Bitcoin

Bitcoin – Is history repeating itself? Here’s why a $400K price target is still in play!

Credit : ambcrypto.com

- Stablecoins are an important a part of crypto markets

- Traits in international alternate reserves can present clues about market sentiment and broader worth traits

Stablecoins are important for facilitating a seamless crypto expertise. It’s a hedge in opposition to volatility as a result of it’s tied to fiat and retains its worth. Stablecoins present liquidity to the markets and simplify complicated actions akin to borrowing, borrowing and good contract implementation in DeFi.

Additionally it is one of many harbingers of a bull run. Rising quantities of on-chain stablecoin are an indication of larger adoption and participation, reflecting demand. This was made clear by the regular manufacturing of stablecoins akin to Tether (USDT) and USD Coin (USDC).

Affirmation of a bull run?

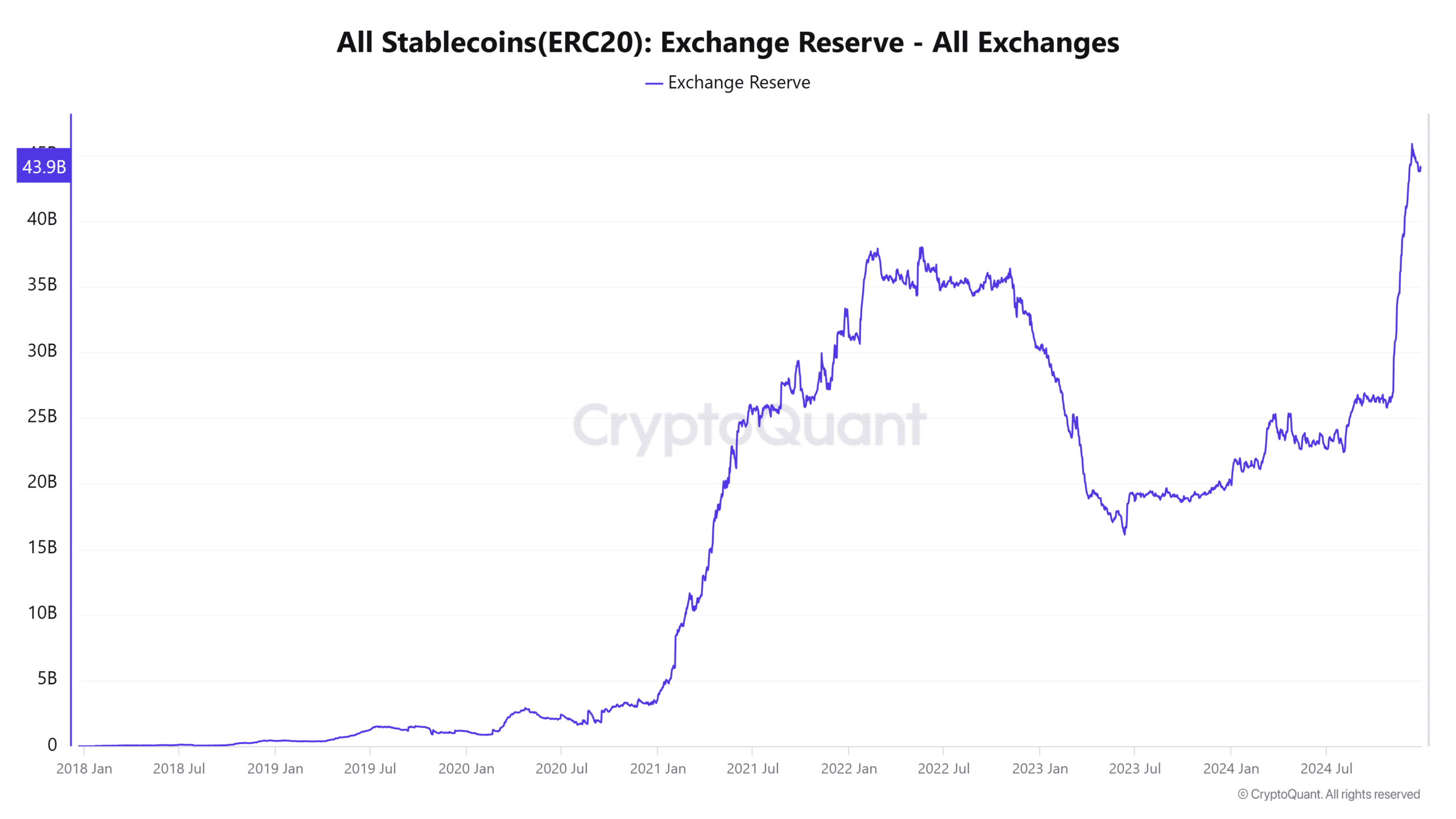

Binance, the world’s largest crypto alternate by quantity, has $29 billion in USDT and USDC reserves – the 2 largest stablecoins. In a submit on CryptoQuant Insights, analyst CrazzyyBlockk says marked the principle inventory market is rising stablecoin reserves.

The implications appeared strongly bullish. Binance’s reserves enable for seamless transfers between crypto and fiat, and its deep liquidity offers merchants and traders the arrogance to purchase and promote giant quantities of crypto property.

Nonetheless, it wasn’t simply the USDT reserves on Binance that grew. Complete stablecoin reserves throughout all fashionable exchanges are trending upward. From October 24 to December 27, the exchanges’ stablecoin reserves expanded from $25.7 billion to $44.1 billion.

The final time such a fast, decisive rebound occurred was in December 2020 – January 2021. This uptrend lasted till early 2022 and heralded the earlier bull run. An analogous state of affairs is now enjoying out. The movement from stables to reserves is usually seen as dry powder that might gasoline the following worth enhance.

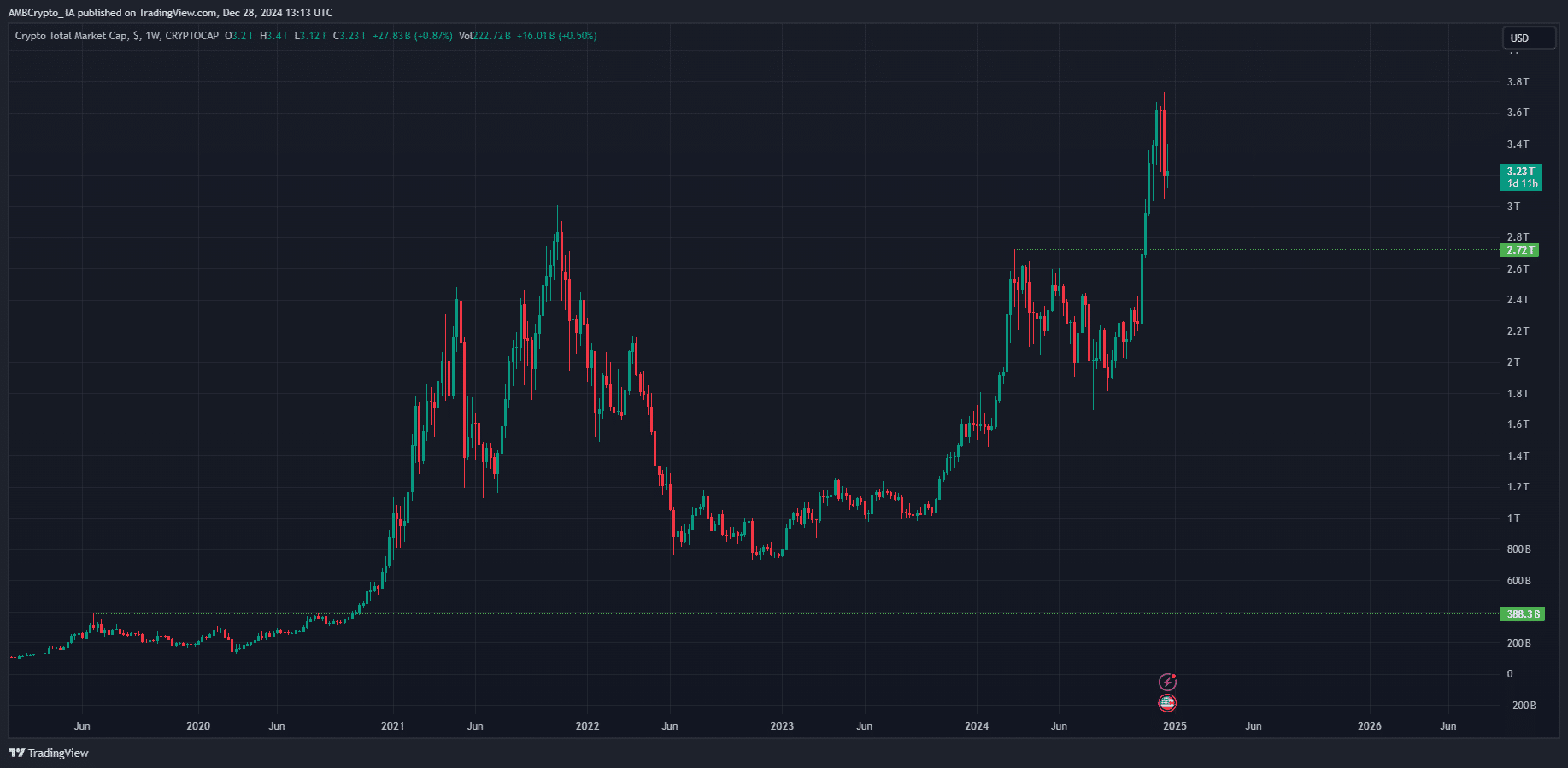

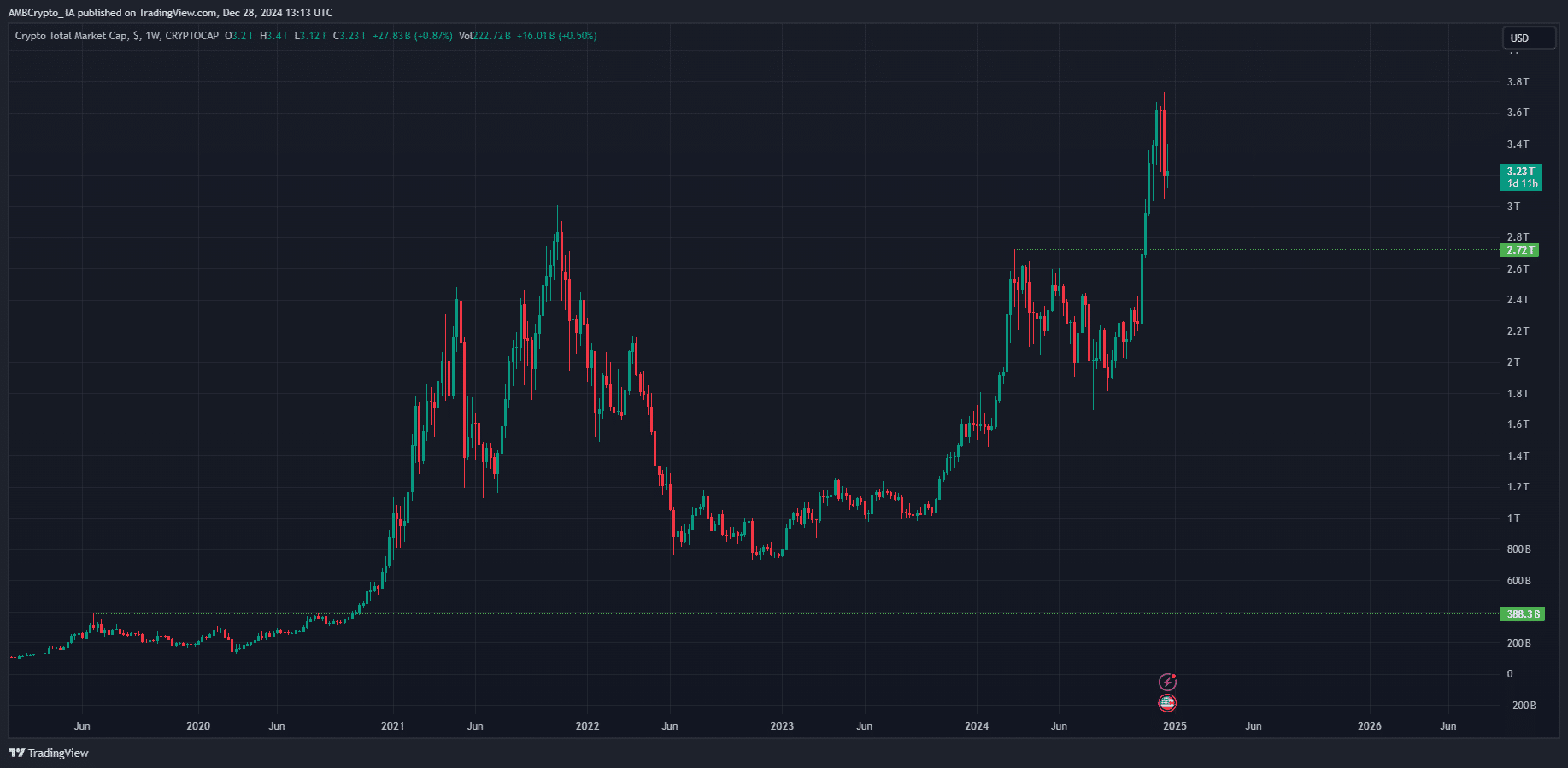

Projections of whole market capitalization for 2025

Supply: TOTAL on TradingView

In early November 2020, the full crypto market capitalization surpassed the native excessive of $388 billion. The next yr, rates of interest rose 685%, reaching a excessive of $3.01 trillion. Quick ahead to 2024 and a brand new all-time file has been set.

If one other 500%-600% rally happens, it will teleport the full cryptocurrency market cap to $16.8 trillion – $19.5 trillion. If Bitcoin has a market dominance of round 50%, its market cap could be round $8 trillion.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

This is able to imply a worth of $400,000 for Bitcoin. No matter whether or not these lofty worth targets are met, the conclusion stays the identical.

There may be one other bull run in play proper now. And the market is enjoying guessing video games with new worth targets.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September