Bitcoin

Bitcoin Mining Stocks Outperform Bitcoin And Corporate Treasuries In Latest Market Rally

Credit : bitcoinmagazine.com

Bitcoin company bonds and the bitcoin mining sector have turn into two of the defining tales of this cycle. From the MSTR billion-dollar purchases on (Micro)Technique’s steadiness sheet to the rise of MetaPlanet and the explosive progress of bitcoin mining firms, institutional and industrial adoption have emerged as highly effective structural helps for the community. However now, after years of near-constant accumulation and market outperformance, the information suggests we’re coming into a vital inflection level — one that would decide whether or not Bitcoin’s company bonds and mining shares proceed to steer or start to lag as the subsequent section of the cycle unfolds.

Accumulation of Bitcoin treasuries

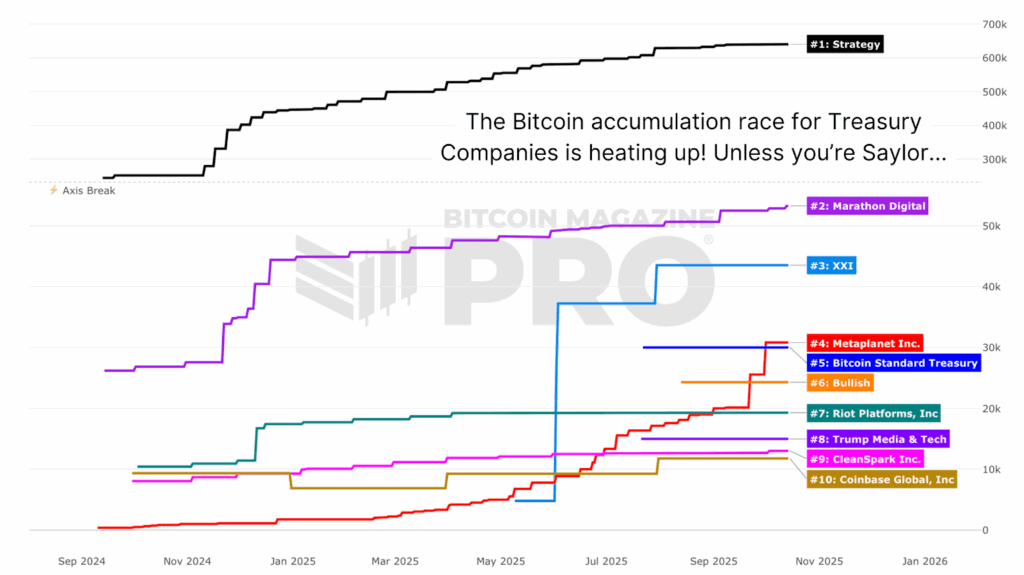

Our new one Bitcoin Treasury tracker offers day by day perception into how a lot Bitcoin these main private and non-private treasuries maintain, once they collected, and the way their positions have advanced. These authorities bonds now collectively maintain greater than 1 million BTC, a staggering quantity that represents greater than 5% of the overall circulating provide.

The extent of this accumulation has been a cornerstone of Bitcoin’s present cycle power. Nonetheless, a few of these firms are going through growing stress as their inventory valuations wrestle to maintain tempo with the Bitcoin worth itself.

Valuation compression for Bitcoin authorities bonds

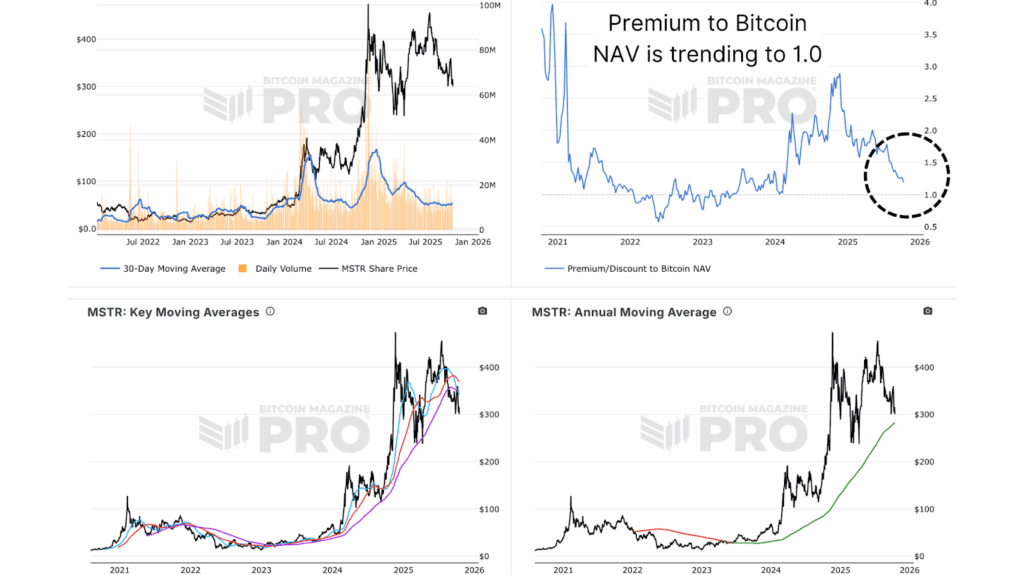

(Micro)Technique / MSTR, the pioneer in company Bitcoin adoption, stays the highest publicly traded Bitcoin holder. Nonetheless, the shares have underperformed Bitcoin’s personal worth motion in current months. As Bitcoin has consolidated throughout a broad spectrum, MSTR’s fairness has fallen extra sharply, pushing Bitcoin’s worth additional Premium net asset value (NAV).the ratio of its market valuation to the underlying Bitcoin it owns, nearer to parity of 1.0x.

This compression signifies that buyers are more and more valuing the corporate in keeping with its pure Bitcoin publicity, with little extra premium for administration execution, future leverage, or strategic innovation. Final cycle and earlier this cycle, MSTR traded at a major premium as markets rewarded its leverage publicity. The pattern towards parity alerts a waning speculative urge for food and highlights how intently the market psychology of this cycle mirrors earlier late-stage expansions.

A Cycle-Defining Turnaround for Bitcoin and Bitcoin Mining Shares

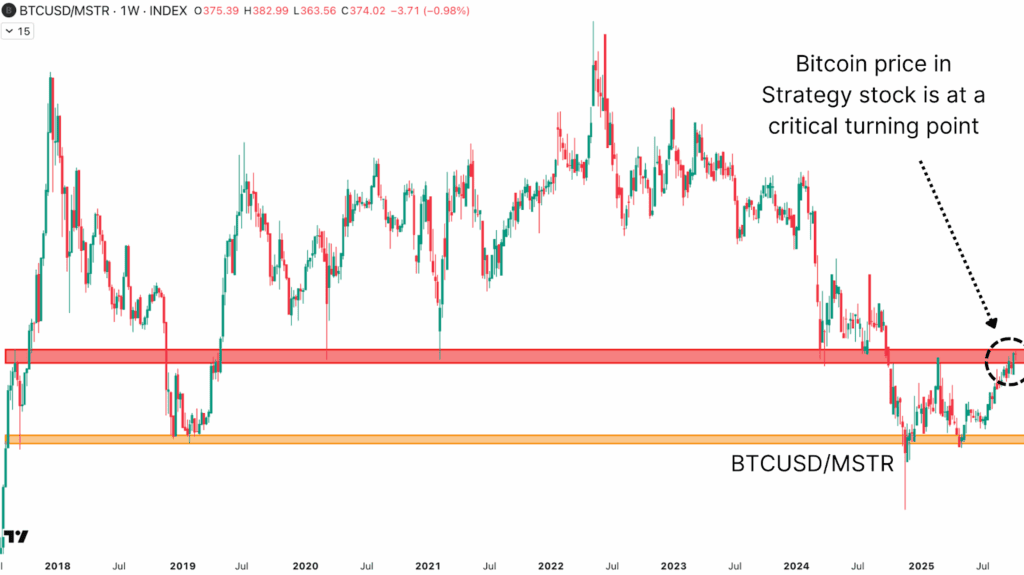

Essentially the most revealing image comes from the BTCUSD/MSTR ratio, which basically measures what number of shares of MSTR will be bought with one Bitcoin. Presently, the ratio is round 350 shares per BTC, which locations it at an vital historic degree of assist and resistance that has outlined turning factors for worth actions.

Proper now, this chart is in make-or-break area. A sustained transfer above the 380-400 zone would suggest renewed Bitcoin dominance and potential underperformance within the MSTR. Conversely, a reversal decrease, particularly beneath 330, might point out that MSTR might reassert itself as a leveraged chief heading into the subsequent section of the bull market.

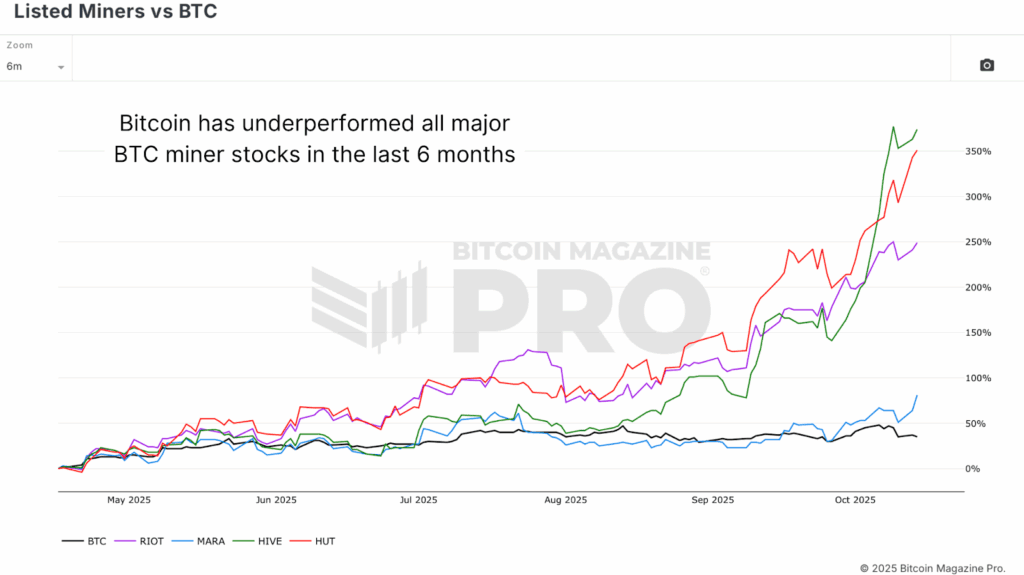

Bitcoin mining shares are taking the lead

In distinction to the underperformance of treasury firms, Bitcoin miners have soared. Over the previous six months, Bitcoin itself is up about 38% Listed mining stocks have exploded greater: Marathon Digital (MARA) is up 61%, Riot Platforms (RIOT) is up 231%, and Hive Digital (HIVE) is up a whopping 369%. The WGMI Bitcoin Mining ETF, a composite of main publicly traded miners, has outperformed Bitcoin by about 75% since September, underscoring the sector’s newfound momentum.

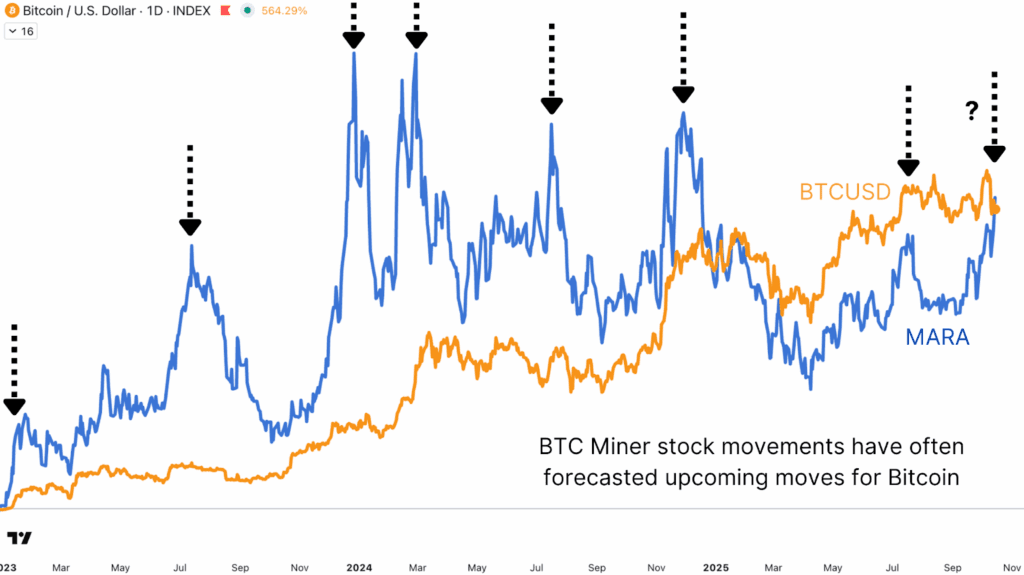

Zooming in on Marathon Digital, the world’s largest publicly traded Bitcoin miner, offers extra perception. Traditionally, the MARA chart has been a dependable main indicator of market inflections. For instance, on the finish of the 2022 bear market, MARA rose greater than 50%, simply earlier than Bitcoin began one other multi-month rally. This sample has occurred a number of occasions this cycle.

Bitcoin Mining Shares and Company Bonds: Diverging Paths in Bitcoin Market Management

With over 1 million BTC on company steadiness sheets, the affect of those entities on the steadiness between Bitcoin provide and demand stays vital. However the steadiness of management seems to be shifting. Authorities bonds like Technique and MetaPlanet, whereas structurally bullish over the long run, are actually at main ratio inflection factors and are struggling to outperform spot BTC. In the meantime, miners are experiencing one in all their strongest durations of relative efficiency in years, usually a sign that broader market momentum might quickly comply with.

As at all times, our objective at Bitcoin Journal Professional is to chop by the market noise and current data-driven insights on each side of the Bitcoin ecosystem, from company investing to miner habits, on-chain provide and macroeconomic liquidity. Thanks everybody a lot for studying, and I will see you within the subsequent one!

For a extra in-depth take a look at this matter, watch our most up-to-date YouTube video right here: Now or never for these Bitcoin stocks

For deeper information, charts {and professional} insights into bitcoin worth developments, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for extra professional market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding choices.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now