Altcoin

Bitcoin Retail question increases 3.4% as small investors return to the market

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and thoroughly assessed

The best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Retail participation within the Bitcoin (BTC) market is growing as a result of knowledge on chains point out that smaller traders regularly re -enter the area. This renewed exercise is usually an indication of rising confidence within the energetic and may act as a catalyst for the subsequent leg in value.

Bitcoin -witnesses rise in retail participation

In accordance with a current cryptoquant Quicktake put up from on-chain analyst Carmelo Aleman, retail traders outlined as portfolios with lower than $ 10,000 in BTC staging return to the market. These contributors are often essentially the most reactive for market actions.

Associated lecture

Aleman famous that though personal traders can’t all the time be as efficient as institutional gamers, their conduct stays an vital barometer of a broader market sentiment. As extra retail traders take part, they have a tendency to create a optimistic suggestions loop, to strengthen bullish tales and stimulate an elevated buying stress that may entice much more contributors.

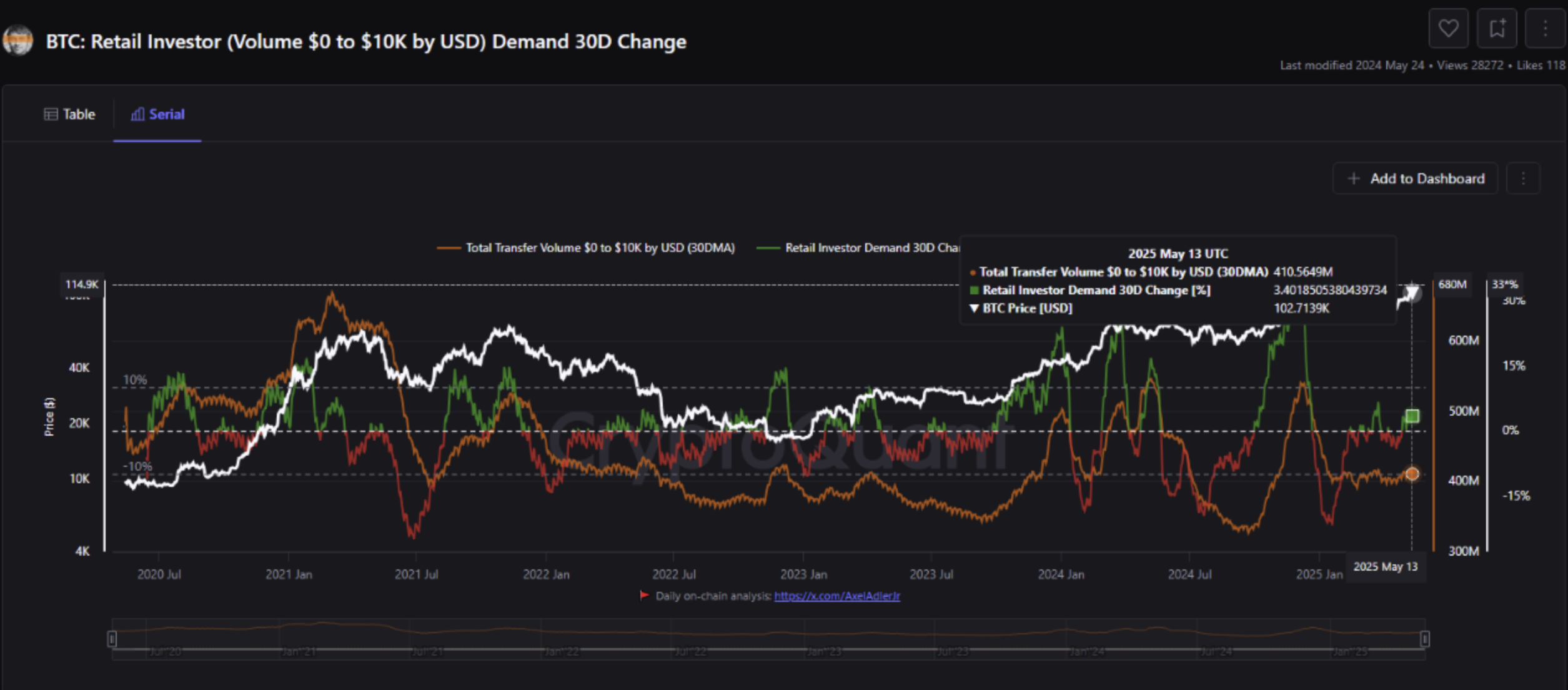

The BTC: Retail Investor 30-Day Change indicator displays this pattern. Because it turns into optimistic on April 28, the indicator has demonstrated a rise of three.4% in shopping for the retail commerce till 13 Could, indicating a powerful revival of the exercise of small traders.

Aleman added that if Bitcoin maintains his upward momentum, the broader cryptomarket may benefit, as a result of retail traders can diversify in different belongings in search of increased returns. He wrote:

This will profit all the crypto area, as a result of small traders most likely diversify in different initiatives, together with Defi, bets, futures and different devices. All indicators point out this shift in retailer conduct as the beginning of a brand new wave of mass acceptance within the cryptocurrency market.

Aleman additionally emphasised the monitoring of different indicators for chains, resembling energetic addresses, unstated transaction output (UTXO) depend, new addresses and switch quantity, which regularly rise with rising retail exercise.

Just a few warning indicators for BTC

Though growing retail curiosity is encouraging, just a few Purple flags watch out. The Trade Stablecoins Ratio (USD) specifically not too long ago rose to five.3 in the course of the Bitcoin assembly to $ 104,000. This means that BTC reserves are actually exceeding the stablecoin baldi -a sign that would construct the gross sales stress.

Associated lecture

In accordance with Cryptoquant Egyshash worker, a lecture above 5.0 is traditionally vital. An identical peak as much as 6.1 in January was adopted by a aggressive value correction, indicating that BTC traders can flip again in money.

Regardless of some warning indicators, Bitcoin continues to indicate Bullish Momentum. The stochastic RSI is to indicate Renewed energy and different technical indicators recommend that the rally might proceed. On the time of the press, BTC acts at $ 103,993, a rise of 0.3% within the final 24 hours.

Featured picture of Unsplash, graphs of cryptoquant and tradingview.com

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024