Altcoin

Bitcoin – my workers earn less despite the high price of BTC – this is why

Credit : ambcrypto.com

- Bitcoin miners had been confronted with pressed revenue, as a result of transaction prices reached historic lows.

- Community difficulties and rising prices are the survival of smaller miners.

Bitcoin [BTC] Miners can be confronted with a difficult panorama in 2025 Most important factors press profitability. Transaction prices have hit their lowest ranges since 2012, whereas the community problem continues to climb.

The Halving from 2024 has elevated competitors and the turnover per unit of computing energy drops quickly.

Furthermore, USD-nominated mining earnings stays unstable, creating uncertainty, even for giant gamers.

Because the revenue margins tighten, miners are pressured to optimize the actions, to shut outdated tools or to contemplate mergers.

With smaller gamers who run the danger of leaving the consolidation of the business, in order that solely essentially the most environment friendly and effectively -capitalized operations are left behind to outlive.

Bitcoin -Mybouw is confronted with profitability tribe

Supply: Alfractaal

The Bitcoin mining ecosystem stands for appreciable challenges, as a result of numerous vital statistics point out falling profitability.

The Bitcoin mempool, which follows unconfirmed transactions, has fallen to the bottom stage in years, which signifies a lowered community demand.

This lower has a direct affect on the turnover of miners from transaction prices, that are important along with block reward.

Traditionally, related choices of transaction exercise are adopted by bear markets, and this decline – regardless of the excessive value of Bitcoin – can point out a structural shift within the community.

Supply: Alfractaal

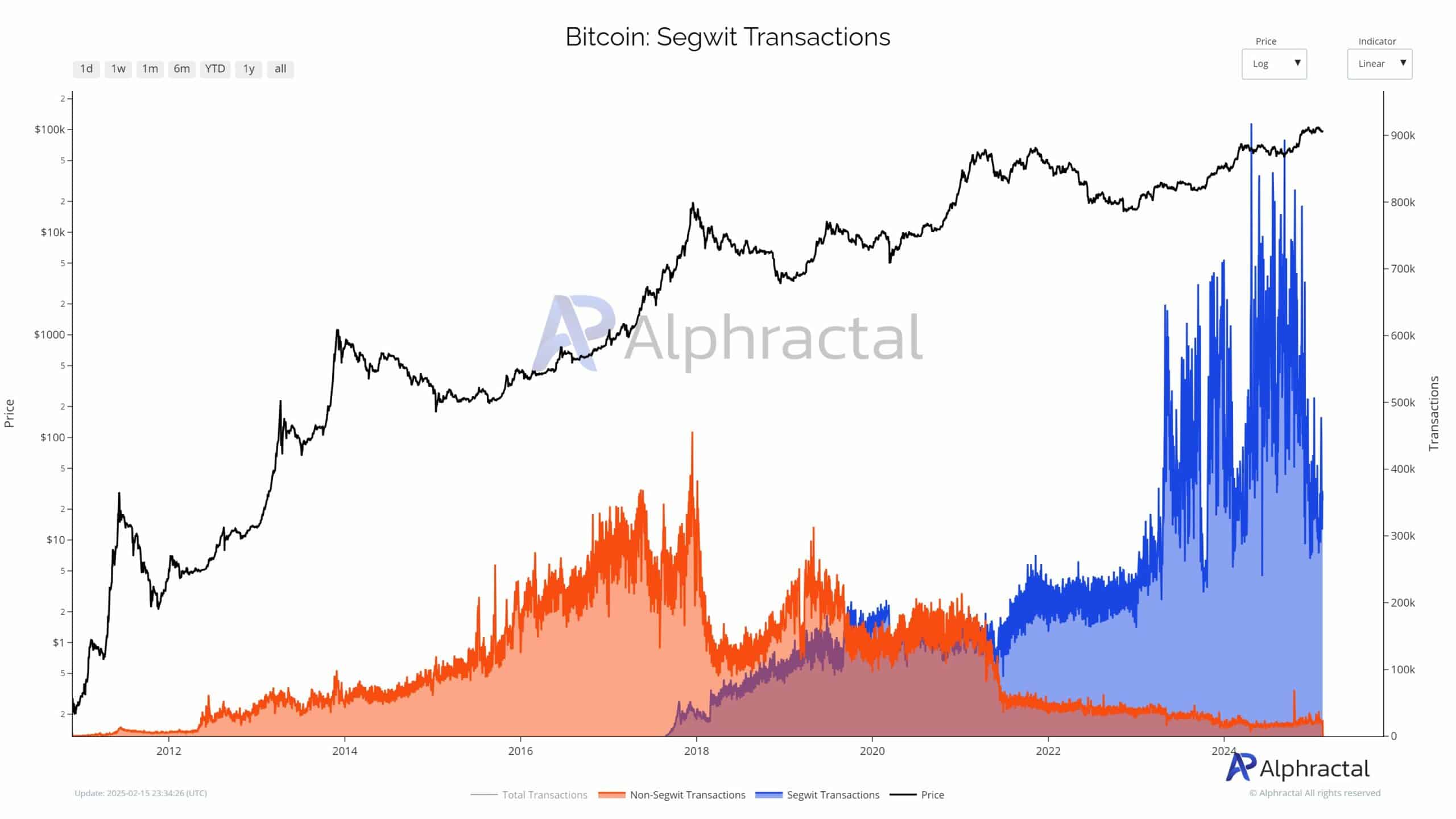

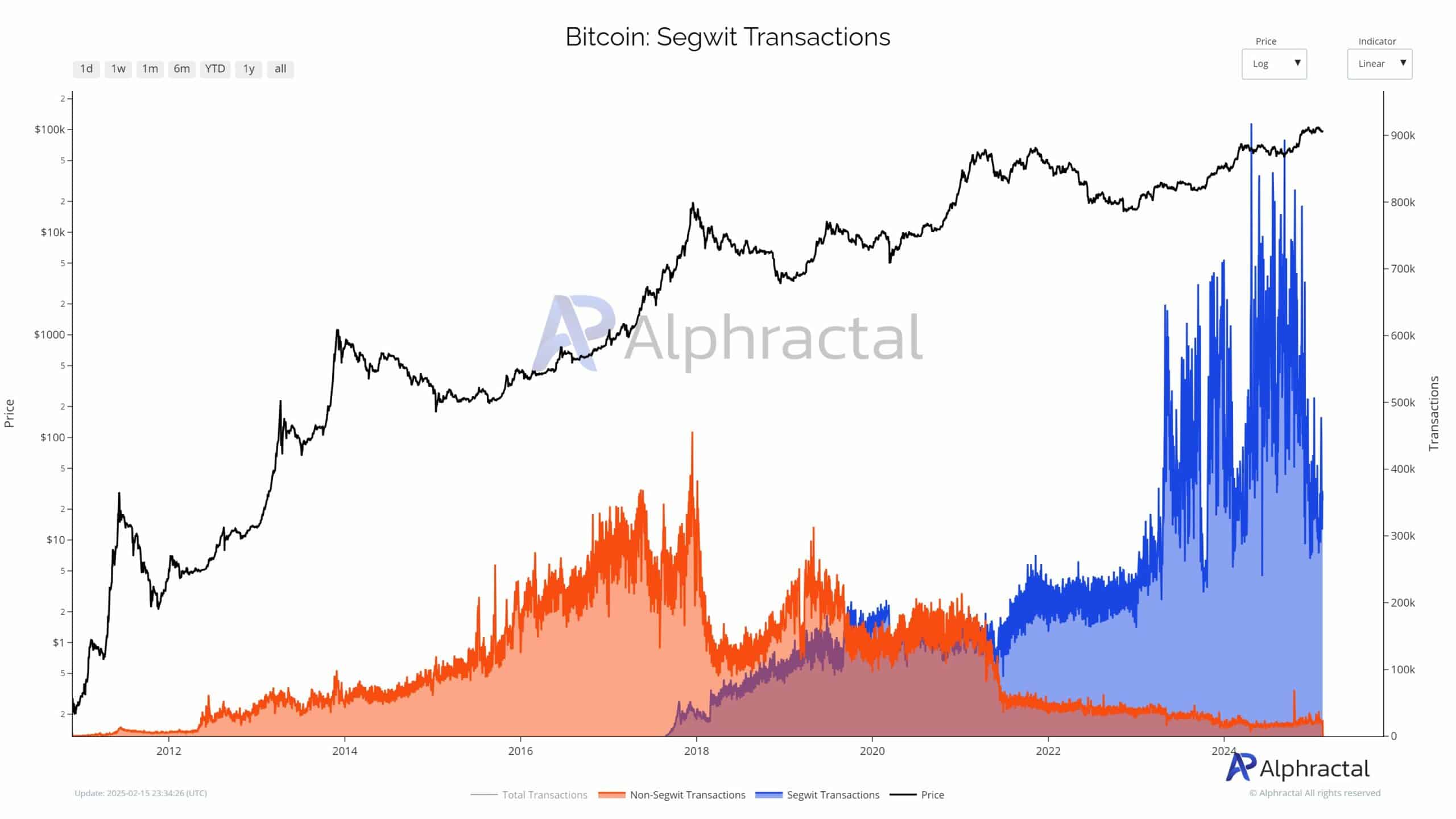

Furthermore, Segwit transactions, which had been as soon as the dominant and environment friendly transaction kind, are actually in decline.

This reduces general community effectivity, growing the demand for block area and exerting additional stress on the earnings of miners.

Supply: Alfractaal

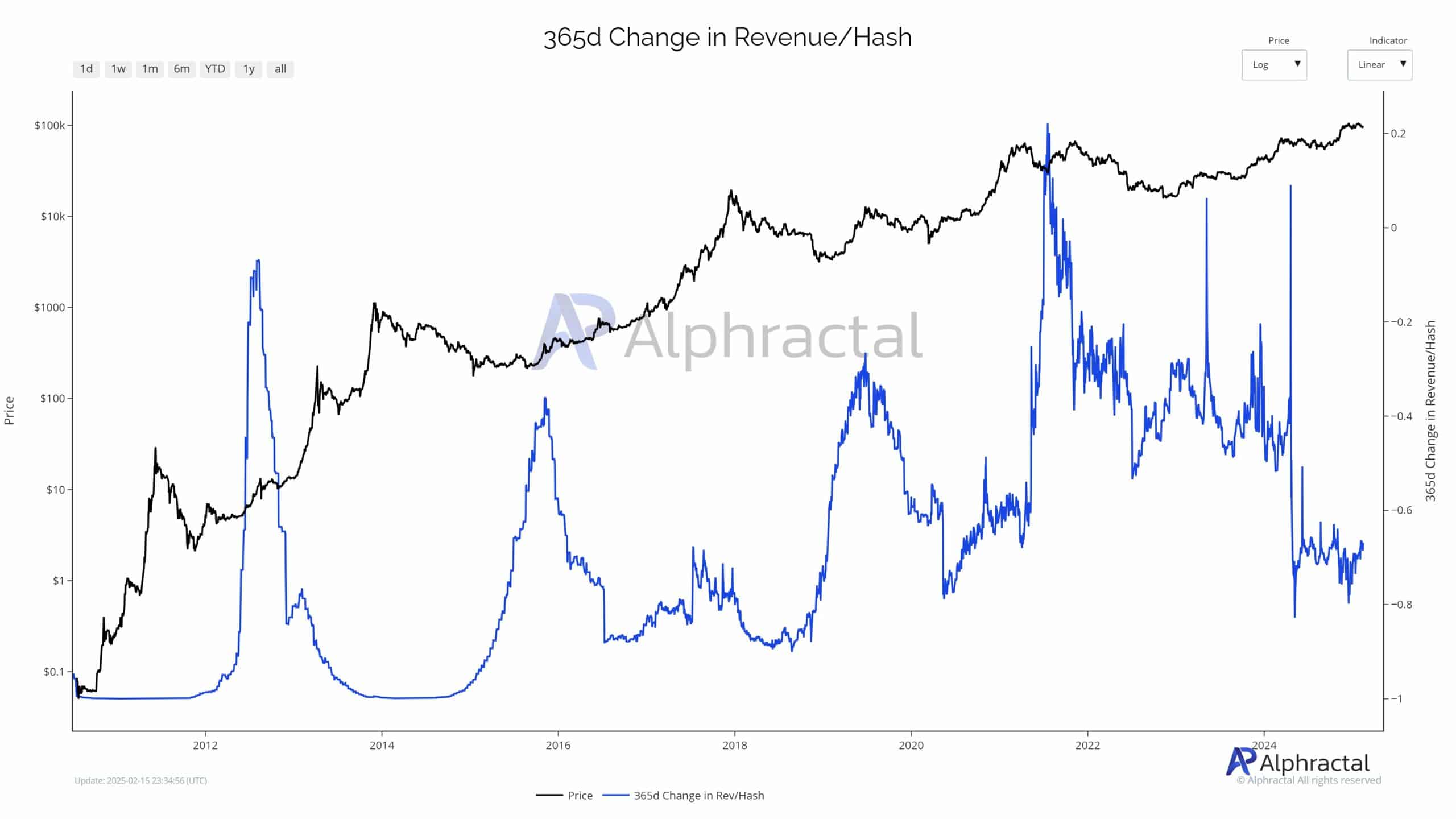

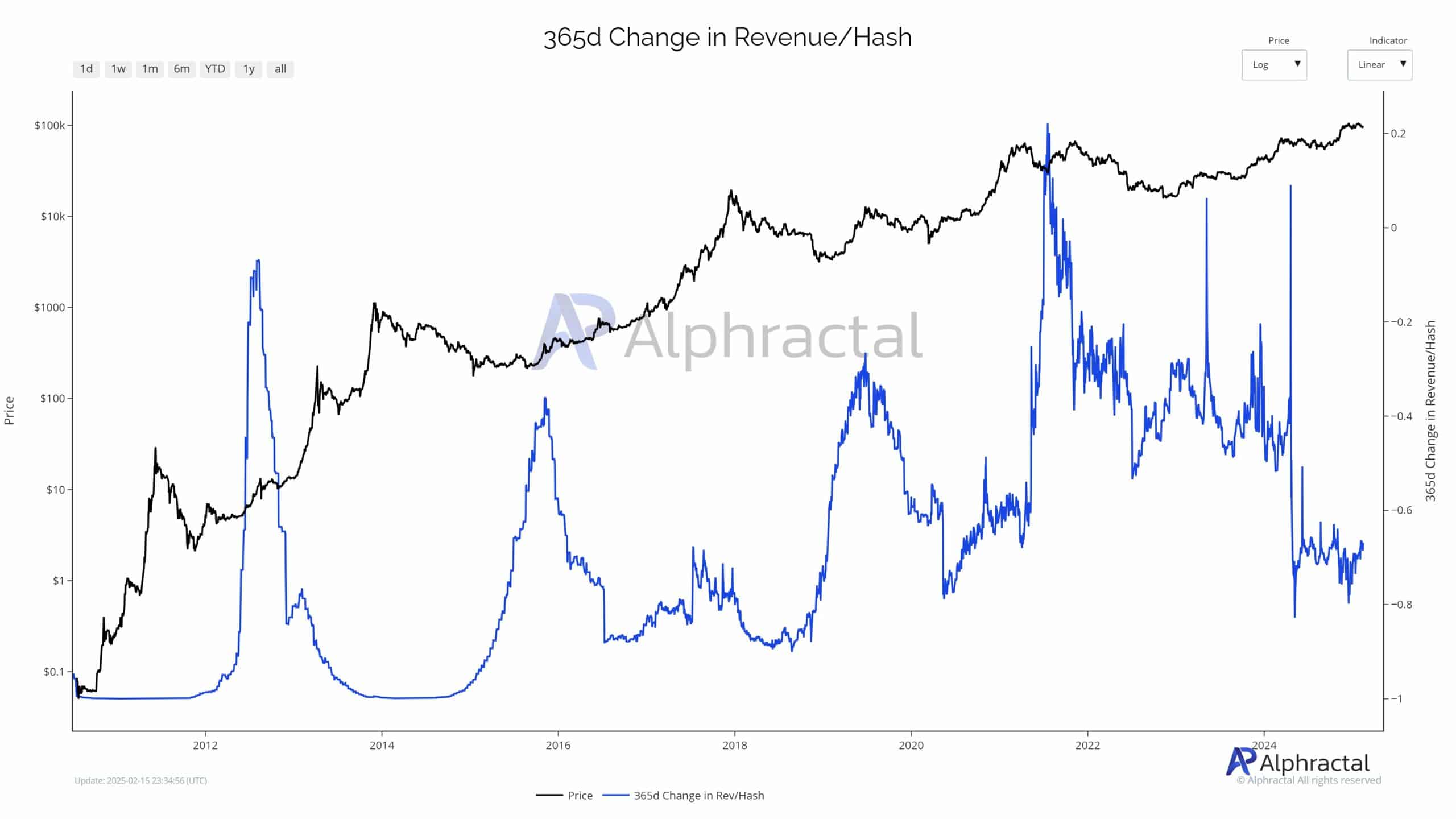

The earnings/hash ratio, an vital statistics for miners, is at historic lows. Regardless of the rising value of Bitcoin, reducing returns point out that rising community issues and competitors erode profitability.

With the approaching halving, lowering block reward, smaller operations could have problem staying worthwhile.

This dynamic can result in elevated centralization, the place solely giant, technologically superior miners will thrive, presumably drive smaller gamers out of the market.

Rising problem and rising prices

Bitcoin miners are confronted with growing stress on profitability, as a result of community difficulties reaches document highs.

The falling earnings per hash makes it tougher for smaller operators with outdated tools to compete, particularly as a result of the vitality and {hardware} prices proceed to rise.

To outlive, many miners migrate to areas with cheaper, extra sustainable vitality sources, akin to hydro or geothermal power.

Some additionally diversify earnings flows by branching to laptop companies, whereas others search for mergers and acquisitions.

These efforts can result in additional centralization in business, with solely essentially the most capitalized and environment friendly mining firms that survive.

This might have a broader penalties for the decentralization of Bitcoin, specifically with regard to the geographical distribution of mining energy.

A reform of Bitcoin’s safety mannequin can comply with, which expresses concern in regards to the lengthy -term well being of his decentralized nature.

Re -balance market

As operational prices rise and profitability decreases, Bitcoin’s Hashraat can see a pure decline, with inefficient miners who’re closed.

This re -balancing will most likely solely depart essentially the most capitalized and technologically superior gamers, which strengthens mining as an business with a excessive barrier.

Nevertheless, this shift evokes concern about centralization. With a shrinking pool of dominant miners, the decentralized ethos of Bitcoin will be in danger, in order that community safety will be concentrated in much less arms.

Though bigger entities can assure stability, this consolidation can result in questions on censorship resistance and belief within the lengthy -term integrity of the community.

The Halving of 2024 has already examined the resilience of the Bitcoin -Mijnbouwecosystem.

The aftermath of this occasion is an important interval to find out whether or not Bitcoin -Mybouw stays an open, aggressive subject, or whether or not the sector continues to consolidate within the arms of some dominant gamers.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024