Altcoin

Bitcoin kept in neutral while markets roar – why?

Credit : www.newsbtc.com

Bitcoin’s lustless tape within the mild of Roaring Macro Threat is much less a distinction than a timing drawback, argues this week of the Weekly Perception (week 160, 20 September 2025). Writing underneath the banner “Why does BTC go behind?”, Contributor @Cryptoinsightuk determines a decisive constructive tone within the medium term-“I need to begin this week by saying that I’m bullish, and I’ll keep Bullish till I imagine we’re near a high” whereas the market feels late cycle. “That mentioned, I feel we’re nearer to a high than a low level right here,” he provides, however the writer nonetheless believes: “We’re approaching probably the most euphoric section of this bull’s cycle.”

Why is Bitcoin lagging behind?

The part Pins a lot of the present malaise about sentiment reflexivity. Crypto-twitter’s grinding negativity is described as a reflective suggestions job, making the market really feel heavier than it’s. “That delay can really feel irritating,” the writer writes and notes that the Worry & Greed Index didn’t proven the clustered “excessive greed” values that characterised the double high of 2021.

Associated lecture

Aside from an exuberance of exuberance across the finish of 2024/beginning-2025- “which coincided with XRPs rally from about 50 cents to $ 2.70, ultimately with about $ 3.30 to $ 3.40”-is the index within the center attain, removed from the blow-off situations that sometimes cycle cycle pievers. The implication is straightforward: regardless of the noise, the market nonetheless has to indicate the basic euphoria clusters that precede tops.

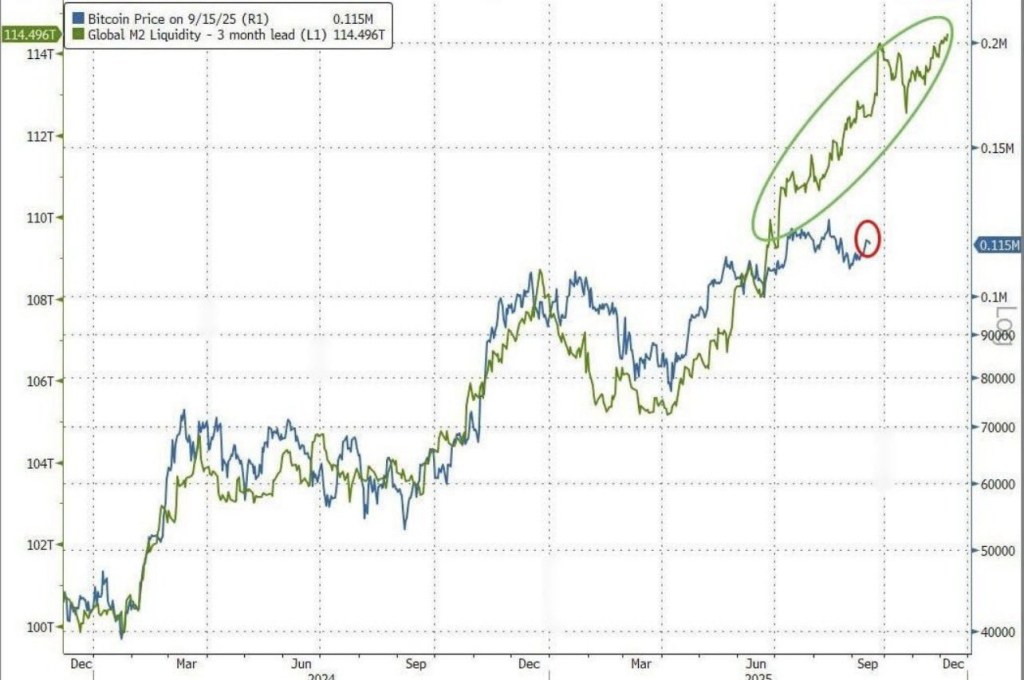

Macro correlations, typically invoked to clarify the management of Bitcoin or UnderPerformance, are used right here to argue for delay as a substitute of demolition. On the M2 cash amount, the writer repeats a well-followed three-month hyperlink: “Bitcoin and the M2 cash amount have thus far correlated, however previously two to a few months, M2 has been completely torn larger.” From right here, readers can “both declare that the correlation has been damaged down, or that Bitcoin simply stays and has to catch up.”

An analogous studying extends to gold. Directional management is interspersed between the 2 belongings, however with Mullion that pushes larger, a catch -up in BTC “would indicate a motion to a minimum of $ 135,000 in comparison with the present stage of round $ 115,000.” Equits inform the identical story in one other register: the Nasdaq, Dow Jones, S&P and Russell 2000 are on or close to contemporary highlights, whereas Bitcoin “normally chopped apart”, once more “seems to be like it could actually keep behind.”

Market microstructure provides a decisive layer. The letter emphasizes the interplay between seen liquidity luggage and consolidation dynamics. “Each time a substantial liquidity has been constructed up, Bitcoin ultimately led by means of it.” As the value has stepped up, the quiet liquidity is thickened – “Crimson signifies the deepest liquidity, the Orange the subsequent and inexperienced the lightest” – and breakouts have been probably the most highly effective as quickly as these deep pockets have been taken.

The given instance is the “Run from $ 70k to $ 100k”, the place “heavy consolidation was {followed} by an explosive outbreak.” In line with that logic, the present card factors to a motion to $ 140k or larger “, which additionally matches the argument of gold parity. The writer’s metaphor says: “I typically clarify worth motion corresponding to saved power. The longer it consolidates and masses, the higher the ultimate launch.”

What function do Altcoins play?

Probably the most highly effective declare within the situation is under no circumstances about Bitcoin, however about altcoins. Each Total2 (Crypto EX-BTC) and Total3 (Crypto EX-BTC and ETH) are mentioned to have concluded “a each day candle in worth discovery.” Total2 “all the time closed a weekly excessive and is now extraordinarily near closing a second consecutive weekly excessive”, whereas a complete of three is “straight on the sting of breaking in new all time.”

Structurally, the report matches in a complete of two because the completion of a Wyckoff accumulation and cup and commerce, and whole 3 because the chopping of a rising triangle prepared for continuation. The mixture – ALDS presses on pricing whereas Bitcoin is making ready to push new highlights ” – is the association of the writer related to” Mania of Euphoria. “Additionally it is the premise for a transparent disclosure of positioning:” It’s precisely why I’m fully right here in Altcoins. “

Associated lecture

That rotation show is strengthened by a name on Bitcoin -Dominance. The writer repeats an extended -term goal: “I feel we’ll go to a minimum of the extent of 35.5 p.c, and probably even within the low 20s.” The historic analogues are unambiguous: the dominance of the 2017 highlights fell by 62 p.c “and from the highs of 2021 it fell” by 46 p.c “, accompanied by an acceleration within the month-to-month decline.

If an identical acceleration coincides with BTC “Tearing to new all time, the consequence” could be “a face -melting altcoin rally that most individuals cannot even think about now. “The letter connects this purely market worldwide angle with exterior catalysts, who” essential legislative shifts within the largest monetary financial system on this planet “and” the potential consumption of trillion {dollars} by Stablecoins and the Readability Act, which might be assumed so rapidly “on the subject of the most important monetary financial system”.

The place does Bitcoin worth go?

The problem concludes with a supplementary technical task from @TheCryptoman1 that brings the danger card into Focus within the brief time period. For BTC Spot, “Choice Time … is rapidly approaching”, with the zone marked between $ 111,000 and $ 115,000 as “large”. Loss it and “the liquidity across the $ 105k vary feels inevitably.” Trade books orderbook Heatmaps present “A bit of liquidity that’s right here about all exchanges”, which means that elevated volatility if examined. The analyst doesn’t forces directive name – “I’m not certain how the market is waving” – and labels aggressive hypothesis “harmful” within the present heel.

A second lens comes by means of USDT Dominance (USDT.D), who reverses the analyst to maintain observe of dangerous urge for food. The metric is “caught [a] Attain the previous 15 months or so “, however structurally” seems to be like a graph on the best way to re -view its highlights (which is definitely the lows). “The aforementioned objective stays 3.76%. Disconnecting. That isn’t monetary recommendation, simply as I strategy it.”

The ‘Max ache’ path within the brief time period is printed with attribute market leirony. A believable order is “$ BTC that pushes as much as $ 120,000, panics and goes for a very long time, feeds the liquidity amongst us after which sweep the lows.” The analyst warns {that a} straight lower in “low $ 100,000 vary” “feels apparent”, however admits that each upward and the downward liquidity are attractors in a compressive flightness setting. The temper music for merchants is wrigged in a single line: “It will get squeaking buttocks.”

On the time of the press, BTC traded at $ 112,712.

Featured picture made with dall.e, graph of tradingview.com

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024