The crypto market has suffered its most dramatic setback but as the overall market capitalization fell 8.92% in a single day to $3.76 trillion. successively, CoinMarketCaps The CMC20 index mirrored this decline, reaching $239.42 as panic engulfed the sector.

The Crypto Concern & Greed Index drops to a fear-driven 35, and the common crypto RSI drops to oversold territory at 25.97. Consequently, investor confidence disappeared nearly instantly. On the middle of this storm, the Bitcoin worth collapsed steeply, inflicting intense promoting strain. This additional heightened the sense of disaster and fueled a wave of heavy liquidations that left each merchants and long-term holders reeling.

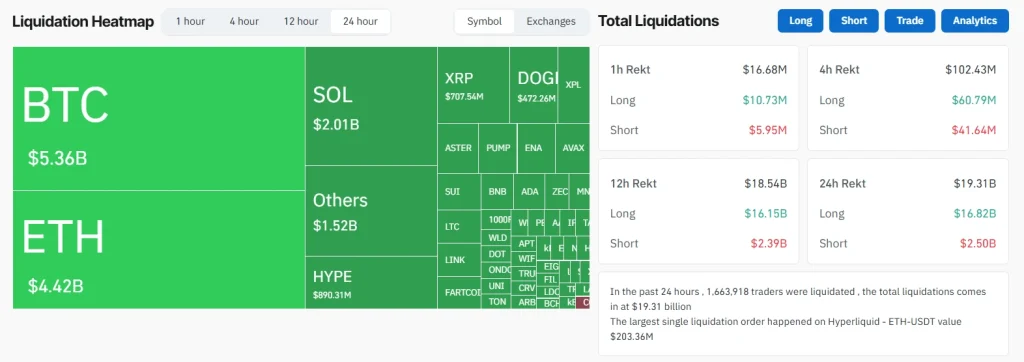

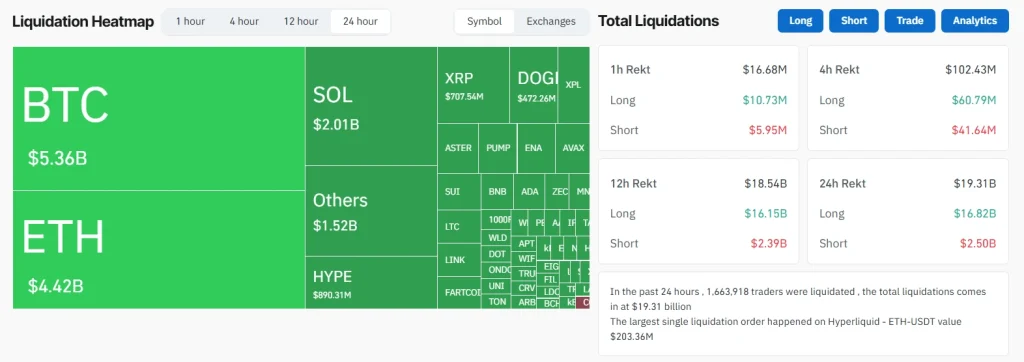

Liquidations soar previous $19.31 billion

In what entrepreneurs are calling the largest crash in crypto historical past, a whopping $19.31 billion in positions had been liquidated inside 24 hours. In keeping with MintGlassBitcoin led the listing with a lack of $5.36 billion, intently adopted by Ethereum with $4.42 billion. Greater than 1.66 million merchants had been worn out because the market underwent a historic debt wave

What made this occasion particular was the convergence of macroeconomic panic and publicity to overleveraged derivatives. The catalyst? President Trump’s aggressive stance on Chinese language tariffs despatched shockwaves via international markets. Contains shares and digital property.

Bitcoin Value Evaluation:

Bitcoin worth fell 6.91% in at some point to $112,759.64, marking a lack of 8.02% up to now week. The market capitalization fell 6.85% to $2.24 trillion, though buying and selling quantity rose 141% to $179.86 billion. BTC worth motion noticed a dramatic drop beneath the essential transferring averages, breaching the psychologically necessary $113,000 degree and hitting a 24-hour low of $104,582.

Technically, it is best to look ahead to worth defenses round $109,200, the 78.6% Fibonacci retracement. Consequently, an oversold RSI at 24.85 suggests reduction could also be so as. However the total context stays clearly risk-free till macro uncertainty subsides and ETF inflows develop past a single supplier.

Regularly requested questions

The primary components had been US-China tariffs, document derivatives liquidations and a pointy flip in investor sentiment, with Bitcoin’s correlation with shares exposing it to broader market panic.

Whereas the RSI indicators an oversold setup and a few establishments are shopping for, common concern stays excessive. The danger is elevated till assist holds at $109,208.

Key indicators embrace the readability of US financial knowledge, stabilization of ETF flows and Bitcoin holding the assist at $109,208.