Bitcoin

Bitcoin Price Sits At $84,000 As Analysts Fear A $75K Crash

Credit : bitcoinmagazine.com

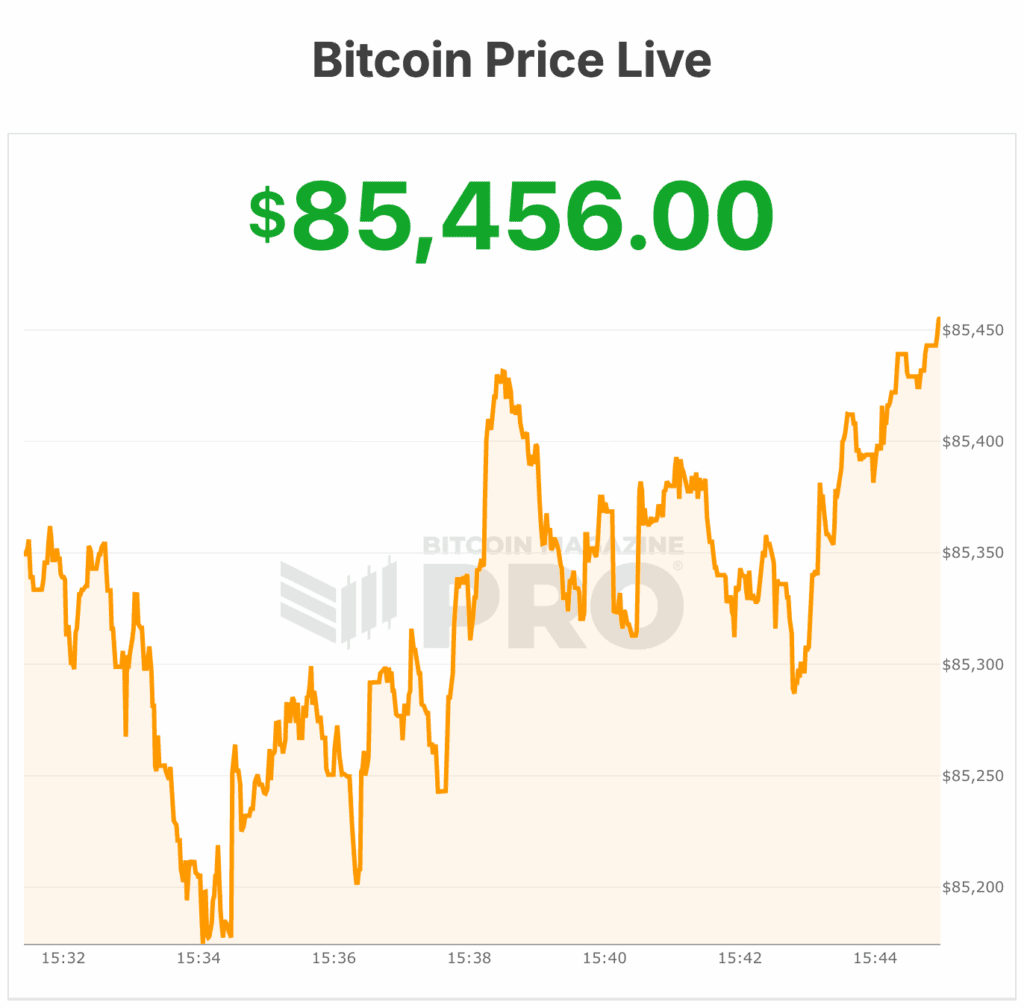

Bitcoin costs bounced into December with new volatility, falling 8% to the mid-$84,000s early Monday earlier than bouncing again to $85,456 on the time of writing.

The world’s largest digital asset is now teetering at a key stage of $85,000 – a value vary that analysts say may decide whether or not the bitcoin value stabilizes within the coming weeks or slides right into a deeper take a look at of $75,000.

The pullback extends a two-month downtrend that has erased greater than 30% of Bitcoin’s file highs in October. Over the previous 24 hours, BTC traded between $91,866 and $83,800, with restricted liquidity and a wave of compelled liquidations accelerating the transfer.

Bitcoin value ranges: $85,000, $84,000 – after which $75,000?

Bitcoin value closed the week and month at $90,385, which confirmed a brief inexperienced weekly candle, however the bears rapidly regained management, sending the value right down to $87,000.

The closing value stays beneath the important thing resistance at $91,400, leaving the bulls in for an uphill battle. In line with Bitcoin Journal analysts, preliminary resistance checks at $91,400 and $93,000 failed, with stronger resistance anticipated between $98,000 and $103,000 because the bulls regain energy.

On the supportive aspect, it was $84,000 final week, though the rebound was weak. Bulls goal to defend the 0.146 Fibonacci stage at $87,000, whereas failure to carry $84,000 may open a path to $75,000. Additional assist is between $72,000 and $69,000, with a deeper take a look at at $57,700 as promoting strain will increase.

The November month-to-month candle closed strongly bearish, lifting earlier inexperienced closes from April by June.

Though bitcoin value stays above the 21-month EMA, the shut confirmed a bearish MACD cross, indicating continued subdued momentum over the subsequent two to 3 months. That is according to expectations of a possible high within the four-year cycle.

Within the brief time period, Bitcoin value could commerce in a variety as bears consolidate whereas bulls attempt to reclaim $91,400 and $94,000. Total, the market is going through downward strain, and warning is suggested for bulls in search of a reversal.

Bitcoin’s November candle erased three months of earlier positive factors and delivered a bearish month-to-month momentum shift. Analysts who observe the four-year cycle say the most recent information provides weight to the argument that October probably marked the cycle high.

Federal Reserve, Bitcoin value and bitcoin enterprise strikes

That of the Federal Reserve expectant The assembly from December 9 to 10 is simply across the nook. Markets at the moment assign an 80% to 87% likelihood of a 25 foundation level charge minimize – a transfer that sometimes helps dangerous property and will doubtlessly increase Bitcoin’s value.

But when the Fed holds agency, analysts warn that the crypto market may see one other sell-off, particularly as Bitcoin costs verify a bearish MACD cross on the month-to-month chart in November – a traditionally robust sign that usually precedes multi-month sideways buying and selling and consolidation or decline.

Bitcoin-linked shares had been additionally in turmoil on Monday. Technique Inc. (previously MicroStrategy) introduced that it has created a $1.4 billion reserve to cowl at the least 21 months of dividend and curiosity funds, aiming to allay investor fears that the corporate may very well be compelled to promote a few of its 650,000 BTC provide.

The corporate additionally introduced a brand new buy of 130 BTC for $11.7 million. The transfer stabilized the inventory after an early market sell-off of greater than 12% at occasions. Presently, $MSTR shares are down 4% on the day.

BlackRock, in the meantime, not too long ago elevated inside publicity to its IBIT spot Bitcoin ETF, with its Strategic Earnings Alternatives Portfolio now holding 2.39 million shares price $155.8 million – up 14% since June.

JPMorgan launched a structured bond linked to IBIT, which might supply 1.5x upside potential by 2028.

Earlier this week, gold costs almost handed $2,300 per ounce.

On the time of writing, the bitcoin value is $85,456. On October 6, the bitcoin value reached an all-time excessive above $126,000.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now