Bitcoin

Bitcoin market caution: Is a 30% BTC pullback coming?

Credit : ambcrypto.com

- An analyst has warned {that a} Bitcoin pullback of as much as 30% could possibly be within the offing.

- That is regardless of robust bullish sentiment and expectations of a continued rally.

Bitcoin [BTC] has proven exceptional power in current weeks, rising 39.51% over the previous month and elevating its market cap to $1.85 trillion.

Nevertheless, within the final 24 hours there was a decline of 5.15%, indicating a potential pause within the uptrend.

Whereas this decline could point out a wholesome correction, bullish fundamentals nonetheless stay. Bitcoin may regain power and resume its climb after this era of consolidation.

Potential BTC correction?

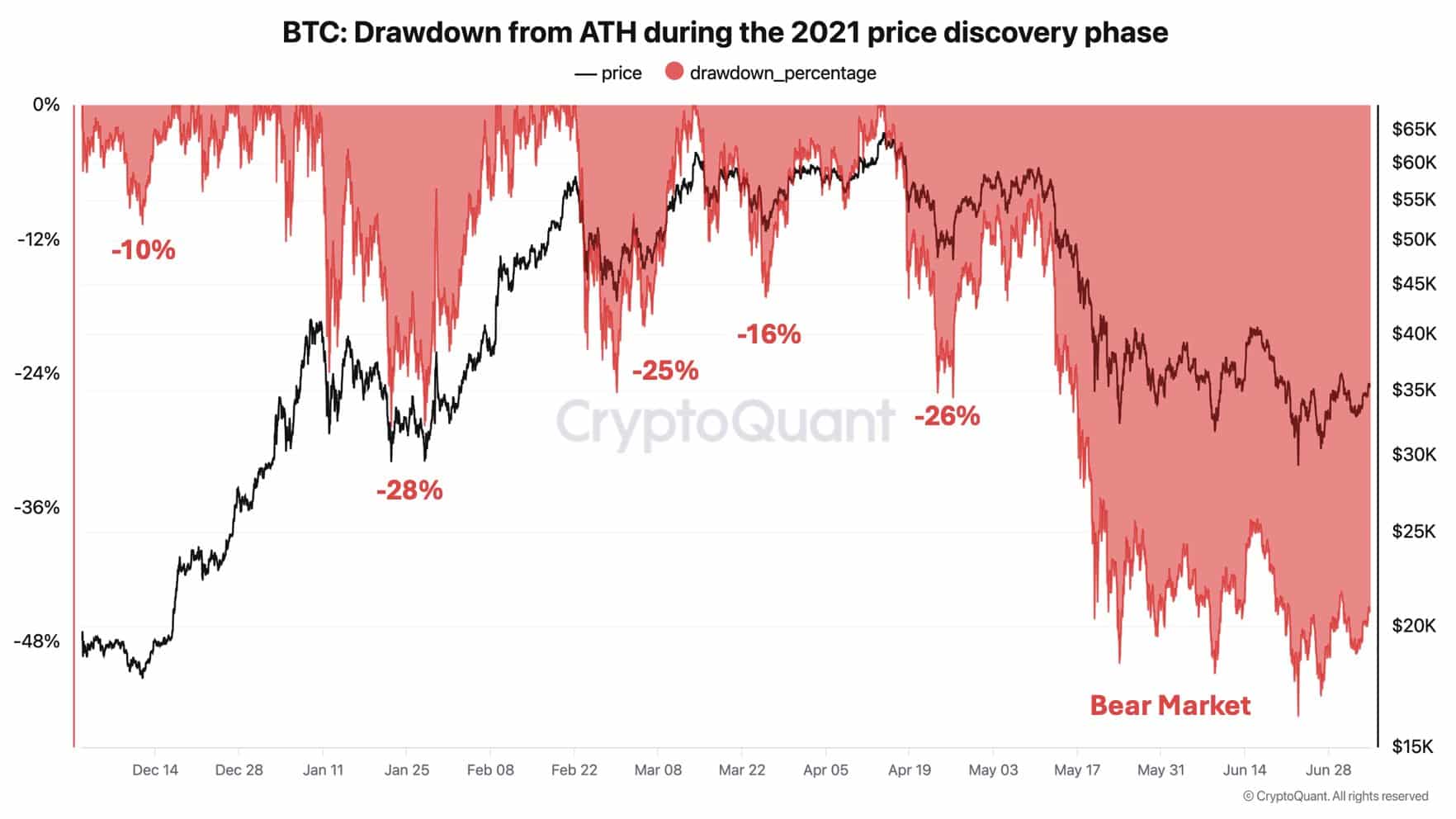

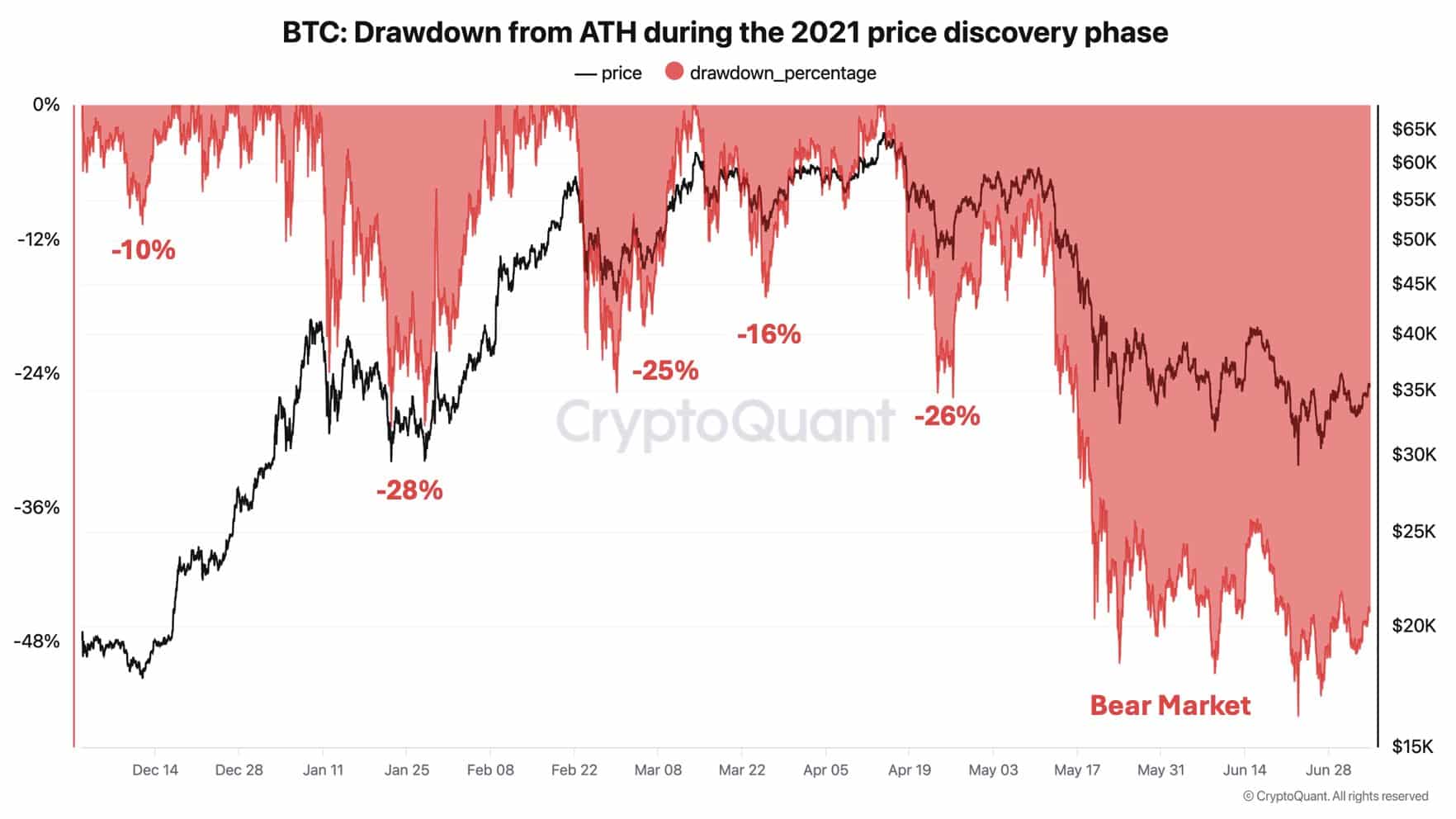

Crypto analyst King Younger Ji has warned that BTC could face a big corrective transfer earlier than it resumes its upward trajectory.

“Even in a parabolic bull run, Bitcoin may see a 30% pullback”

He famous, citing historic knowledge to assist his declare.

He pointed to Bitcoin’s efficiency through the 2021 bull run, the place costs rose from $17,000 to $64,000. Regardless of the robust rally, BTC skilled 5 notable corrections.

The smallest decline was 10%, whereas the biggest reached 28%, highlighting the volatility of even bullish market phases.

Supply:

Primarily based on his evaluation, BTC’s present rally may endure the same correction. Whereas troubling, such pullbacks are a part of a wholesome market cycle and sometimes precede additional positive factors.

Nevertheless, the analyst advises warning because the market navigates by this part.

Transaction quantity and energetic handle improve

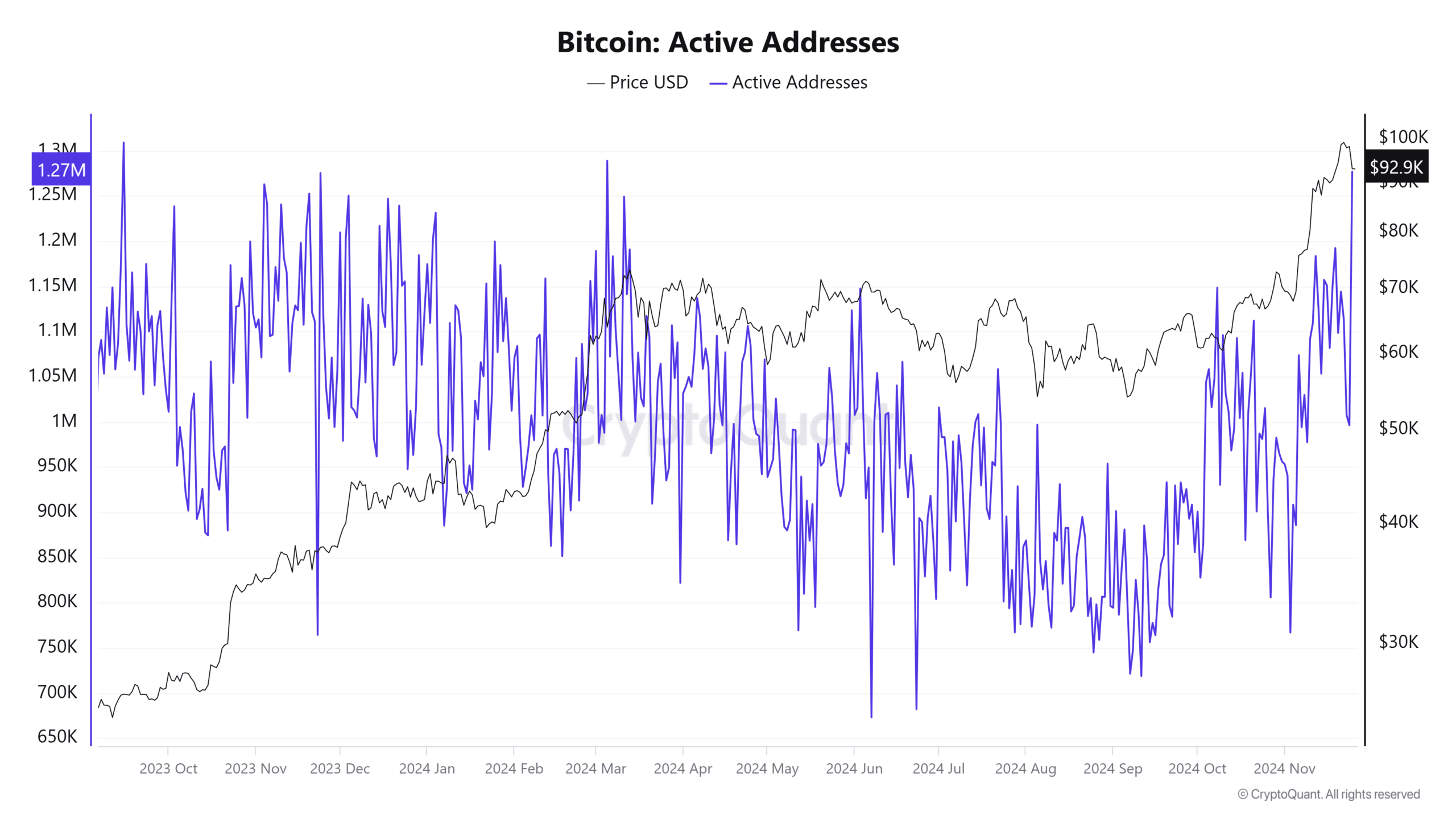

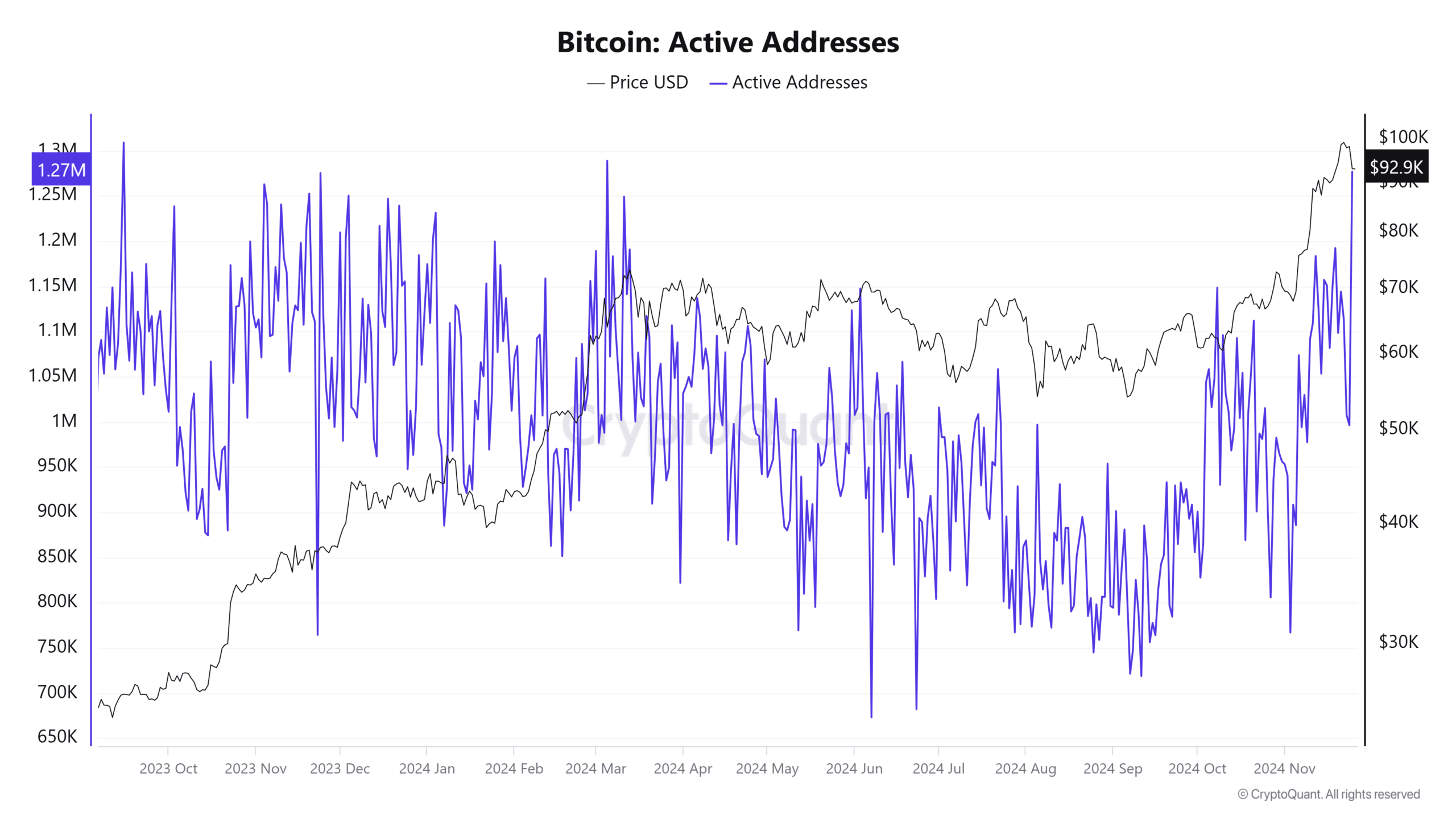

Bitcoin community exercise is gaining momentum, with a pointy improve in transaction quantity and energetic addresses – each key indicators of a possible rally.

Energetic addresses rose to 1,276,535, a degree final seen in Could. This improve is accompanied by a 56.27% leap in transaction quantity, reinforcing the potential for bullish momentum.

Energetic addresses are calculated based mostly on distinctive wallets collaborating in BTC transactions (sending or receiving) over a sure time frame, on this case the final 24 hours.

Supply: CryptoQuant

In the meantime, token switch quantity has rebounded sharply after a pointy decline the day past. Greater than $1 million price of BTC has moved, reflecting renewed investor exercise.

If this uptrend continues, Bitcoin may regain power and transfer greater within the coming days.

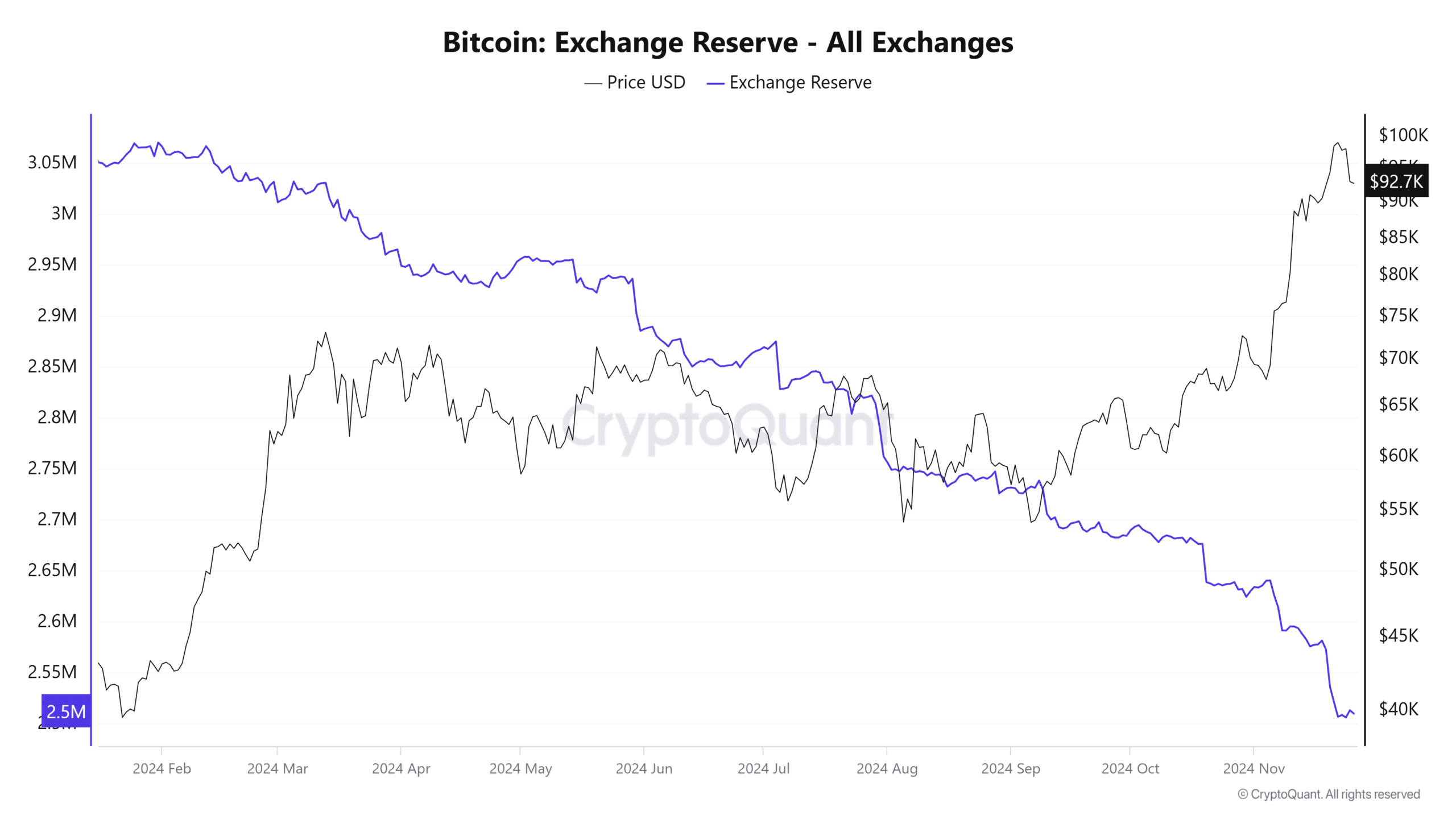

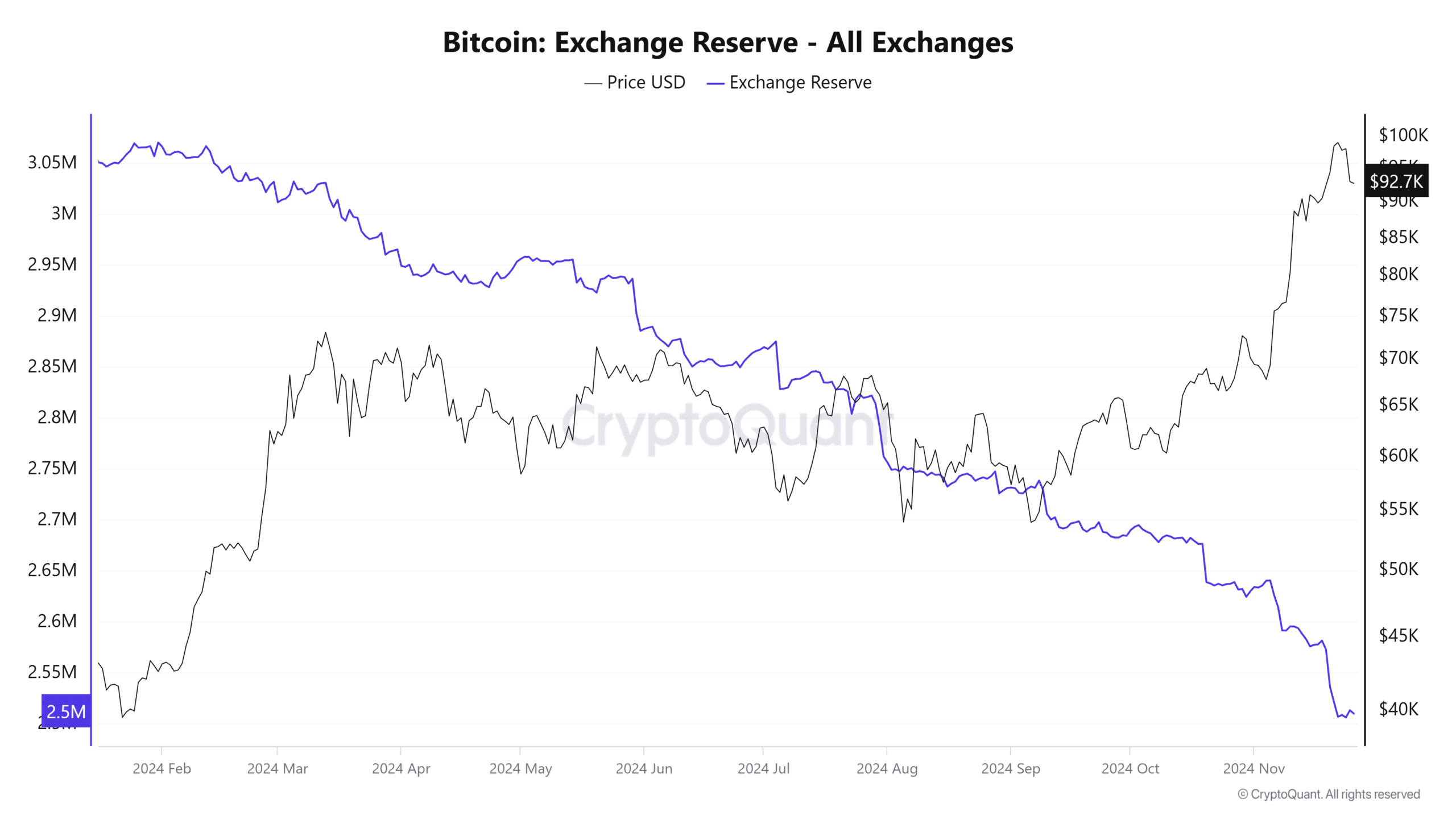

Overseas change reserves proceed to say no

Bitcoin change reserves, which monitor the full provide of BTC on numerous exchanges, have continued to say no.

Over the previous seven days, reserves have fallen by 2.75%, with solely 2,507,706 BTC obtainable on the exchanges on the time of writing – a pattern that exhibits no indicators of slowing.

Supply: CryptoQuant

Such a drop usually signifies that market members are transferring their BTC to self-custodial wallets, prioritizing private management over their belongings.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

This habits typically corresponds to long-term bullish sentiment as traders cut back the provision obtainable for buying and selling or promoting.

If this pattern continues, it may strengthen the bullish outlook for Bitcoin, probably pushing the asset’s worth greater as provide on exchanges continues to say no.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now