Bitcoin

Bitcoin net position change for STH hits +750k BTC.

Credit : ambcrypto.com

- Bitcoin’s short-term holders held the market with a internet place change worth of +750k.

- BTC fell 12.37% final week.

Since reaching $108k, Bitcoin [BTC] is struggling to take care of upward momentum. As such, BTC has been buying and selling in a consolidation vary between $92,000 and $97,000.

On the time of writing, Bitcoin is buying and selling at $93,905, down 2.18% on the each day charts. Furthermore, the cryptocurrency is down 12.37% on the weekly charts.

This dip has left most short-term holders in losses, together with those that purchased Bitcoin in November. The widening loss margins amongst short-term bonds have analysts contemplating the following step.

Bitcoin’s LTH vs STH internet place change

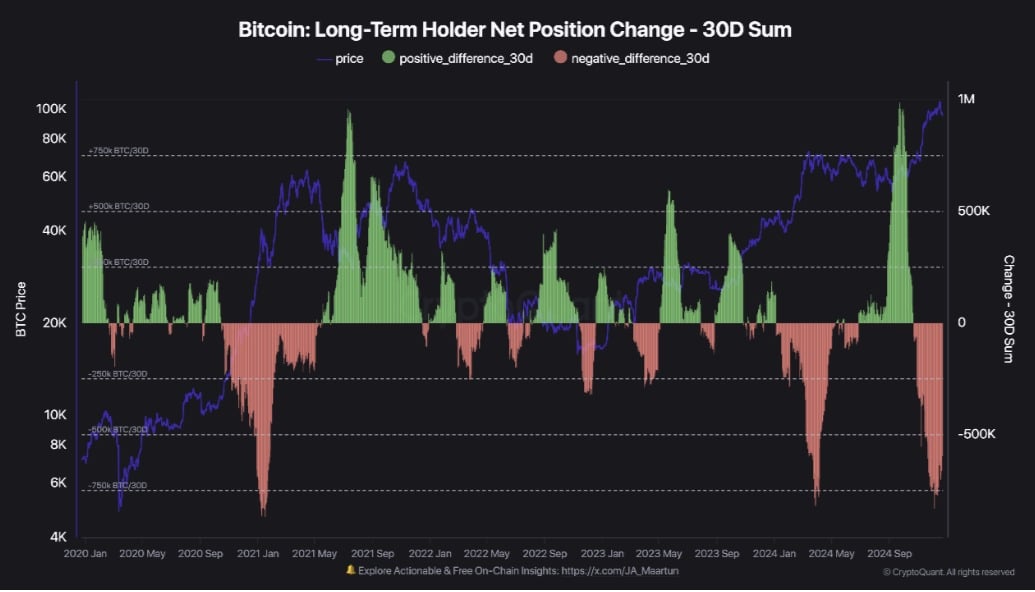

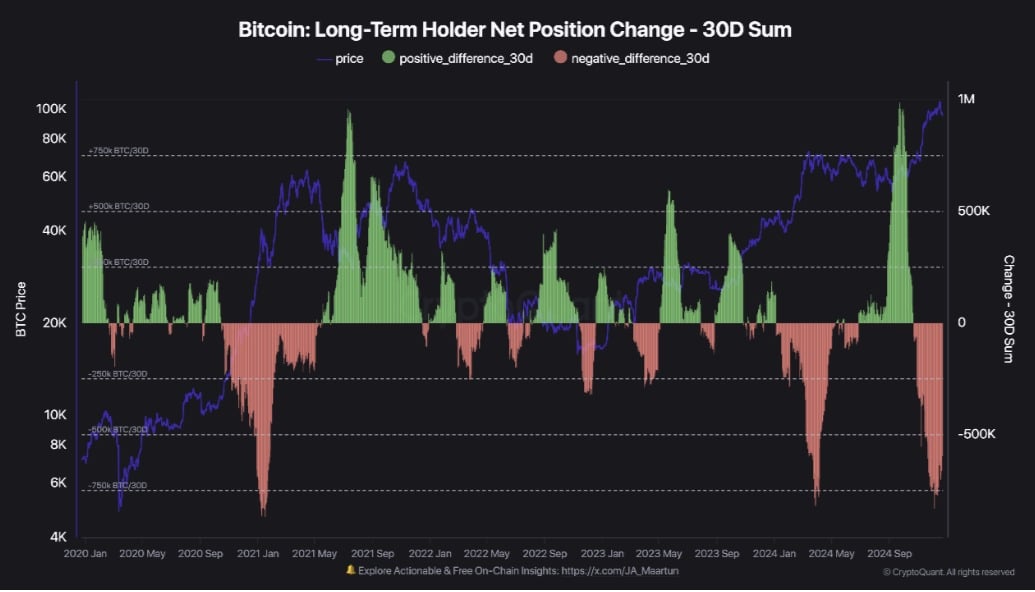

In accordance with cryptoquant, the 30-day internet place change for long-term holders (LTH) has turned destructive, reaching -750k BTC.

Supply: CryptoQuant

Regardless of this alteration, Bitcoin costs have managed to stay sturdy and never expertise a pointy decline. It’s because short-term holders (STH) have continued to build up whilst BTC rallied to a brand new ATH.

Supply: CryptoQuant

The web place change for short-term holders (STH) elevated to a constructive worth of +750,000 BTC.

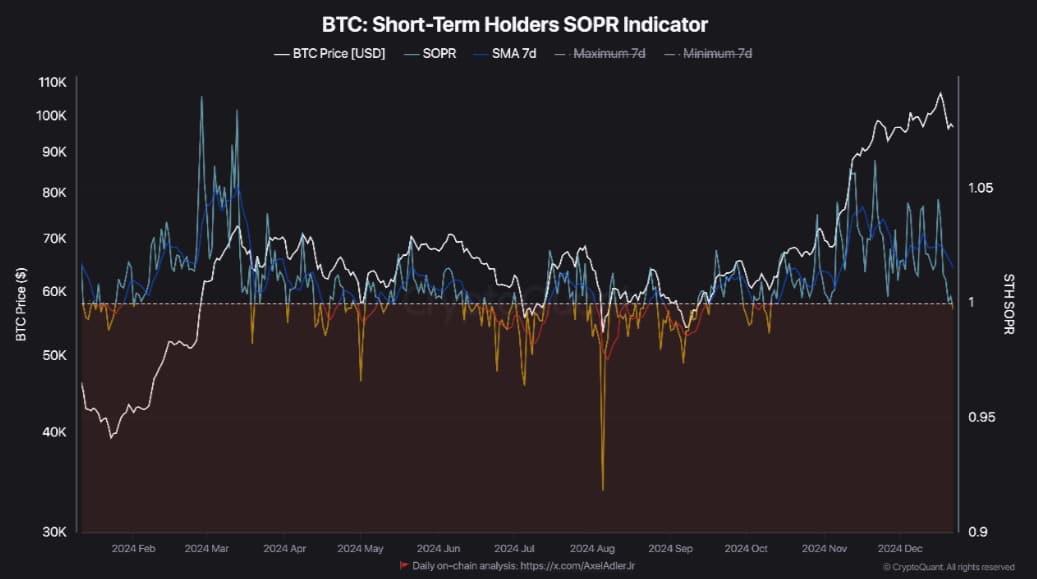

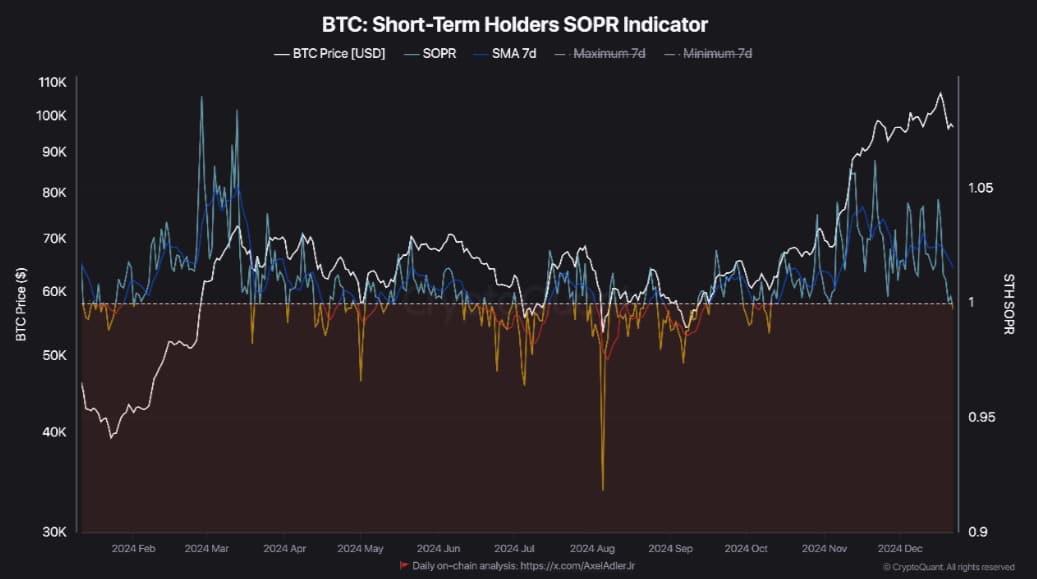

As short-term traders continued to build up as BTC costs rose, the STH SOPR turned destructive. This means that STH holders are working at a loss.

If short-term holders endure a loss, they’ve two choices: maintain and look forward to BTC costs to get well, or purchase at decrease costs. If STH demand stays sturdy and long-term holder (LTH) demand is impartial or constructive, this might create constructive momentum for BTC.

Nonetheless, if STH decides to promote at a loss, it might create promoting stress and drive costs down additional. The course short-term holders take will affect BTC’s worth trajectory.

Supply: CryptoQuant

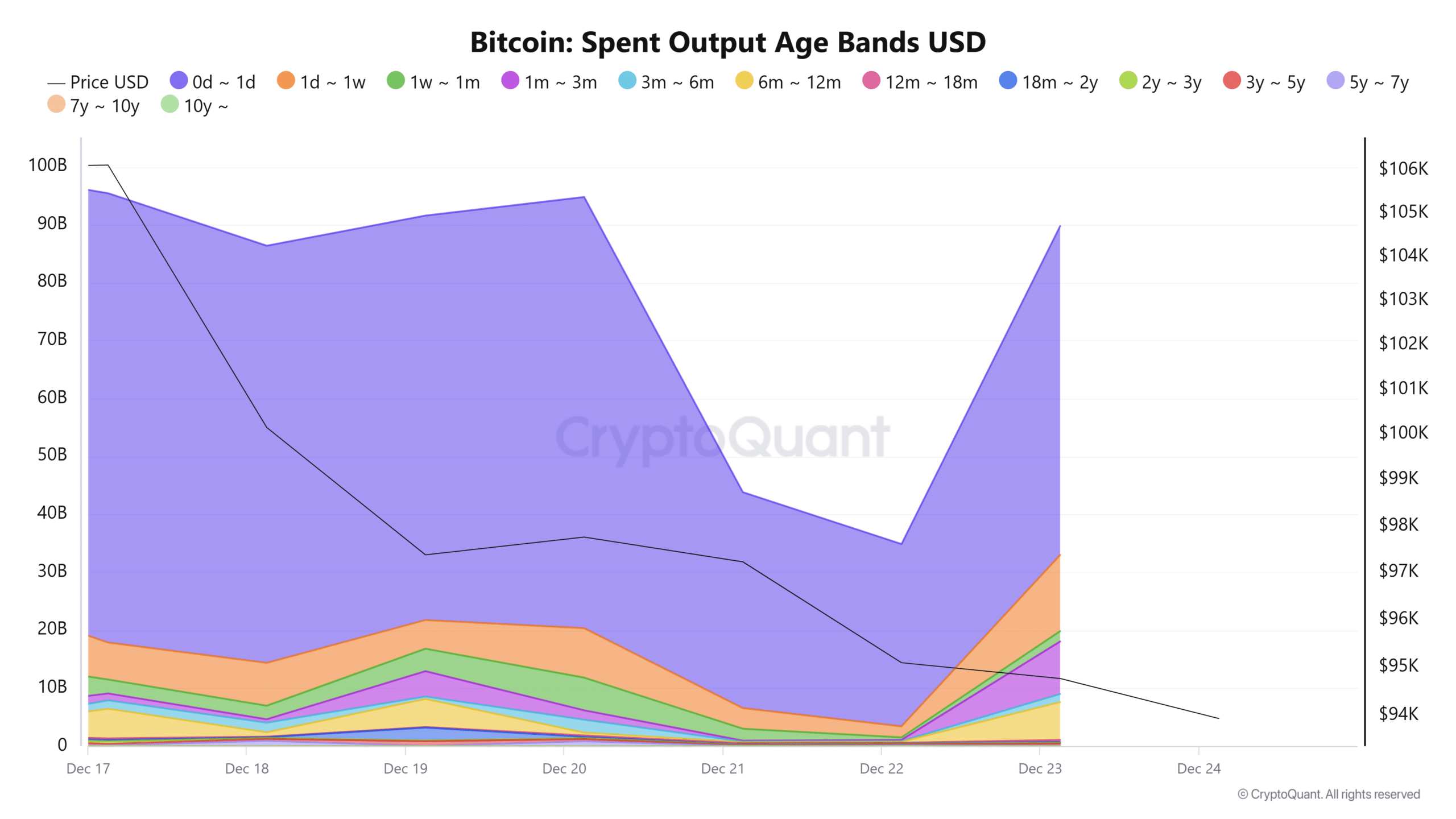

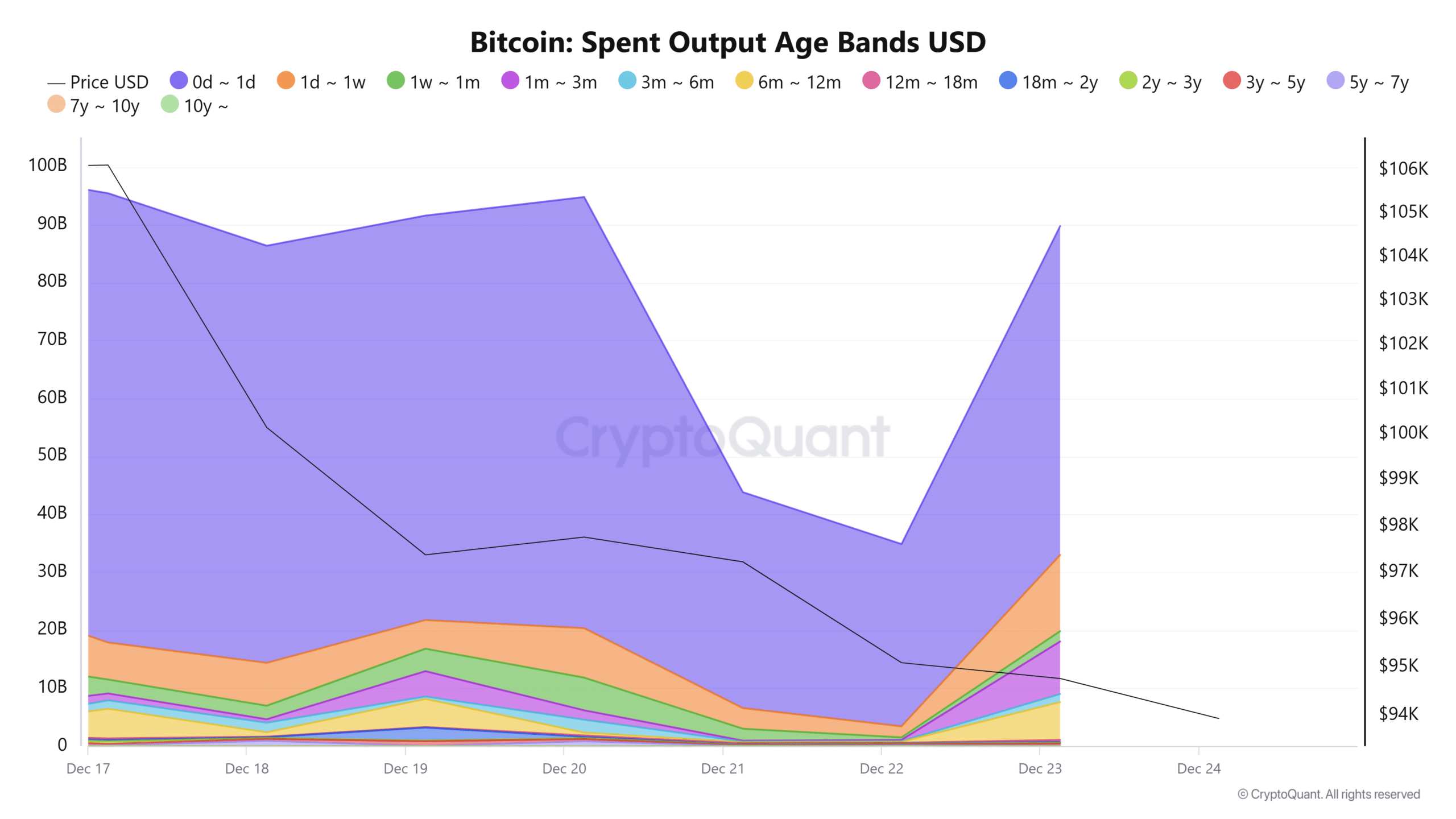

From the age ranges spent on output, we will see that short-term holders are actively promoting. So short-term holders spent extra cash than LTH, with the worth of cash held for in the future reaching 56 million and cash held for per week reaching 9 million.

Supply: CryptoQuant

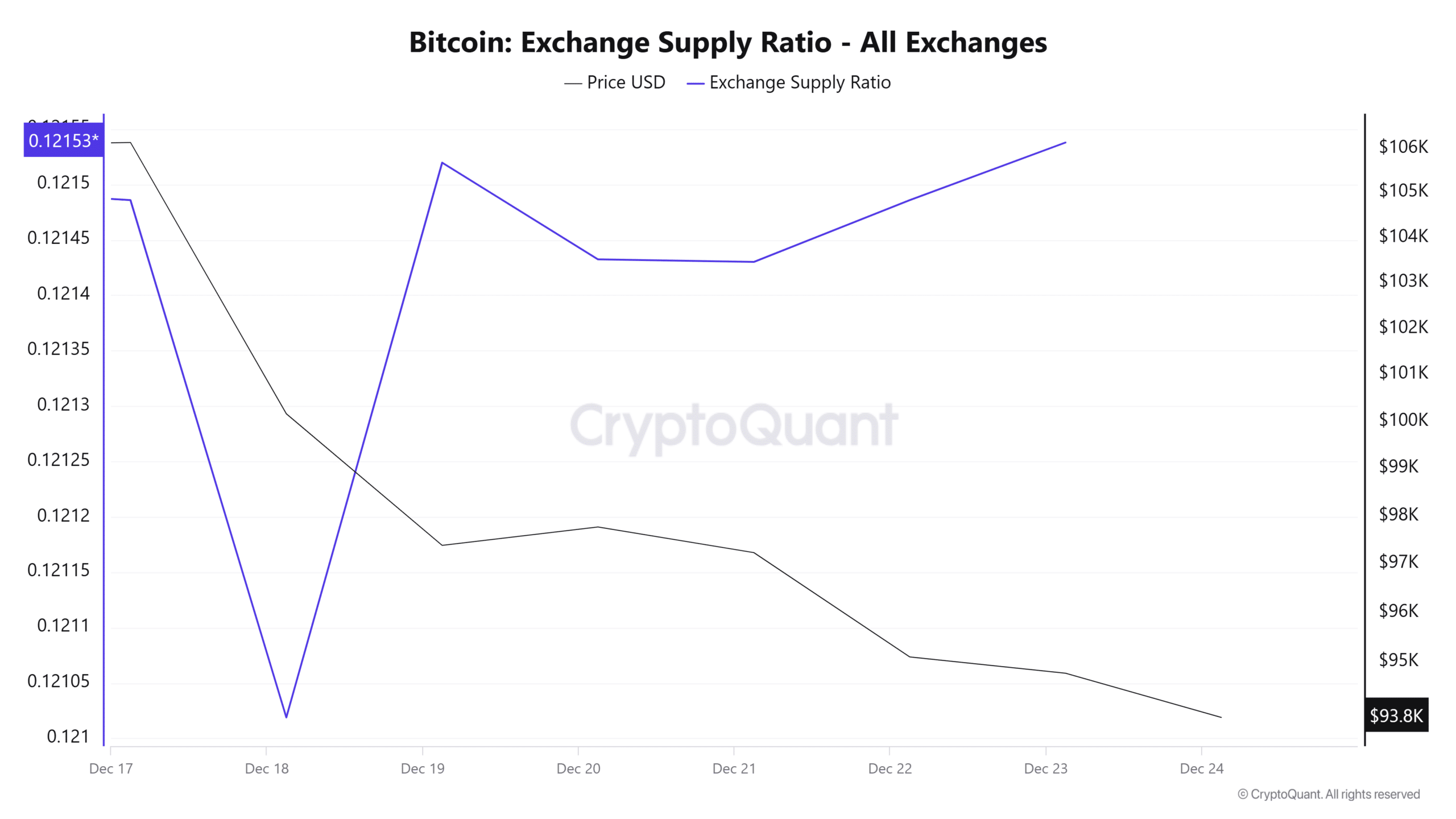

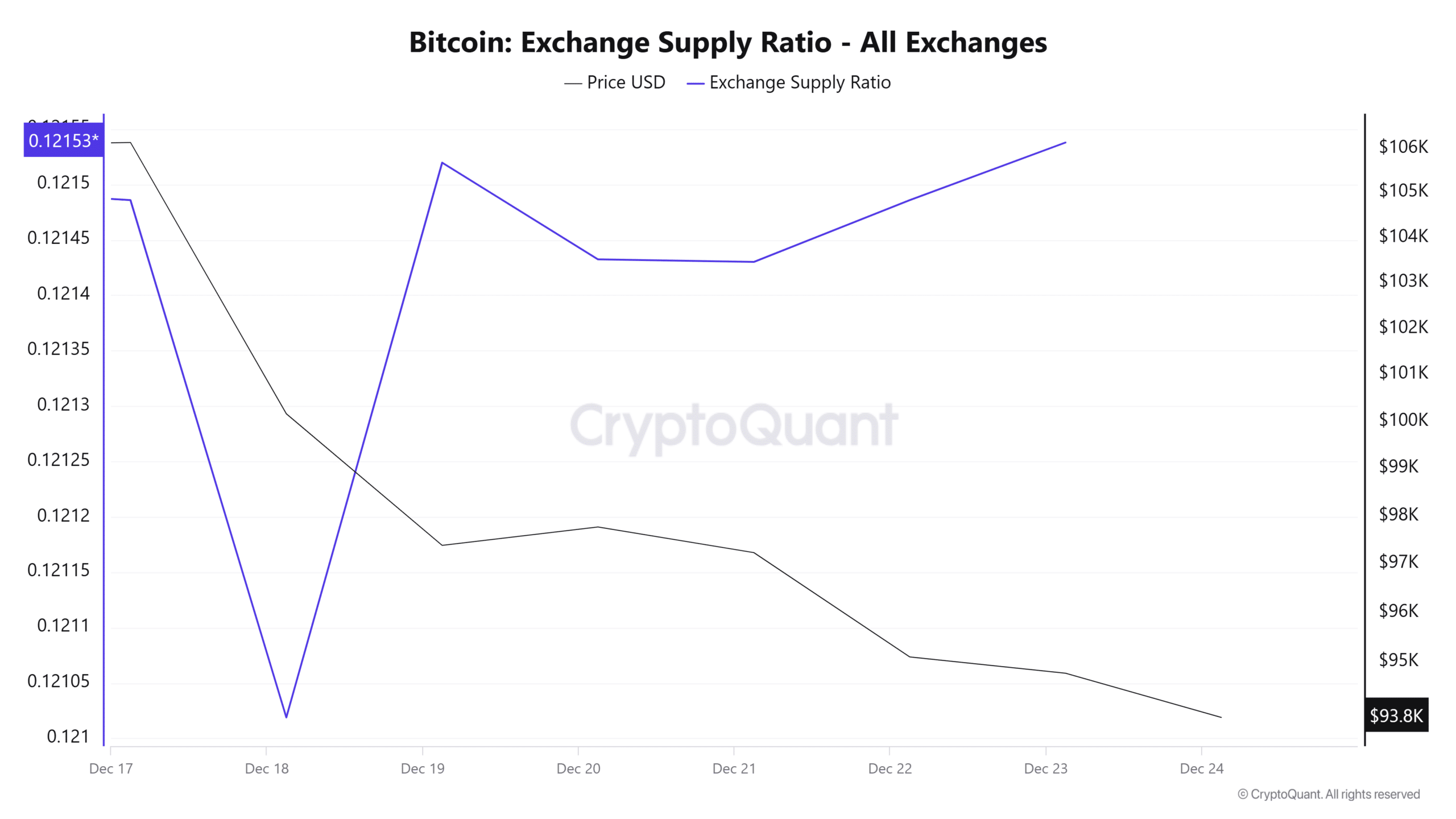

As such, a spike within the trade fee provide ratio has occurred over the previous week. A surge in trade provide means that these issued cash are going public, inflicting merchants to switch extra Bitcoin tokens to exchanges to promote or put together to promote them.

This means that there’s a lot of speculative buying and selling amongst STH merchants and so they even promote at a loss to accumulate at decrease charges.

Implications for BTC?

As famous above, short-term holders management the market. As such, BTC dangers going through increased promoting stress from this cohort, which might in flip drive down costs.

Learn Bitcoin (BTC) worth prediction 2024-25

With STH actively promoting their tokens, it reveals their lack of market confidence and proceeds to purchase at a decrease stage after promoting at a loss. If their internet place adjustments and turns into destructive, like long-term holders, Bitcoin might fall additional.

If this bearish sentiment continues, BTC might fall to $92,130. Nonetheless, if STH demand continues, BTC will look to get well in the direction of $95,800.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now