Bitcoin

Bitcoin Price Set For Big Move As Volatility Drops

Credit : bitcoinmagazine.com

Bitcoin appears to be about to be a big worth motion, and information means that volatility might return in a big means. With the worth motion of Bitcoin that stagnates in latest weeks, we have now crucial indicators analyzed to know the potential scale and route of the approaching motion.

Altering

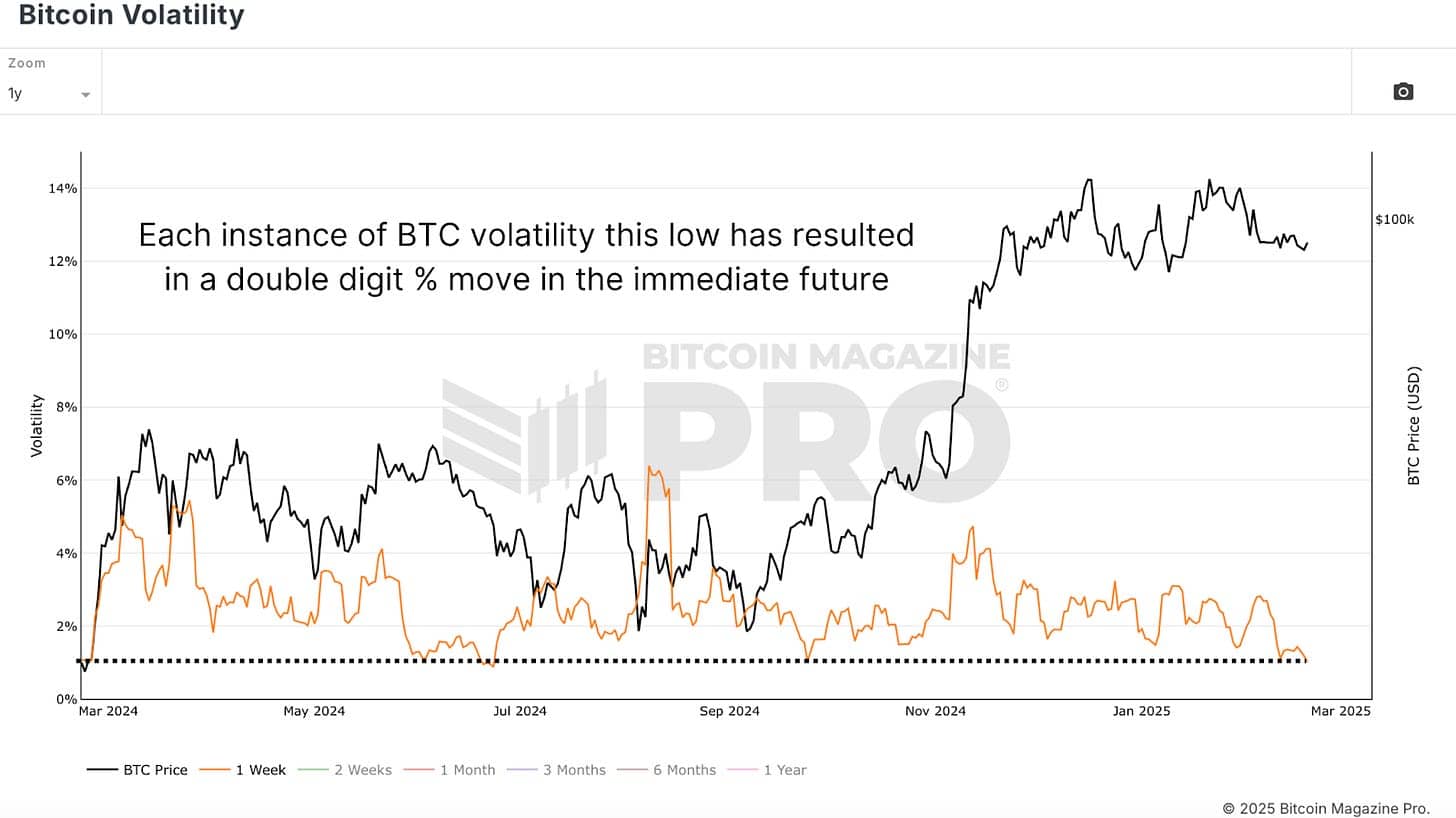

A terrific place to start out is Bitcoin -VolatilityWho follows worth motion and volatility over time. By isolating the info from the previous yr and concentrating on weekly volatility, we see that the worth of Bitcoin has not too long ago been comparatively flat, floating within the $ 90,000 collection. This lengthy -term lateral motion has resulted in a dramatic fall in volatility, which signifies that Bitcoin experiences a part of essentially the most steady worth conduct in latest historical past.

Traditionally, such low volatility ranges are uncommon and are usually brief -lived. In viewing earlier instances the place volatility was so low, Bitcoin succeeded with appreciable worth actions:

A rally of $ 50,000 to a highest excessive level of $ 74,000.

A lower from $ 66,000 to $ 55,000, adopted by a brand new rise to $ 68,000.

A interval of stagnation round $ 60,000 earlier than a rise of as much as $ 100,000, the present of all time excessive.

Each time the volatility to this degree dropped, Bitcoin skilled a motion of not less than 20-30percentwithin the following weeks, if not anymore.

Bollinger -Bands

To additional affirm this, the Bollinger bands -Width -indicator, provides a device that measures the volatility by following the worth deviation of a progressive common, additionally that Bitcoin has been rolled up for a big transfer. The quarterly tires are at present at their tightest ranges since 2012, which signifies that worth compression is excessive. The final time this occurred, Bitcoin skilled a worth vacation spot of 200percentwithin a number of weeks.

We’re investigating earlier occasions of comparable tight Bollinger, we discover:

2018: A lower from 50% from $ 6,000 to $ 3,000.

2020: An outbreak of $ 9,000 to $ 12,000, which units up the ultimate rally to $ 40,000.

2023: A gradual battery part round $ 25,000 earlier than a quick soar to $ 32,000.

Doable route

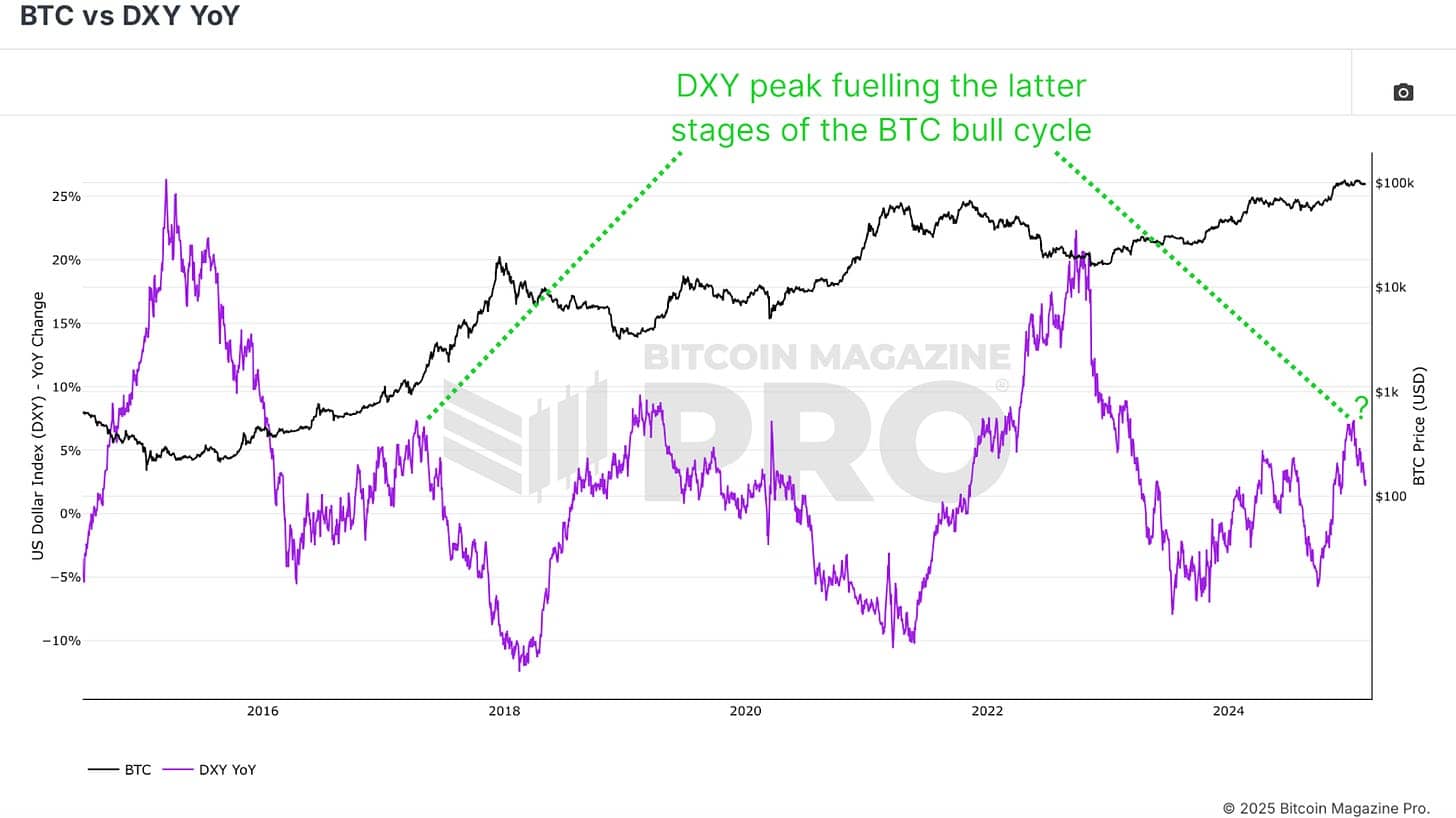

Understanding the route is harder than predicting volatility, however we have now directions. A robust indicator is the US Dollar Strength Index (DXY) YOYThat traditionally reversed to Bitcoin has moved. The DXY is not too long ago gathering exhausting, however Bitcoin has stored its land. This means that Bitcoin has underlying drive, even in much less favorable macro circumstances.

Furthermore, political components can play a job. Traditionally, when Donald Trump took workplace in 2017, the DXY fell and Bitcoin noticed an enormous bull operating from $ 1,000 to $ 20,000. With an analogous association which will unfold in 2025, we might even see a repetition of this dynamic.

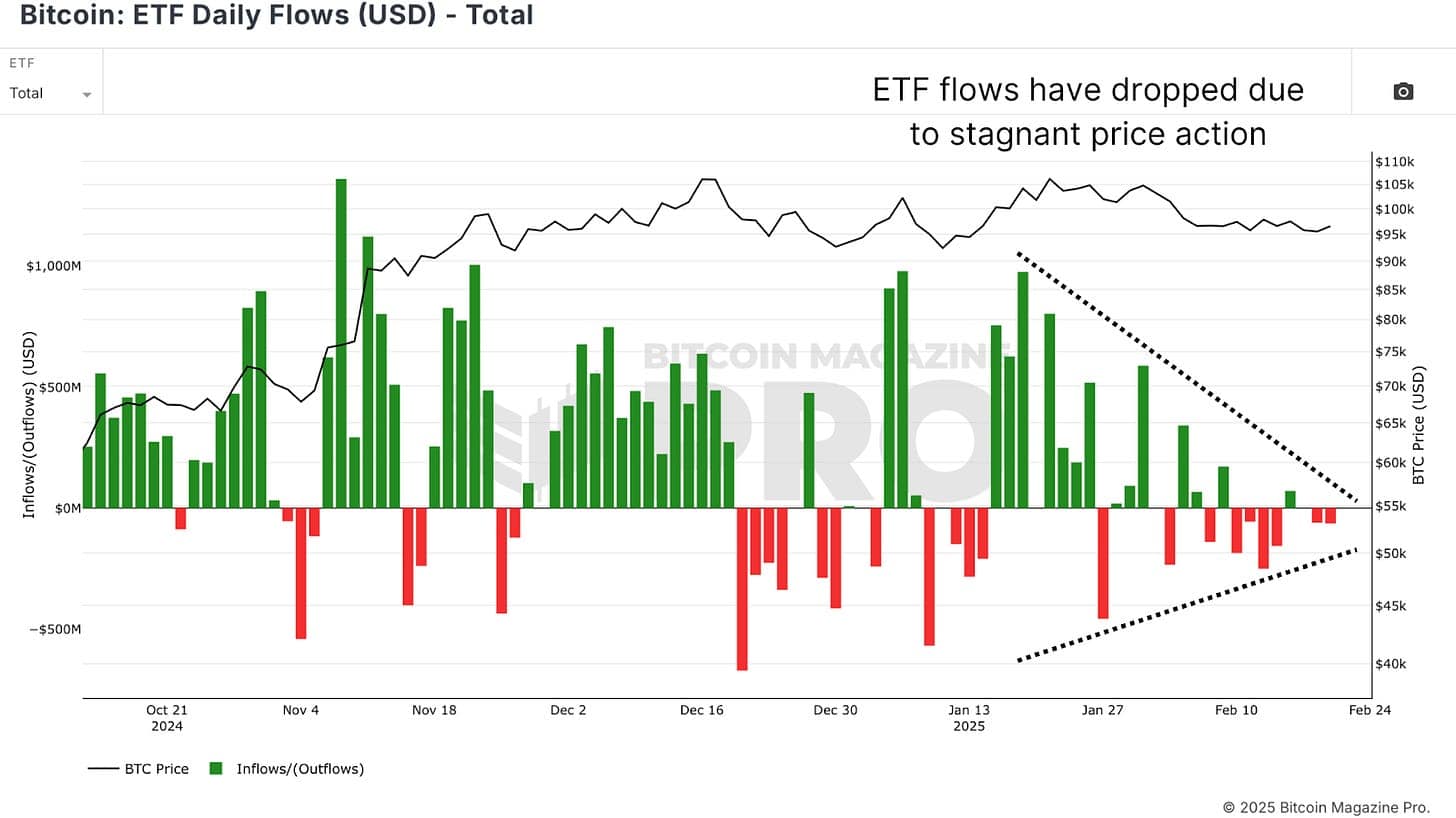

ETF -Influx

Additional bitcoin ETF -InflowA proxy for institutional demand is significantly delayed throughout this era of low volatility. This means that massive gamers are ready for a confirmed outbreak earlier than they add their positions. As quickly because the volatility returns, we might see renewed curiosity from establishments and float Bitcoin even greater.

Conclusion

The volatility of Bitcoin is at one of many lowest ranges in historical past, and such circumstances have by no means lasted lengthy. When volatility compresses a lot, that is the stage for an explosive motion. The information means that an outbreak is imminent, however whether or not it leans bullish or bearish will depend on macro -economic circumstances, investor sentiment and institutional flows.

Be careful for extra detailed Bitcoin evaluation and for superior capabilities resembling dwell graphs, personalised indicator warnings and in-depth industrial reviews Bitcoin Magazine Pro.

Safeguard: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your personal analysis earlier than you make funding selections.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now