Bitcoin

Bitcoin Open Interest crashes by $10B – Will this wipeout fuel a new rally?

Credit : ambcrypto.com

- The Futures market of Bitcoin noticed greater than $ 10 billion in open curiosity swept away.

- CME Open rate of interest fell by 45% from December 18 to March 18.

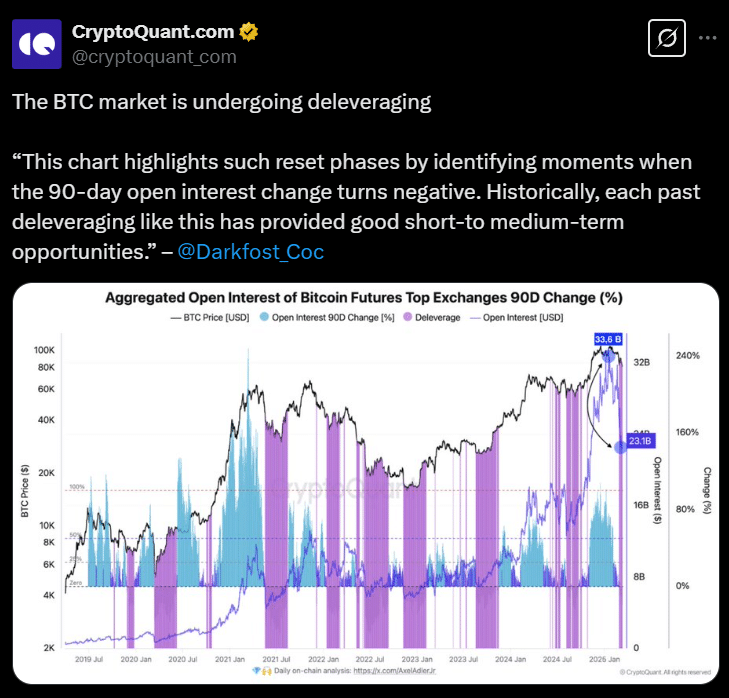

Bitcoin’s [BTC] Futures Market is present process one of many largest Deleveraaging occasions, with greater than $ 10 billion in open curiosity since January 2025. The height, on January 17, amounted to $ 33 billion.

It was a document excessive of market lever, in keeping with one Cryptuquant Analyst.

Supply: X

Between February 20 and March 4, the open rate of interest fell by $ 10 billion.

The decline was apparently accelerated by organising the uncertainty of each home and worldwide political developments and market -wide liquidations.

Cryptoquant analysts describe this section as a pure market set, a sample that has been traditionally preceded prematurely of bullish traits in brief to medium time period.

This decline just isn’t the primary time that extreme leverage has activated a market set.

Historical past repeats itself: Echos from March 2024

An identical occasion occurred in March 2024, when Bitcoin returned sharply from $ 69,000 to $ 59,700. That particular occasion pressured a wave of obligatory outputs of lifting tree positions, a complete of $ 1 billion.

Furthermore, that correction led to a standardization of financing percentages in giant cryptocurrencies, which made the street clear for a seamless assembly later within the yr.

As historical past suggests, Deleveraging -Cycli usually coincides with exterior financial and geopolitical developments, which additional reinforces market reactions.

The latest Deleveraging Wave was reportedly influenced by exterior geopolitical tensions and steady macro -economic shifts, including complexity to market dynamics.

A collection of market reactions adopted Donald Trump’s current statements about Crypto, together with claims of ending “Joe Biden’s Struggle on Bitcoin and Crypto.”

Market -wide delevering just isn’t remoted. Financing proportion Actions present additional perception into how merchants have adjusted their danger publicity throughout this era.

From $ 104k to $ 82k – what actually occurred?

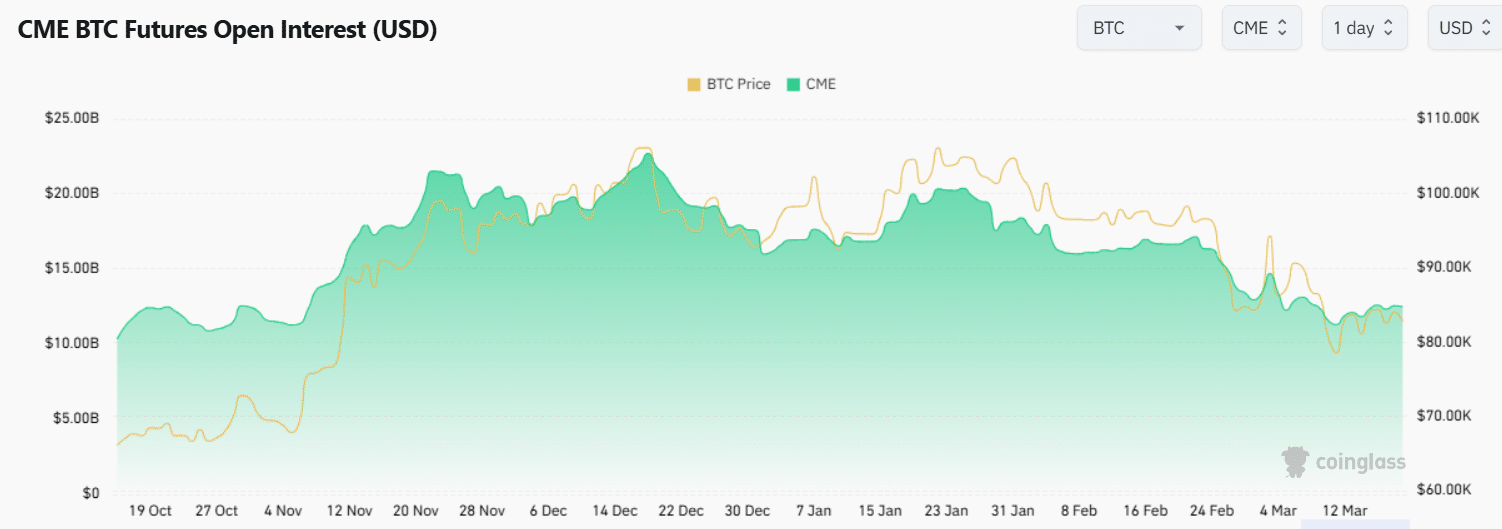

By the top of February, the open curiosity on Bitcoin -Futures contracts had fallen beneath $ 60 billion, a lower of $ 70 billion in January, in keeping with information from Coinglass.

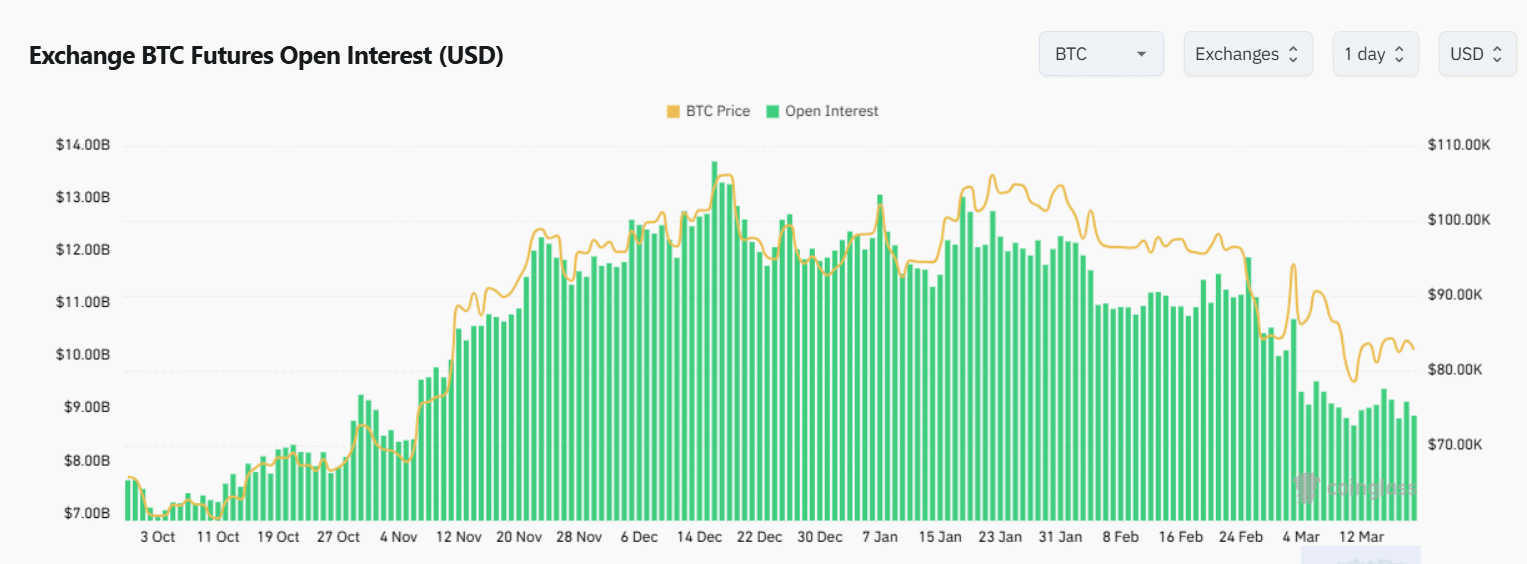

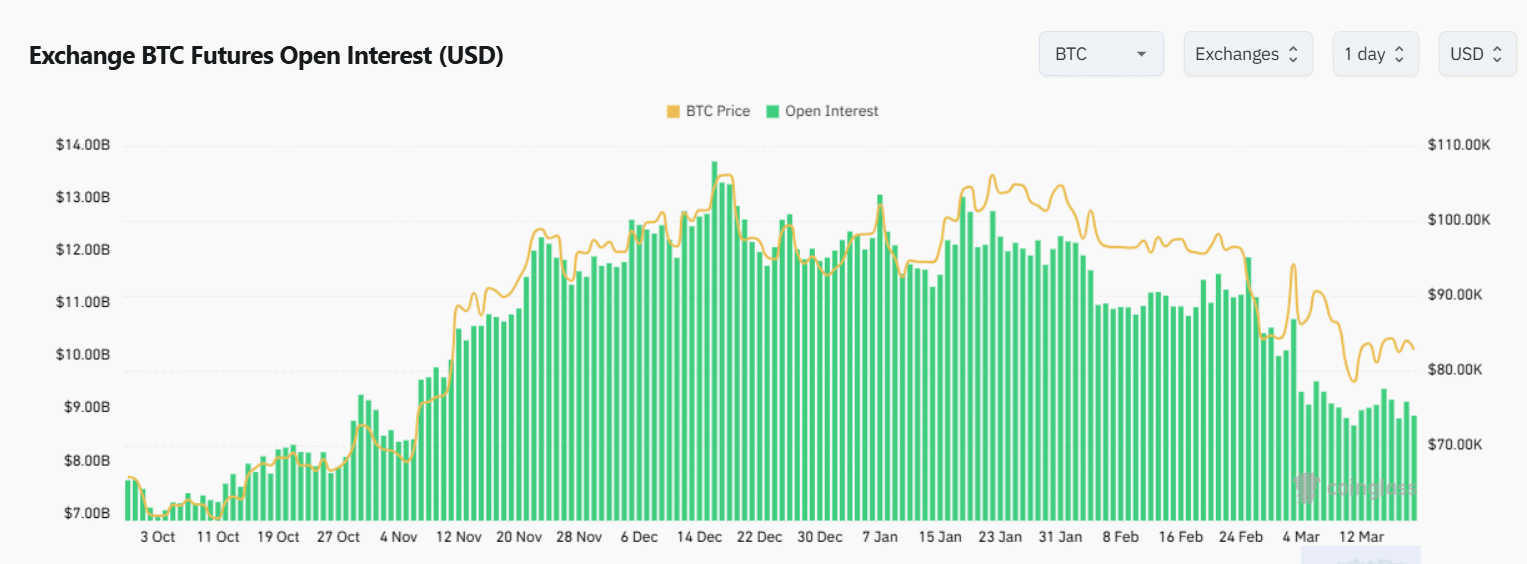

Supply: Coinglass

Bitcoin’s Futures Open curiosity on Coinglass emphasised the connection between leverage discount and worth actions.

Between December 2024 and March 2025, Bitcoin’s open rate of interest fell from $ 13.70 billion to $ 8.86 billion. The information verify a lower of 35% in OI throughout this era, along with a 20% lower within the Bitcoin worth.

This implies that the December rally was fed by extreme leverage, which was later settled as sentiment shifted.

Supply: Cryptuquant

Financing percentages Flip

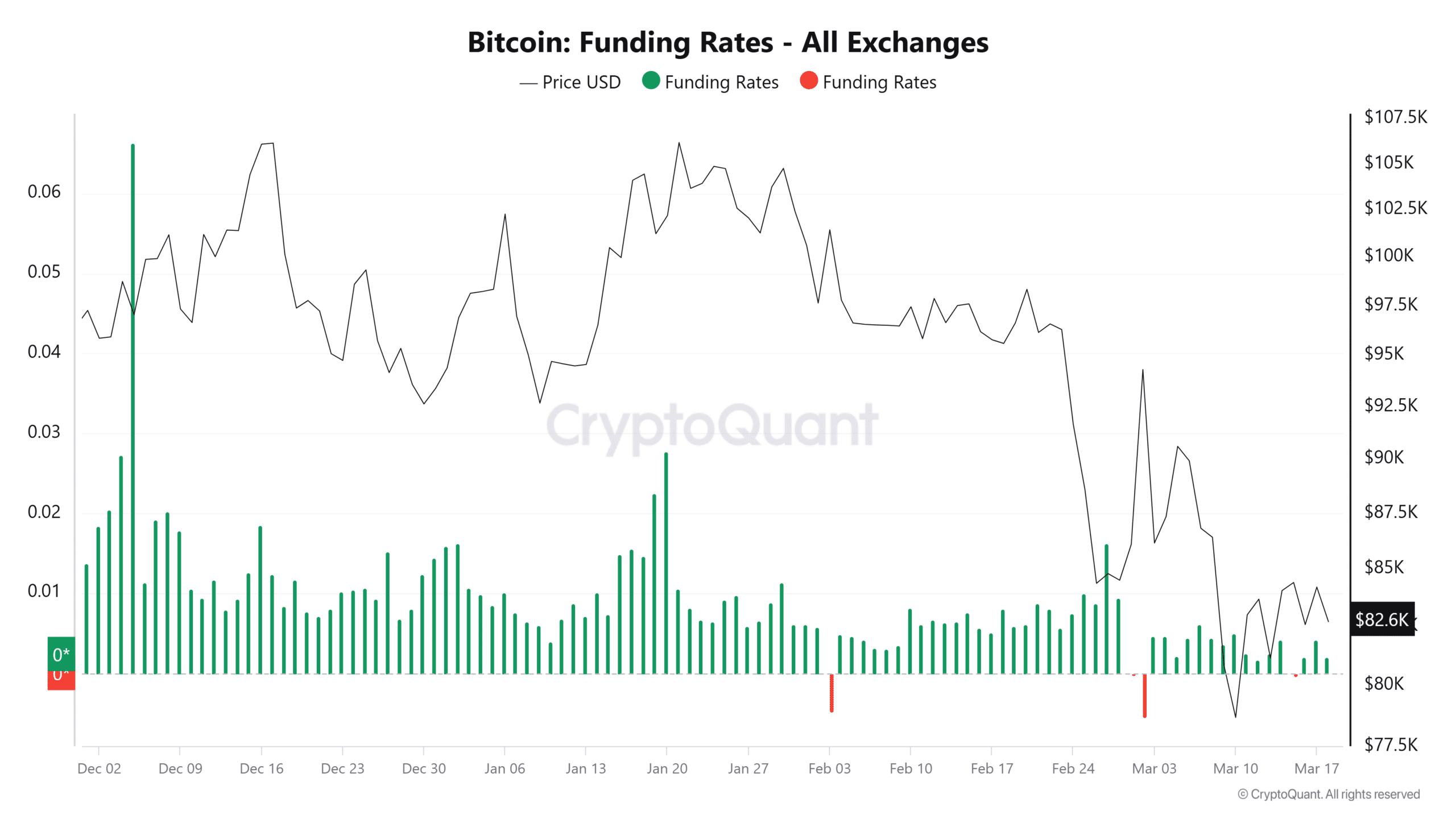

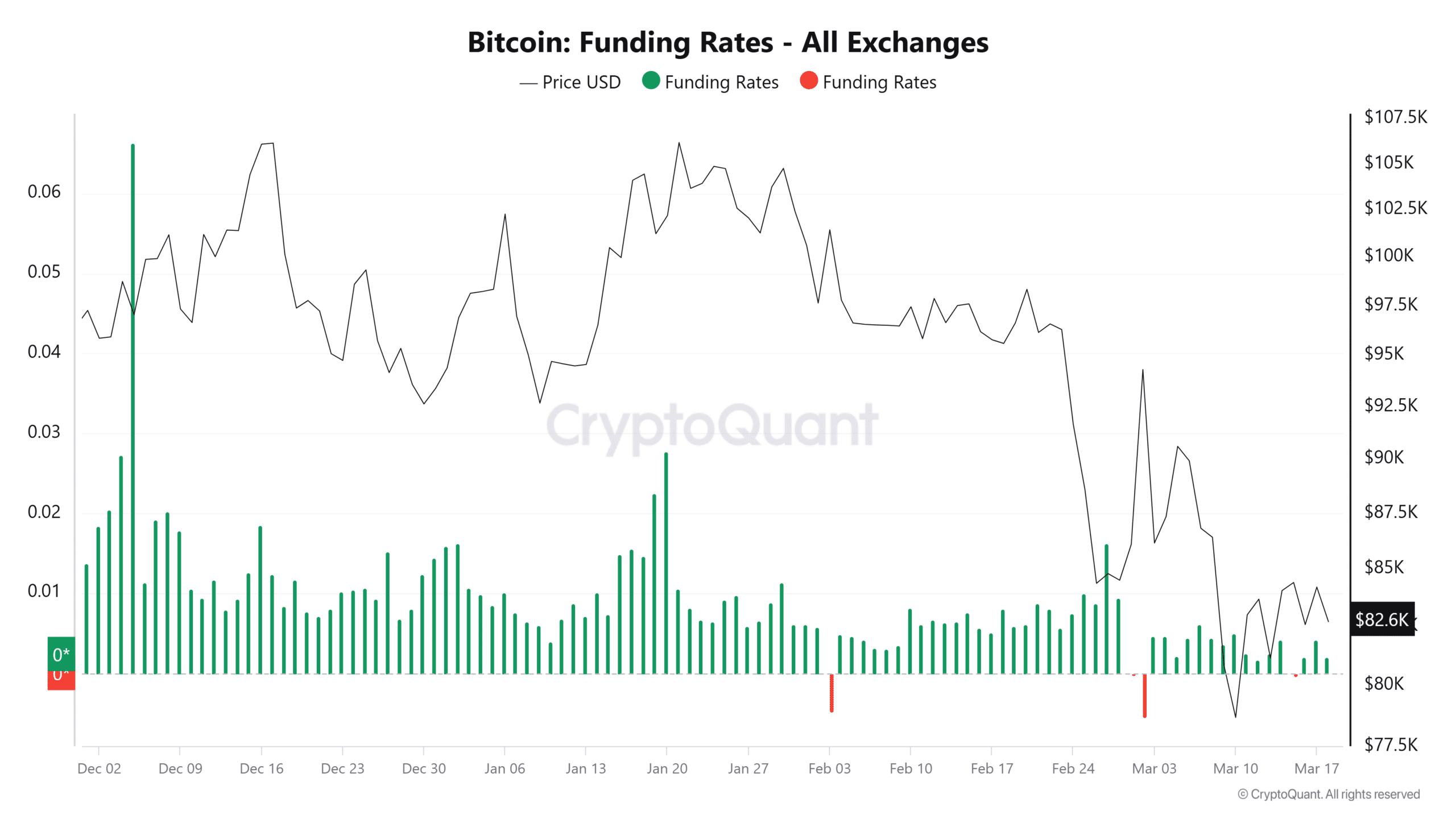

Tendencies for financing proportion provided Extra affirmation of the present delevering of Bitcoin.

Between December 2024 and March 2025, the financing percentages shifted from extremely constructive to unfavorable. That was a transition from bullish to bearish sentiment.

Throughout December and the start of January, the financing percentages have been constantly constructive, which displays a excessive demand for livered lengthy positions.

On 3 February, the financing percentages turned unfavorable for the primary time in months (-0.00479), along with Bitcoin’s prize peak of $ 101,440.

By March 2, the financing percentages had fallen additional to -0,00554. This confirmed that merchants conclude lifting tree positions or have been confronted with pressured liquidations.

This lower displays the reset from March 2024, when the charges have collapsed from triple figures to lower than 20%, indicating the top of an overheated futures market.

Because the financing percentages reset, open curiosity information supply a unique perception into perception into how capital left lifting tree positions.

How institutional merchants responded

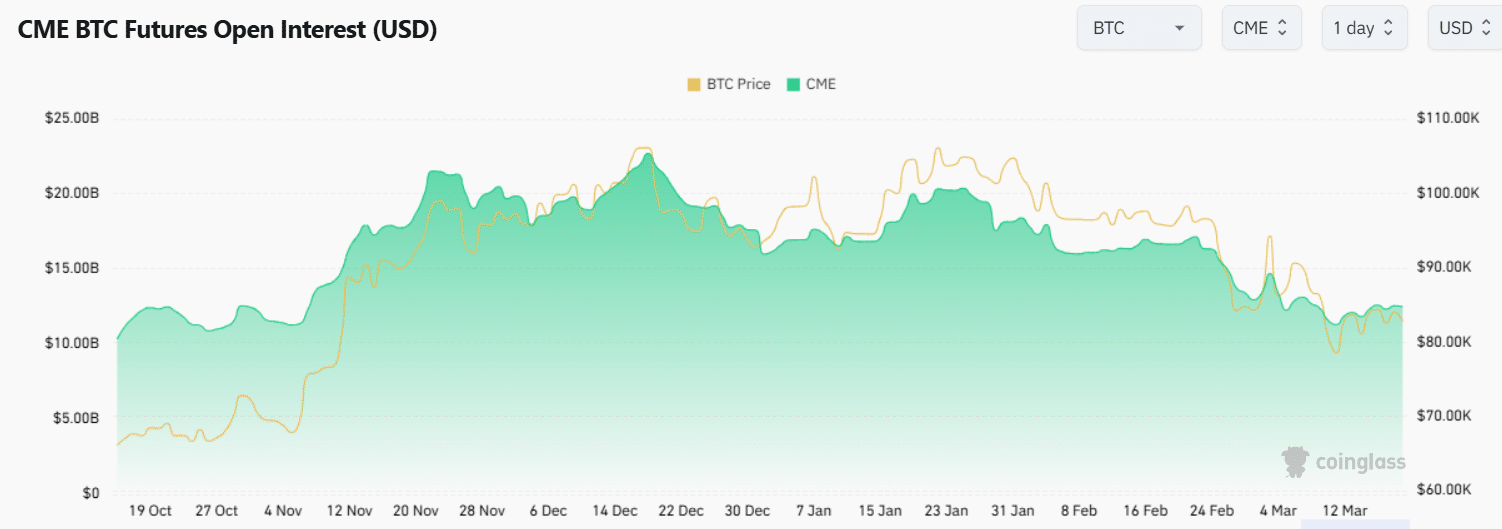

Institutional merchants adopted an identical sample, with CME Bitcoin -Futures that confirmed an identical discount in publicity to livered.

A pointy lower within the open curiosity of CME Bitcoin Futures confirms that institutional merchants have additionally decreased publicity to leverage.

Supply: Coinglass

CME Bitcoin Futures Open rate of interest fell by 45% of $ 22.71 billion on December 18 to $ 12.50 billion by March 18, when Bitcoin dropped to $ 82,785.

To additional validate the diploma of market set, financing velocity on a broader scale supply an additional perspective.

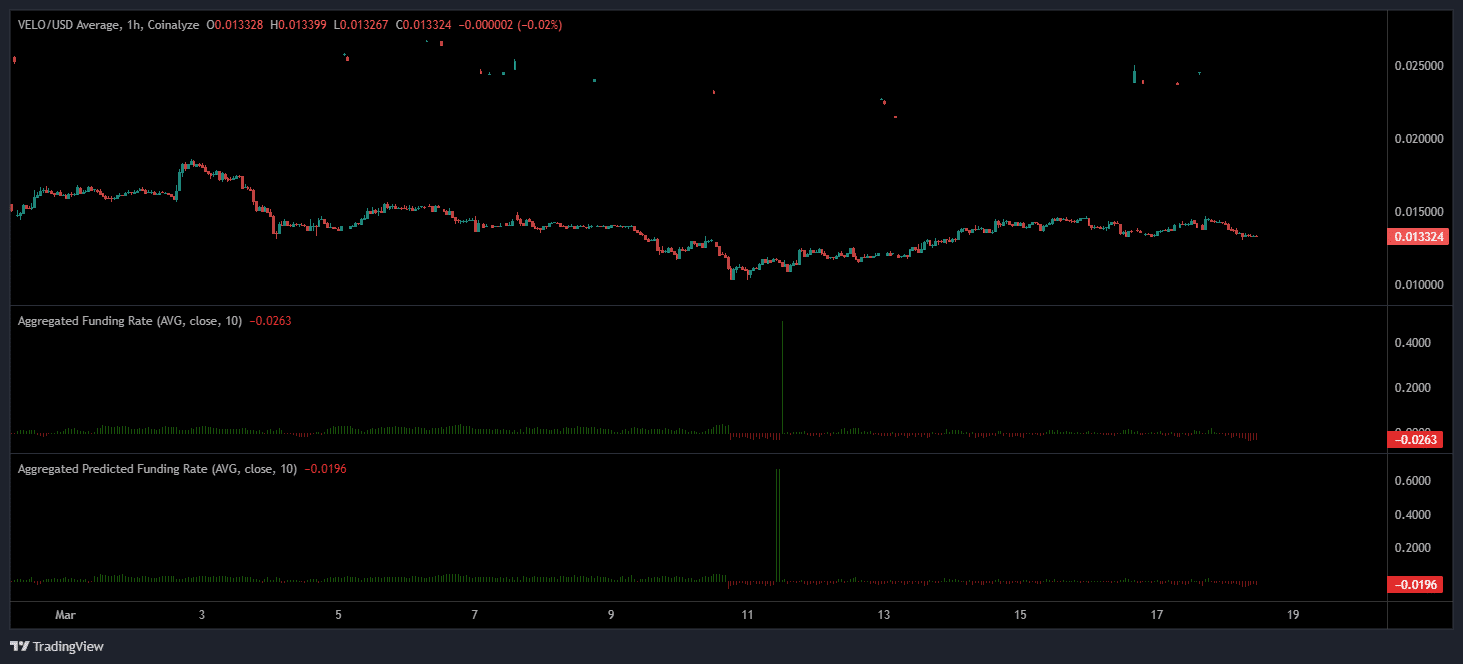

An evaluation of aggregated financing percentages additionally helps the Deleveraging thesis.

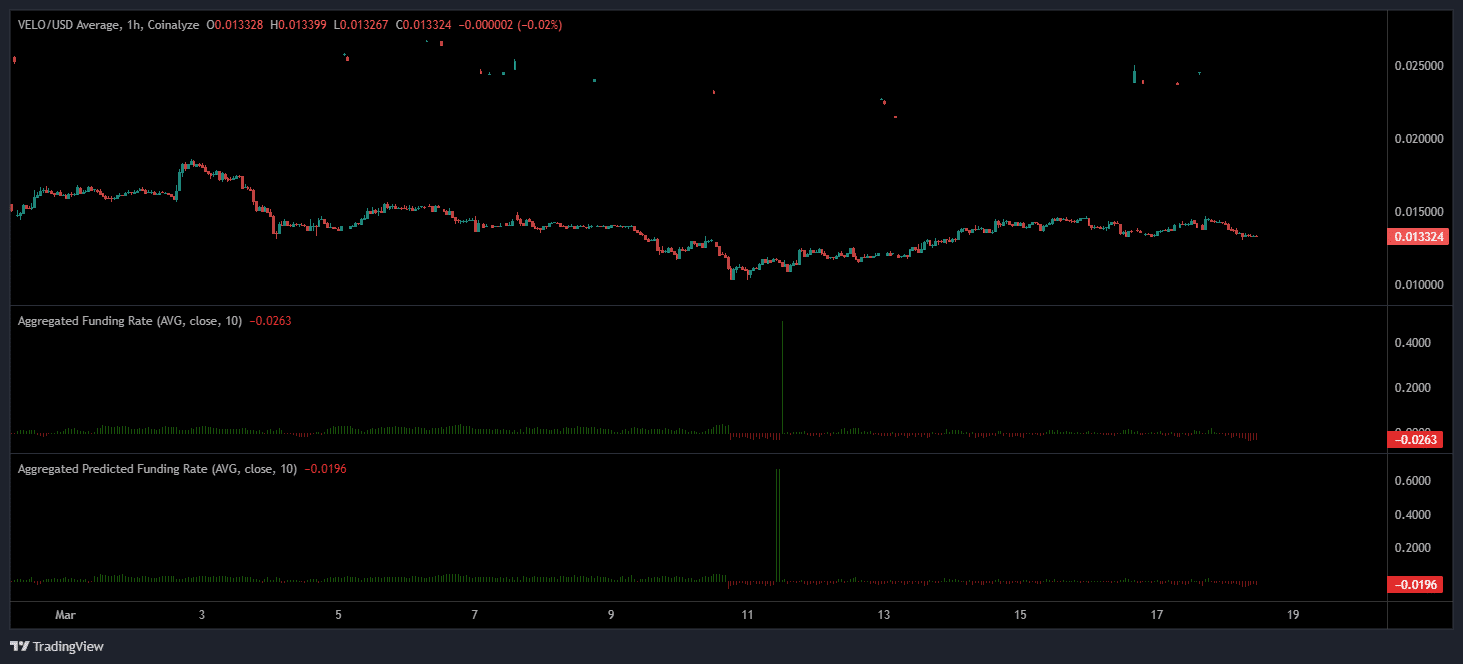

On March 11, aggregated financing percentages streamed as much as +0.4984, because of an overheated market. Nonetheless, a fast reversal adopted, with the charges that turn out to be unfavorable by March 18 (-0.0263).

Supply: VELO/COINALYZE

The value lower of Bitcoin from $ 101,440 in February to $ 82,800 in March means that merchants are aggressively lengthy positions settled, which reinforces the downward stress.

A reset or a reversal?

Regardless of the current decline, analysts see potential for a bullish restoration.

Bitcoin’s Deleveraaging of $ 10 billion is likely one of the largest resets in additional than a yr.

With the normalization of financing and stabilizing open curiosity, merchants watch accumulation indicators that may trigger a bullish development in Q2 2025.

Though uncertainties persist, historic patterns point out that such resets usually release the way in which for lengthy -term restoration.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024