Bitcoin

Bitcoin miners’ exit confirm $61K support – Why this is key for October’s rally

Credit : ambcrypto.com

- Bitcoin miners exiting the cycle may sign a market backside, paving the way in which for brand new curiosity

- And but, particular circumstances should apply for a confirmed bull rally

Per week of bearish decline adopted Bitcoin [BTC] falling beneath $61k from the earlier resistance of $65k. Nonetheless, on the time of writing, optimism appeared to be brewing available in the market, with the crypto valued at virtually $62,000.

Nonetheless, a worth correction may happen within the second week of the fourth quarter, particularly as revenue takers money of their good points and exit the cycle. Amongst them are miners who’ve capitulated as BTC approaches $62,000.

Nonetheless, except the underside is totally exhausted, it could be tough for bulls to spark a sustained rally.

The miners’ departure may sign a market backside

On the every day worth graphic BTC’s weekly motion mirrored the worth motion of mid-August, when a rejection close to $65,000 halted a possible bull run.

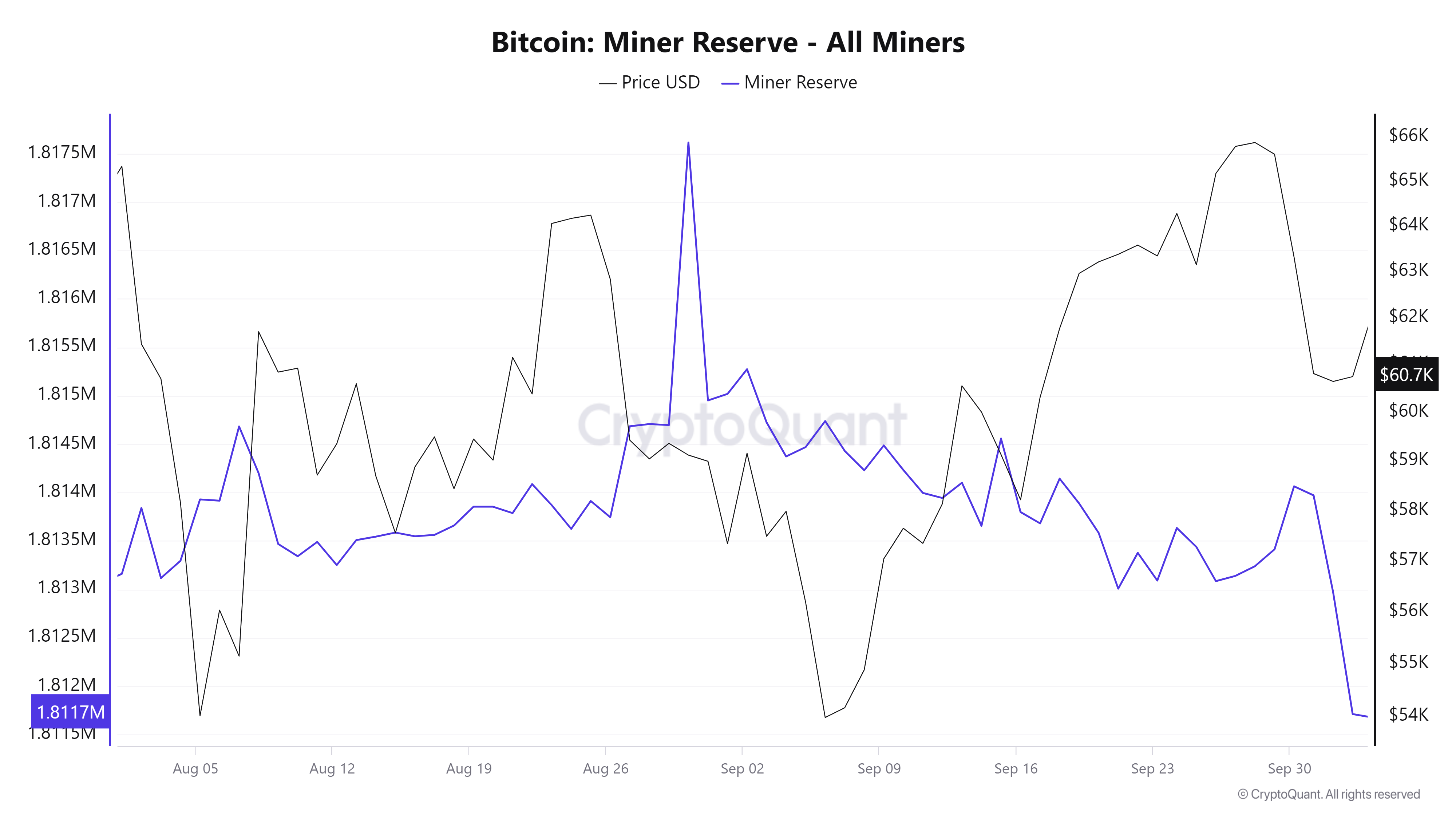

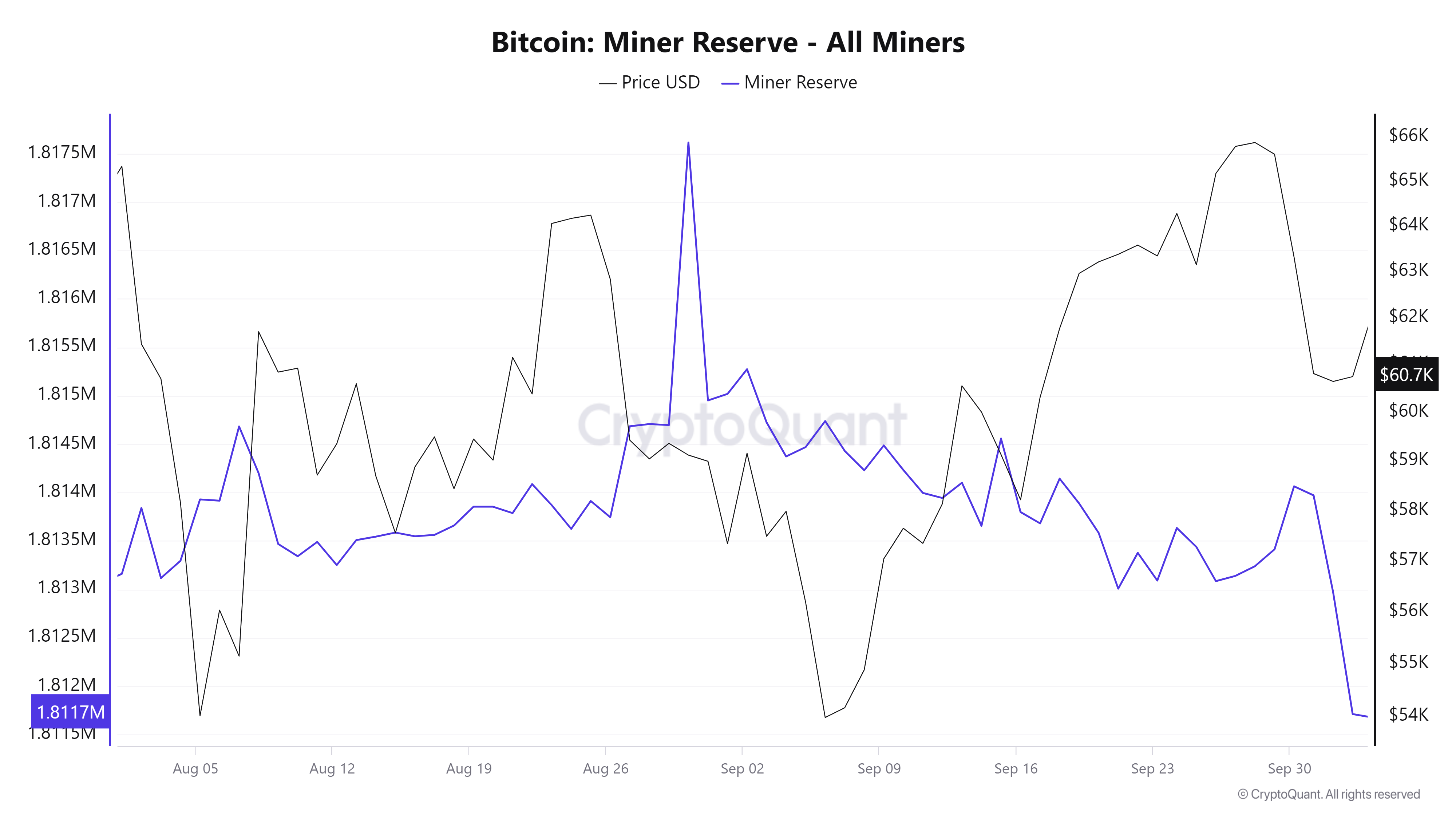

Throughout that point, miners exited the cycle after 5 consecutive days of downward stress, with their holdings falling from 1.817 million to 1.814 million.

Supply: CryptoQuant

An analogous pattern was additionally noticed just lately. This previous week, as Bitcoin retreated from $65,000 to $60,000, miner reserves noticed a big drop, from 1,814 million to 1,811 million on the time of writing.

Sometimes, the departure of weaker buyers usually results in a extra steady market, permitting stronger palms to construct positions at favorable costs.

If this pattern continues, miners breaking even may very well be an indication of a market backside. If weak palms depart to seize income, this might current itself new buyers with preferrred dip shopping for alternatives.

Nonetheless, as famous earlier, it’s essential to show $61,000 into assist earlier than a bullish cycle can start. Whereas miner exits may also help cement this assist, different circumstances should additionally align.

LTHs have faith in Bitcoin bulls

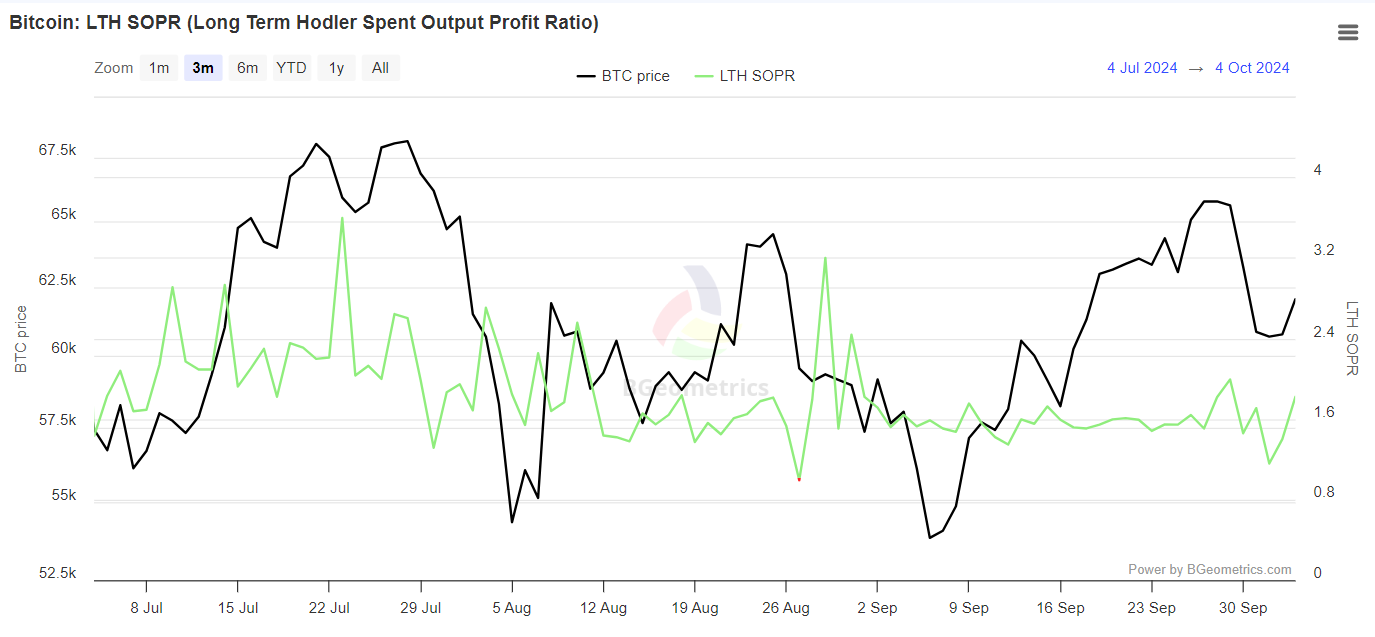

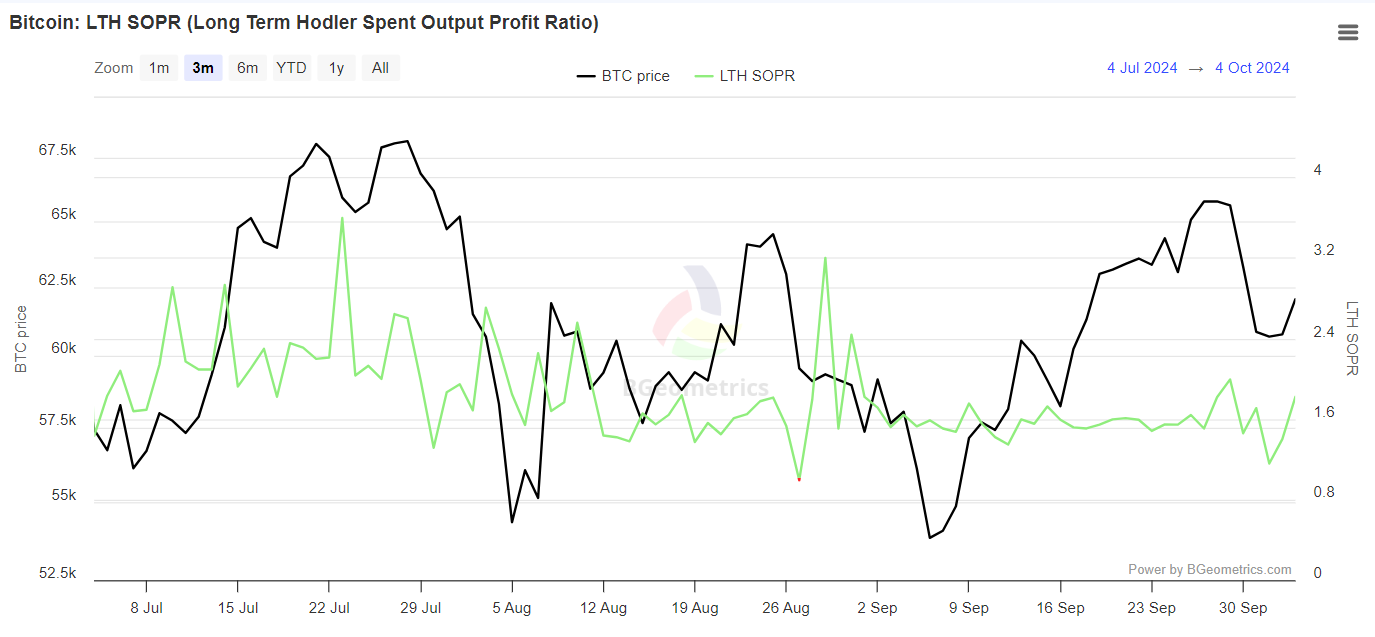

Not like miners who capitulate to chop their losses earlier than the market falls additional, holders of Bitcoin who’ve held them for greater than 155 days look like promoting at a revenue.

The LTH SOPR just lately made the next excessive. Traditionally, such strikes have pushed positions into FOMO and fueled expectations for future good points within the subsequent cycle.

Supply: BGeometrics

If LTHs keep away from panic promoting – which appears doubtless – there may very well be a near-term worth correction. This might see resistance at $61,000 flip into assist, with bulls then concentrating on the following resistance at $64,000.

In brief, Bitcoin’s decline from $65,000 to $60,000 was key to shaking off weak palms, establishing $61,000 as the following assist degree.

This drop filtered out much less dedicated buyers, permitting stronger holders to take action accumulate positions.

Whereas the numbers confirmed stable fundamentals, AMBCrypto investigated additional to find out if the current rally was actual or only a quick squeeze.

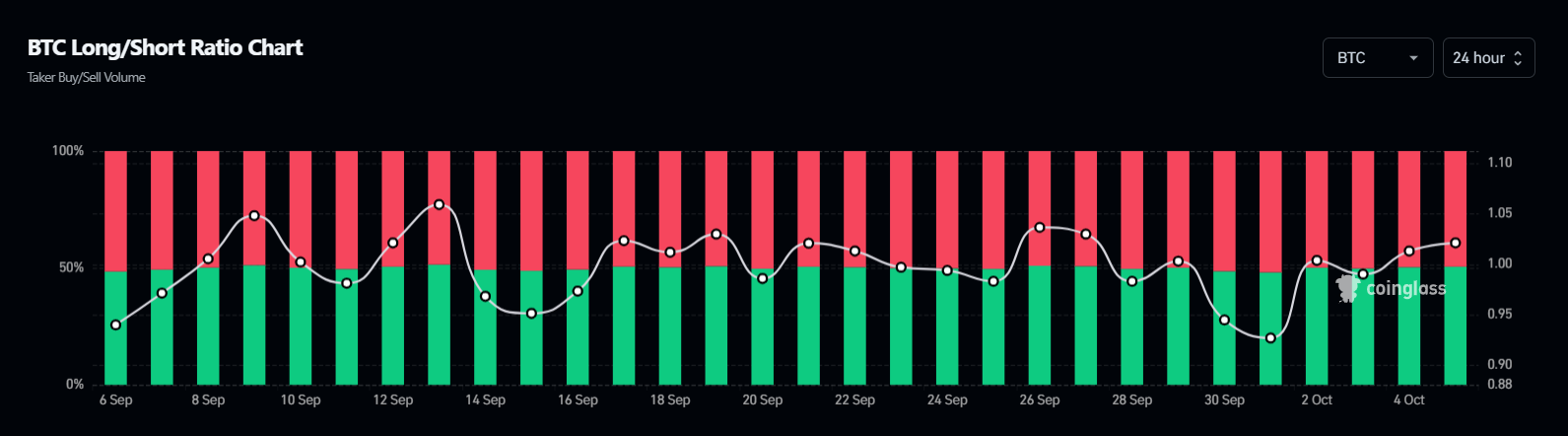

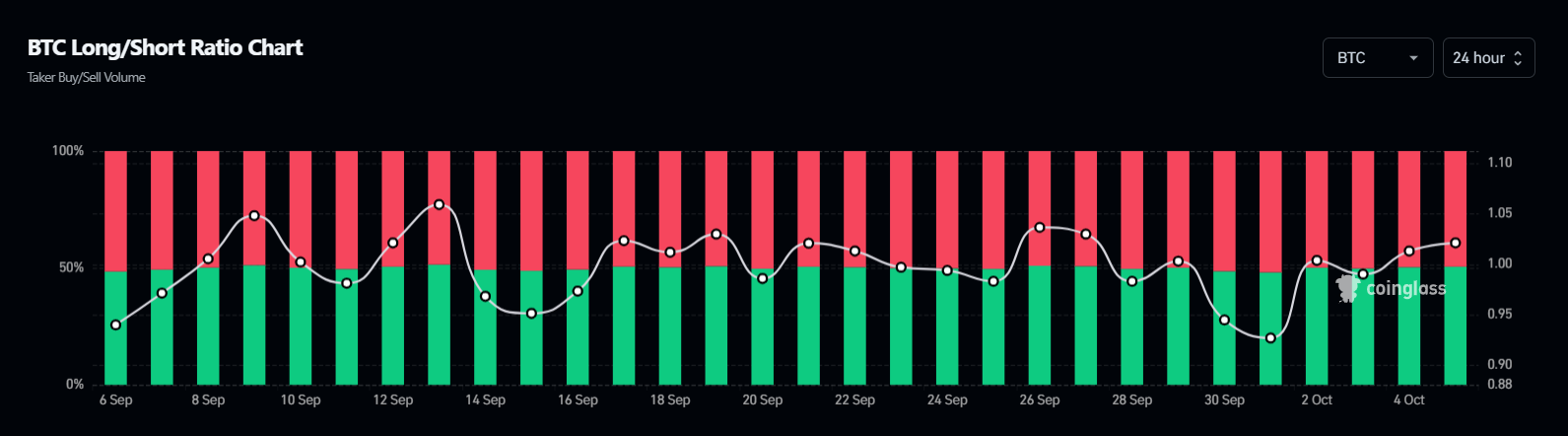

BTC longs regain management

Over the previous 4 days, lengthy positions have regained dominance within the derivatives market, stopping quick sellers from successfully shorting Bitcoin.

Supply: Coinglass

Whereas this can be a bullish signal, it additionally implies that the inflow of lengthy positions has put stress on quick positions, resulting in vital liquidations.

So this does not utterly rule out a short-squeeze situation, however it may function a place to begin for a bullish reversal, which may create pleasure amongst patrons.

Learn Bitcoin’s [BTC] Value forecast 2024-25

General, with confirmed assist at $61,000 and renewed optimism from lengthy positions, bulls are prone to maintain at $62,000 subsequent, which may result in a rally in direction of $64,000.

To attain this, nonetheless, it’s important that quick sellers are carefully monitored.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024