Altcoin

Bitcoin: How the rising Stablecoin range can jeopardize BTCs $ 90K

Credit : ambcrypto.com

- Stablecoin reserves on derivatives festivals have risen.

- Till the Stablecoin quantity flows to Spothandel once more, the volatility is anticipated to live on.

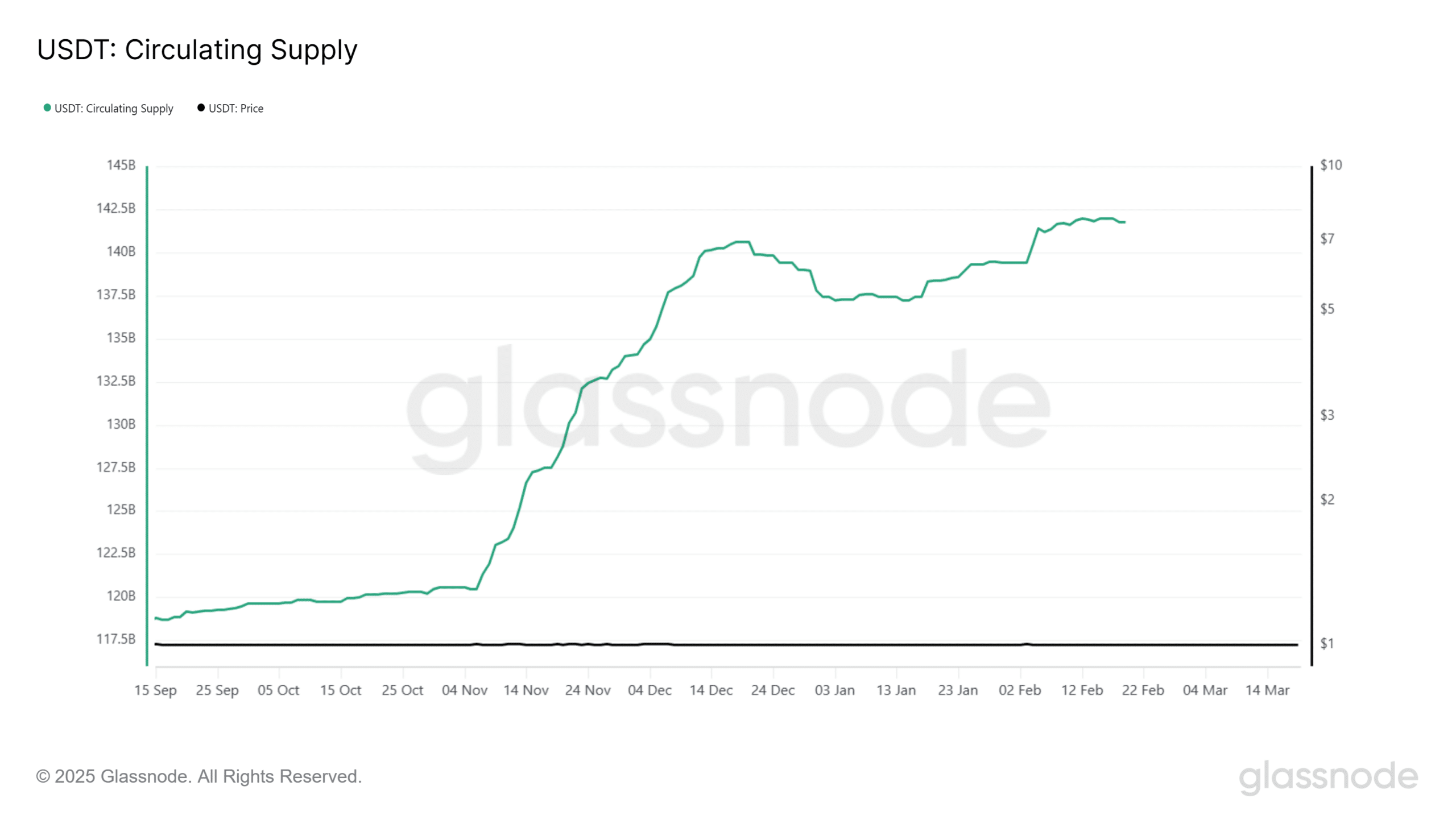

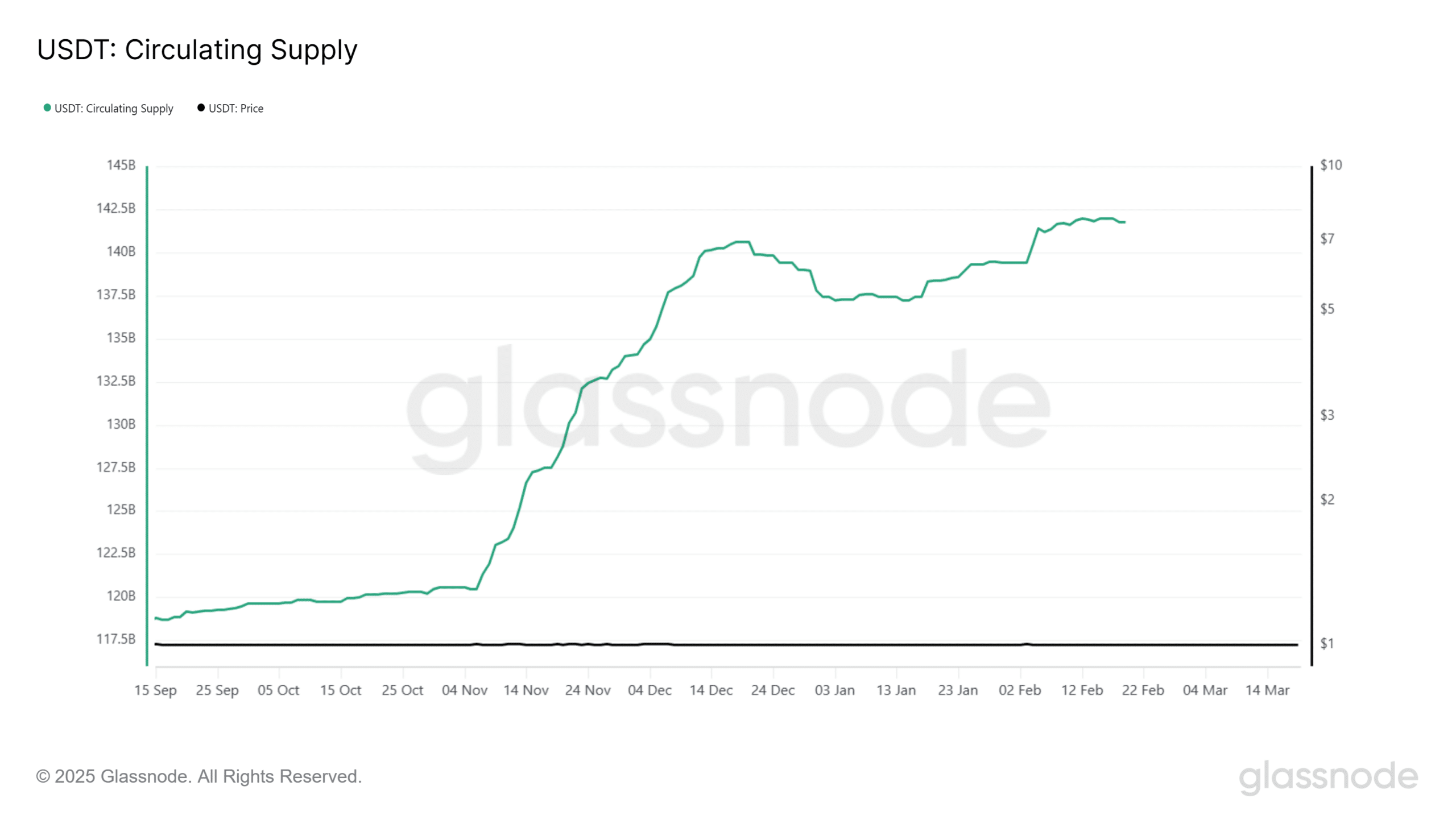

Since November there was a big improve in StableCoins vary, coinciding with Bitcoin’s [BTC] Bullish Rally.

Nevertheless, this liquidity has primarily flowed to derivatives markets as a substitute of spot markets.

This report analyzes the implications of this pattern. Is the market surpassed and may extreme commerce with excessive leverage Bitcoin’s value within the quick time period to jeopardize?

Livered bets are on the forefront when utilizing the Stablecoin

A rising stablecoin vary often signifies elevated buying energy. Nevertheless, its derivation to derivatives means that merchants want lifting tree positions over direct BTC accumulation.

Since November, merchants have added round $ 20 billion to Tether (USDT) to the circulation, coinciding with Bitcoin’s climb to all time of $ 109k.

Supply: Cryptuquant

Whereas this improve in USDT lividity pointed to the market, particularly at BTC shopping for stress, facts From cryptoquant revealed that a lot of this liquidity was led to dangerous leverage.

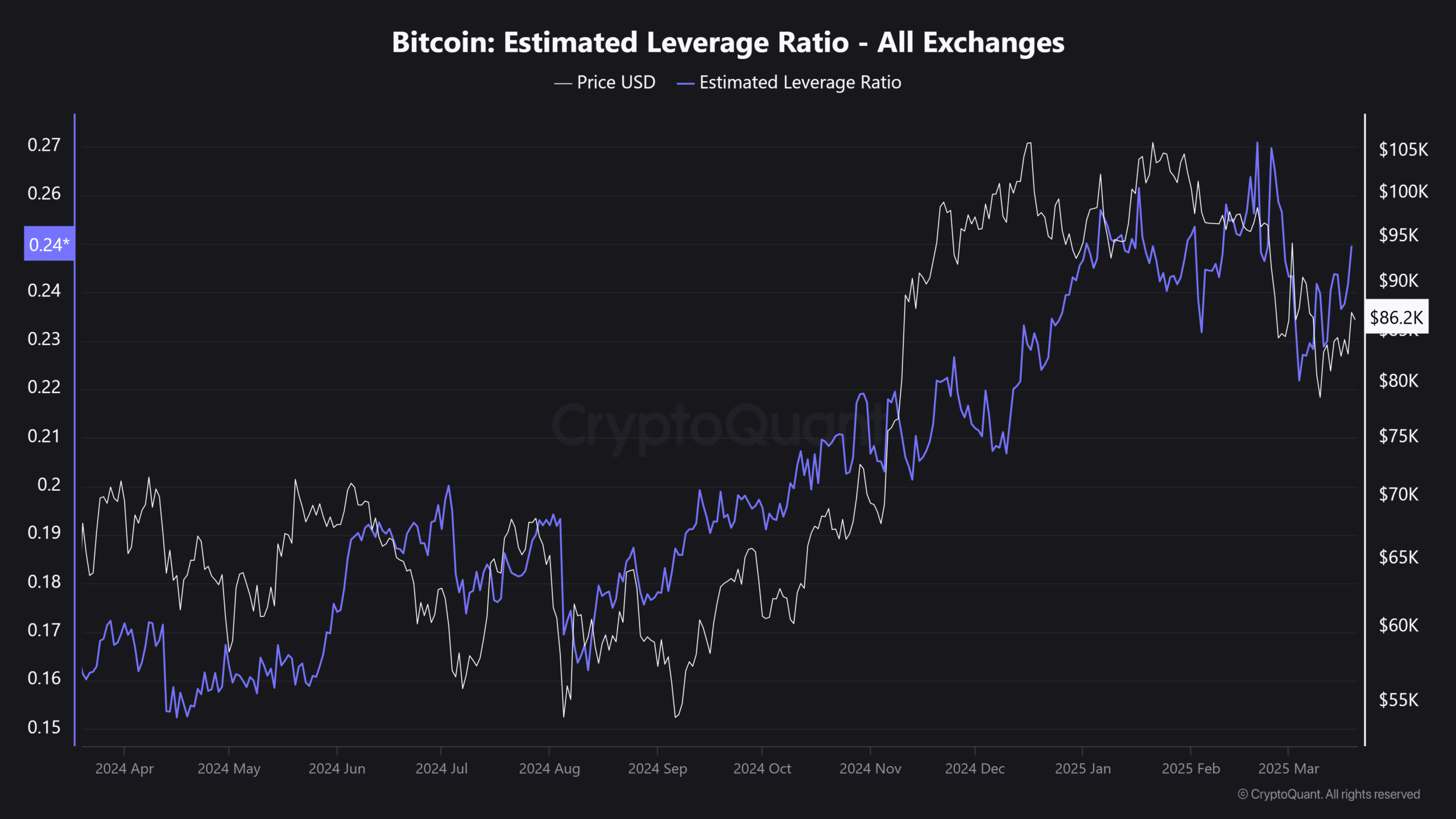

Whereas the Derivatenmarkt noticed a peak in purchase orders, Open curiosity (OI) increased Till a document excessive of $ 70 billion on January 22.

At the moment it’s $ 52 billion. The closure of those positions has put intense downward stress on the BTC value, making it a problem for Bitcoin to reclaim the $ 90k marking.

Weak spot demand endangers the way forward for Bitcoin

The USDT movement This shift exhibits clearly on election day. On November 6, the online stream of Stablecoins from Spotbeurzen marked elevated buy exercise – often a bearish indicator.

Nevertheless, the derivatives market noticed an explosive influx of 1.2 billion in USDT, pointing to a rise in leverage.

Though such liquidity influx in derivatives can point out a bullish sentiment in a robust market, they introduce a substantial danger in a risky surroundings.

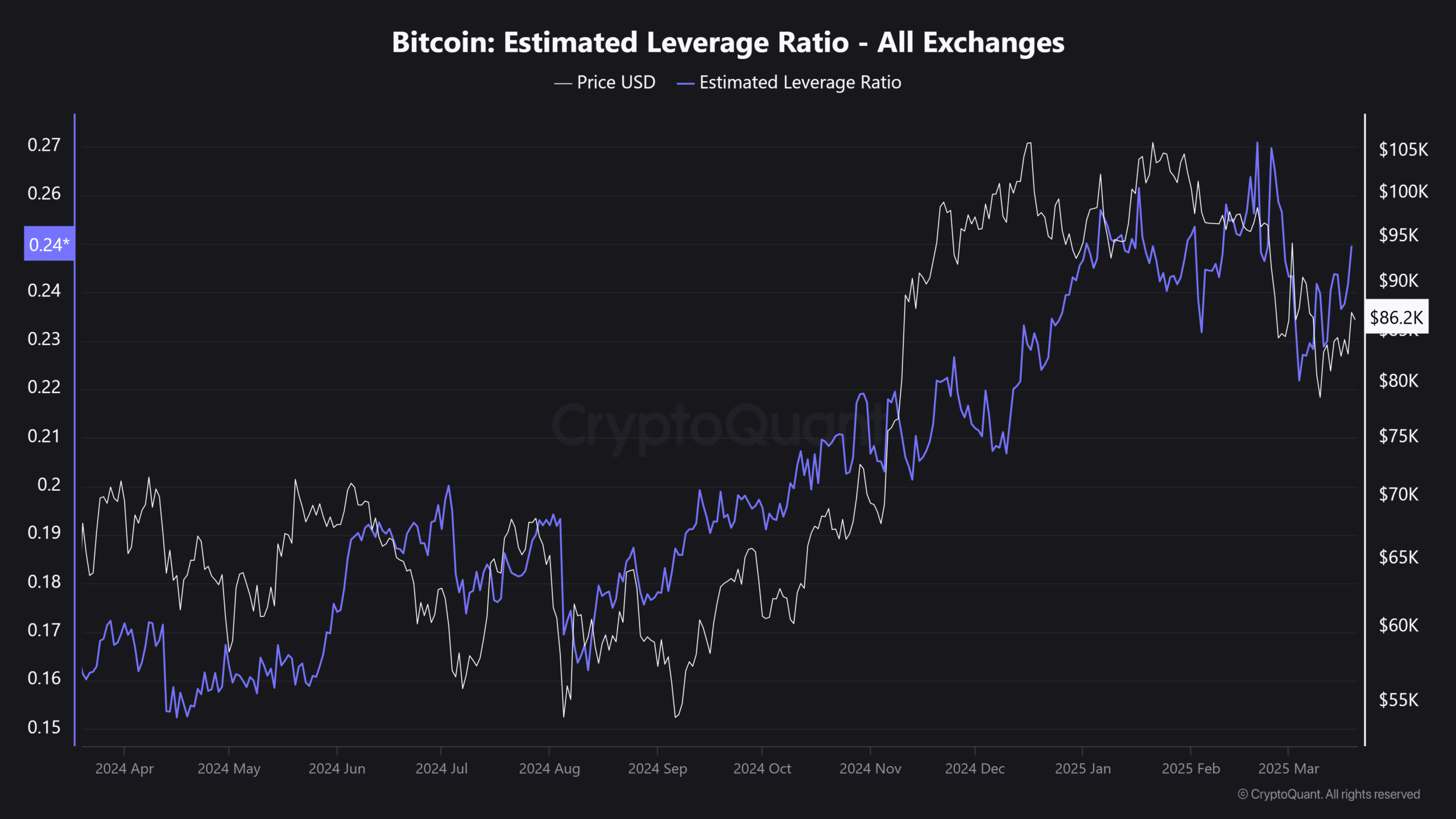

After the FOMC assembly, which led to barely optimism for potential pace reductions, the estimated lever ratio of Bitcoin (ELR) noticed a dramatic improve.

Supply: Cryptuquant

Because the expectations for decrease mortgage prices grew, merchants flowed to excessive leverage positions. This pattern is one to maintain intently as Q2 progresses.

Given the weak accumulation on the spot market, these lifting tree positions are confronted with a better likelihood of liquidation.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now