Bitcoin

Bitcoin Price Crashes Below $98,000 To 6-Month Low

Credit : bitcoinmagazine.com

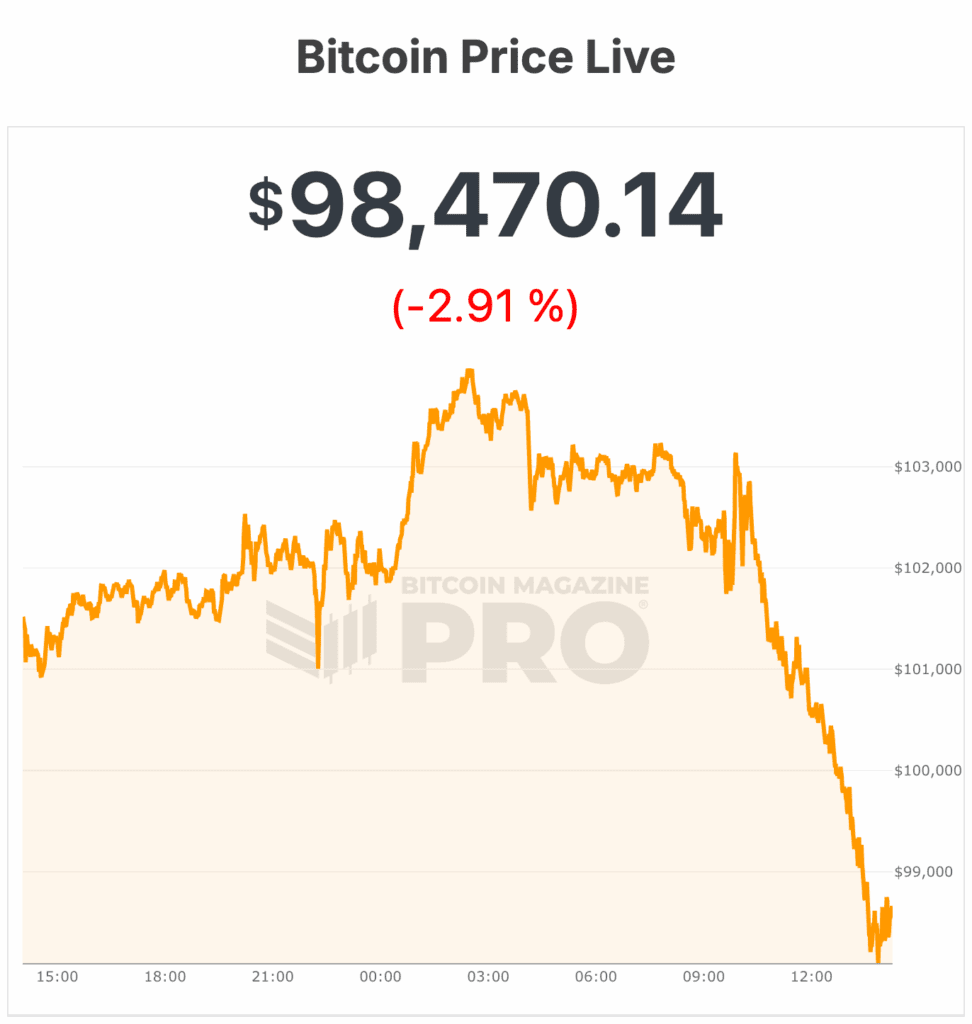

Bitcoin worth fell sharply right this moment, falling from an intraday excessive of $104,000 to $98,113, erasing earlier positive aspects and marking a decisive break in worth motion.

As of morning buying and selling, Bitcoin worth constantly fell from a excessive of $102,000 to a low of $97,870.

Based on information from Bitcoin Journal Professional, the final time the Bitcoin worth was close to this degree (beneath $98,000) was in early Could – round Could 8, relying on time zone. Bitcoin’s worth then rose above $100,000 for greater than 40 days earlier than falling again to $98,000 in late June.

One attainable cause why the bitcoin worth is long-term holders unloading at report ranges. Information from CryptoQuant shows they bought round 815,000 BTC in 30 days – probably the most since early 2024 – as demand for spot and ETFs weakens. Revenue-taking dominates, with $3 billion in realized earnings on November 7 alone.

Institutional purchases have additionally fallen beneath day by day mining provide, rising promoting strain. Costs are hovering close to the essential 365-day shifting common of round $102,000, and failure to carry them may result in greater losses, in keeping with Bitcoin Journal Professional evaluation.

Analysts at Bitfinex say bitcoin’s present pullback displays mid-cycle retracements, with the decline from the October excessive matching the standard 22% decline seen in the course of the 2023-2025 bull market.

“Additionally it is essential to notice that even on the $100,000 degree, roughly 72 % of the entire BTC provide continues to make earnings,” Bitfinex analysts wrote. Bitcoin Journal. They imagine {that a} temporary revival of emergency assist is probably going, however {that a} sustainable restoration would require new demand.

That is what JPMorgan analysts say at The Block participation Bitcoin’s present estimated manufacturing value of $94,000 acts as a historic worth flooring, indicating restricted draw back.

The analysts imagine that rising community issues have elevated manufacturing prices, maintaining Bitcoin’s price-to-cost ratio close to all-time lows. The analysts preserve a daring upside projection for the subsequent six to 12 months of round $170,000.

All this comes because the US authorities has reopened after a report 43-day shutdown, the longest in historical past, after President Trump signed a funding invoice late Wednesday.

Whereas federal operations resume, restoration will likely be gradual. Federal employees are nonetheless ready for again funds, and air journey delays may proceed.

Timot Lamarre, director of market analysis at Unchained, described bitcoin Bitcoin Journal as a “canary within the coal mine for drying up market liquidity.” He notes that the latest authorities shutdown has precipitated the Treasury’s Common Account to develop, absorbing liquidity, including that with the federal government reopening, “extra liquidity injected into the system will profit Bitcoin’s greenback worth within the close to time period.”

Companies such because the tax authorities suffer from major backlogsand nationwide parks are struggling to regain misplaced income. The short-term financing measure solely runs till January 30, which suggests the specter of a brand new shutdown looms.

The return to normality will take a while as the results of the extended shutdown proceed to ripple by the financial system and public providers.

Bitcoin’s worth soared in October as the federal government shutdown started, rising to new all-time highs above $126,000. However the pleasure shortly gave strategy to turbulence: Bitcoin costs fluctuated wildly for the remainder of October and November.

On the time of writing, Bitcoin’s worth stands at $98,470.

Regardless of an general bullish temper available in the market, the bitcoin worth has continued to fall deeper into the month.

Bitcoin worth and Nasdaq is the correlation that solely hurts: Wintermute

Bitcoin remains to be carefully tied to the Nasdaq, however reveals an uncommon sample: it responds extra strongly to cost drops than to positive aspects, a latest research reveals. report from Wintermute.

This “unfavorable skew” – which falls tougher on dangerous inventory days than rises on good ones – is often seen in bear markets, not when BTC is close to all-time highs. It signifies that buyers are considerably drained and never euphoric.

Two essential components are driving this. First, by 2025, consideration and capital could have shifted to equities. Massive tech and Nasdaq progress shares are absorbing a lot of the danger urge for food which will have flowed into cryptocurrencies. Bitcoin strikes with the market when issues go improper, however would not get the identical carry when optimism returns, behaving like a high-beta macro threat tail.

Secondly, liquidity in crypto is smaller than earlier than. Stablecoin issuance has stalled, ETF inflows have slowed, and worth depth has not but totally recovered. This makes downward actions extra obvious and widens the efficiency hole.

That stated, BTC is holding up remarkably nicely, in keeping with Wintermute. Even with this continued downward pattern, the worth is lower than 20% beneath its all-time excessive. The sample is uncommon close to the tops – it normally seems close to the bottoms – nevertheless it additionally displays Bitcoin’s rising maturity as a macro asset.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now