Altcoin

Bitcoin Network Turns Positive: A Bullish Signal for Investors?

Credit : ambcrypto.com

- BTC rose to $70,000 with community fundamentals constructive.

- Is that this a bullish sign regardless of the short-term correction and certain consolidation?

Bitcoin [BTC] community foundations modified constructive for the primary time in October, on what one analyst thought-about a constructive sign for the property within the medium time period.

In response to CryptoQuant, the positive community metrics have been a recognized pattern throughout bullish durations and recommended a possible constructive end result for the asset regardless of a possible correction or consolidation.

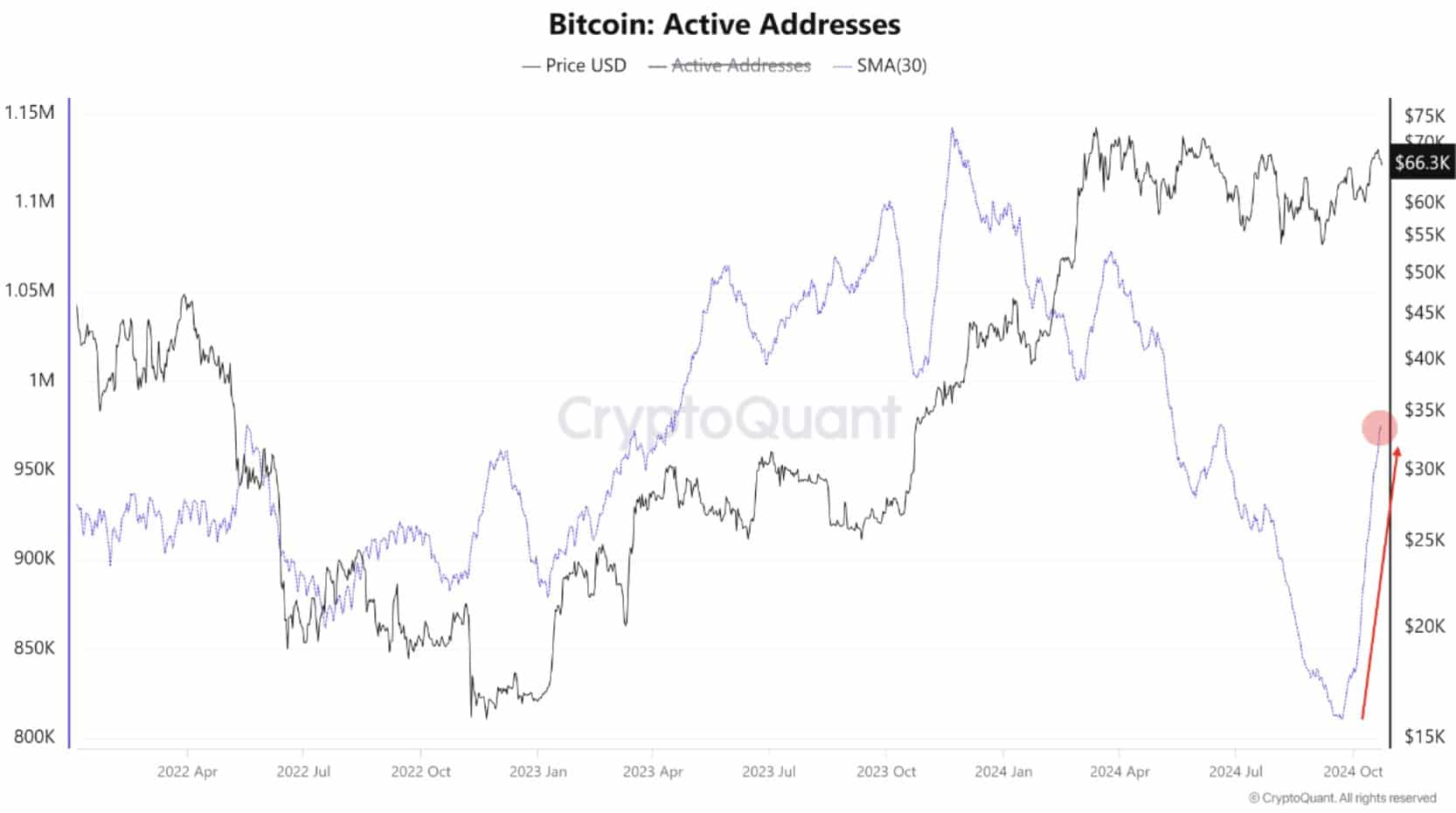

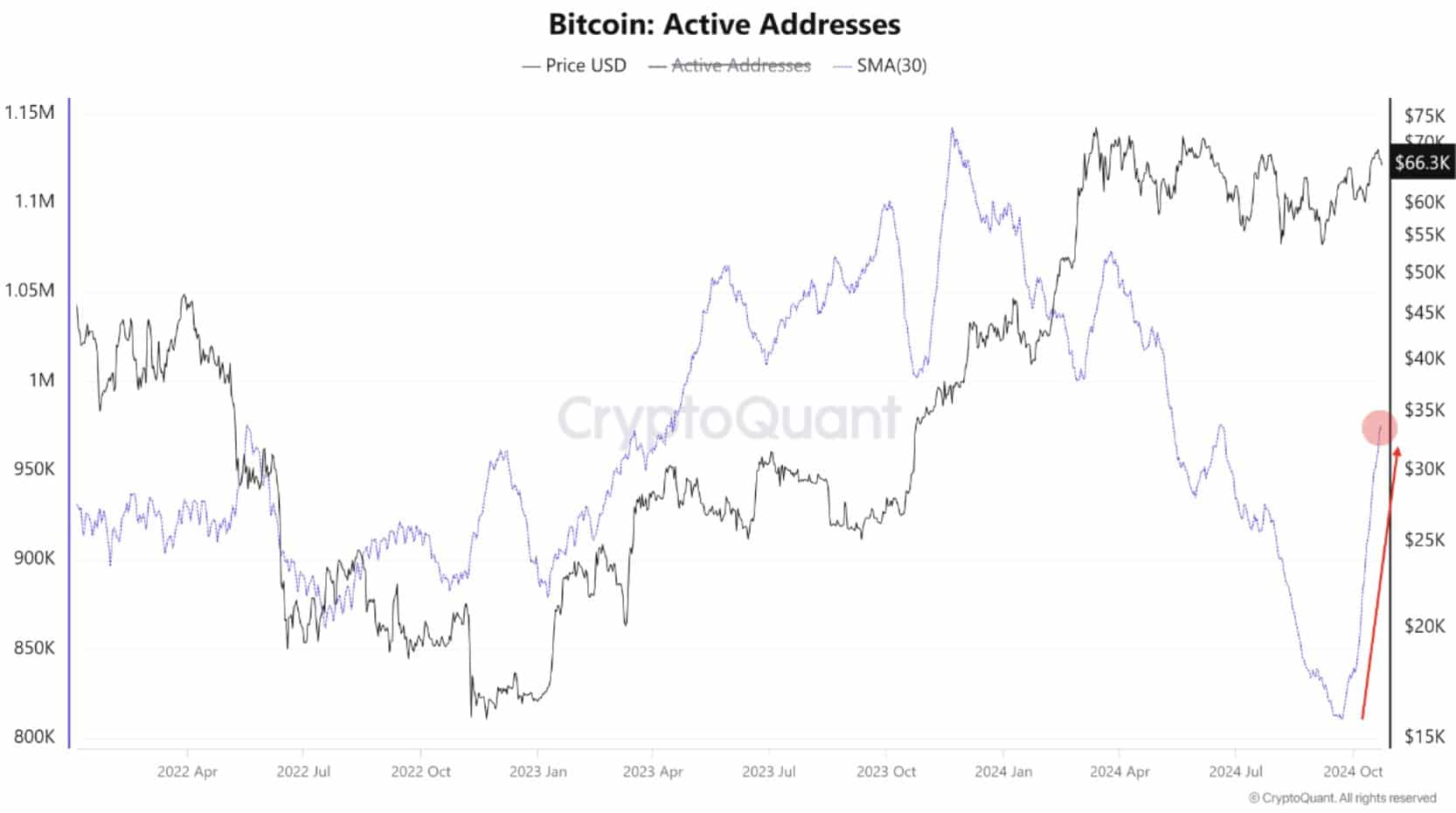

After a current run in direction of $70,000, the 30-day common variety of energetic BTC addresses rose in direction of the 1 million mark. It reached ranges final seen in June, indicating a surge of curiosity on this asset throughout final week’s pump.

Supply: CryptoQuant

Subsequent step a BTC improve?

An analogous constructive pattern was recorded within the mining section and community prices. Particularly the mining issues reached an all-time excessive, indicating intense competitors for rewards amongst BTC miners, a constructive catalyst for BTC’s intrinsic worth.

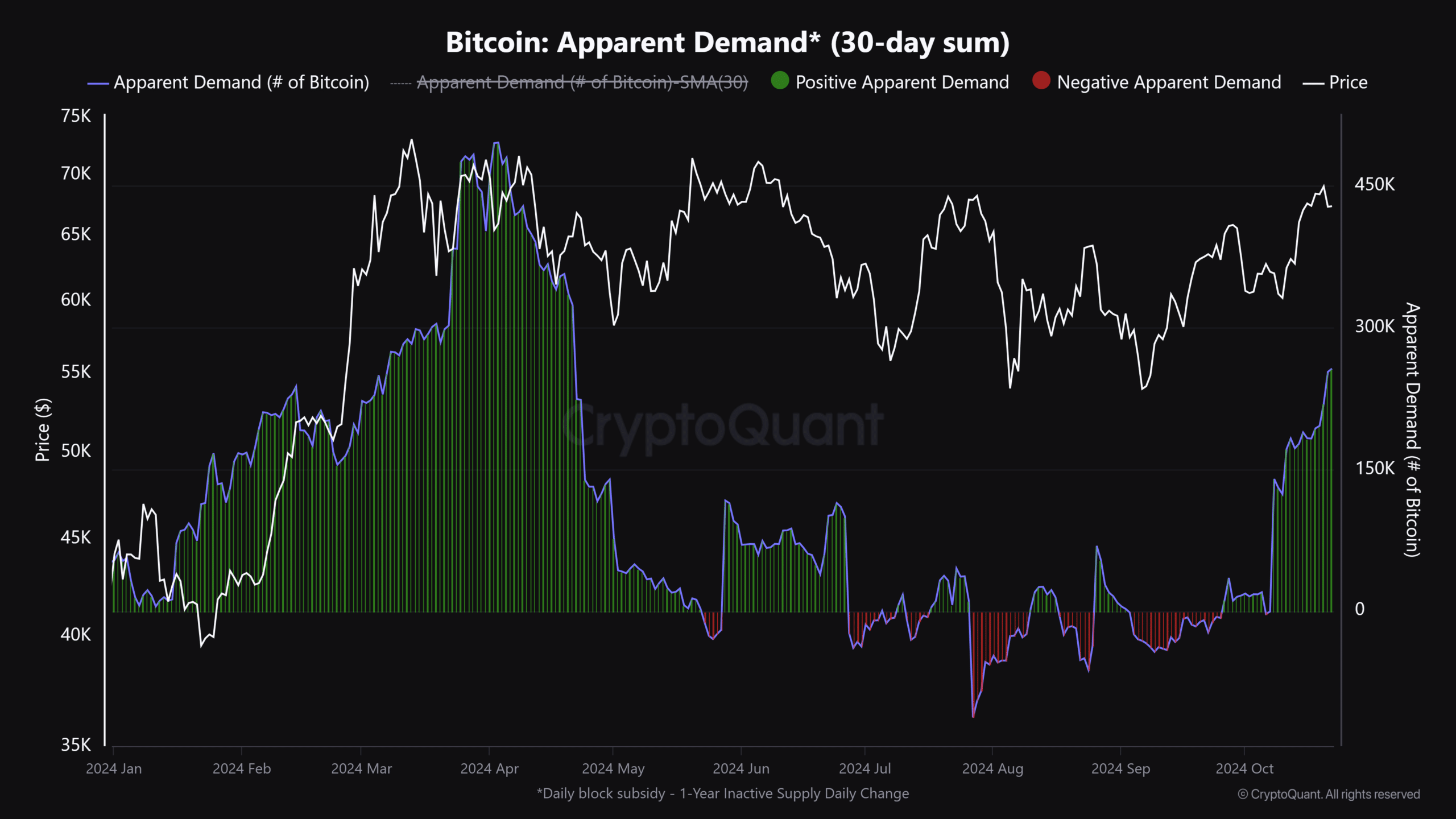

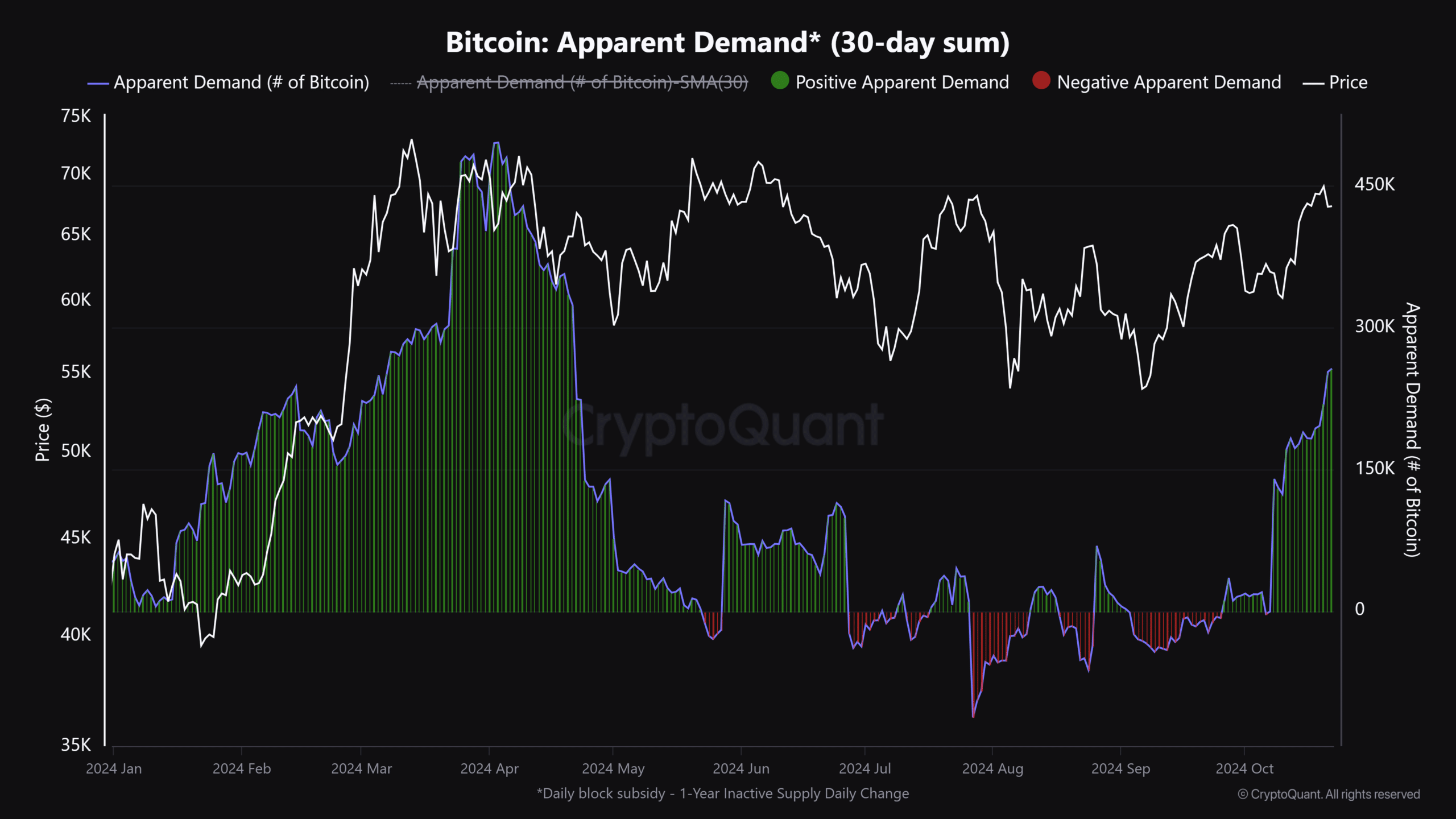

Moreover, BTC obvious demand, or the distinction between manufacturing and stock schedule, rose to a six-month excessive of 256,000 BTC on the time of writing. Typically, the height in demand is all the time preceded by a BTC worth improve.

Supply: CryptoQuant

Regardless of the constructive catalysts talked about above, analysts had combined BTC worth projections because the US elections approached.

Blockworks analyst Felix Jauvin warned that BTC might be range-bound till the election was over.

“No one needs to be a marginal danger purchaser right here so near the elections. Most likely simply a variety of chopping till it is over…:

One other professional, Justin Bennettreiterated its cautious sentiment, citing whales’ lack of curiosity in benefiting from the current midweek dip.

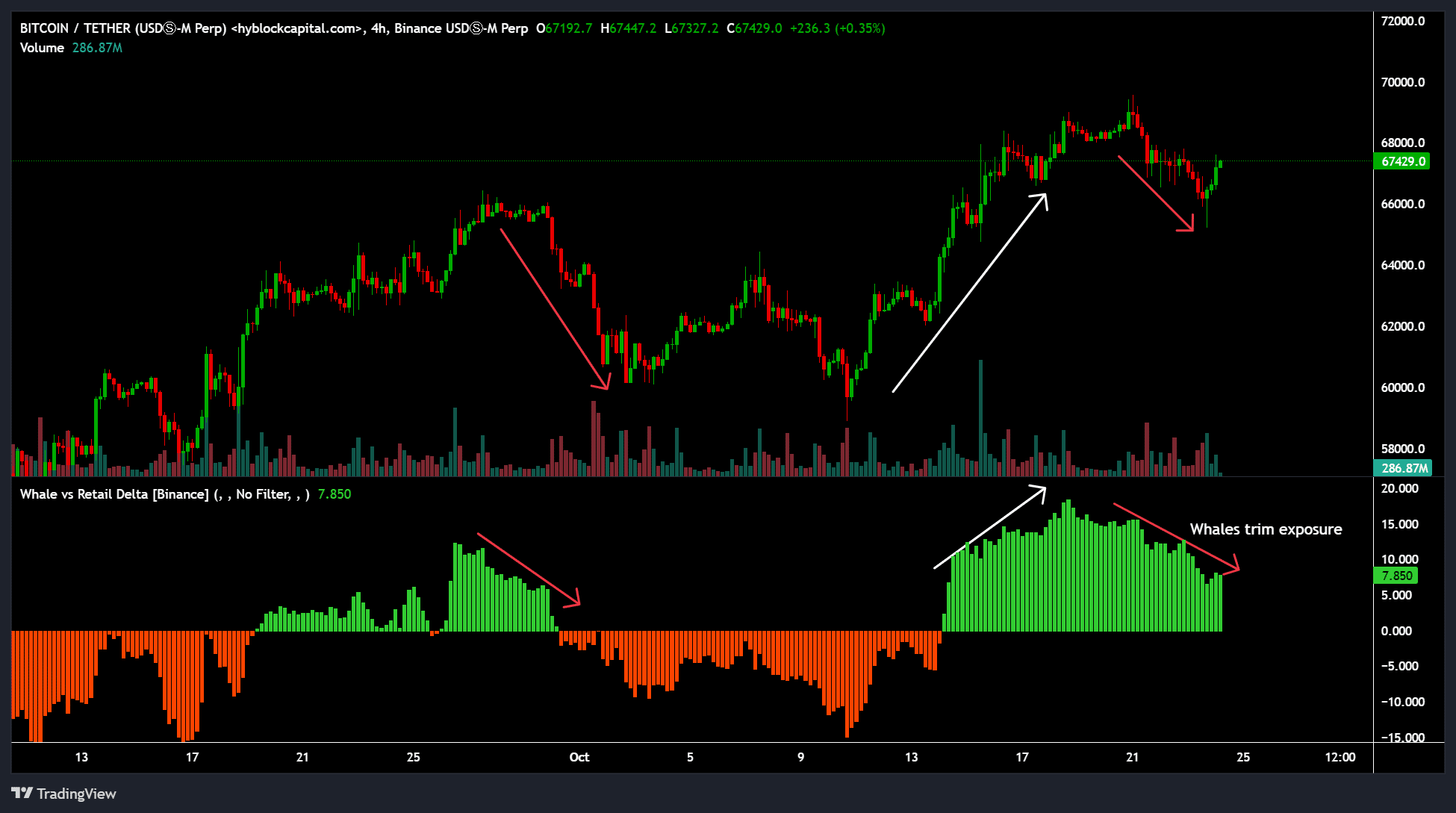

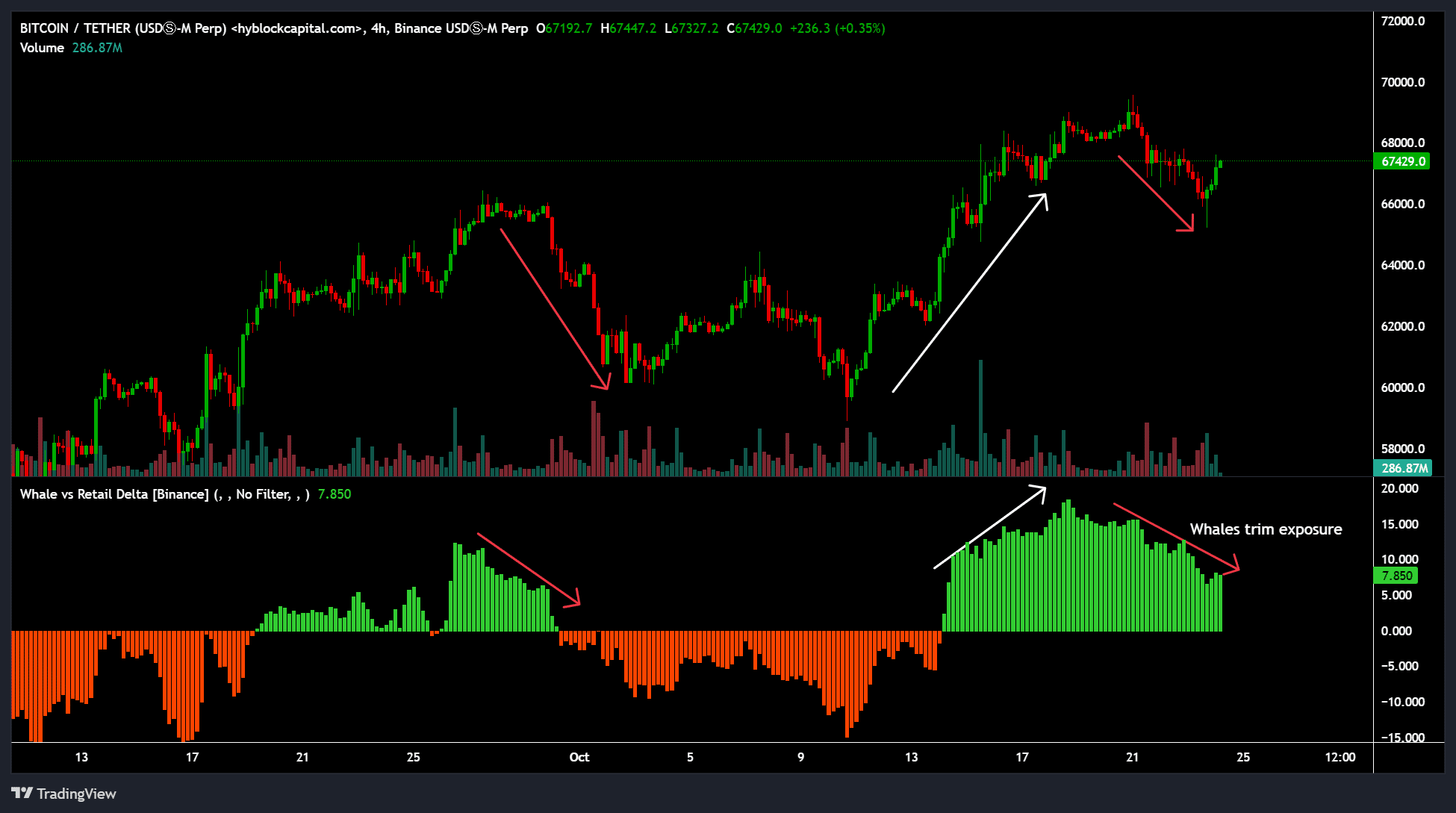

Since October 17, Whale vs. Retail Delta, which tracks Whales’ positioning towards retailers, fell, indicating Whales have trimmed their publicity to BTC.

Supply: Hyblock

Apparently, choices merchants remained bullish, as evidenced by their elevated buy of name choices (bets that the BTC worth will rise) on Election Day.

Within the day by day replace of October 22, buying and selling agency QCP Capital stories noted,

“Quick-term implied volatility peaks on the shut of Election Day, with an expansion of 10 vol over the earlier expiration and skews favoring calls over places, regardless of BTC buying and selling round 8% beneath its excessive stage ever is”

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024