Bitcoin

Bitcoin – How USD’s strength, low stablecoin supply could dictate price action

Credit : ambcrypto.com

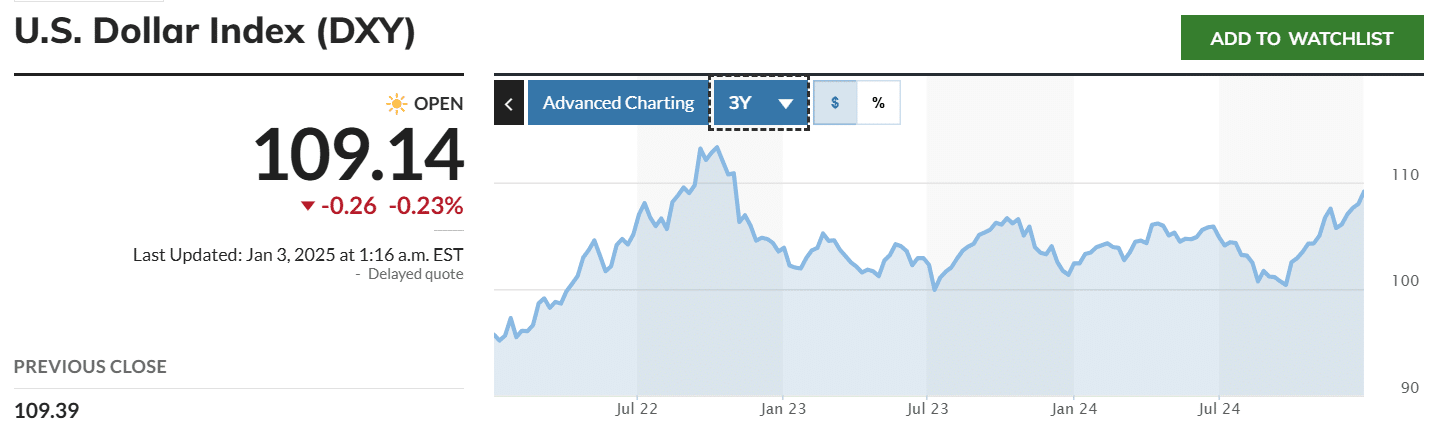

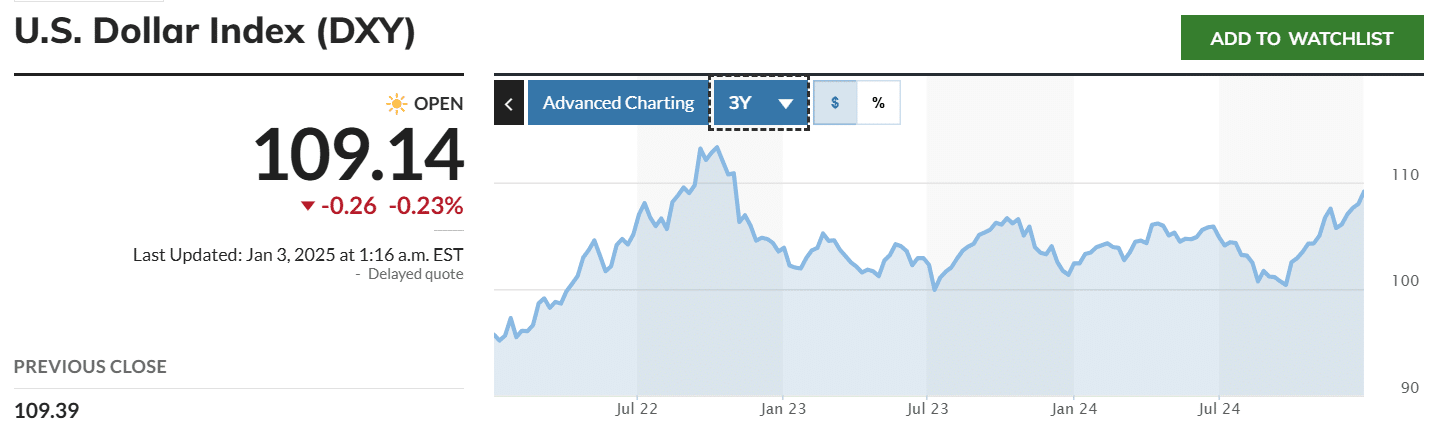

- The US greenback index has risen to 109, the best stage since November 2022

- A robust greenback might weaken demand for dangerous property like Bitcoin, which might restrict the crypto’s upward pattern

Bitcoin (BTC) By mid-December it fell under $100,000. Since then, the King Coin has struggled to regain its momentum on the charts. On the time of writing, BTC was buying and selling at $96,789 after gaining 1.5% in 24 hours, whereas the crypto was nonetheless simply over 10% off its ATH.

Whereas Bitcoin might stage a restoration later this month due to Donald Trump’s inauguration As US president, two key components might proceed to weigh on costs.

The US greenback index rises to its highest stage in two years

The US Greenback Index (DXY), which measures the efficiency of the US greenback in opposition to main currencies, has risen to 109 – the best stage since November 2022. What this rise signifies is that the US greenback has been gaining power these days .

(Supply: MarketWatch)

The DXY is inversely correlated with the value of Bitcoin, that means {that a} rise limits the coin’s upside potential. Moreover, a stronger greenback tends to weaken demand for dangerous property like cryptocurrencies.

The truth is, the decline in demand is already clearly seen within the exchange-traded fund (ETF) market. On its first day of buying and selling in 2025, the BlackRock iShares Bitcoin Belief (IBIT) ETF recorded outflows of $332 million, marking the best outflows in historical past. The whole outflows from all 11 Bitcoin ETFs quantity to $242 million SoSoValue.

If these outflows proceed, it might trigger a surge in promoting stress. This in flip will trigger a downward pattern for BTC on the charts.

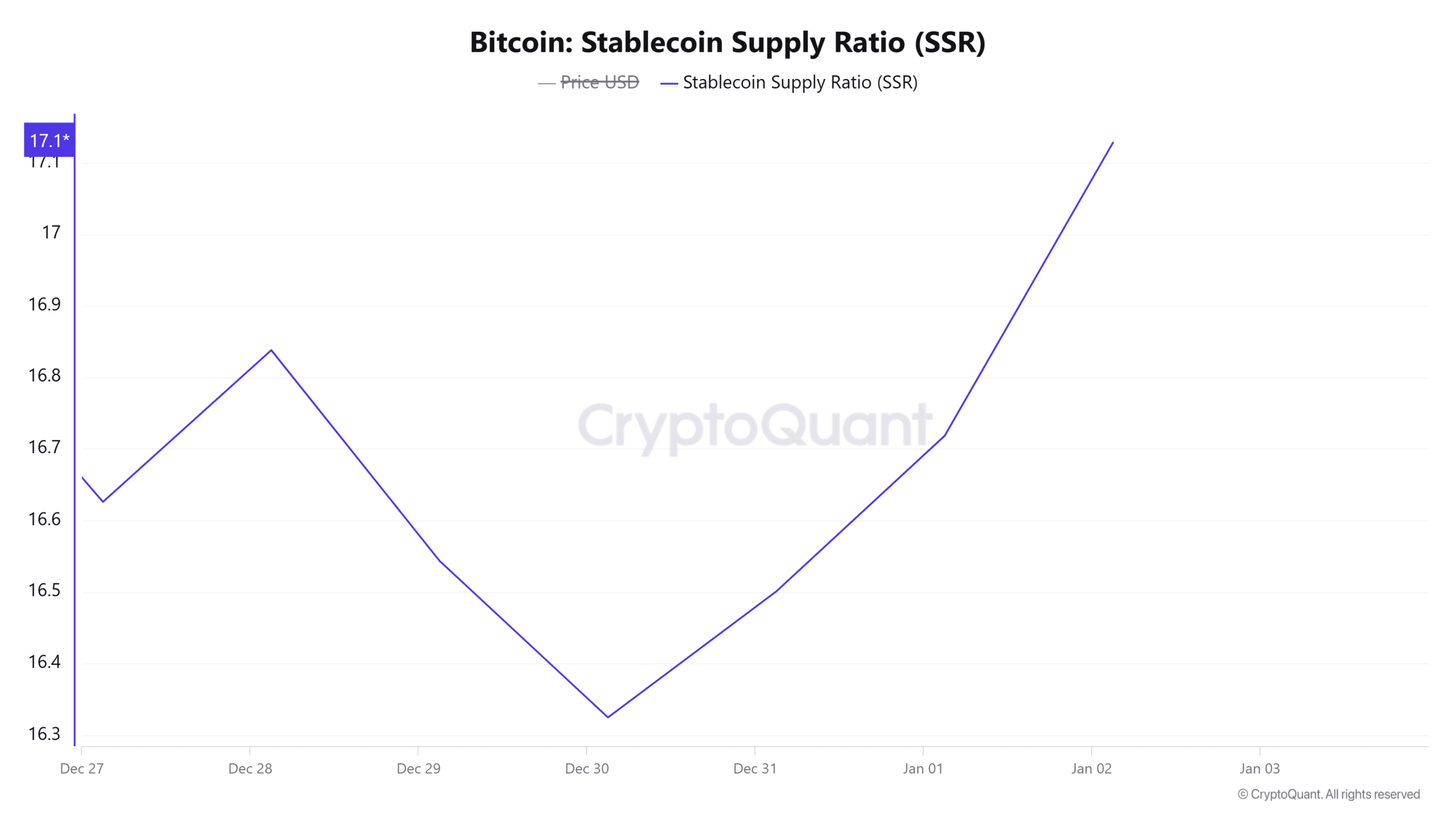

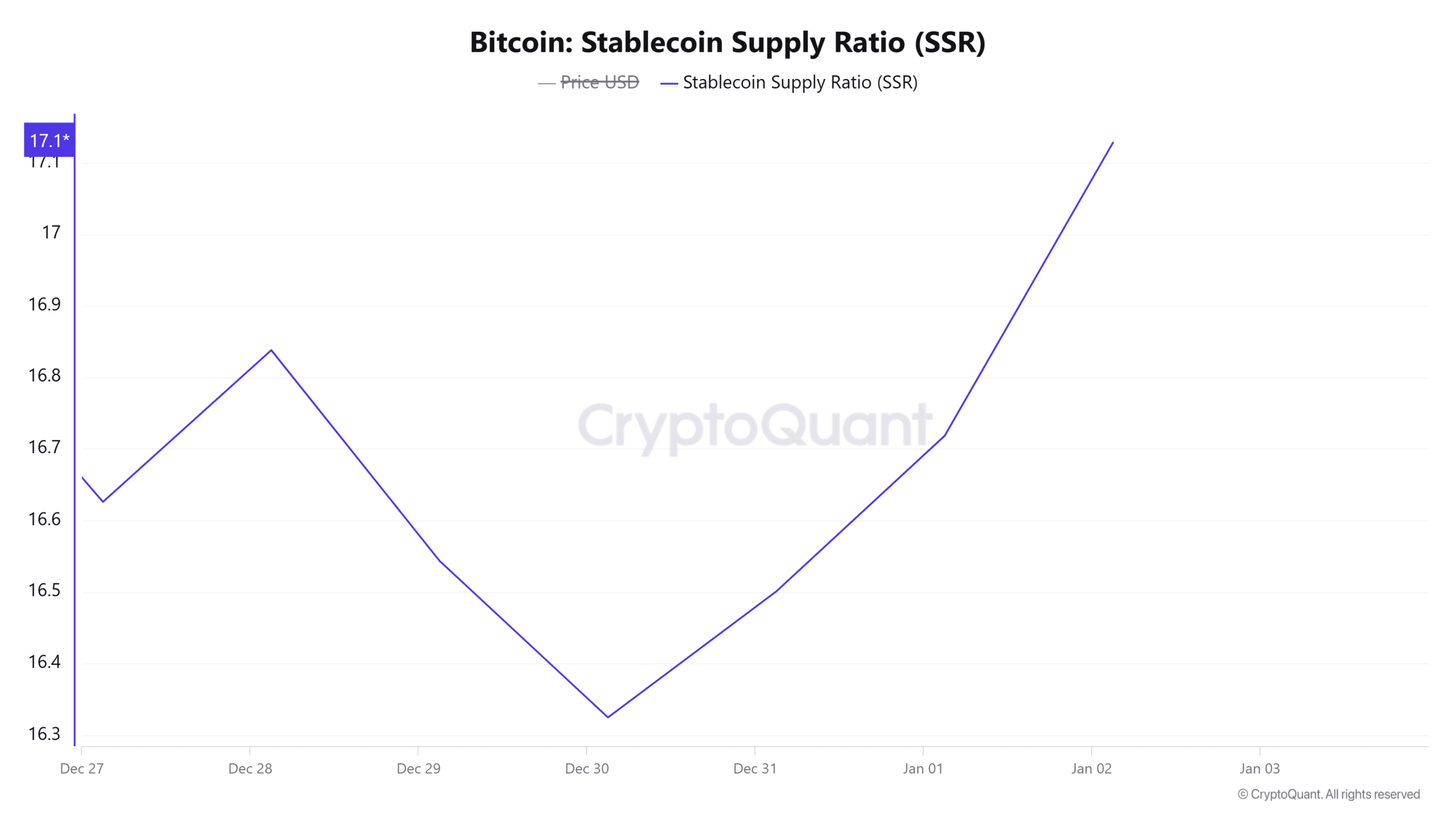

Rising stablecoin provide ratio

The weakened demand appeared to be seen not solely amongst institutional traders, but additionally within the non-public market. For instance, in keeping with CryptoQuant, Bitcoin’s Stablecoin Provide Ratio (SSR) rose to 17 – the best stage in seven days.

(Supply: CryptoQuant)

A better ratio implies that the availability of stablecoins is low in comparison with the market capitalization of BTC. This ends in low shopping for stress that would put downward stress on the value.

Bitcoin’s concern and greed index continues to be bullish

Regardless of market components indicating declining demand and buying stress, the Fear and Greed Indexwhich gauges market sentiment revealed that merchants are nonetheless bullish.

This index had a worth of 74 on the time of writing, which signifies that the majority merchants are optimistic about BTC’s worth motion. Because the index rose from 65 earlier this week, it could possibly be excellent news for BTC if merchants begin shopping for.

Nevertheless, if buy-side stress shouldn’t be sufficient to soak up the cash bought, it might restrict chart beneficial properties.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September