Bitcoin

Bitcoin Market Nears Equilibrium as 80% of Holders Stay in Profit, Says Analyst

Credit : coinpedia.org

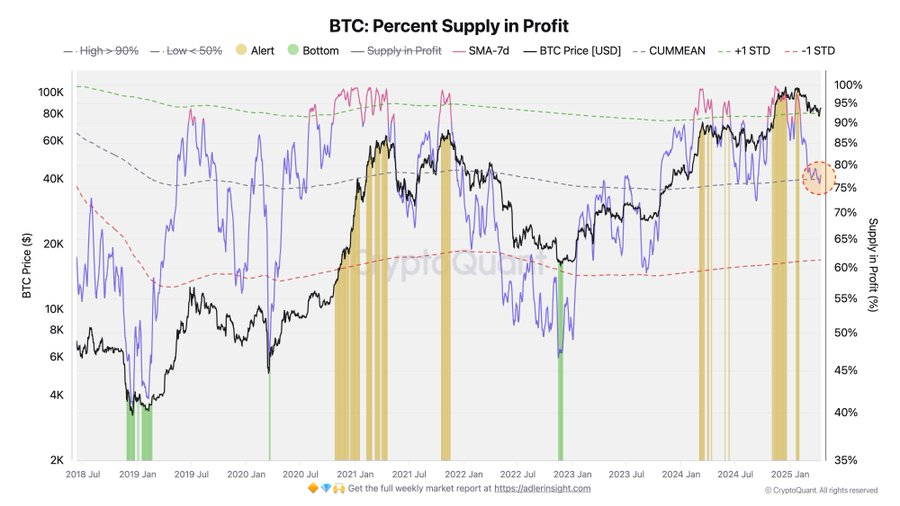

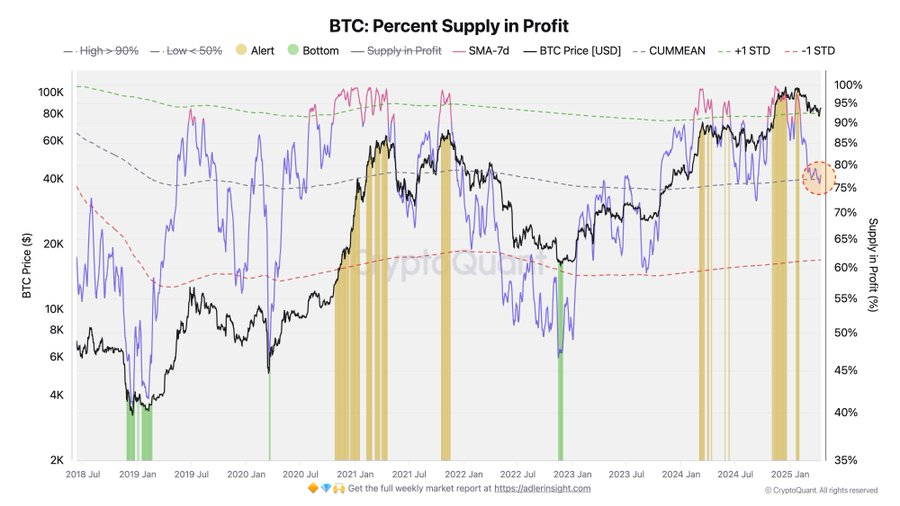

A latest message from Crypto analyst Axel Adler JR sheds gentle on Bitcoin’s present market well being utilizing the Pareto precept. His evaluation reveals that 80% of the networks of the community are nonetheless in revenue, whereas there are a 20% loss. The large query is: is Bitcoin overheated? Curious to know extra? Learn on!

Perception into the Pareto precept in crypto -markets

The Pareto precept, popularly referred to as the 80/20 rule, means that about 80% of the consequences comes from 20% of the causes.

Briefly, the precept explains the uneven relationship between inputs and outputs.

The acclaimed crypto analyst Axel Adler claims that the pareto precept applies to the crypto market, specifically the Bitcoin market, as an efficient methodology to investigate market well being.

Bitcoin in stability: what it means

The BTC proportion provide within the revenue graph reveals that at present greater than 80% of Bitcoin holders are in revenue, whereas at least 20% BTC retains with a loss.

The analyst factors out that previously, when 95 to 98% of the cash have been in revenue, the market was overheated.

He claims that the variety of worthwhile cash has now come to a extra balanced, common degree.

Briefly. Which means that the market is not overheated, and though many nonetheless have a revenue, the circumstances are actually more healthy than they’re close to the Ath when everybody made a revenue and haste to promote.

- Additionally learn:

- Why is Crypto Market nonetheless occurring in the present day? Market capitalizations sink as merchants to flee danger activa

- “

BTC -Market overview

In the beginning of this yr, the Bitcoin market was $ 93,623.09. Within the first month of the yr, the market skilled a rise of 9.54%. At one level on January 20, the market crossed the essential $ 109k.

Issues weren’t spectacular in February. The market registered a lower of 17.5%.

In March the market confirmed lateral motion, oscillating inside the vary of $ 94,922.29 to $ 76,580.61. Particularly, the market has not but been recovered from this attain.

April has been a risky month earlier than BTC due to the worldwide financial destruction attributable to the aggressive tariff coverage of US President Donald Trump. Firstly of this month, the value of BTC was $ 82,541.66. Though on the second day of the month, the market hit a month-to-month peak of $ 88.502.71, by the point of closing that day, the market dropped to $ 82,541.66. Between 5 and eight April the market witnessed a lower of 8.93%.

Though the Bitcoin market has risen by greater than 9.56% since 9 April, the present value of BTC is only one.43% above the opening value of the month.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, skilled evaluation and actual -time updates on the newest developments in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

The volatility of Bitcoin in April 2025 stems from worldwide financial points as a consequence of Trump’s aggressive fee coverage, which causes a rise of 9.56% after a lower of 8.93%.

With a possible rise, the Bitcoin (BTC) value can shut the month with a peak of $ 95,000.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024