Altcoin

Bitcoin profit-taking drops 93% from December peak – what’s next for BTC?

Credit : www.newsbtc.com

This text is on the market in Spanish.

After testing the low value degree of $90,000 a number of occasions over the previous two months, Bitcoin (BTC) briefly broke out of its tight buying and selling vary earlier this week, hitting a brand new all-time excessive (ATH) of $108,786. Nevertheless, a latest report from Glassnode means that the continued consolidation of latest months is nearing an finish, with the main cryptocurrency poised for its subsequent transfer. vital motion.

Bitcoin profit-taking drops sharply

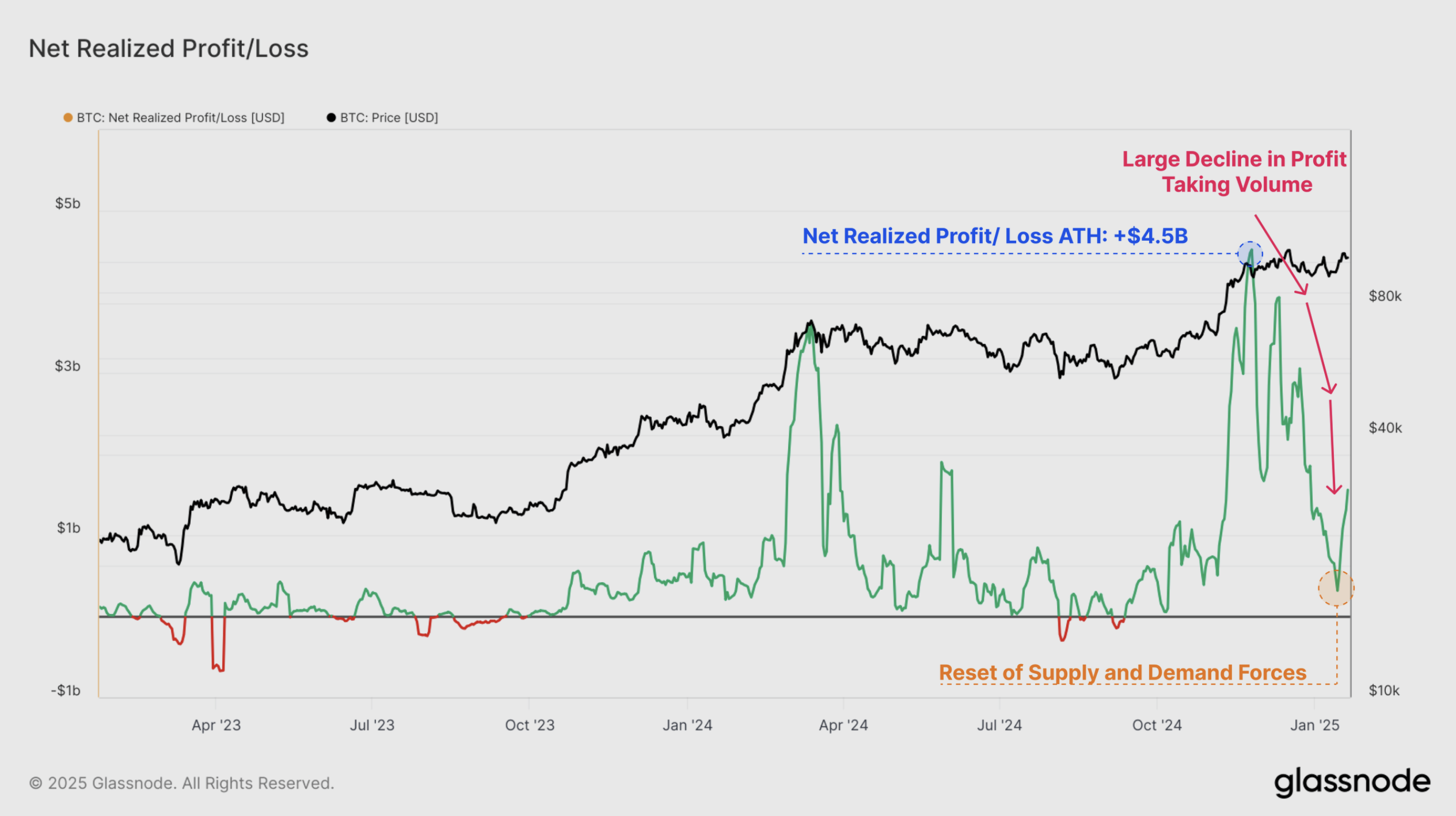

In line with the latter edition In line with Glassnode’s ‘The Week On-Chain Report’, BTC profit-taking volumes have fallen considerably, from a peak from $4.5 billion in December to about $316.7 million – a pointy decline of 93%.

This decline in revenue taking signifies a considerable discount in promoting stress for Bitcoin. At the moment, BTC trades inside a decent 60-day value vary, a sample that has typically preceded vital market volatility.

Associated studying

When Bitcoin trades inside a slender value vary, it signifies the start of a bull market rally or the ultimate levels of a bear market. capitulation. A key metric highlighted within the report is realized provide density, which measures Bitcoin’s provide focus across the present spot value inside a 15% vary, each up and down.

At the moment, roughly 20% of Bitcoin’s provide is inside this value vary, indicating elevated value sensitivity. Small value actions inside this vary can considerably influence investor profitability, fueling market volatility.

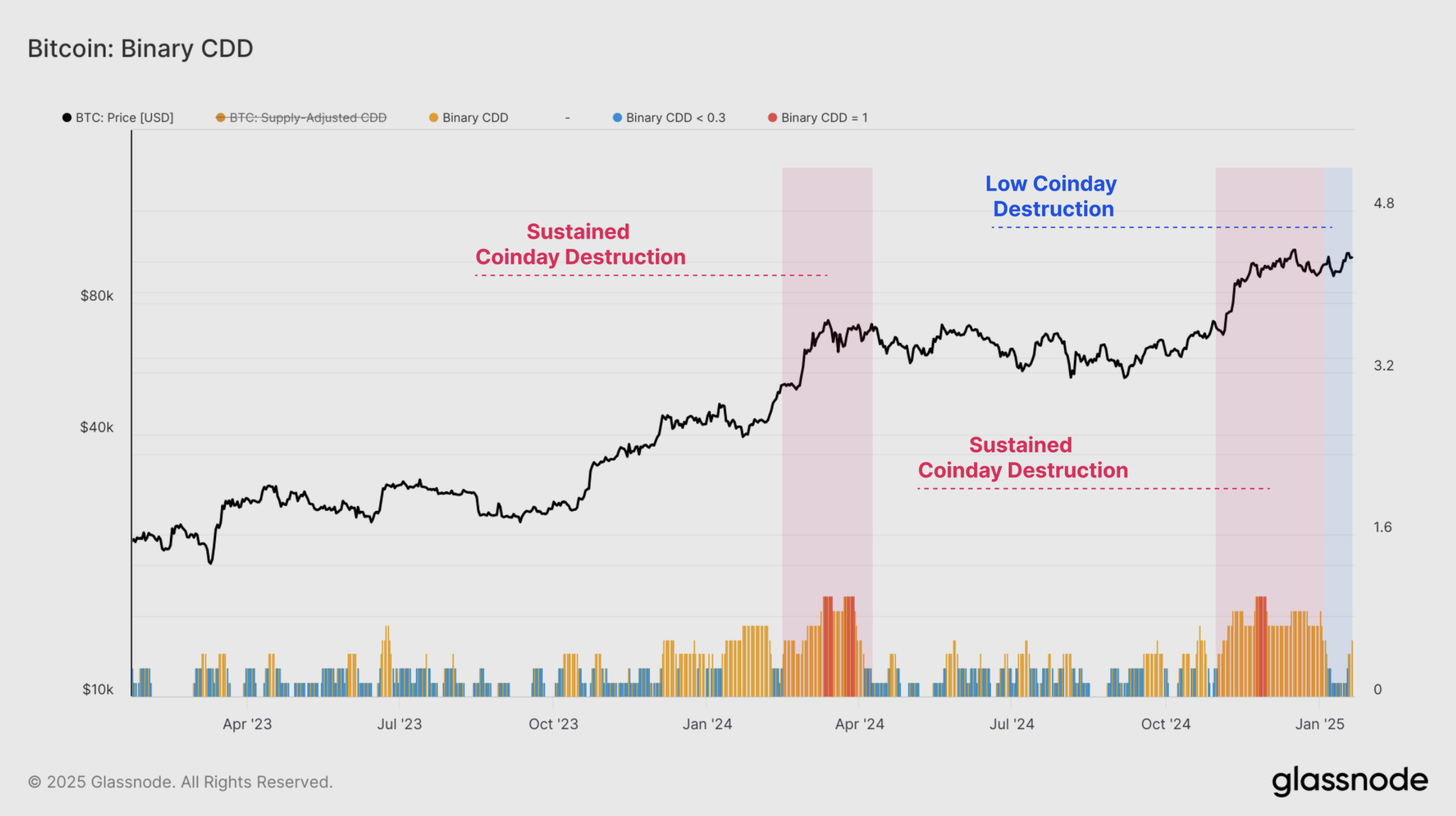

The report additionally factors to a key metric, CoinDay Destruction (CDD), as additional proof of easing promoting stress. In late December and early January, CDD values had been noticeably excessive, reflecting elevated exercise from long-term traders. Nevertheless, the statistic has cooled in latest weeks.

For the uninitiated, CDD measures the financial exercise of BTC issued by monitoring how lengthy cash had been held earlier than being moved. It multiplies the variety of cash by the variety of days they’ve remained inactive, highlighting whether or not long-term holders spend their cash.

CDD’s latest decline means that many BTC traders who deliberate to take income have already executed so inside the present value vary. In consequence, the market might enter a brand new value vary to unlock the following wave of provide and liquidity.

Lengthy-term traders are returning to accumulation mode

The report additionally highlights the Lengthy-Time period Holder (LTH) Binary Spending Indicator, a key metric that tracks Bitcoin held by long-term traders. The report notes:

According to the massive profit-taking volumes seen beforehand, we may even see a big drop in complete LTH provide when the market reached $100,000 in December. The tempo of decline in LTH provide has since stalled, indicating that these distribution pressures have eased in latest weeks.

Furthermore, LTH inflows to crypto exchanges have fallen sharply, from $526.9 million in December to simply $92.3 million. That mentioned, complete LTH BTC provide is displaying indicators of progress, indicating that long-term traders are additionally return to accumulation mode.

Associated studying

In the meantime, retail demand for BTC has elevated stays robust. Traders who owned lower than 10 BTC collectively bought roughly 25,600 BTC final month. By comparability, Bitcoin miners solely minted 13,600 BTC throughout the identical interval. On the time of writing, BTC is buying and selling at $104,207, up 0.5% within the final 24 hours.

Featured picture from Unsplash, charts from Glassnode and TradingView.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September