Altcoin

Bitcoin is apart while Altcoins is struggling: a sector -wide breakdown

Credit : ambcrypto.com

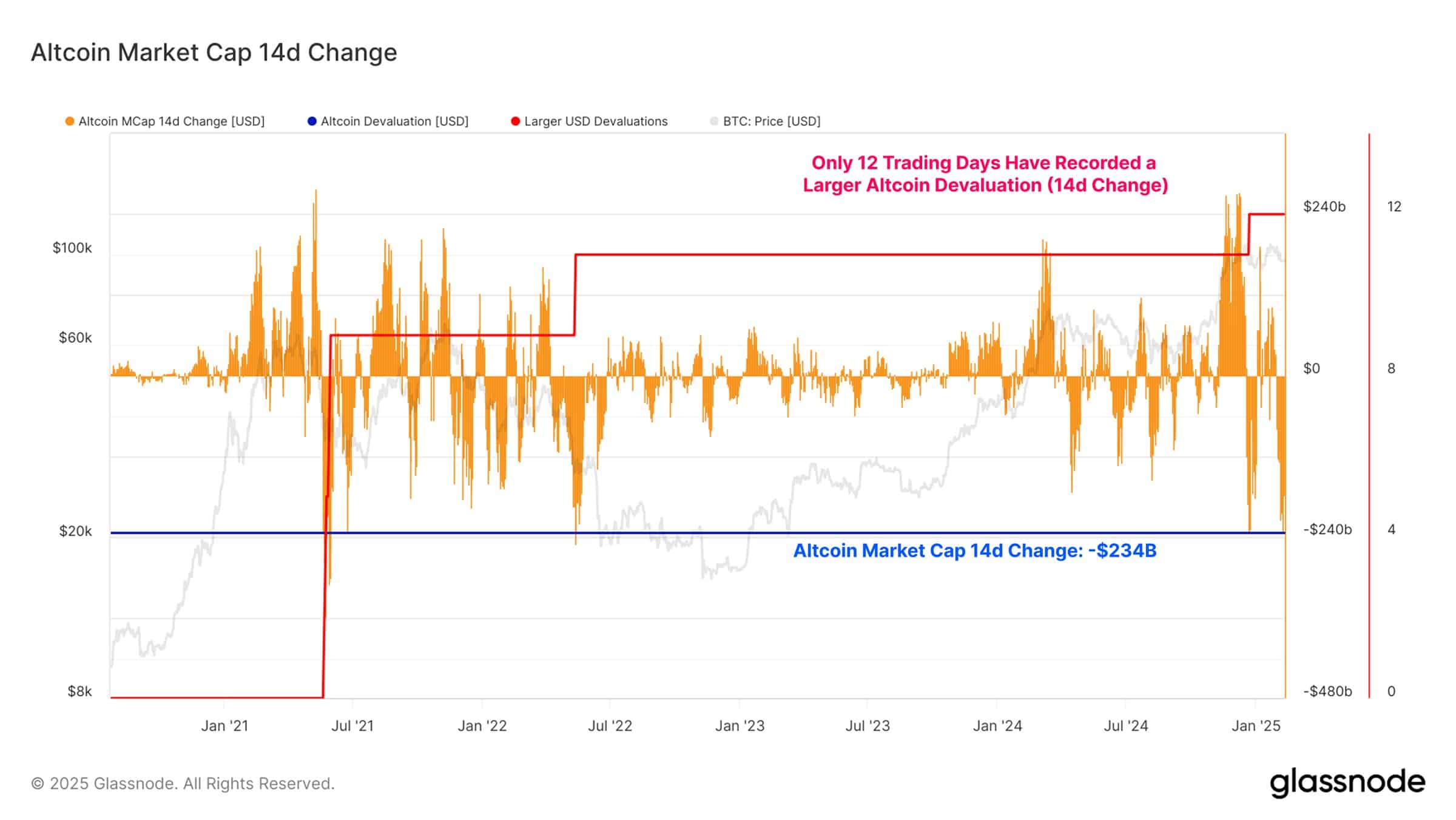

- The facility of Bitcoin was clear as a result of ERC-20 Altcoins noticed Sharp drops, with the sector in simply 14 days $ 234 billion waste.

- Altcoin markets had been confronted with a uncommon historic devaluation.

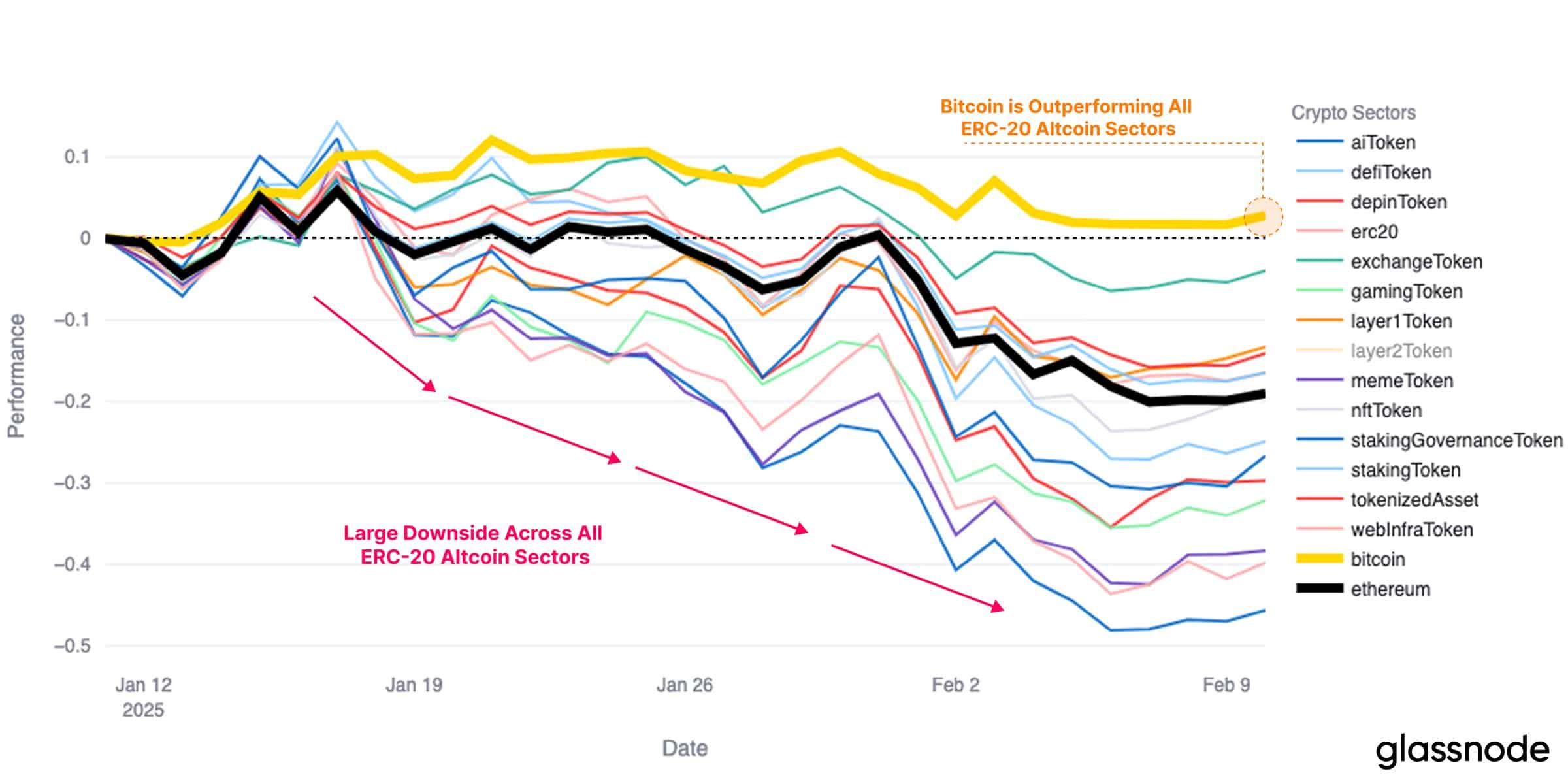

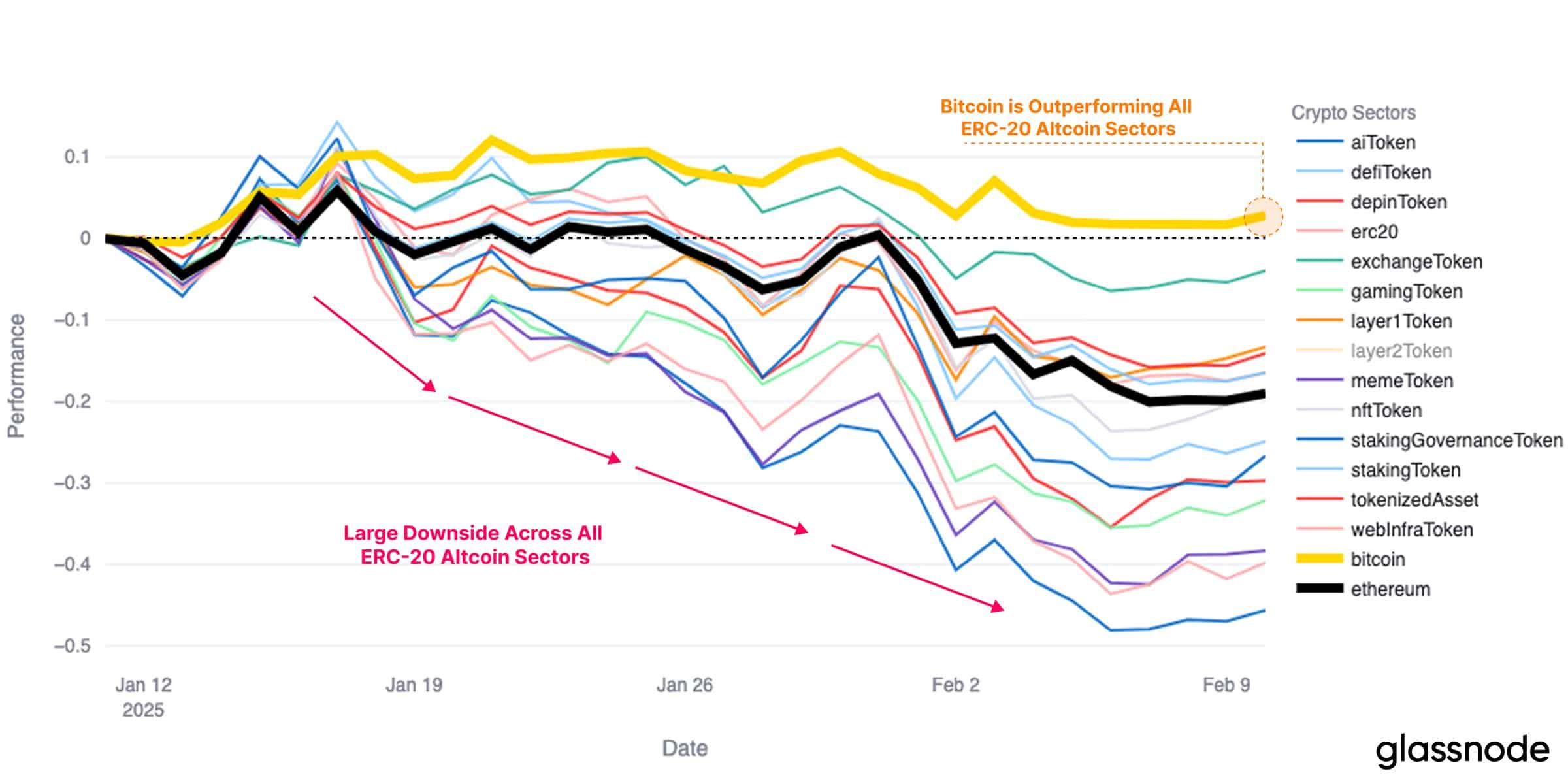

Bitcoin [BTC] his resilience remained within the midst of a broader market, which final week carried out significantly higher than the ERC-20 Altcoin sectors.

The most recent knowledge revealed a pronounced decline in a number of subsectors, with an emphasis on a grim divergence in market efficiency.

With Altcoin analysis that skilled considered one of their best devaluations in years, the broader cryptomarkt is confronted with elevated volatility.

Bitcoin holds whereas Altcoins dive

Regardless of market-wide weak spot, Bitcoin has retained a steady place, which performs higher than all ERC-20 Altcoin sectors.

In response to Glassnode’s Efficiency card, Bitcoin [yellow line] has stored above the impartial threshold, whereas retaining relative stability in comparison with Ethereum [ETH] [black line] And varied Altcoin classes which have suffered vital falls.

Supply: Glassnode

An necessary pick-up meal of this pattern is the in depth drawback of ERC-20 sub-sectors, together with Defi-Tokens, Gaming tokens and Meme tokens, all of which have been trived down since mid-January.

The sharp drop suggests lowering investor confidence in Altcoins, with capital rotation that want Bitcoin. This shift emphasizes the position of BTC as a safer lively throughout unsure market circumstances.

Altcoin Market sees one of many largest 14-day devaluations

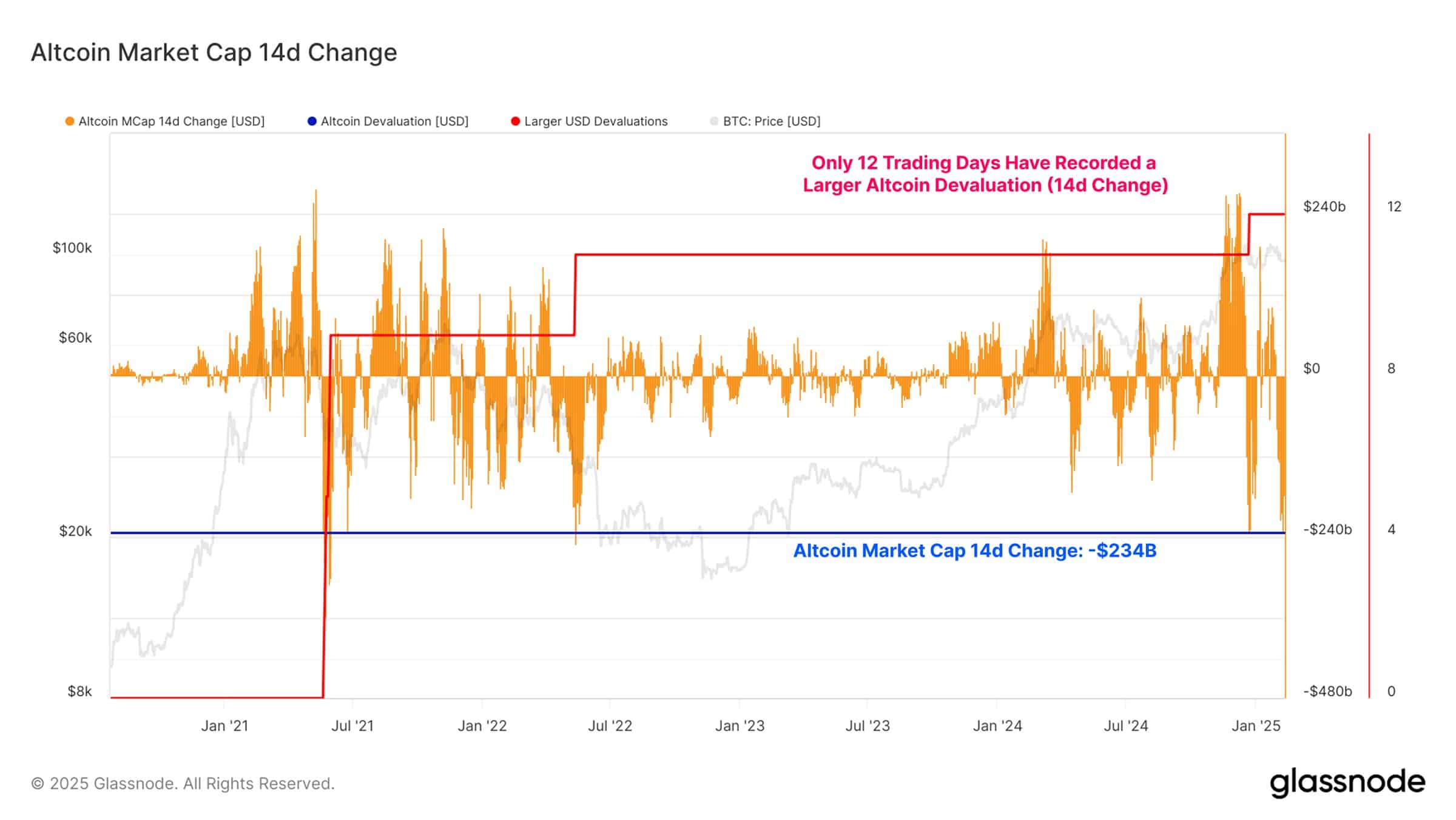

Take a look at Glassnode’s Altcoin Market Cap 14-Day Change Chart strengthened this Bearish Development, with a shocking lower of $ 234 billion in Altcoin market capitalization up to now two weeks.

Traditionally, such vital falls had been uncommon, with solely 12 earlier buying and selling days witnessing a bigger Altcoin devaluation.

This degree of deduction means that the urge for food within the Altcoin area has fallen sharply, with merchants aggressively discharging positions.

Supply: Glassnode

Particularly, these kinds of sharp corrections usually coincide with giant structural shifts in market sentiment.

If Altcoins maintain discovering out whereas Bitcoin is steady, additional capital flight to BTC might strengthen its dominance, which implies that each broad restoration within the Altcoin market could also be postponed.

What this implies for the market

The fixed divergence between Bitcoin and Altcoins means that traders place themselves defensively, and like BTC as a extra steady lively one.

Traditionally, comparable intervals of Altcoin UnderPerformance preceded Bitcoin-conducted market trally, the place capital consolidates in BTC for the primary time earlier than they rotate later in riskier property.

Nevertheless, an important issue to have a look at is whether or not Bitcoin can protect its power within the midst of rising macro -economic uncertainty. If BTC begins to weaken, the broader crypto market might be confronted with additional downward stress.

As a substitute, when Bitcoin stabilizes and begins up one other leg, this may trigger a renewed speculative curiosity in altcoins.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024