Bitcoin

Bitcoin losses mount, traders hit hard! – Is the worst yet to come?

Credit : ambcrypto.com

- Bitcoin short-term holders had been confronted with steep losses, which surpass FTX ranges, however with out activating full panic.

- BTC buyers skilled long-term losses within the brief time period, whereby market uncertainty prompted warning as an alternative of capitulation.

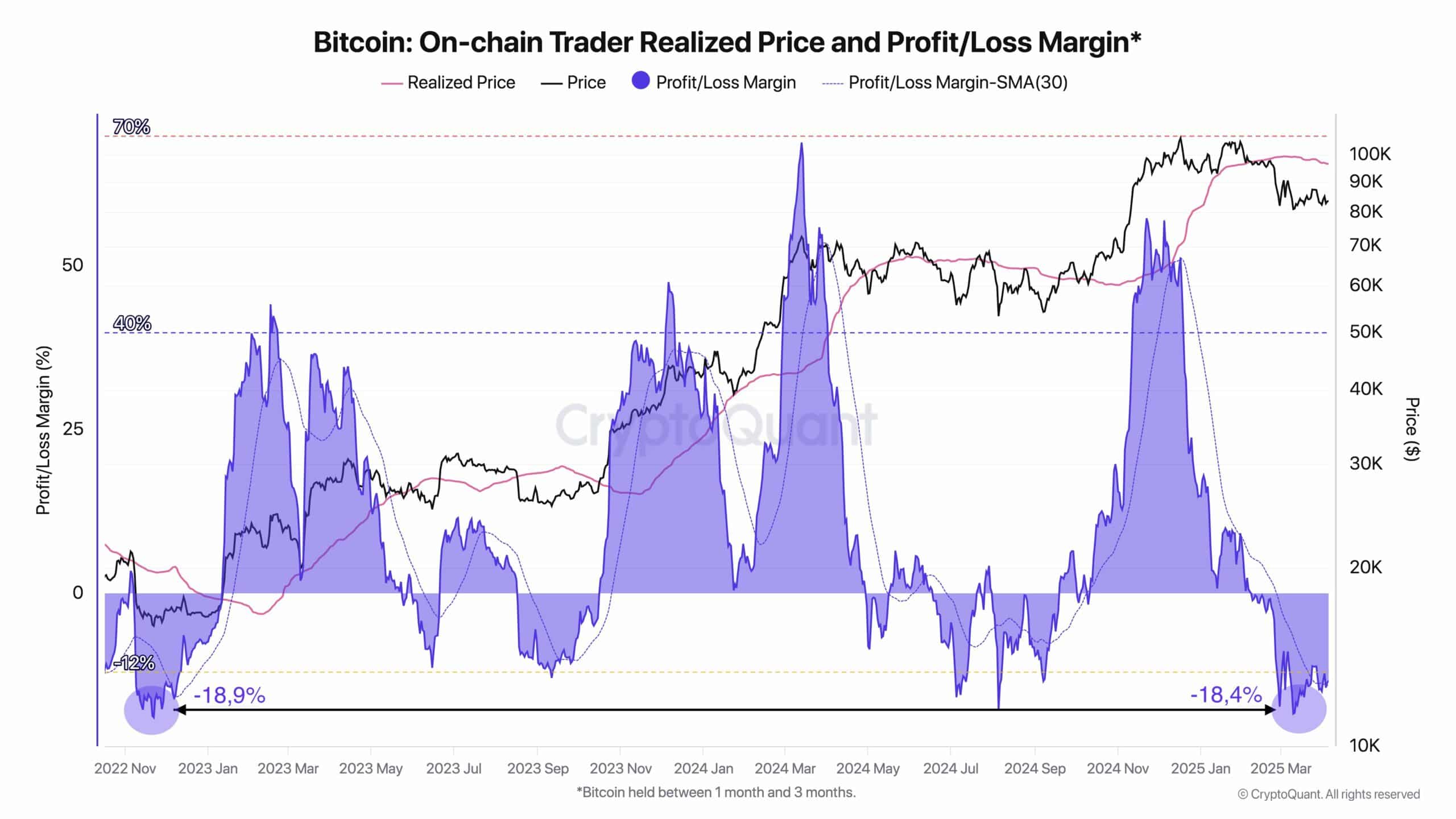

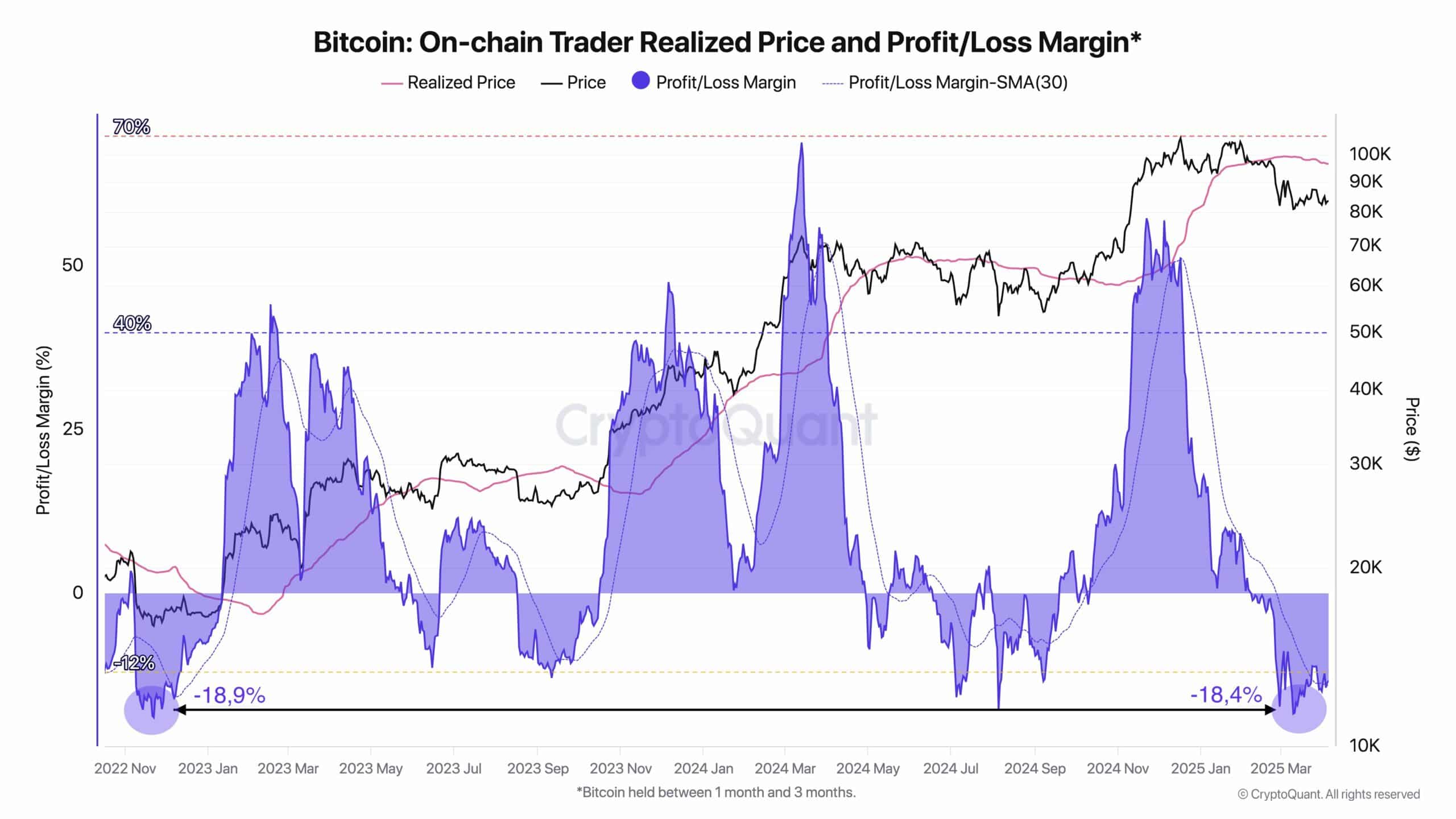

Because the starting of February, Bitcoin [BTC] Merchants have been a lack of nursing, with the present figures that now even exceed the chaos throughout the FTX -Crash and the market correction of 2024.

The ache is essentially the most tough within the brief time period buyers, particularly that of BTC for only one to three months.

Whereas the uncertainty of the market lingers, this development of rising lack of buyers can point out a deeper shift in sentiment within the brief time period, in order that many ponder whether the worst ought to get or whether or not we’re simply caught on an outbreak.

Ache, however no capitulation

Supply: Cryptuquant

The short-term holders of Bitcoin are deep within the pink, with them now on realized losses which can be worse than every part that has been seen for the reason that FTX implosion.

The graph exhibits The profit/loss margin Dank to -18.4%, creepy near the degrees of -18.9% of the tip of 2022.

However fascinating is that this doesn’t trigger an entire panic. Whereas the market is bleeding, there may be little signal of an enormous exodus – solely merchants chunk their lips and watch for it out.

The temper? Much less “exit now”, extra “that is higher value it.”

Bitcoin: Why this time feels worse for holders within the brief time period

In distinction to long-term hodlers who’ve beforehand weathered Berencycli, STHs are likely to get near native tops when the hype peaks.

Whereas BTC flirted at the start of March with highlights of round $ 84k, many of those merchants gathered, however had been trapped in a sluggish bleeding as an alternative of a dramatic crash.

It’s the worst sort of loss: towed away, self -confidence and cloudy in course. The info exhibits that this group is now the sufferer of realized losses – a transparent reminiscence that FOMO patrons are nonetheless studying within the laborious manner.

Echos from FTX

The present drawdown displays the FTX -Crash in measurement, however not within the temper. On the time, the losses had been pushed by panic, contamination and disappearing liquidity.

These days markets are hesitant, liquidity is appreciable and BTC continues to be above $ 80k.

Supply: TradingView

Nonetheless, the ache is actual. Market guards observe the patterns from the previous carefully and with loss ranges that are actually violating the 2024 correction, comparisons with November 2022 have gotten tougher to disregard.

If historical past rhymes, the capitulation can nonetheless be lurking across the nook within the brief time period.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September