Bitcoin

Bitcoin Price Prediction Today, August 6th 2025

Credit : coinpedia.org

Bitcoin fell by 0.8% to $ 113,467 on Wednesday and remained near the bottom of a month it hit earlier this week. The lower got here when the US commerce price threats and indicators of delaying worldwide progress weighed closely on the belief of traders and pushed merchants away from extra dangerous property comparable to Crypto.

The decline additionally follows a wave of worthwhile after the robust assembly of July. Earlier this week, Altcoins rose quick, however the momentum pale shortly and pulled the broader market decrease subsequent to Bitcoin.

Make a revenue of lengthy -term holders

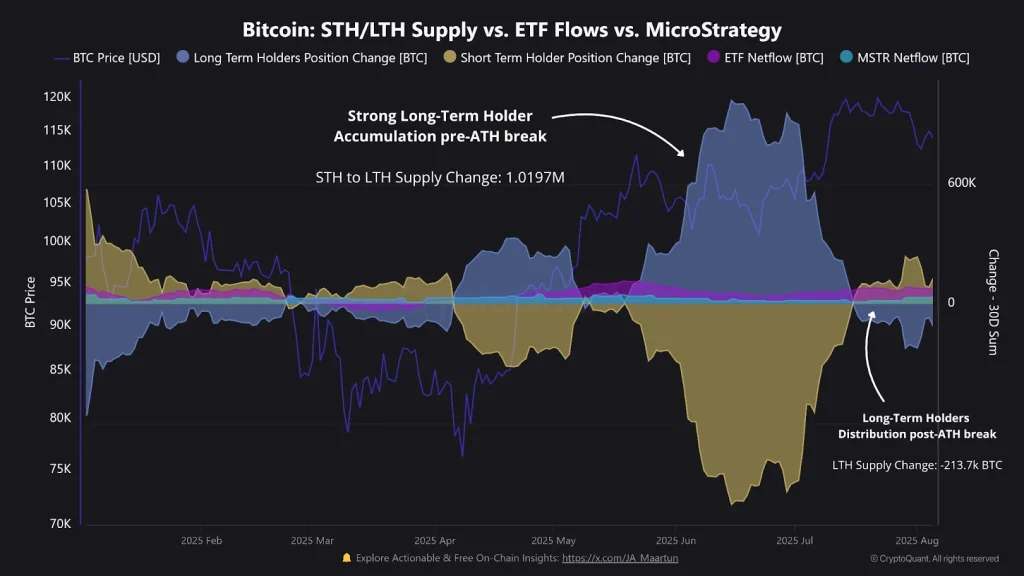

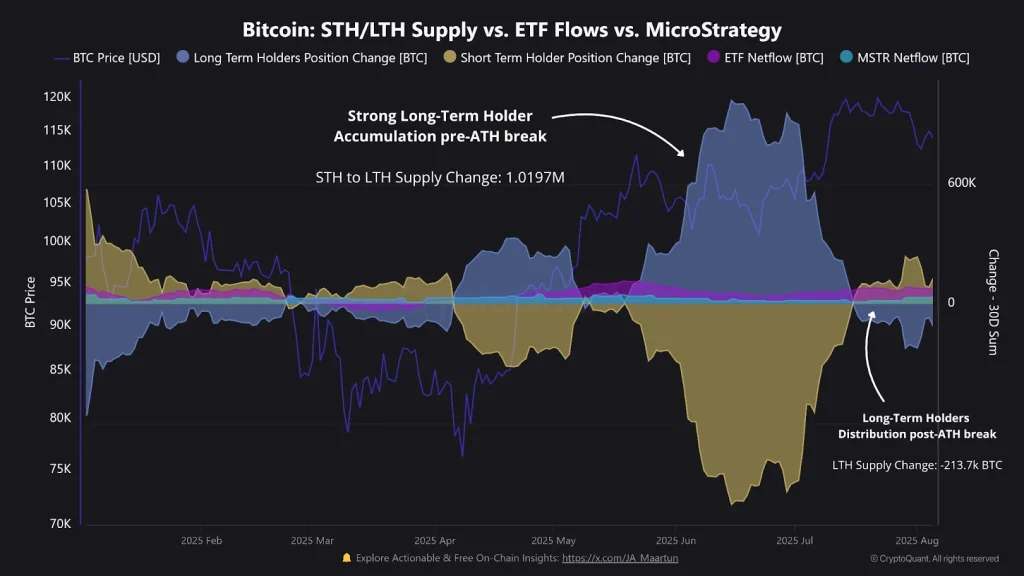

Based on on-chain Cryptuquant Analyst MarchunnBitcoin’s current slip is basically powered by the sale of long-term holders (LTHS), together with the pinnacle of the 80,000 BTC head of a pockets of Satoshi period. Whereas that some occasion made waves, Marchunn emphasizes that wider market dynamics is far higher.

“This isn’t only one whale, it’s a wave of long-term traders who cashed in after the break-out of the ATH,” he defined.

Retail and institutional exercise

Retail traders have come in the marketplace predictably in the marketplace after the document excessive of Bitcoin, a standard sample throughout bullish pimples. Institutional significance has additionally been seen, with corporations comparable to technique and metaplanet including publicity. Nonetheless, Marchunn notes that the mixed buying energy was not enough to keep up costs above $ 120k, resulting in renewed gross sales stress.

- Additionally learn:

- “Bitcoin makes it really easy to get wealthy,” says Robert Kiyosaki

- “

Brief -term holders below water

The sharpest influence comes from quick -term holders (STHs) who capitulate within the occasion of loss. Knowledge on the chain Present realized losses of 52,230 BTC in mid -July, 42,493 BTC later that month, and an intensive sale of 70,028 BTC after 31 July. Marchunn says that the final copy stands out for each measurement and length, signaling that quick -term sentiment significantly weakened.

ETF outflows contribute to the stress

Bitcoin ETFs have additionally proven in current classes, though Baartunn describes this as modest as compared with earlier corrections. However, they contribute to taking revenue and STH capitulation, at a market struggling to discover a new upward momentum.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, skilled evaluation and actual -time updates on the newest developments in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

The value of Bitcoin has fallen attributable to a mixture of things, together with international financial issues, American commerce price threats and making a wave of revenue from each long-term and short-term holders after a current robust rally.

Each long-term holders (together with a whale from Satoshi period that sells 80k BTC) and short-term merchants, the place STHs understand appreciable losses.

Whereas corporations comparable to Micro Technique proceed to build up, their buying has not compensated the broad sale of each retail and long-term traders.

Sure-typical post-rally conduct with taking LTH revenue after Aths and STH capitulation, though worldwide financial elements strengthen the dip.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now