Bitcoin

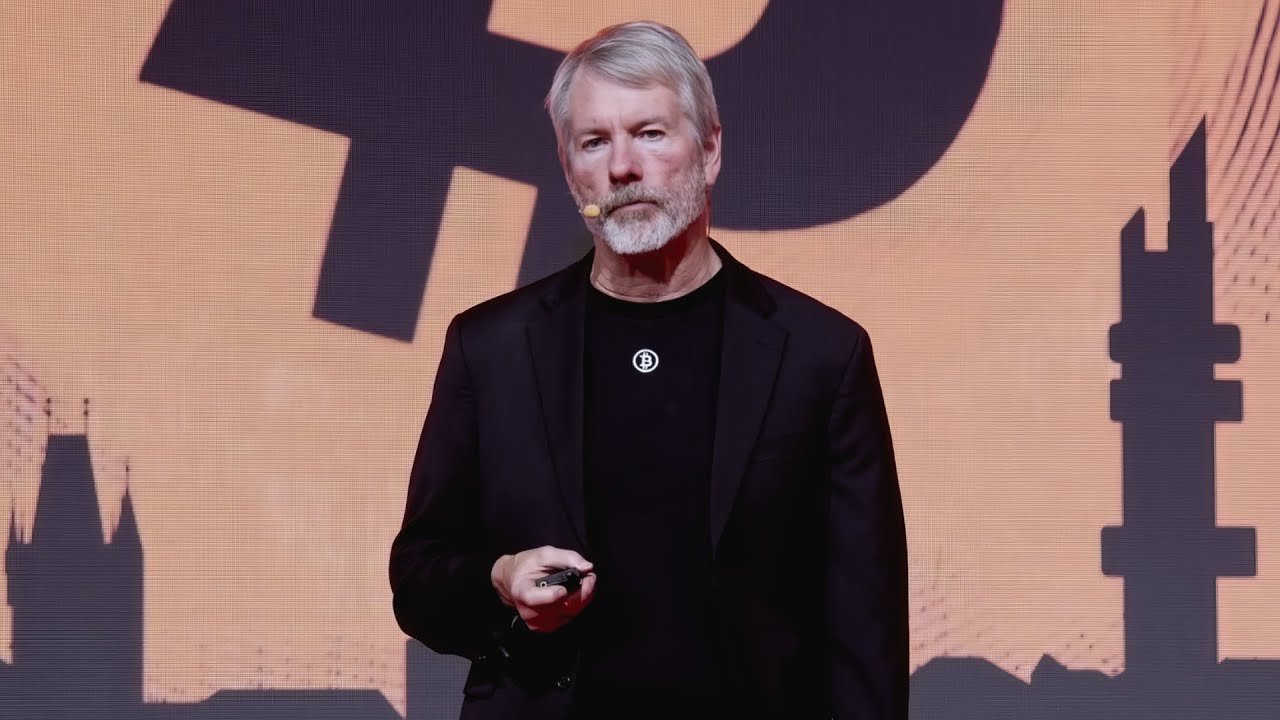

Bitcoin Price Slides Below $115,000 As Strategy Buys Additional Bitcoin

Credit : bitcoinmagazine.com

Technique announced The acquisition of an additional 525 Bitcoin (BTC) for $ 60.2 million, even when the Bitcoin value withdrew from his current excessive of $ 116,700. The acquisition, introduced in a SEC coming into Monday, brings the whole significance of the corporate to 638,985 BTC, which additional confirms his place as the most important firm holder of Bitcoin.

The Last acquisition was carried out at a median Bitcoin value of $ 114,562 per BTC, which will increase the whole common buy value of the corporate to $ 73,913.

The constant accumulation technique of the technique arises within the midst of a rising institutional curiosity in Bitcoin, whereby holdings of the enterprise group now symbolize greater than 1 million BTC greater than 5% of the circulating Bitcoin provide. This development is accelerated in 2025, with newcomers who be part of the ranks of Bitcoin Treasury firms.

The proliferation of enterprise Bitcoin treasures displays a basic shift in find out how to view Bitcoin establishments. We see new firms coming into this house virtually each day, every with appreciable capital obligations.

Regardless of the continual Bitcoin purchases of the technique, the shares (MSTR) of the corporate left Bitcoin in 2025, with solely 14% in comparison with the 23% score of Bitcoin.

The market response to the most recent buy of the technique emphasizes the creating dynamics of institutional Bitcoin acceptance. Whereas originally of 2025 Bitcoin value improve after $ 124,000, current value promotion suggests a extra measured method to buyers, with help above the extent of $ 110,000.

Diversification of firms in Bitcoin has grow to be a mainstream phenomenon. What began with technique has developed right into a wider motion, during which firms in numerous sectors now regard Bitcoin as a reputable treasury activum.

The growth of Bitcoin Holdings of firms has contributed to decreased market volatility, whereby institutional holders often keep positions in the long term. This development is particularly clear in 2025, as a result of the variety of Bitcoin Treasury firms has greater than doubled since January.

The regular electrical energy of firm patrons has created a brand new ground for the value of Bitcoin. Every dip is more and more seen as an accumulation possibility by institutional gamers.

Wanting forward, analysts count on that the development of the acceptance of the corporate bitcoin will proceed, specifically as a result of the readability of the laws enhance and embrace extra conventional monetary establishments Bitcoin. The rising variety of Bitcoin Treasury firms suggests an grownup market infrastructure and growing institutional consolation with Bitcoin investments.

The most recent buy of technique, though paperwork in comparison with a few of its earlier acquisitions, exhibits the non-repellent dedication of the corporate to his Bitcoin-oriented treasury technique, even when the market experiences value volatility within the brief time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024