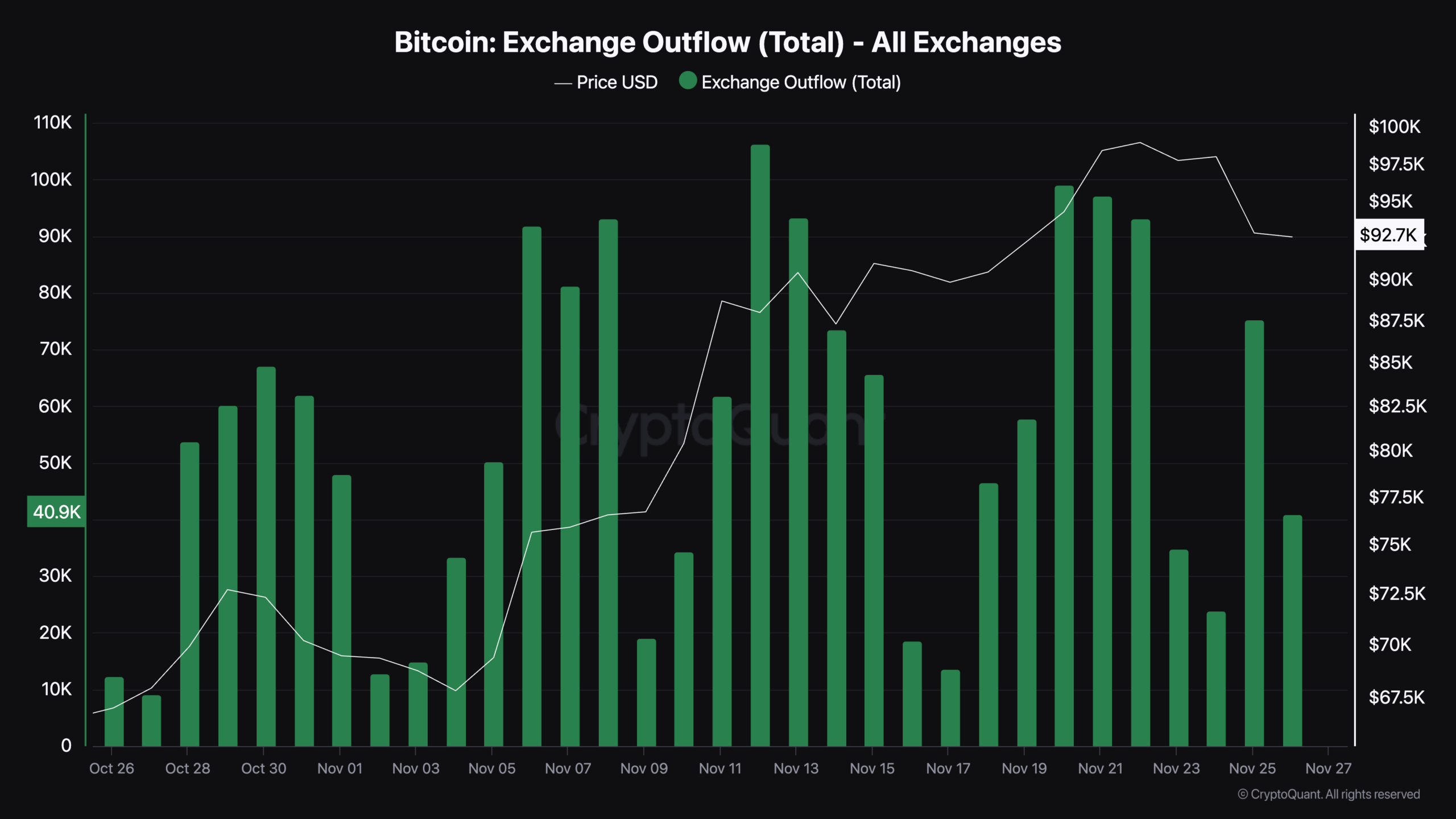

Past retail exercise, analyzing Bitcoin outflows and Open Curiosity supplies a deeper perception into market dynamics. Facts from CryptoQuant exhibits a exceptional development in forex outflows.

Supply: CryptoQuant

Lately, the metric recorded a major spike, with greater than 75,000 BTC flowing out of exchanges on November 25.

Whereas this determine has since dropped to round 31,000 BTC on the time of writing, the quantity was nonetheless exceptional, particularly contemplating that the day is simply starting.

This development of Bitcoin shifting away from exchanges signifies that buyers could also be choosing self-preservation, signaling intentions to carry the inventory for the long run reasonably than short-term promoting stress.

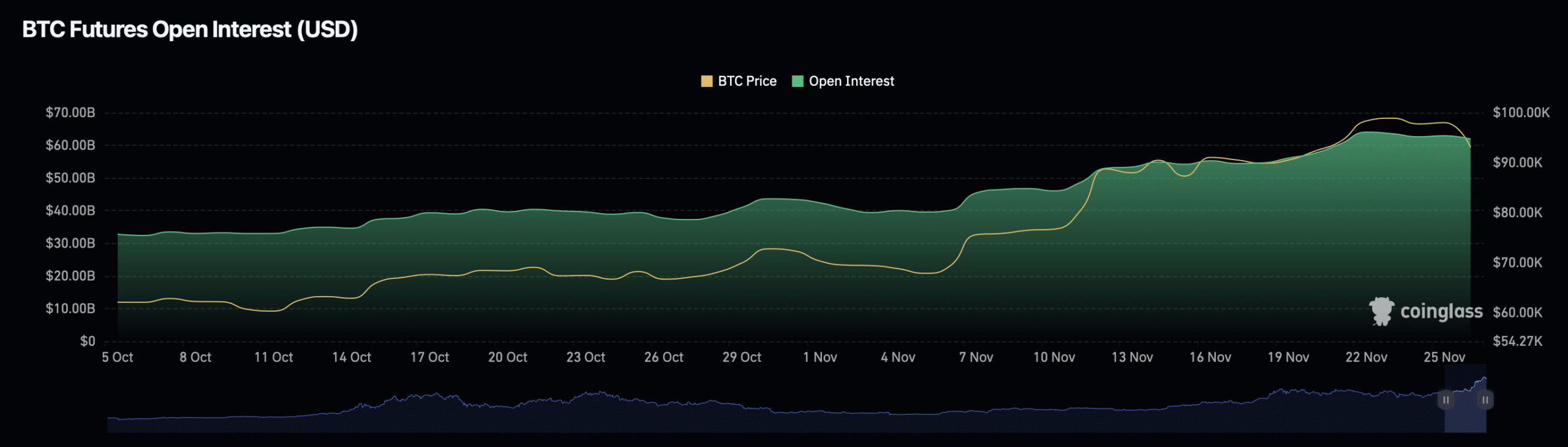

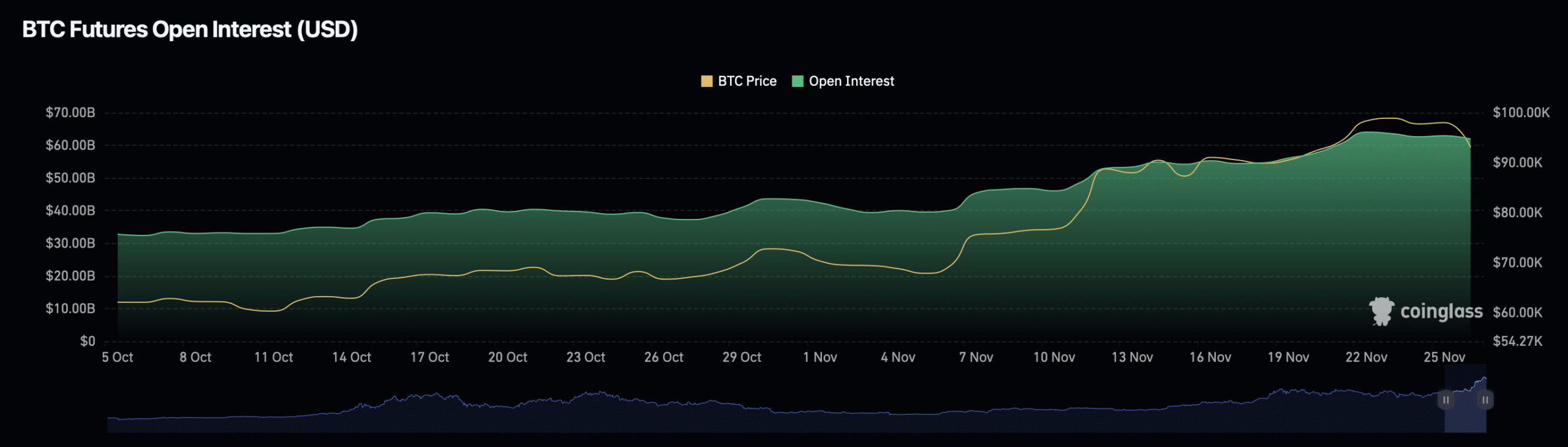

Alternatively, Bitcoin’s open curiosity metrics paint a blended image.

In accordance with Mint glassBitcoin’s Open Curiosity worth fell 4.55% to $60.37 billion, signaling a attainable cooling of leverage positions.

Nonetheless, Open Curiosity rose a formidable 62.58% to succeed in $132.86 billion.

Supply: Coinglass

This disparity signifies that though the entire worth of contracts has decreased, there was a rise within the variety of lively positions out there.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

This improve in quantity might point out elevated market exercise, with merchants opening positions in anticipation of additional worth actions.

Nonetheless, the decline within the general worth of those positions might trigger warning amongst bigger buyers.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024