Bitcoin

Bitcoin Is Up 36% in November as It Approaches $100,000

Credit : www.coindesk.com

November 30 is the final buying and selling day of the month, so all eyes will likely be on bitcoin’s (BTC) month-to-month candle. Bitcoin is lower than 4% away from the $100,000 psychological wall. Whereas Bitcoin’s $9 billion possibility expiration simply handed, pushing the token barely larger on the day to over $96,000.

CoinGlass knowledge exhibits that November has been one of many strongest months for bitcoin for a number of years, at present up over 36%, which might be the fourth finest performing month since October 2021.

November’s enhance was solely crushed 3 times in February 2024 (44%), January 2023 (40%) and October 2021 (40%). November’s spectacular efficiency is basically on account of Donald Trump successful the US presidential election earlier this month.

Nonetheless, Bitcoin nonetheless has two days till the official month-end shut, so there’s nonetheless time to beat these milestones.

On a quarterly foundation, Bitcoin is at present up 51% on the quarter with December nonetheless to come back, whereas the month of December averages a return of round 5%. The fourth quarter of 2024 was the strongest quarter for the reason that first quarter, with a return of 69%.

It looks like a matter of when or if Bitcoin will cross $100,000 as it’s heading in the right direction for an all-time excessive on the month-to-month market.

Analyst Caleb Franzen believes there’s nonetheless extra juice left to squeeze into this present Bitcoin bull market.

“BTCUSD month-to-month chart with the RSI indicator: Bitcoin bull markets typically peak with the month-to-month RSI buying and selling above 90, versus the present stage of 75. Traditionally, we now have seen each bull market peak with a decrease RSI, illustrated by the descending trendline The implication is that momentum just isn’t but ‘overheated’ and extra upside potential could be squeezed out of this uptrend within the coming months/quarters.

Related market construction as This fall 2020

Bitcoin is in the same market construction as within the fourth quarter of 2020. Each durations noticed robust inexperienced months in October and November, with a correction through the Thanksgiving interval of 2020. In late 2020, this was the second when bitcoin definitively modified the psychological left the $10,000 barrier behind and went to $60,000 in April 2021.

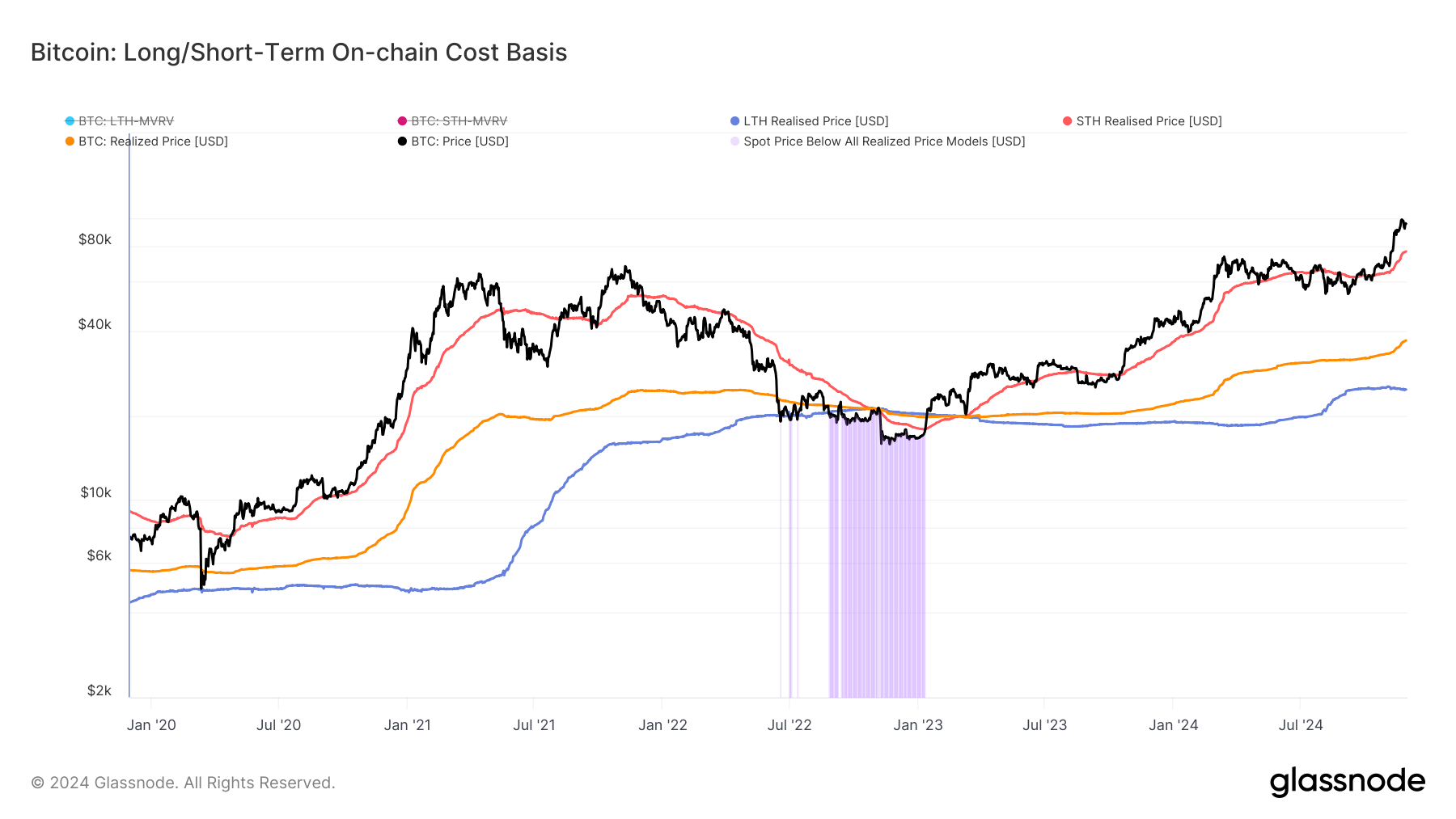

Knowledge from Glassnode exhibits that when bitcoin is above the short-term holder’s realized value (STHRP), it normally means bitcoin is in a bull market. Within the fourth quarter of 2020, bitcoin persistently used the STHRP as a assist stage as the worth continued to maneuver larger.

One expectation could possibly be for Bitcoin to proceed larger and use the STHRP as a assist stage that mimics the fourth quarter of 2020. STHP displays the typical on-chain buy value for cash held exterior of overseas change reserves which have moved throughout the final 155 days. These mirror the most probably cash to be spent on a given day.

There may be additionally a rising hole between the realized value (which displays the typical on-chain buy value for the complete provide of cash) and the realized long-term holder value (LTHRP), which displays the typical on-chain buy value for cash which are saved exterior the chain. overseas change reserves, which haven’t modified previously 155 days. These mirror the least possible cash to be spent on a given day.

A rising divergence tells us that new members are getting into the market, whereas long-term holders spend cash or make earnings.

One very small knowledge level signifies that Bitcoin might even attain $100,000 on November 29. Bitcoin reached $1,000 for the primary time on November 27, 2013. 4 years and a day later, Bitcoin reached $10,000 for the primary time. Can we see $100,000 simply seven years and sooner or later later?

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024