Altcoin

Bitcoin remains above the Gaussian channel and the bull market structure is still intact

Credit : www.newsbtc.com

Bitcoin is buying and selling round $107,000 after the current sudden crash, sustaining stability to stop additional decline, however has but to return to buying and selling above $110,000. Notably, fashionable crypto analyst Titan of Crypto shared an in depth Gaussian Channel evaluation on regardless of short-term volatility. His submit, which was accompanied by a Bitcoin value chart, reveals how Bitcoin’s place in opposition to the Gaussian channel gives a transparent view of the continued cycle.

Associated studying

Bull market intact above Gaussian channel

Titan of Crypto noticed that Bitcoin’s placement above the Gaussian channel represents energy within the long-term pattern. As proven within the weekly candlestick value chart under, the inexperienced channel corresponds to bullish phases, whereas the crimson areas symbolize bearish downturns, of which the 2022 bear market is a first-rate instance.

On the time of writing, the higher band is round $101,300 and is on an upward pattern. Subsequently, Bitcoin’s value motion round $107,000 implies that it has but to interrupt into the Gaussian channel and the general market construction remains to be stable. From this, it may be inferred that Bitcoin’s present pullback from October 6’s all-time excessive above $126,000 is only a short-term pause. inside a bigger bull market.

Bitcoin Gaussian Channel. Source: Titan by Crypto on X

Nevertheless, whereas the Gaussian channel worth seems to be favorable, Crypto’s Titan famous that the indicator shouldn’t be handled as a buying and selling set off. “It’s not a shopping for sign, it’s an indicator of the macro context,” he declared. Being above the Gauss channel doesn’t essentially imply shopping for extra. It merely implies that the bull market construction remains to be intact.

The Gauss channel works finest in combination with other indicators resembling buying and selling quantity, shifting averages and on-chain accumulation traits to substantiate directional momentum.

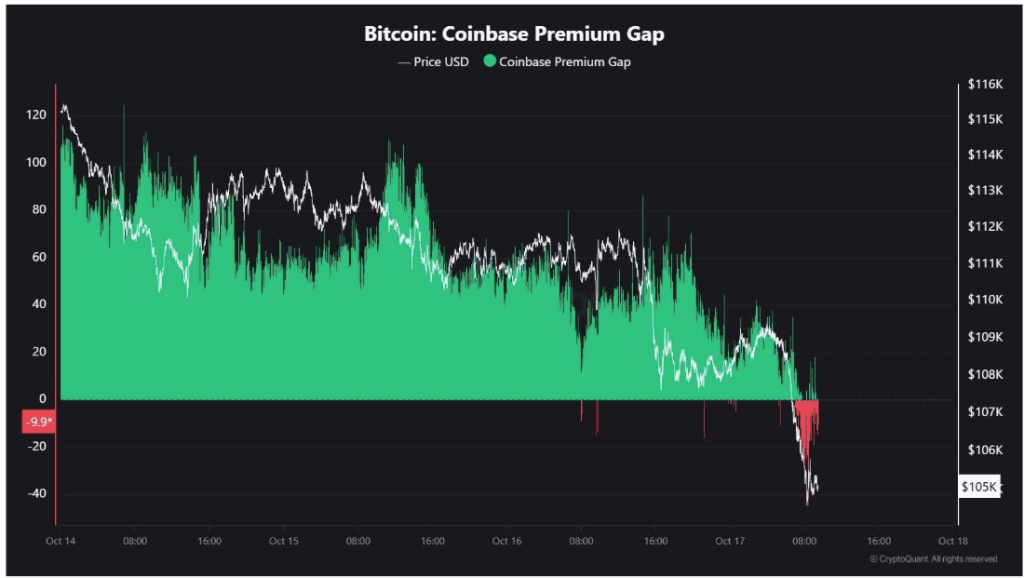

Coinbase Premium Hole turns crimson

Talking of different indicators, on-chain information from CryptoQuant reveals that the Coinbase Premium Hole, a metric that compares the value of Bitcoin on Coinbase to different exchanges, has turned crimson. As proven within the chart under, Coinbase’s Premium Hole fell sharply from optimistic premium ranges above +60 earlier this week to a low of -40 because the Bitcoin value fell to $101,000.

Curiously, on the time of writing, the Coinbase Premium Hole has risen to round -10, that means US buyers are too is starting to turn bullish again. This may be seen as a bullish sign, as related declines in US demand had been recorded between March and April earlier than the Bitcoin value finally surged greater than 60% to hit new all-time highs.

Associated studying

Nevertheless, a crimson Coinbase Premium Hole alone isn’t decisive. It must be so interpreted alongside others information factors together with ETF inflows, buying and selling quantity, liquidity and derivatives funding charges. On the time of writing, Bitcoin was buying and selling at $107,120.

Featured picture from Vecteezy, chart from TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024