Bitcoin

Bitcoin Price Dip Or New Bear Market?

Credit : bitcoinmagazine.com

The Bitcoin value is beginning to present clear indicators of weak point, and the latest drop beneath six figures has compelled a reassessment of the short-term outlook. With a number of key technical and on-chain ranges misplaced, I’ve recalibrated my base case in order that the likelihood of retesting new all-time highs within the coming weeks has fallen beneath 50%. That would change rapidly if main ranges are regained, however till then, circumstances resemble a market shifting away from pattern power and right into a deeper corrective section.

Bitcoin Worth: Is ‘Shopping for The Dip’ Nonetheless the Proper Transfer?

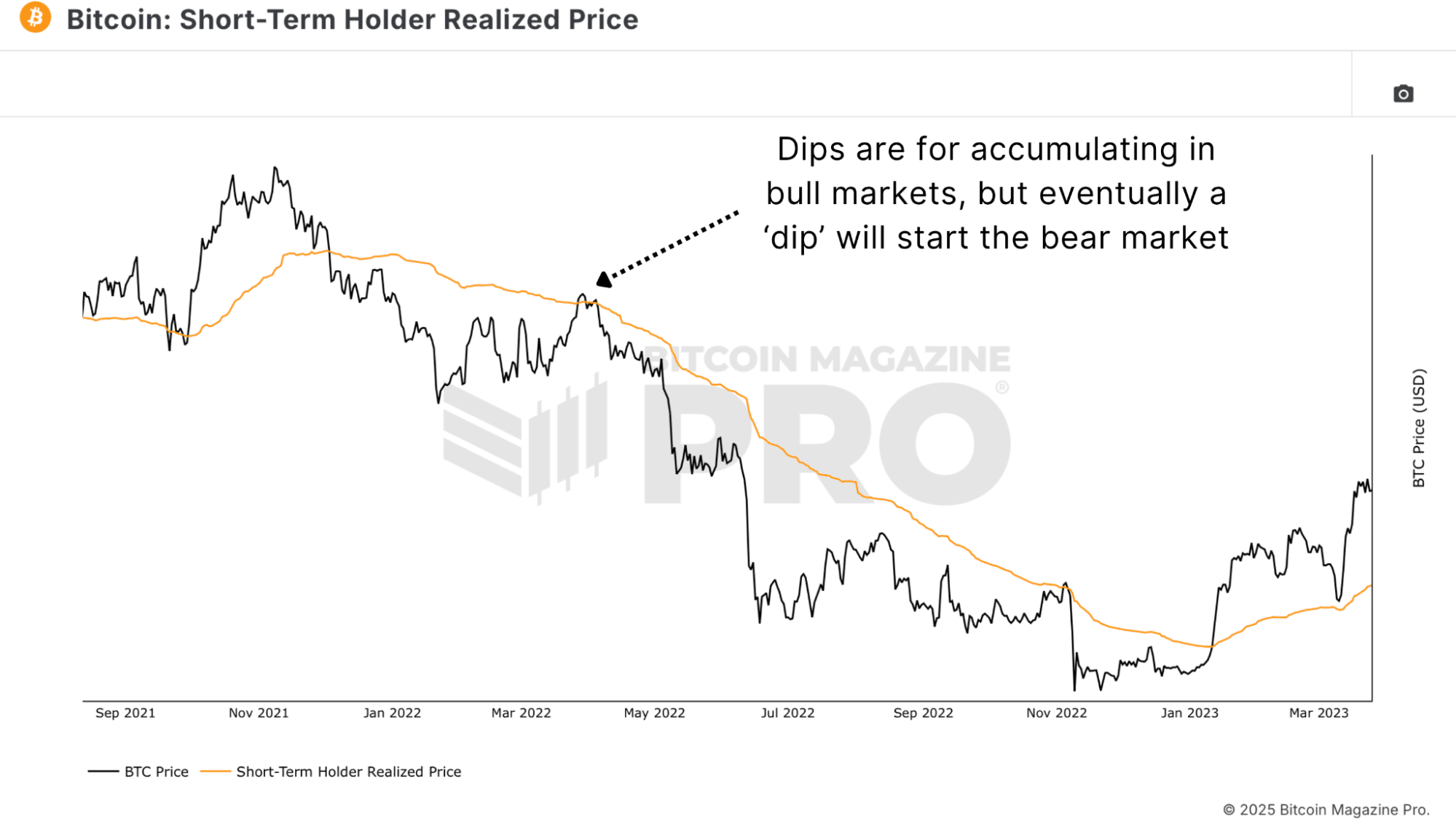

Bitcoin is already in a major pullback, however shopping for each drop shouldn’t be at all times the optimum method, barring a confirmed bull pattern. In a bear market surroundings, seemingly engaging dips can nonetheless result in considerably decrease costs. Quick-term rallies and sharp retracements are typical of bear markets, so reacting to information somewhat than preemptively predicting a backside turns into far more essential.

This sample of a number of dips turns into clear once we have a look at the Short-term holder Realized price graph over the last cycle. It is usually clear to see how this metric acted as a key resistance all through this section, with a sustained restoration solely skilled after BTC regained STH Realized Worth ranges.

There may be one caveat: if the value meaningfully regains key ranges, the entire image modifications. Subsequently, a small allocation throughout this dip could make sense, whereas delaying additional purchases till we see a deeper macro cycle emerge is a extra defensive method.

Black Friday Sale: 40% off annual subscriptions!

The BEST financial savings of the yr is right here. Obtain a 40% low cost on all our annual subscriptions.

Unlock +100 Bitcoin Charts.

- Entry indicator alerts – so that you by no means miss a factor.

- Personal TradingView indicators out of your favourite Bitcoin charts.

- Studies and insights for members solely.

- Many new graphs and features are coming quickly.

All for just $17 a month with the Black Friday deal. This is our biggest sale all year!

Bitcoin Worth: Key Ranges to Watch Now

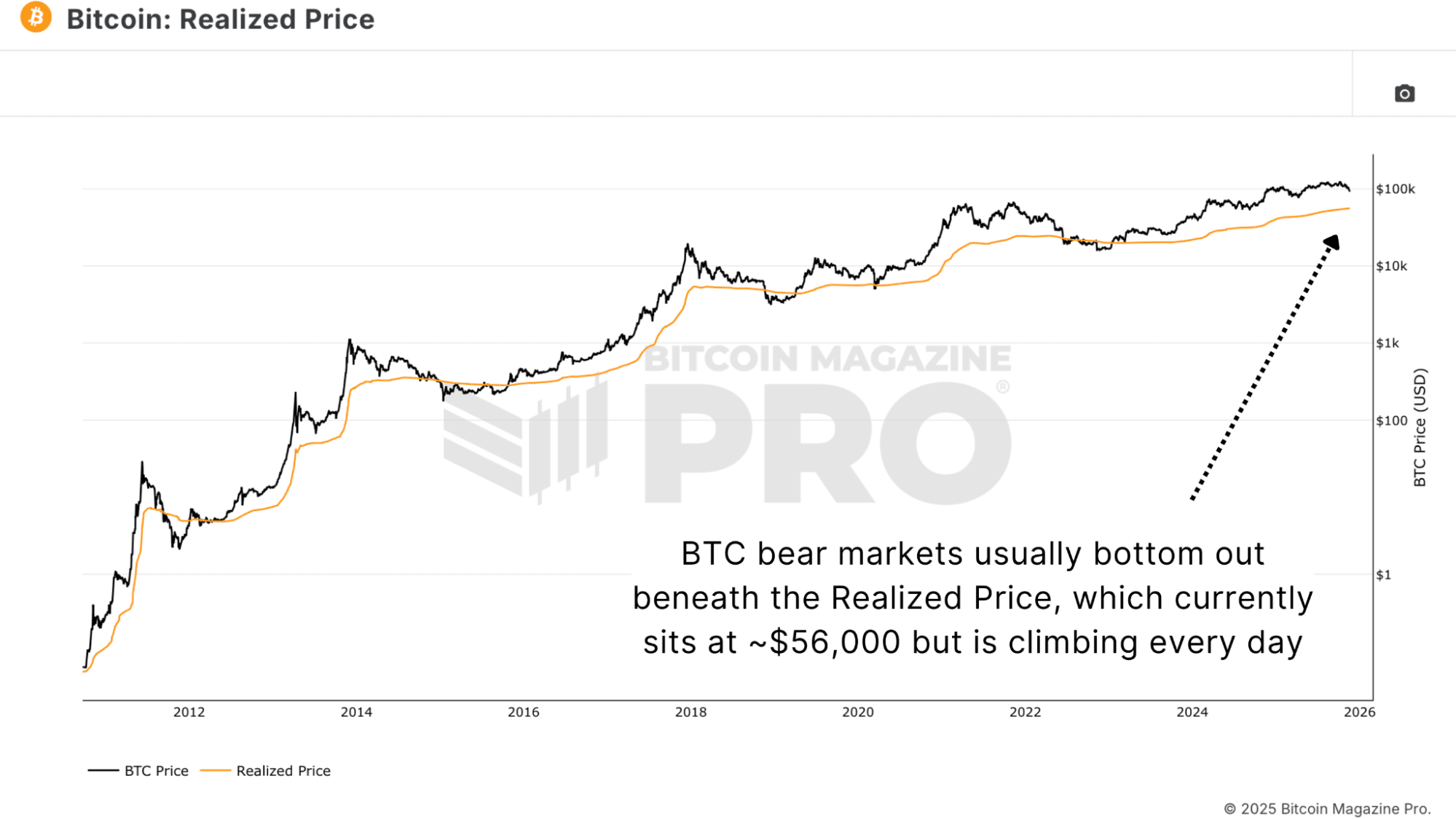

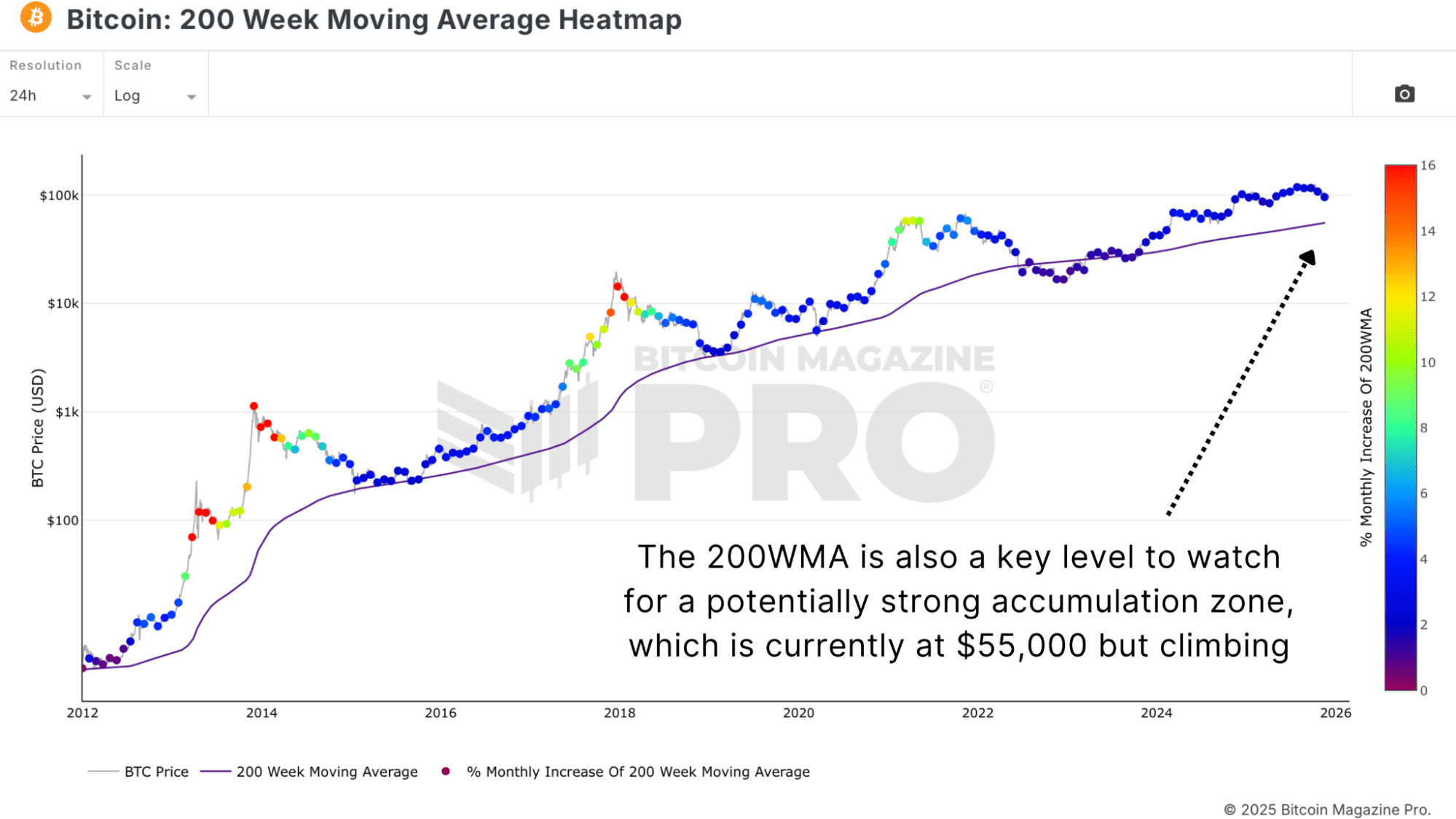

The MVRV Z score and the Bitcoin realized price present a clearer image of the place the broader market’s value base is. The community’s realized value base is presently round $50,000, however this determine continues to rise every day.

The same story emerges from the moving average over 200 weeksas that is additionally presently round $50,000. Traditionally, factors the place this measure converges with value have supplied sturdy long-term accumulation alternatives.

These ranges are slowly rising every day, that means a possible backside might kind at $60,000, $65,000 or increased relying on how lengthy Bitcoin stays in a downtrend. The essential level is that worth tends to emerge when the spot value is near the typical historic value of the community, and there’s a confluence of essential ranges of shopping for help.

Bitcoin Worth: What Provide and Demand Alerts Actually Say

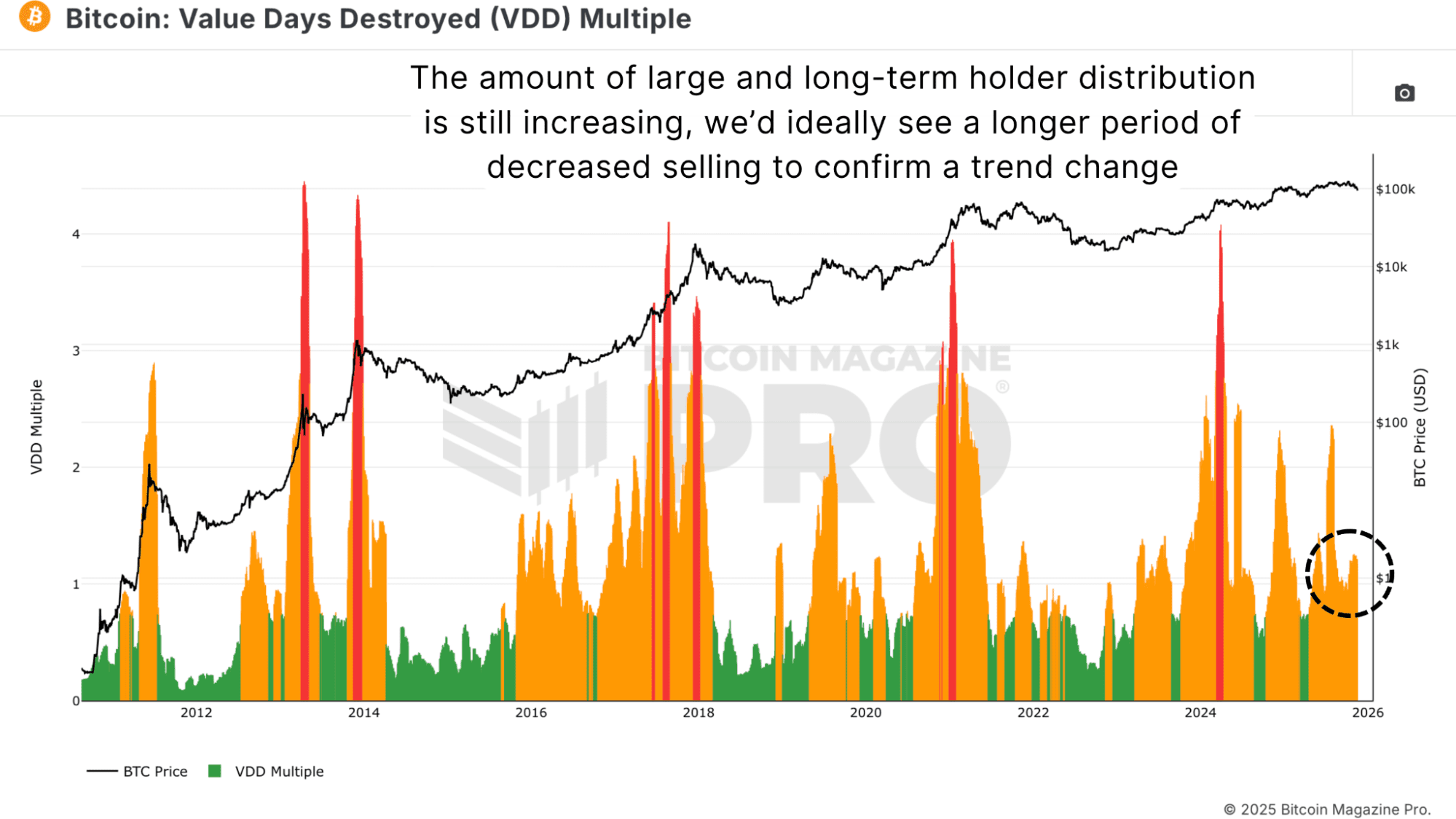

Value days destroyed (VDD) Multiple stays an essential metric in figuring out stress factors amongst long-term and skilled holders. Very low values counsel that giant, previous cash aren’t shifting, which regularly aligns with market bottoms. Nevertheless, a pointy spike can point out capitulation stress, which regularly accompanies or precedes main market turning factors.

Presently, the benchmark continues to rise as the value falls, indicating that many holders are dividing into weak point. That is not typical of a cycle backside, the place compelled promoting is usually excessive and compressed over a brief time period. At this stage the market nonetheless appears to be settling somewhat than exhausting. In addition to this, Long-term container supply has been in a downward pattern. Ideally, this stabilizes and begins to rise once more earlier than a serious backside varieties, as bottoms kind when essentially the most affected person individuals begin to maintain on and never depart.

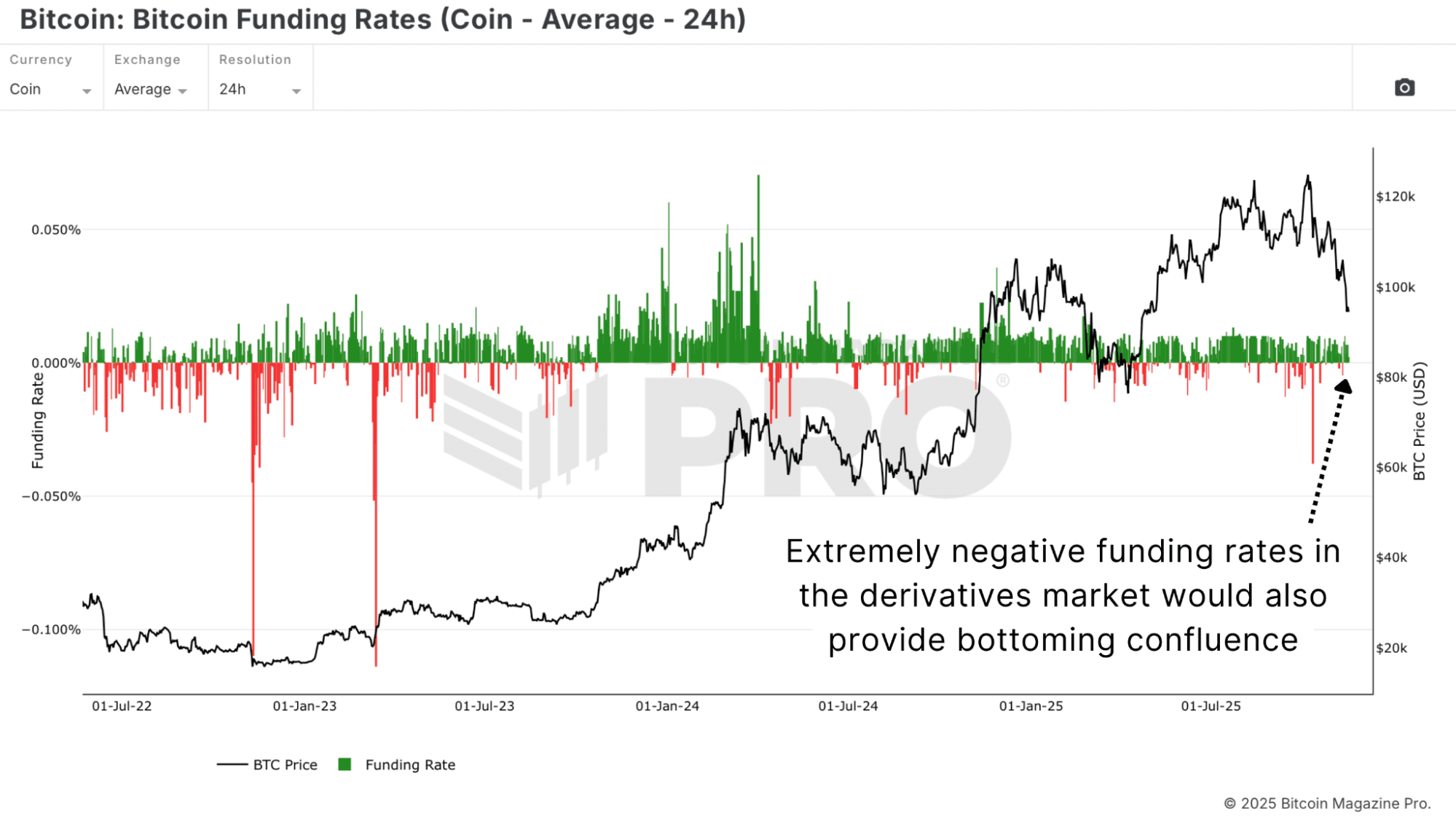

Bitcoin Worth: What Funding Charges Reveal About Capitulation (or Lack Thereof)

Intervals of peak worry are sometimes evident in heavy shorting and adverse financing, as evidenced by the Bitcoin financing ratesand huge realized losses. These circumstances point out that weaker arms have capitulated and stronger arms are absorbing that provide.

The market has not but exhibited the everyday panic promoting and shorting that usually accompanies main cyclical lows. With out derivatives stress and a rush of loss-taking, it is laborious to argue that the market has been fully washed out.

Bitcoin Worth: The Precise Ranges to Reclaim to Kill the Bear Case

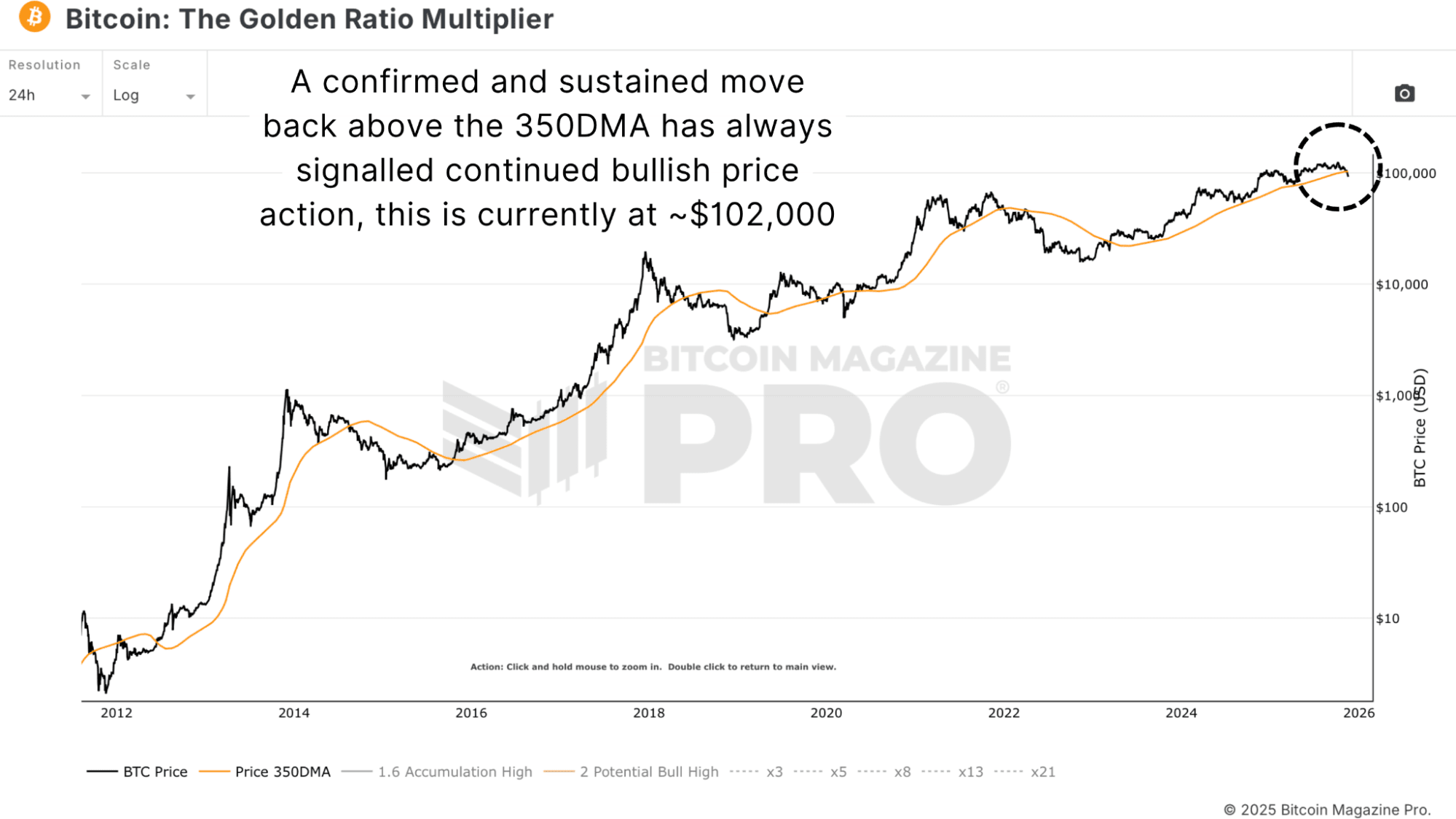

Suppose the bearish situation is unsuitable, which might clearly be preferable. In that case, Bitcoin ought to begin reclaiming key structural ranges, together with the $100,000 psychological zone, the Short-term holder Realized priceand the 350 day shifting common as proven within the Golden Ratio Multiplier graphic.

Momentary fuses or one-day closures aren’t ample. Persistent closures above these ranges, together with the power of danger belongings globally, might point out the pattern is shifting. However till that occurs, the info is cautious.

Bitcoin Worth Outlook: Ultimate Ideas on Dip vs. New Bear Market

Since falling beneath some key ranges, the outlook has change into extra defensive. There isn’t any structural weak point in Bitcoin’s long-term fundamentals, however the short-term market construction doesn’t resemble a wholesome bull pattern.

For now, the advisable technique is to keep away from shopping for on each dip, watch for a confluence earlier than heavy scaling, respect macro circumstances and ratio developments, and solely get aggressive as soon as the market proves sturdy. Most traders by no means determine the precise high or backside; the aim is to place close to high-probability areas with sufficient affirmation to keep away from months of pointless withdrawal.

For a extra in-depth have a look at this matter, watch our most up-to-date YouTube video right here: My Bitcoin Strategy for the Future

For deeper information, charts {and professional} insights into bitcoin value developments, go to BitcoinMagazinePro.com. Subscribe Bitcoin Magazine Pro on YouTube for extra professional market evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding choices.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now