Analysis

Bitcoin Price Holds Above $108K Despite Sharp Drop in Futures Open Interest—What’s Next?

Credit : coinpedia.org

After weeks of sharp swings, the broader crypto market seems to be getting into a part of cautious stability. Bitcoin’s value continues to commerce resiliently above the $100,000 mark, whereas Ethereum and main altcoins stay inside vary as market momentum cools.

Investor sentiment has shifted from excessive optimism to measured consolidation as merchants reassess their positions after months of aggressive debt and hypothesis. On-chain information reveals regular accumulation amongst long-term holders, whilst speculative exercise in derivatives markets begins to wane.

In opposition to this backdrop, one key metric – Bitcoin Futures Open Curiosity (OI) – has caught the eye of analysts, hinting at potential leverage that might affect BTC’s subsequent transfer.

Bitcoin Futures Open Curiosity Plummets 20%

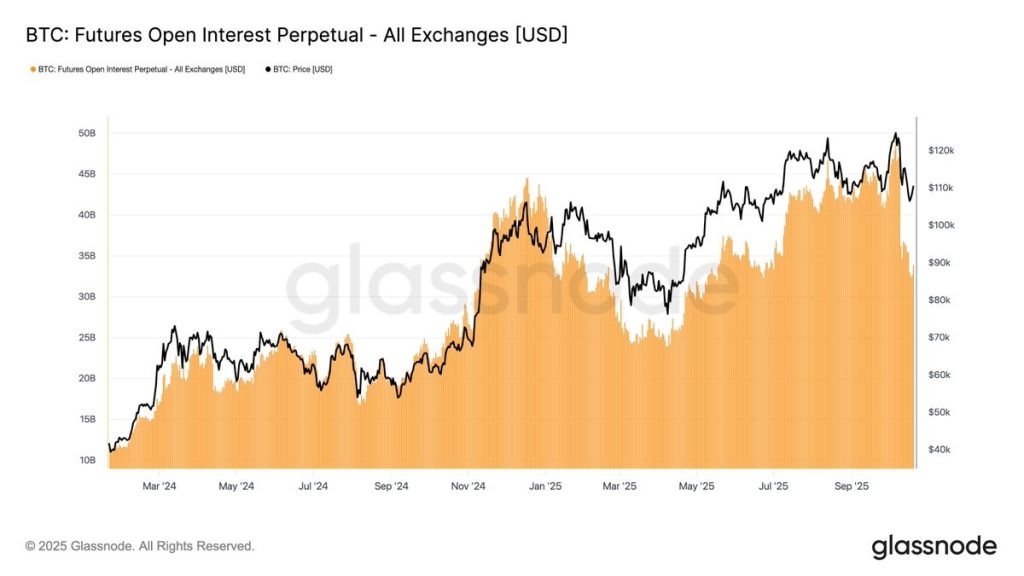

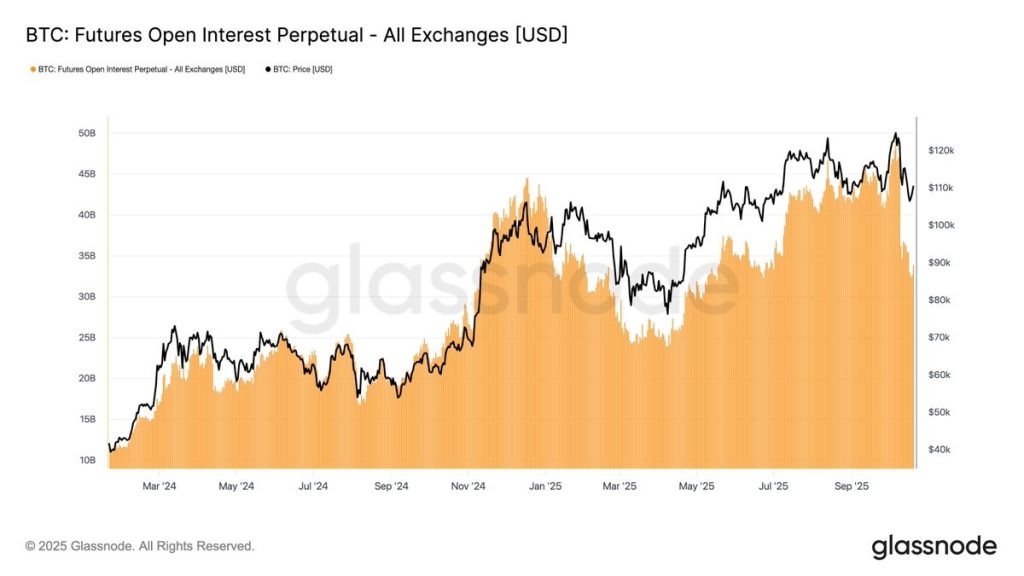

All through 2025, Bitcoin’s open curiosity has proven a powerful correlation with value motion: rising throughout rallies and contracting throughout corrections. Earlier peaks in January and July confirmed comparable patterns: as OI breached the $45-47 billion mark, leverage-driven rallies ultimately cooled, resulting in minor pullbacks earlier than the following breakout.

Based on the most recent Glassnode information, Bitcoin open curiosity on the main exchanges has fallen from nearly $45 billion to $35 billion, marking a major drop of 20% in just some weeks.

This contraction comes on the similar time that Bitcoin’s spot value stays secure, suggesting merchants are decreasing leverage quite than exiting the market fully. Traditionally, such declines in OI have occurred in periods of profit-taking or liquidations.

Wholesome market cooling, no panic

Regardless of lowered futures exercise, Bitcoin’s spot value construction stays robust. The asset has maintained a assist zone between $95,000 and $100,000, suggesting that long-term holders and establishments proceed to build up in periods of rising debt.

It is a wholesome signal for the market; quite than a panic-induced sell-off, this part displays danger discount and revenue realization, key substances for sustainable development. If open curiosity stabilizes round $30-35 billion, it might mark the beginning of a base-building part earlier than Bitcoin retargets $115,000-$120,000.

On-Chain and Derivatives Information Verify Consolidation

Further statistics assist this consolidation story:

- Futures Open Curiosity: Down ~20%, confirming lowered speculative leverage.

- Financing charges: Return to impartial ranges, indicating a stability between lengthy and quick positions.

- Volatility Index: Leveling off from current peaks and displaying early indicators of market stabilization.

- Change Balances: Bitcoin reserves stay low, reflecting long-term holder confidence.

Collectively, these tendencies spotlight a cooling however basically robust market surroundings – the type that usually precedes large value strikes.

Worth Outlook: Warning within the Brief Time period, Power within the Lengthy Time period

Within the close to time period, Bitcoin is predicted to consolidate between $95,000 and $110,000, with occasional volatility as a consequence of futures repositioning. A break above $112,000–$115,000 might unleash the following bullish wave in direction of $120,000–$125,000, whereas a drop beneath $95,000 would seemingly set off robust spot shopping for curiosity. The long-term outlook stays bullish, supported by ETF inflows, institutional accumulation and declining inventory market provide – all pointing to rising structural demand for Bitcoin.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial tips based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We attempt to offer well timed updates on all the pieces crypto and blockchain, from startups to trade majors.

Funding disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding selections. Neither the author nor the publication accepts accountability in your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our web site. Adverts are clearly marked and our editorial content material stays fully impartial from our promoting companions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024