Bitcoin

Bitcoin: Is a local top forming? Why BTC’s pullback looks close

Credit : ambcrypto.com

- Bitcoin reveals indicators of a possible native high, with necessary momentum indicators that point out overloading.

- Is there nonetheless a pullback in your palms?

On March 2, Bitcoin [BTC] 9.44% rose in a single day-the highest one-day revenue in three months.

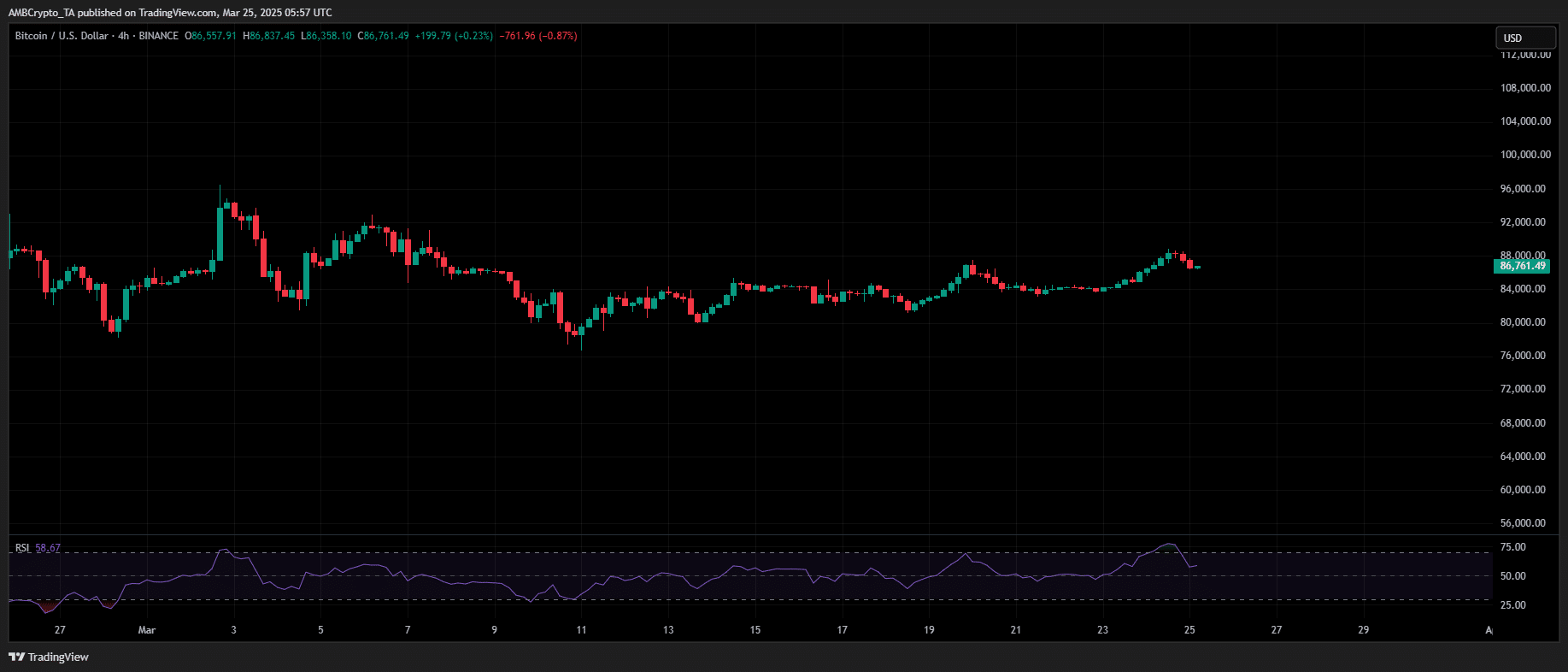

As a result of the 4-hour RSI reached a peak at 70, the value motion returned, which led to a lower from 14.13% to $ 81,500 inside 10 commerce periods.

Supply: TradingView (BTC/USDT)

The final time Bitcoin noticed a comparable capital influx in the course of the election run, when BTC reached its then excessive of $ 88,400 on 11 March, which pushed the 4-hour RSI to the Overboughtre space.

Regardless of the overhead lecture, Bulls absorbed the liquidity on the gross sales facet, rinsed weak palms and pushed BTC two days later to a peak of $ 92,647.

Sooner or later, the relative energy index (RSI) is a momentumoscillator that measures the pace and alter of value actions on a scale of 0 to 100.

Historically, a RSI above 70 signifies that an energetic overbough could be, which means that it’s potential for a pricebackback, whereas a RSI beneath 30 means that it may be offered over, which factors to potential for a value -repellent.

Traditionally, when Bitcoin’s 4-hour RSI Overbought enters territory, this means a powerful bullish momentum, however has usually preceded this at aggressive value corrections.

Now, three months later, Bitcoin has recovered $ 88k for the primary time in 17 days. Nonetheless, RSI has risen once more on the 4 -hour graph.

By taking a revenue in all probability, can bulls soak up the sales-side strain, or is one other correction in March model imminent?

Bitcoin prepared for a pullback

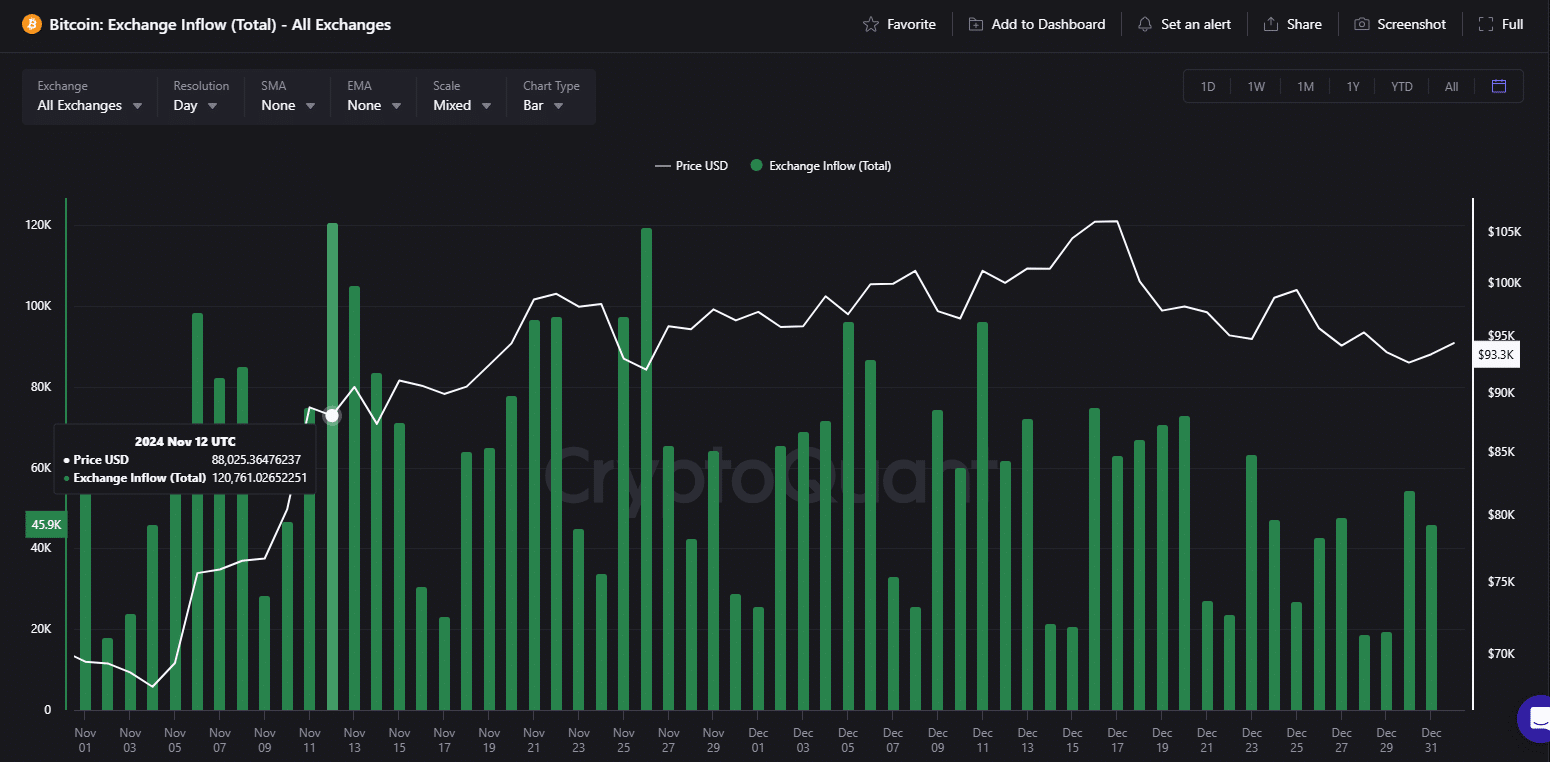

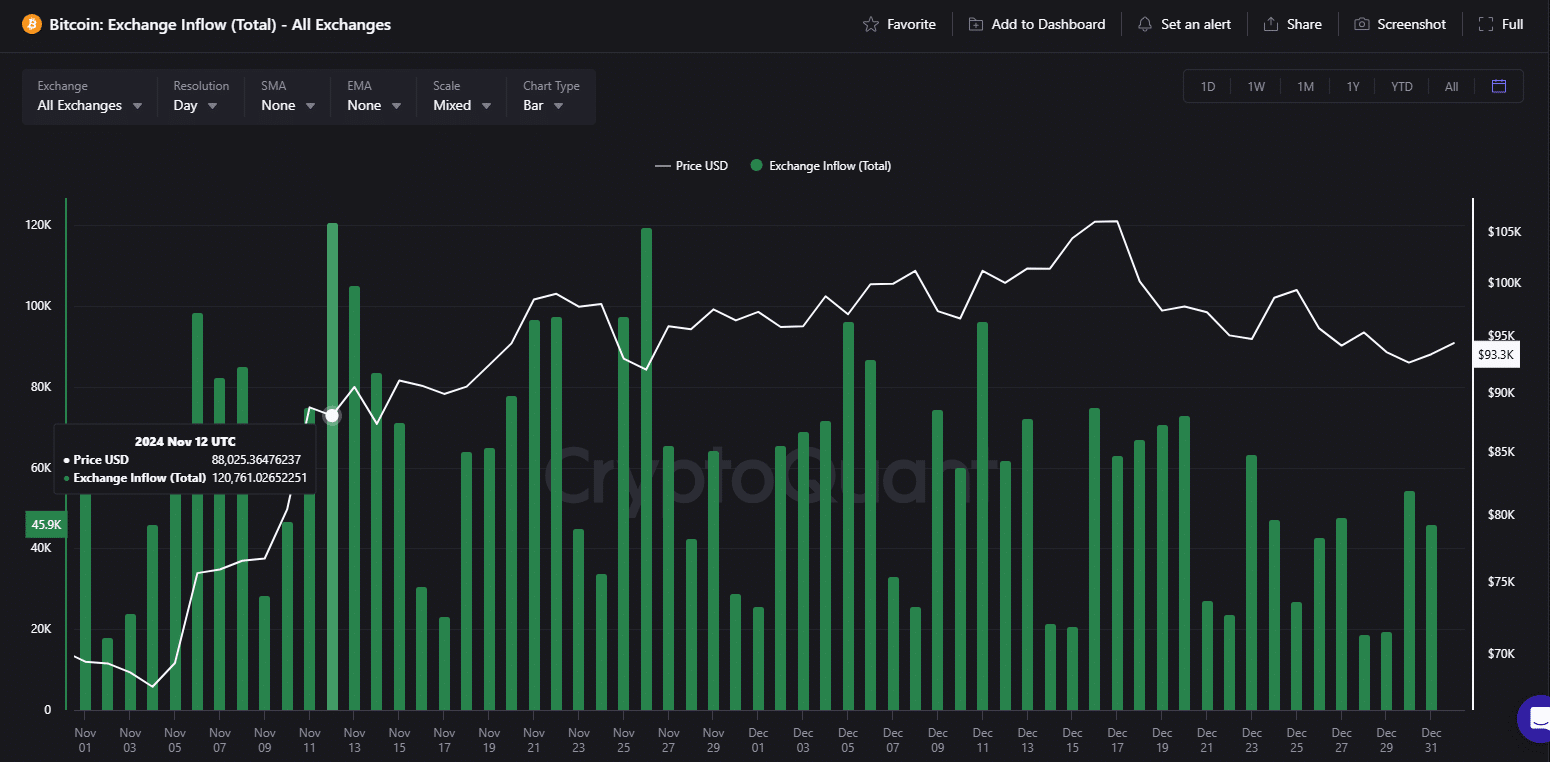

Ambcrypto found an necessary sample. On March 12, as Bitcoin’s RSI signaled overload, Bitcoin ETFs registered Their second highest influx and document of $ 1.114 billion.

This urged that persistent institutional query performed an important function in absorbing the impression of 120,761 BTC, price $ 10.67 billion, who flooded in a single sale.

Supply: Cryptuquant

For the time being, Binance Mockery Stays robust, with web outflows that point out steady Bitcoin accumulation. The derivaten market additionally mirrored bullish positioning.

In the meantime, each lengthy and short-term opens (finest output win ratio) reversed Above 0, affirmative that holders now have a revenue.

With the 4-hour RSI of the Bitcoin in an overbought territory, the strain of revenue might escalate, which can trigger volatility within the quick time period. For Bitcoin to push to $ 90k, the persistent momentum of shopping for is essential.

However with “mutual” charges that come into impact on 2 April, market uncertainty stays excessive. If the resistance is in power, a corrective motion to the vary of $ 82k – $ 83k in all probability appears within the quick time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024