Bitcoin

Bitcoin: Key metric suggests ‘bull cycle is over’- Should you sell now?

Credit : ambcrypto.com

- The destructive pattern of market capitalization versus the realized PET is traditionally a bearish sign

- The Halt within the development of the Tether Reserve pointed to secure, fairly than rising buying energy

The worldwide M2, a classification of cash provide that features cash market funds, refers back to the cash provide of huge economies such because the US, China and the eurozone.

In a current report it was famous that the worldwide M2 cash quantity in 2025 grew to become parabolic whereas Bitcoin [BTC] Was consolidating.

Traditionally, such variations don’t final lengthy. That’s the reason there’s a probability for Bitcoin to understand.

Then again, the Commerce Conflict initiated by the US has affected the arrogance of traders. China’s retribution of 34% fee On April 2, the tensions, which additionally affect the cryptomarkt.

Evaluation of the Bearish Arguments for Bitcoin

The Bitcoin spot ETFs have been weak in current days. The pessimistic macro -economic outlook on account of the present commerce wars was an element right here.

Blackrock’s spot ETF IBIT (Ishares Bitcoin Belief ETF) noticed a couple of influx over the previous two weeks, however most different merchandise have just lately witnessed gross sales strain. This sketched a bearish quick -term sentiment.

Within the midst of this Bearish background, the CEO and co-founder of the favored crypto-analysis firm Cryptoquant acknowledged that the “bull’s cycle is over”.

Is the BTC Bull cycle about it?

In a single Post on X (formerly Twitter)he defined the idea of the realized restrict to assist this argument.

The market capitalization of an energetic is calculated by multiplying its circulating supply with its present market value.

The realized cap, however, measures the market capitalization of Bitcoin based mostly on the worth with which every coin was final moved. This presents a extra correct image of the capital that flows into the Bitcoin market.

The analyst used 365-day superior averages (MA) for each market capitalization and the realized cap to calculate the 365-day MA of the Delta development.

A lower in these metric indicators a rising cap mixed with a falling market capitalization and pattern noticed since November-December 2024.

Ki Younger Ju emphasised that capital inflows that don’t stimulate the value revenue point out a Bear Market. On the time of study, the MA of the Delta Development was destructive, which is in keeping with the Bears Market situations.

An identical scenario occurred in December 2021, after Bitcoin’s earlier all instances of $ 69k and its subsequent decline. Ju additionally predicted {that a} quick -term rally is unlikely, and this bearish part might live on for an additional six months.

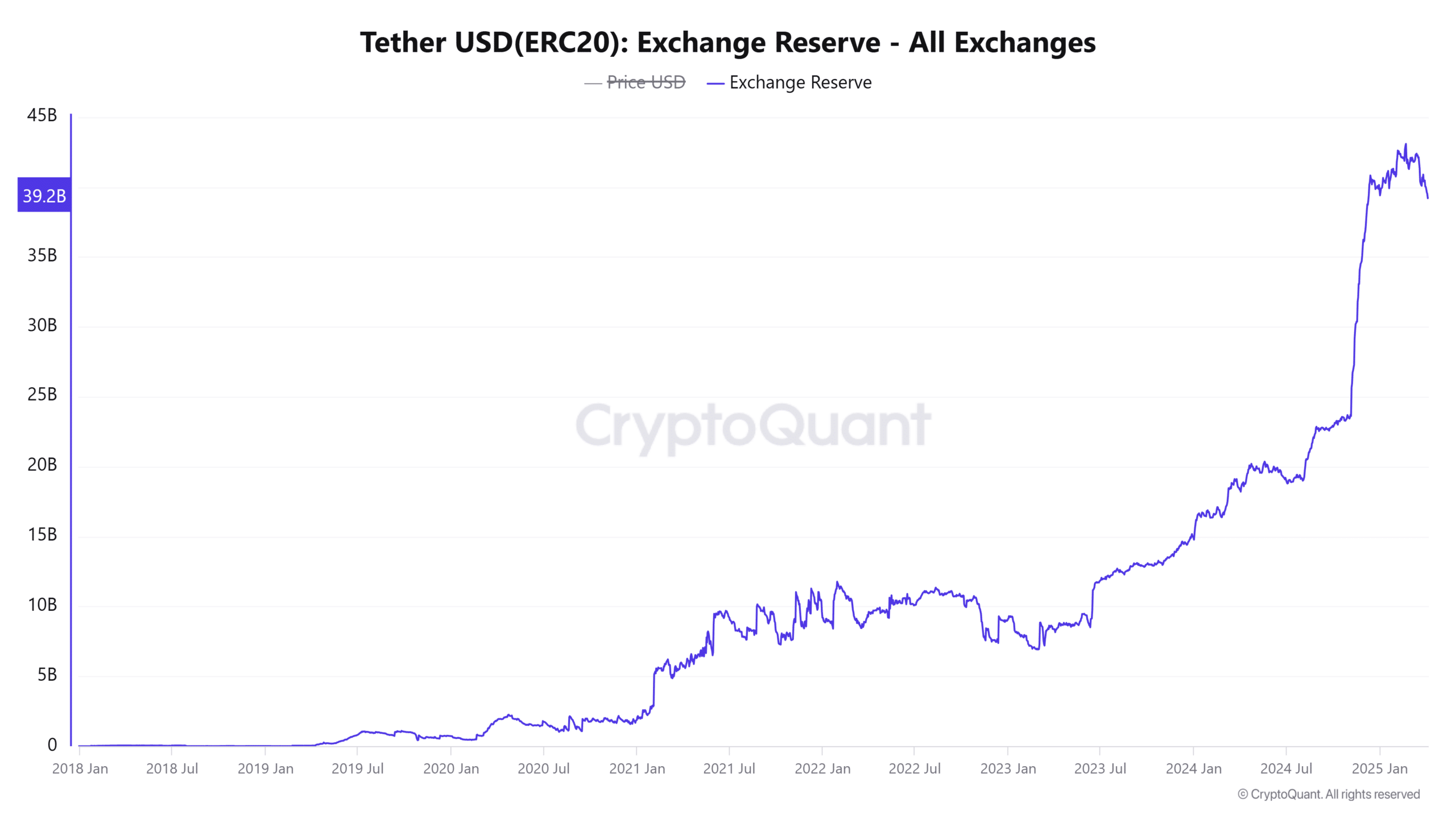

In response to the realized CAP knowledge, the beginning of one other Bear Market appeared doable. In the meantime, however, the Change Reserve or Tether [USDT] Has stopped his development in current months.

Reverse these views, the aforementioned international M2 identified that was beforehand named after the rising buying energy available in the market.

A delay within the development of Tether Reserve was accompanied by the earlier market prime.

The info right here urged that one other bear market might be underway, nevertheless it have to be famous that not one of the ordinary cycle prime statistics have reached overheated ranges that replicate the earlier cycle.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now