Bitcoin

Bitcoin Price Shows Strength as BCMI Signals Early Accumulation Phase

Credit : coinpedia.org

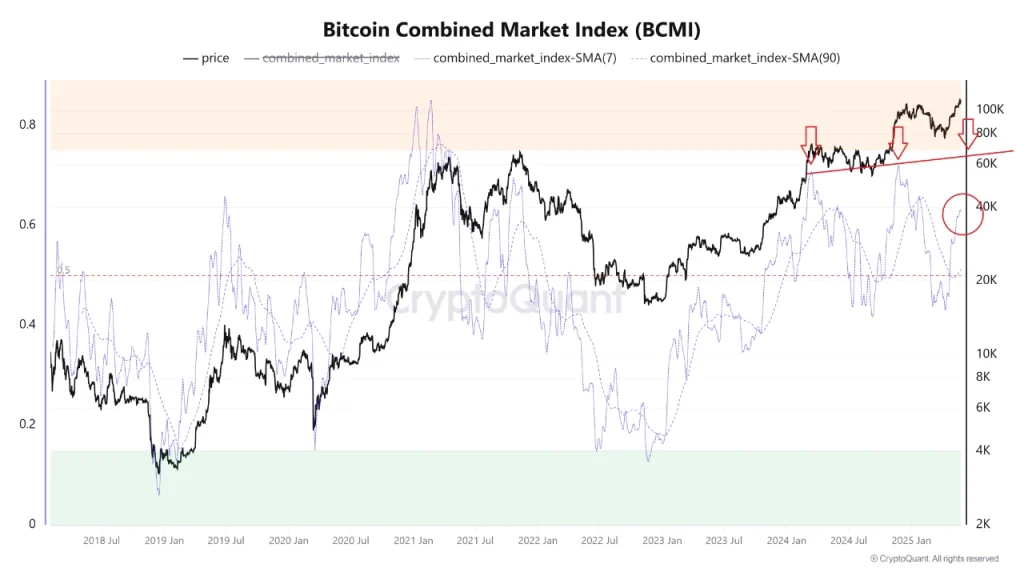

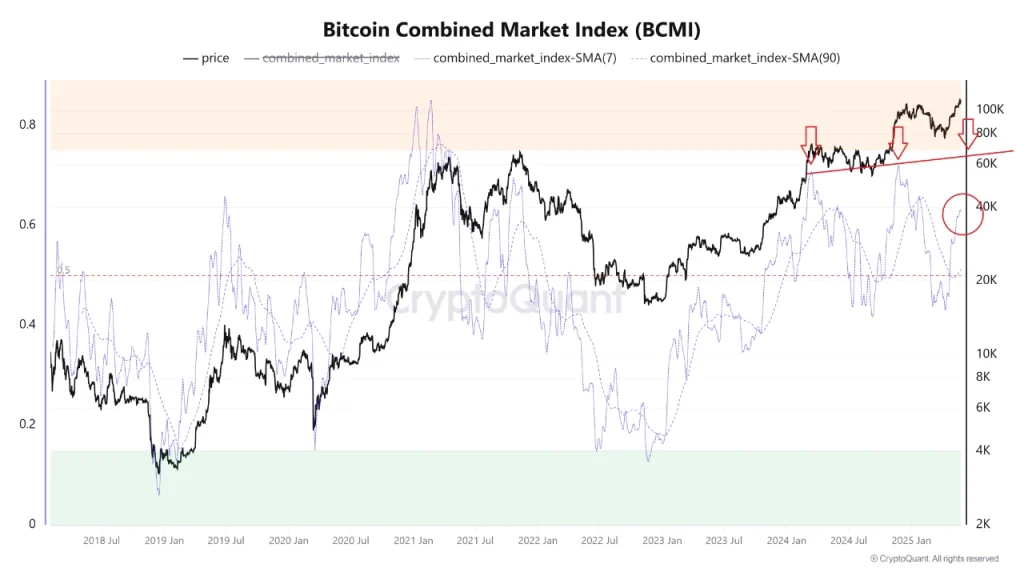

A brand new replace of Crypto analyst Woominkyu Emphasizes a pointy rebound within the Bitcoin mixed market index.

This means that the Bitcoin market could enter an early battery section.

By bettering sentiment and decreased worthwhile, indicators in chains blink a probably upward sign for Bitcoin buyers.

Here’s what you have to know.

What’s BCMI?

Bitcoin Mixed Market Index (BCMI), developed and popularized by on-chain analyst Woominkyu, is a composite indicator designed to evaluate the overall market sentiment and section of Bitcoin utilizing 4 necessary on-chain statistics (MVRV, Nupl, Sopr, STEX).

Market worth to realized worth compares Bitcoin’s present market value with the common value with which all cash had been bought.

Web non -realized revenue/loss measures the full revenue or lack of Bitcoin holders.

The perfect output revenue ratio tracks if the cash are moved are in revenue or loss.

Concern & Greed Index is a sentiment index that displays the feelings of buyers.

The BCMI lecture under 0.15 signifies that the market is within the excessive nervousness zone. That is typically seen within the neighborhood of macro soils, when costs are low and the sentiment is destructive.

The lecture above 0.75 means that the market is within the state of euphoria. That is seen on Cyclus tops, when costs are excessive and greed unbridled.

BCMI: Evaluation of present standing

Based on the evaluation of Woominkyu, the 7-day SMA of BCMI is 0.6 and the 90-day SMA of BCMI at 0.45.

The rebound of the brief -term common, particularly within the gentle of latest market corrections, means that the rising belief of buyers is supported by an elevated transaction quantity and stronger Fundamentals on chains and attainable early indicators of a bull section,

Within the meantime, the soundness of the lengthy -term common that the market is secure doesn’t recommend.

- Additionally learn:

- Peter Schiff blames himself for Bitcoin Growth: “You do not purchase each time I say”

- “

Which BCMI signifies concerning the present pattern?

Investor sentiment improves, supported by a lower within the alternate circulate and the lengthy -term accumulation, whereas taking a revenue has fallen, as indicated by the reducing issued output Winstratio (SOPR).

That is the stage for a battery section, whereby institutional or sensible buyers begin to purchase, whereas the costs are nonetheless comparatively low.

Up to now seven days, the Bitcoin market has reported a fall of 1.9%. Within the final 24 hours alone, the market has fallen by 0.3%.

The Bitcoin value just lately reached a brand new highest level of $ 111,980, and surpassed his earlier ATH of $ 108,786 included in January 2025.

At present, the BTC value is $ 108,492.71 – no less than 3.11% beneath the ATH registered on 22 Might 2025.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, skilled evaluation and actual -time updates on the newest traits in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

BCMI is a composite indicator that measures Bitcoin Market sentiment utilizing MVRV, NUPL, Sopr and Concern & Greed Index.

BCMI values beneath 0.15 sign nervousness/soils, above 0.75 point out euphoria/tops, which identifies market cycle phases.

With the BCMI under 0.5, two eventualities come up: a wholesome correction inside a bull market or an early transition to a bearish section. The monitoring of the 7-day and 90-day advancing averages of BCMI is essential for a clearer course.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now