Altcoin

Bitcoin or Altcoins? Here is how volatility shape your trade decisions

Credit : ambcrypto.com

- The value actions of Bitcoin in March 2025 have been extra steady in comparison with Altcoins

- Divergence is an indication of the maturity of Bitcoin as a steady energetic, whereas altcoins are confronted with larger speculative stress

In March 2025, altcoins similar to Cardano are [ADA]Solana [SOL]And XRP noticed a pointy peak in realized volatility, during which Ada hit a report of 150percentand surpass Sol and XRP 100%.

In the meantime Bitcoin [BTC] Additionally noticed a major volatility, however it remained comparatively modest at 50% – properly beneath the historic highlights.

Realized volatility displays the value variation for a sure interval. The stroll in ADA, SOL and XRP volatility is an indication of bigger value fluctuations, whereas the volatility of Bitcoin has remained comparatively steady.

Altcoins as hypothesis with a excessive threat

Compared with Bitcoin, Altcoins are extra delicate to speculative commerce, typically powered by information, rumors and group -driven momentum. This could result in exaggerated value fluctuations.

XRP has been notably delicate to authorized information, whereby the present sec -right case contributes to irregular value actions.

Throughout Uptrends available on the market, traders typically transfer capital from Bitcoin to Altcoins to pursue a better effectivity, which additional strengthens the volatility of Altcoin. Though this volatility gives bigger possibilities of revenue, it additionally will increase the chance of appreciable losses.

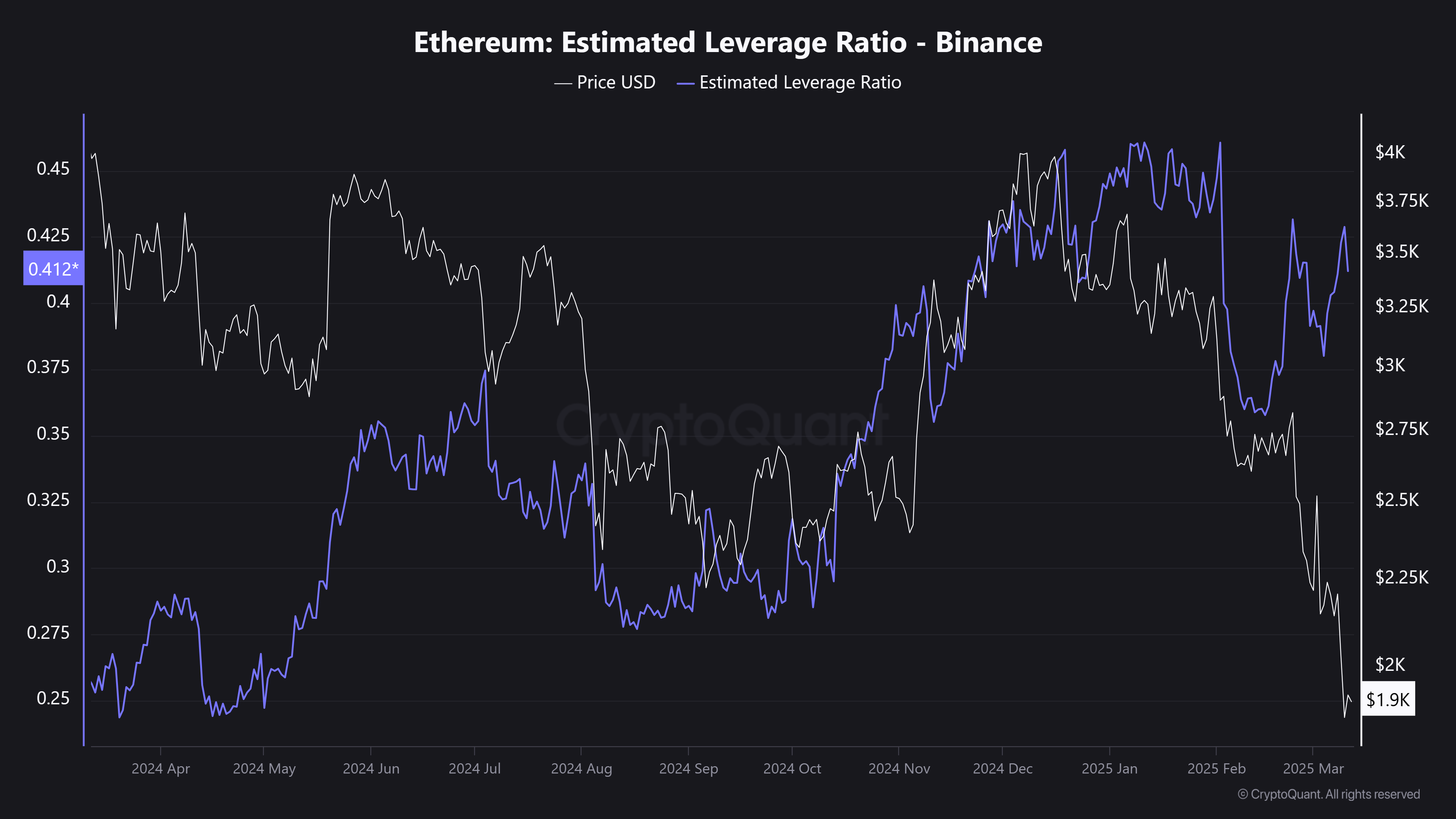

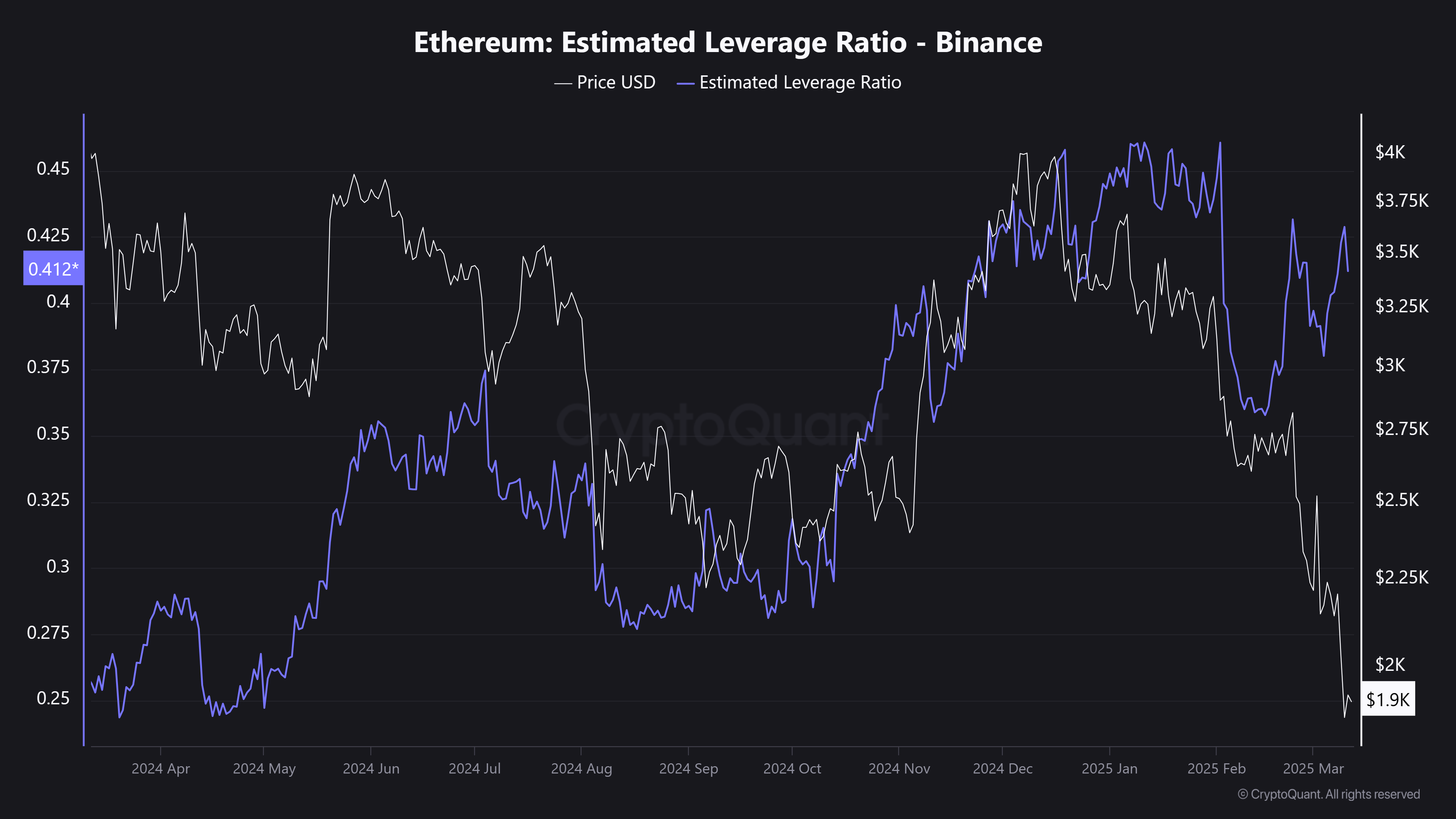

Ethereum (ETH) is an instance of this pattern. Regardless of the lack of help of $ 2,000 for the primary time since 2023 and the trade reserves are rising, the estimated lever ratio (ELR) has risen to a month-to-month excessive. This is a sign of elevated threat publicity in derivatives markets.

Supply: Cryptuquant

In different phrases, merchants elevate aggressive use of positions on each side, reinforce volatility – a conventional “excessive threat, excessive reward” setup that would feed aggressive value fluctuations.

This Altcoin diversion can be clear in value motion, with ADA, SOL and XRP that break below a very powerful help zones and are caught in consolidation.

Growing volatility is to show from Altcoin commerce right into a speculative sport with a excessive threat.

Nonetheless, Bitcoin, nonetheless, positions itself because the extra steady asset within the midst of the rising uncertainty?

Bitcoin as a steady retailer of worth

Traditionally, BTC has seen Volatility Pikes above 100%, however The details of March 2025 appeared to level out a extra steady value construction.

Though Bitcoin gives a safer port with decrease volatility, it additionally limits the revenue potential within the brief time period. This, in distinction to Altcoins, the place strengthened threat ends in the temptation of upper rewards.

Does this strengthen the function of Bitcoin as an extended -term firm? Nicely, volatility developments recommend that it may simply be.

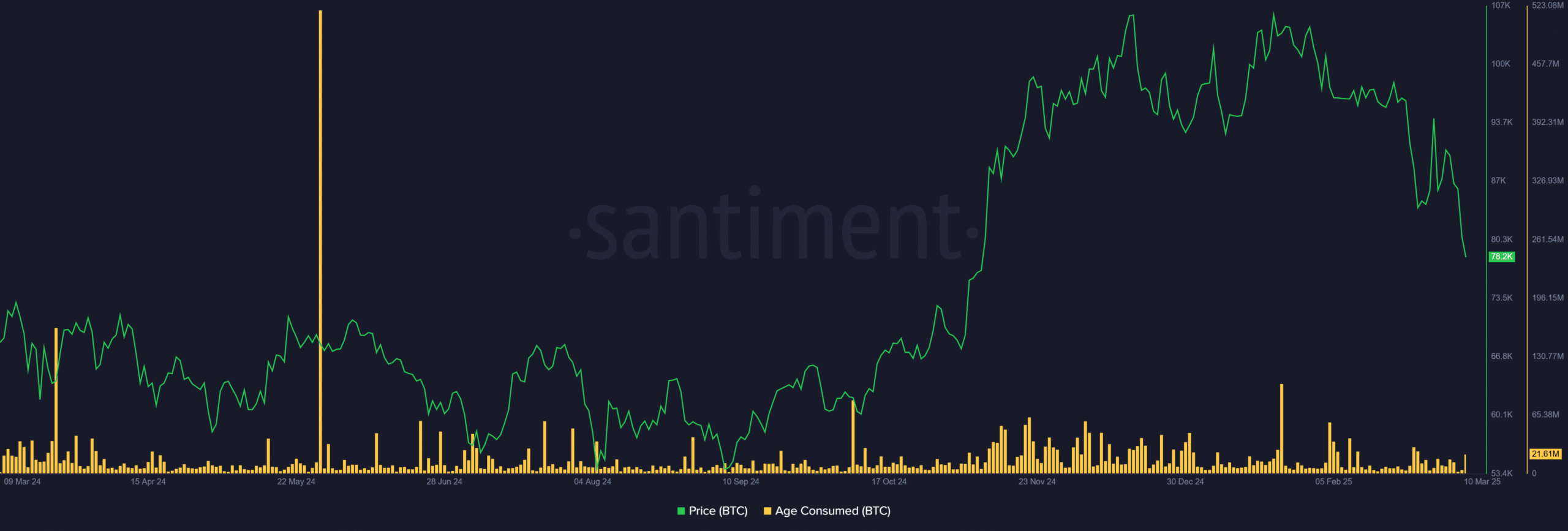

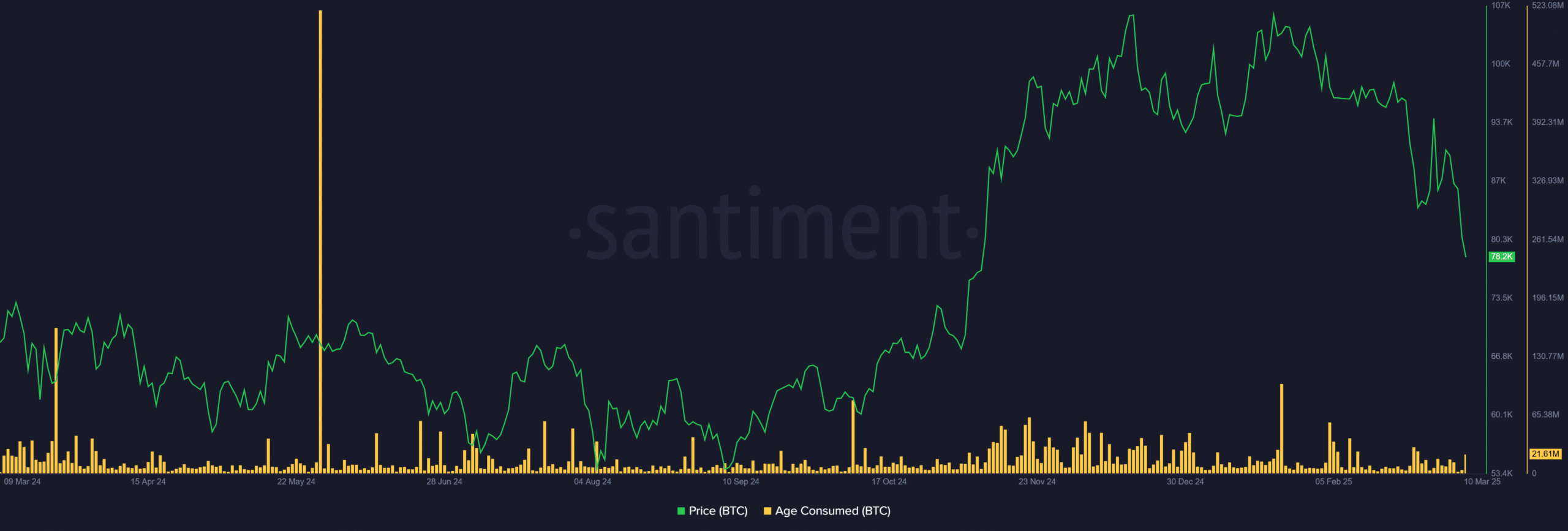

Within the meantime, the metrics utilized by the age of long-term holders’ actions is to not nail, even supposing BTC fell beneath $ 80k and knew billions in market worth.

Supply: Santiment

This prompt that seasoned traders usually are not shocked, reinforcing confidence in Bitcoin’s lengthy -term course of.

It’s clear that volatility developments now type commerce methods.

With altcoins that exhibit a better risk-remuneration potential, they’ll dominate hypothesis within the brief time period. Whereas Bitcoin continues to settle as the popular storage of worth in the long run.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024