Altcoin

Bitcoin Open Interest Drops to $20.7 Billion: A Sign of Market Caution?

Credit : ambcrypto.com

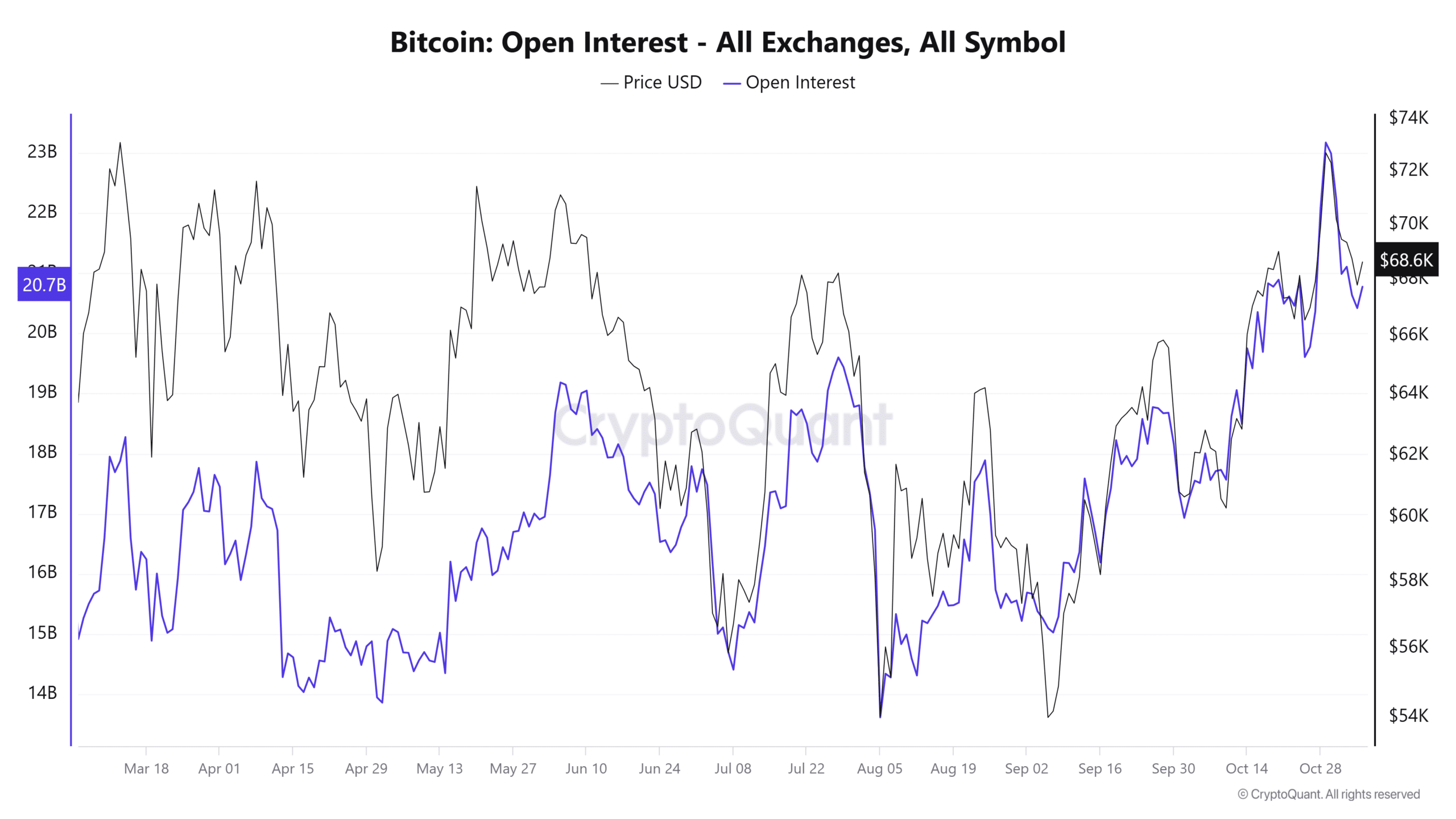

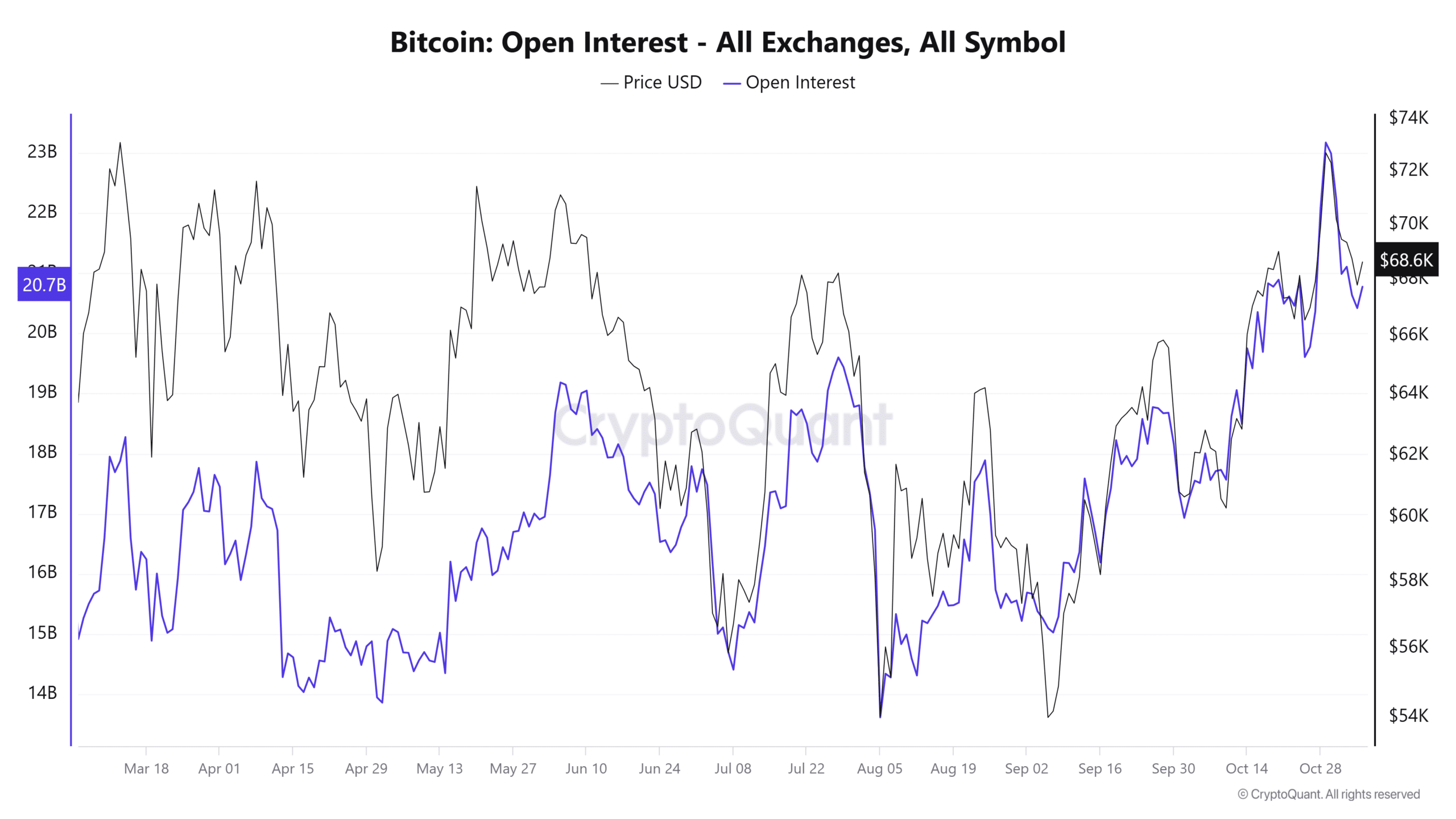

- Bitcoin’s open curiosity lately fell from $23 billion to $20.7 billion.

- Regardless of the drop in open curiosity, the worth of BTC stays above $68,000.

The Bitcoin [BTC] open curiosity and worth motion are displaying notable shifts as market volatility will increase forward of US election week. Knowledge signifies a pointy decline in BTC open curiosity throughout all exchanges, indicating merchants have gotten extra cautious amid unsure market circumstances.

The present panorama displays a cautious however speculative atmosphere, coupled with rising volatility within the S&P 500 (adopted by the VIX Index) and excessive numbers on the Crypto Concern & Greed Index.

Bitcoin Open Fee Drop: A Signal of Warning or an Alternative?

Bitcoin’s open curiosity lately fell from over $23 billion to $20.7 billion, reflecting a shift as merchants unwind their leveraged positions.

Traditionally, decreased open curiosity signifies much less market leverage, indicating merchants could also be pulling again from riskier bets. This pattern may very well be influenced by the approaching US elections, as political occasions typically deliver further uncertainty and volatility to monetary markets.

Supply: CryptoQuant

Curiously, regardless of the decline in open curiosity, Bitcoin’s worth has remained secure above $68,000, indicating underlying power. This resilience could point out that whereas leverage has declined, spot shopping for stays sturdy, presumably pushed by long-term holdings.

For merchants, the discount in open curiosity might imply a pause in speculative exercise, however for long-term traders it boosts confidence in Bitcoin’s upside potential.

The Impression of the US Elections on Bitcoin Open Curiosity and Market Volatility

The VIX, or Volatility Index, for the S&P 500 has risen to round 21.97, indicating heightened worry in conventional markets. Traditionally, excessive VIX ranges correspond to elevated warning round riskier property resembling cryptocurrencies.

Buyers look like making ready for broader market swings because the US election approaches, which is able to influence each shares and digital property like Bitcoin.

Supply: TradingView

The Relative Volatility Index (RVI) for Bitcoin, at present round 47.7, signifies potential worth swings and not using a sturdy directional pattern.

With the RVI close to 50, Bitcoin might expertise additional swings, in keeping with cautious sentiment because the elections strategy. A post-election shift in laws, particularly relating to digital property, might improve Bitcoin’s volatility.

Bitcoin Open Curiosity and Sentiment Indicators: Optimism Amid Warning

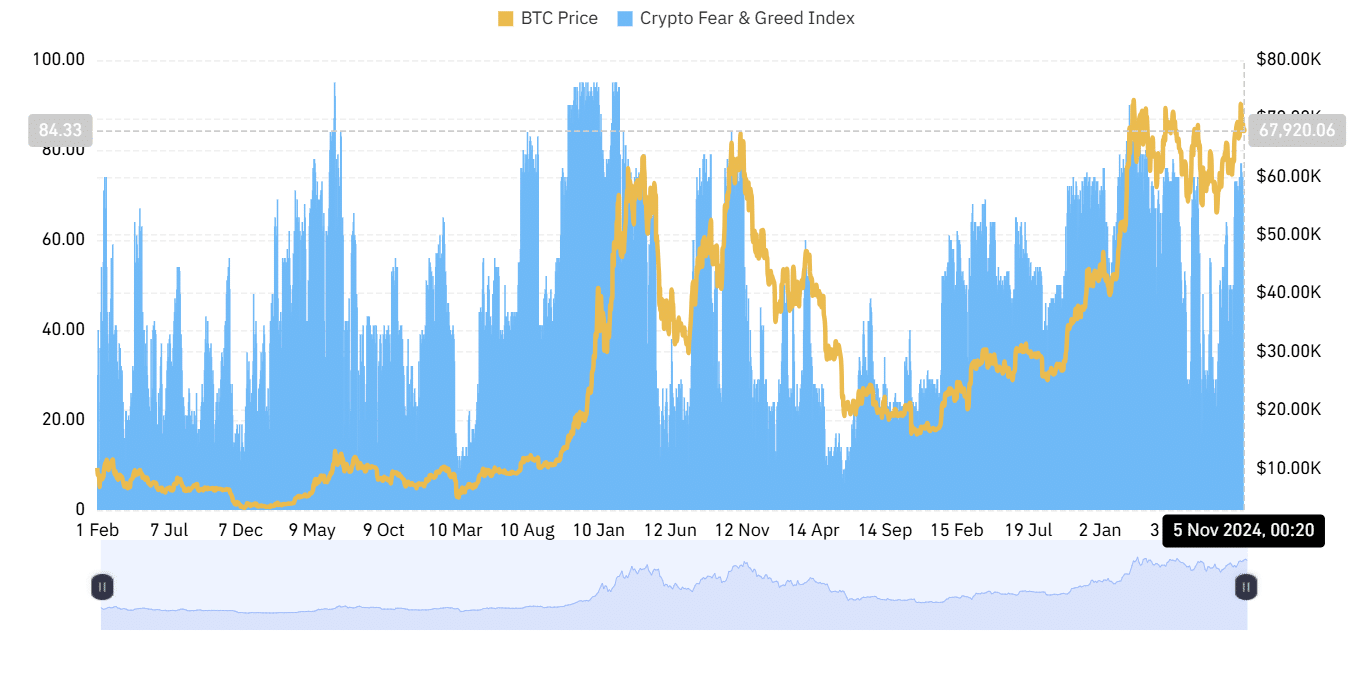

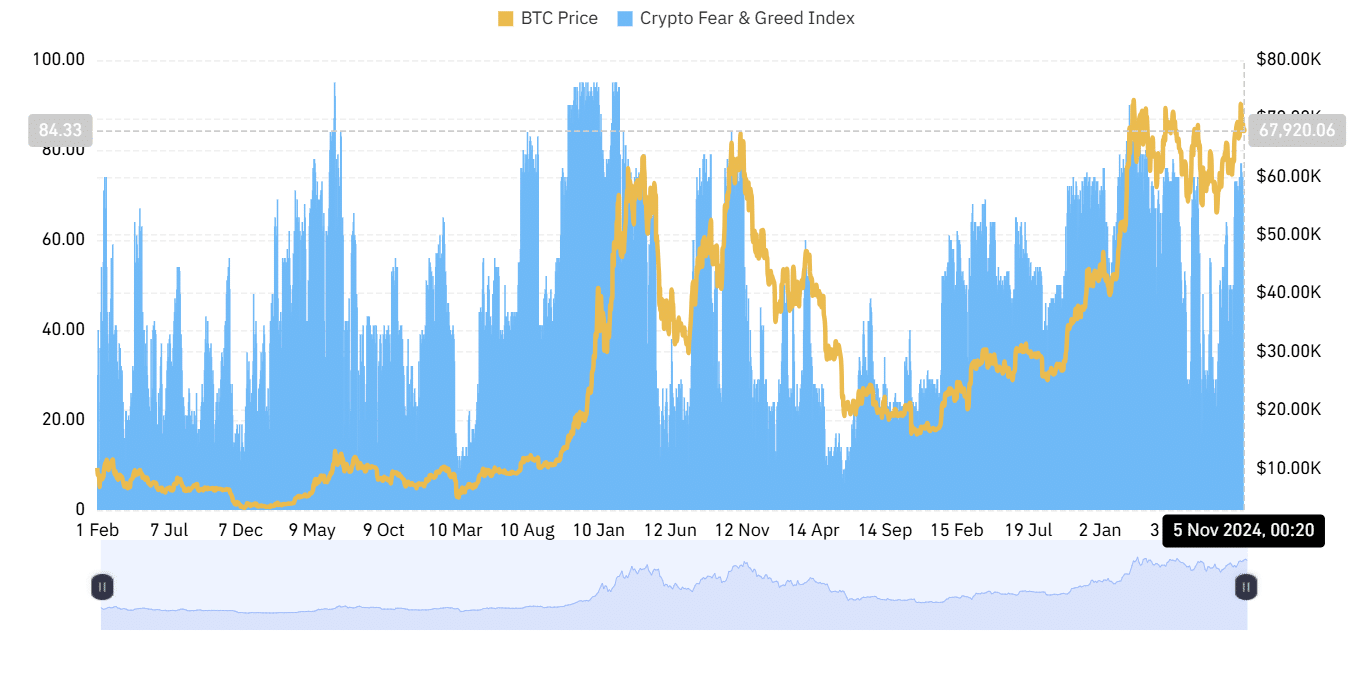

Regardless of the elevated warning, the Crypto Fear & Greed Index stands at 70 (Greed), indicating that whereas warning is warranted, general sentiment stays optimistic. This hole between excessive sentiment and cautious buying and selling conduct means that the market is ready for extra certainty after the elections.

Traditionally, Bitcoin has proven consolidation patterns or slight pullbacks earlier than resuming tendencies in response to election outcomes.

Supply: Coinglass

The mix of excessive sentiment and declining curiosity in Bitcoin Open might suggest that merchants are hesitant to extend leverage however nonetheless anticipate BTC’s worth resilience.

This sample of elevated sentiment with decrease leverage typically results in a consolidation part, the place optimistic traders look ahead to volatility to subside earlier than absolutely re-entering the market.

Outlook for Bitcoin Worth and Open Curiosity After the Election

With the US elections as a possible catalyst, Bitcoin futures actions might rely upon each political and macroeconomic developments.

Merchants will probably search for a breakout above $70,000 or a secure consolidation above key help ranges to substantiate a post-election uptrend. Conversely, any sudden election consequence or new regulatory coverage might briefly disrupt Bitcoin’s path.

Learn Bitcoin (BTC) worth prediction 2024-25

Because the election approaches, Bitcoin seems to be in a holding sample, supported by long-term confidence, but tempered by near-term warning.

Metrics resembling Bitcoin Open curiosity and the Concern & Greed Index will likely be essential for measuring market sentiment. Relying on the result of the election, Bitcoin might consolidate or set its sights on new highs within the coming months.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now