Altcoin

Bitcoin rises when the dollar falls, research shows

Credit : www.newsbtc.com

Based on NYDIG researchBitcoin’s value actions are pushed extra by the power of the US greenback and broad liquidity situations than by direct hyperlinks to inflation.

Greg Cipolaro, the worldwide head of analysis at NYDIG, mentioned the information exhibits weak and inconsistent hyperlinks between inflation measures and Bitcoin. This view diverts consideration from the outdated narrative that Bitcoin is primarily an inflation hedge.

Associated studying

Inflation hyperlink weak

Cipolaro argued that inflation expectations are a barely higher sign than inflation charges, however are nonetheless not a superb predictor of Bitcoin’s value. price.

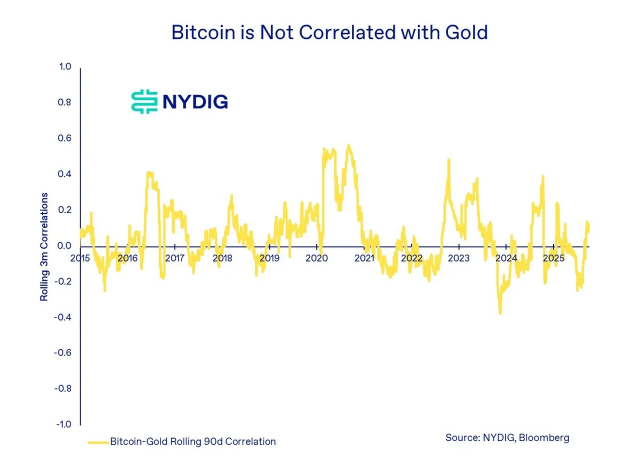

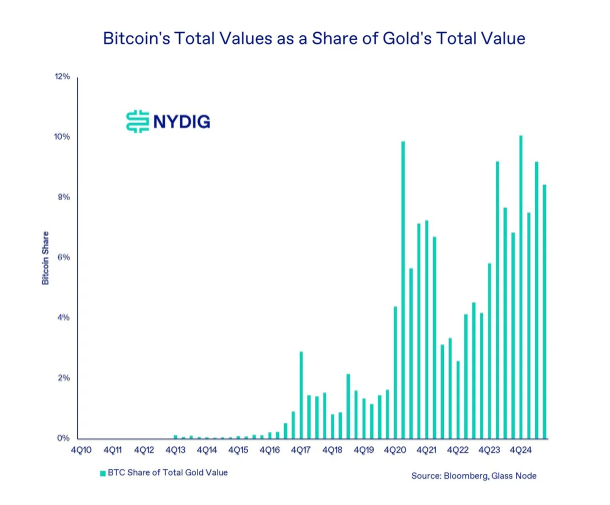

As an alternative, Bitcoin and gold have a tendency to achieve when the US greenback weakens. Whereas gold’s inverse relationship with the greenback has been long-standing, Bitcoin’s reverse transfer in opposition to the greenback is newer however seen.

Gold and Bitcoin react to greenback actions

Primarily based on studies, gold has traditionally risen because the greenback fell. Bitcoin follows that sample, though its correlation is much less secure than gold.

As Bitcoin turns into extra related to the mainstream monetary world, NYDIG expects that its inverse relationship with the greenback will probably strengthen.

This is sensible for merchants who value every thing in {dollars} and search for options when the greenback loses buying energy.

Rates of interest and cash provide

Cipolaro emphasised that rates of interest and cash provide are the 2 most necessary macro levers that transfer each gold and Bitcoin.

Decrease rates of interest and looser financial coverage have typically supported increased costs for these property.

Merely put, when borrowing prices fall and liquidity rises, Bitcoin typically advantages. The observe framed gold extra as an actual rate of interest hedge, whereas describing Bitcoin as a gauge of market liquidity – a delicate however necessary distinction for traders.

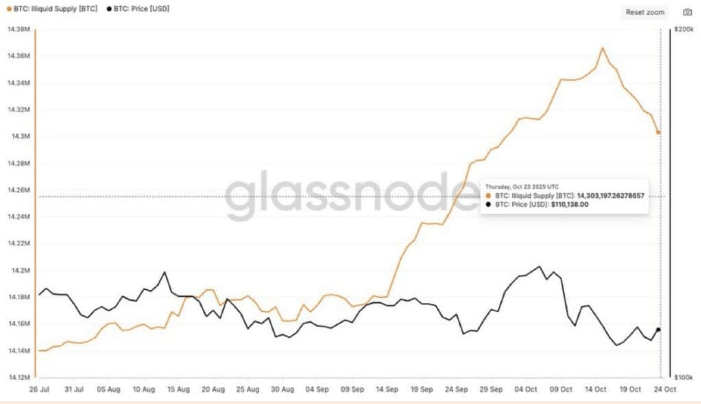

Illiquid provide decreases, promoting strain returns

Knowledge on the chain exhibits indicators of renewed gross sales. Reviews say illiquid Bitcoin – cash held in long-dormant wallets – fell from 14.38 million earlier in October to 14.300 million on October 23.

Associated studying

That change implies that about 62,000 BTC, price about $6.8 billion at current costs, has been put again into circulation. Up to now, giant inflows brought on value strain. In January 2024, a big quantity of cash turned accessible, which diminished value momentum.

Based on Glassnode information, there was a constant sell-off of wallets holding 0.1 to 100 BTC, and the provision of latest consumers has fallen to ~213,000 BTC.

The general evaluation from a macro perspective and on-chain metrics just isn’t favorable. Demand from new consumers appears to be lighter, momentum merchants appear to have stepped apart and there are actually extra cash accessible to commerce. This mix might blunt rallies or amplify pullbacks till liquidity situations enhance or the greenback weakens.

Featured picture of Gemini, chart from TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024