Bitcoin

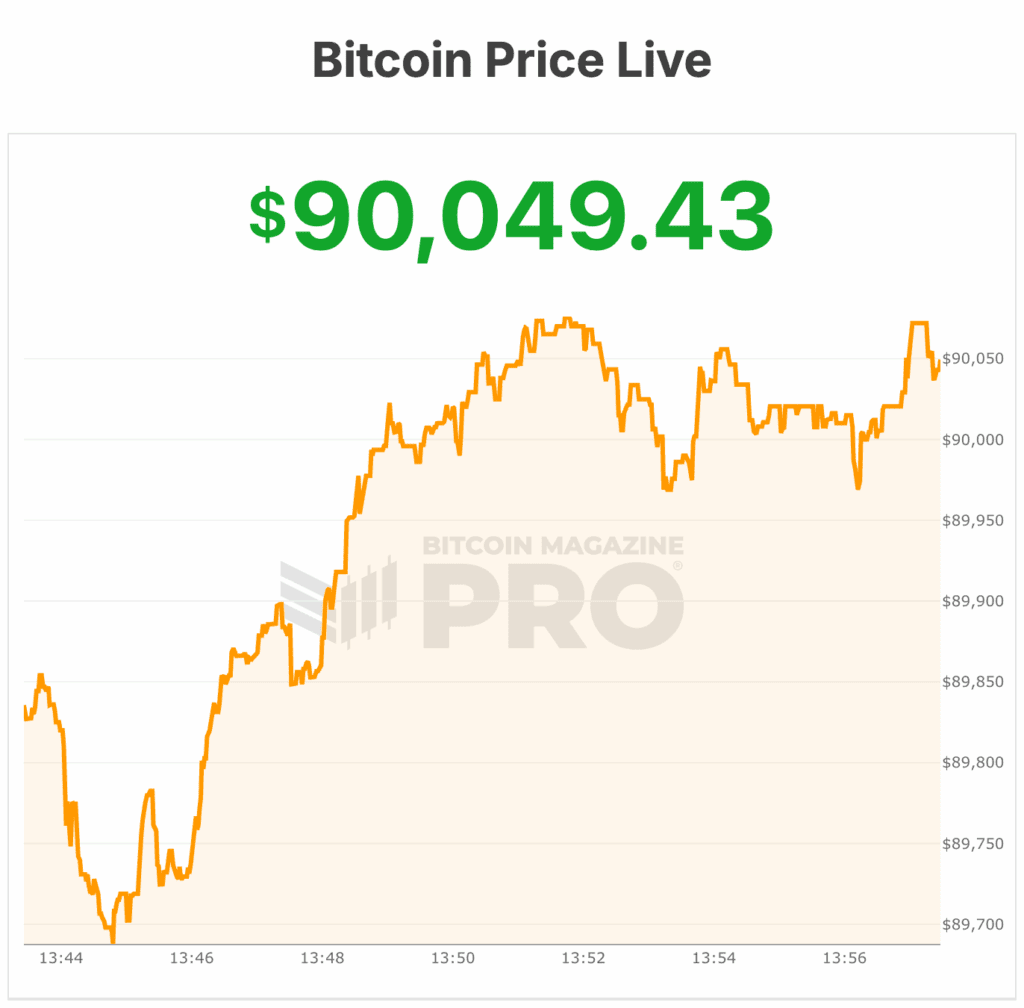

Bitcoin Price Roars Past $90,000 On Strong Wall Street News

Credit : bitcoinmagazine.com

Bitcoin’s value rose above $90,000 on Wednesday, persevering with a pointy rally fueled by accelerating institutional demand and a brand new wave of Wall Road-developed crypto merchandise.

The rise adopted new revelations to show BlackRock increasing exposure to its personal place Bitcoin ETF, and JPMorgan launching a fancy, high-stakes structured bond tied on to BlackRock’s IBIT fund.

Bitcoin costs hit a 24-hour low of $86,129 earlier than rebounding above $90,300, persevering with a unstable rebound that has outlined the fourth quarter.

BlackRock’s newest regulatory submitting exhibits that the Strategic Revenue Alternatives Portfolio now owns 2,397,423 shares of IBIT, valued at $155.8 million as of September 30. That is 14% greater than in June, when the fund reported 2,096,447 shares.

The regular construct underlines how the world’s largest asset supervisor is utilizing its inner portfolios to deepen its Bitcoin-linked positions.

These strikes come as demand for structured crypto-linked investments will increase amongst main banks. JPMorgan’s newly proposed derivatives-style bond gives institutional shoppers a solution to wager on the longer term value of Bitcoin by way of IBIT, at present the biggest Bitcoin ETF with practically $70 billion in belongings.

The product is uncommon – and aggressive. The notice sets a price for IBIT subsequent month. If IBIT trades at or above that value in a yr, the notice will likely be robotically known as and traders will obtain a hard and fast return of 16%.

If IBIT trades beneath the set stage inside a yr, traders will stay within the product till 2028. Ought to IBIT exceed JPMorgan’s subsequent goal value by then, traders will earn 1.5x their funding with no upside restrict. When the Bitcoin value shoots up, the payouts comply with.

There’s additionally backside safety. If IBIT 2028 ends with a lack of not more than 30%, traders will obtain their full principal again. But when the ETF falls greater than 30%, the losses will match the decline in IBIT.

The construction combines a bond-like wrapper with spinoff publicity, a system that FINRA broadly classifies underneath the “structured bond” class. These notes mix a conventional safety with options-based payouts tied to a reference asset – on this case, BlackRock’s Bitcoin ETF.

The pitch for establishments is easy: predictable returns if Bitcoin’s value stagnates subsequent yr, upside leverage by way of 2028, and restricted long-term draw back. The tradeoff is equally clear: no curiosity funds, no FDIC insurance coverage, and the chance of shedding most or your whole principal.

Reporting by The Block helped with this text.

Bitcoin value volatility

JPMorgan is express concerning the dedication. The prospectus warns that traders “must be ready to lose a good portion or the entire principal at maturity.” Bitcoin’s volatility, the report provides, may be excessive, and the notes stay unsecured liabilities of the financial institution.

The financial institution’s newest transfer additionally highlights an ongoing shift in Wall Road’s tone towards Bitcoin. CEO Jamie Dimon as soon as mocked Bitcoin as “Worse than tulip bulbs.” But JPMorgan is now creating merchandise that depend on the long-term trajectory of digital belongings.

Morgan Stanley has explored comparable territory. Its personal IBIT-linked structured bond raised $104 million final month. The financial institution’s two-year ‘twin directional autocallable’ product affords improved payouts if IBIT rises or stays the identical, and modest positive factors if it falls to 25%. However as soon as losses exceed that stage, traders will take the hit with none cushion.

Analysts say these merchandise mirror a revival within the structured bond market. Bloomberg reported that the business is recovering from a decade-long stoop after the collapse of Lehman Brothers worn out billions tied to comparable devices.

Bitcoin costs have fallen greater than 30% from an all-time excessive in October, falling to round $87,000 as a virtually two-month slide retains markets tense. Mid-range whale portfolios holding greater than 100 BTC are rising – a possible signal of discount looking – however bigger cohorts of whales proceed to dump, contributing to weakened spot market demand.

Analysts warn that the important thing assist zone between $80,000 and $83,000 is being repeatedly examined, whereas Citi says the market doesn’t have the inflows wanted to stabilize costs.

On the time of writing, the bitcoin value is $90,049.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?